Markets Brief: May CPI Forecasts Show Little Slowdown in Inflation

Overall price pressures may soften, but services prices are keeping inflation well above the Fed’s target.

While forecasts for the May Consumer Price Index report call for a slowing in the overall rate of inflation, under the hood, upward pressure on prices remains stubbornly strong.

Unfortunately for consumers and investors, meaningful relief from inflation may not be in the cards without a broader economic slowdown.

The issue facing the Federal Reserve and investors is that even as goods price increases slow, services inflation is staying hot. That means it could take more work from the Fed to push inflation down to its long-term target, though ultimately, getting “close enough” may still constitute a win.

The May CPI report is expected to show a 4.2% increase in inflation from year-ago levels, according to FactSet’s consensus forecasts. That would be slower than April’s year-over-year increase of 4.9% but still more than twice the Fed’s target levels.

“Over the next few months, headline CPI numbers should be slowing down,” says Donald Rissmiller, a chief economist at Strategas Research Partners. “But as we dig through the details, we’re going to have to see what exactly is happening to some of the other pieces that may or may not be moving the same way.”

Rissmiller says the key question that the Fed and economists now face is whether core inflation will slow. In recent months, core inflation has been held up by increasing services prices, fueled by the strong labor market.

For May, the overall CPI is forecast to rise 0.2%, while core CPI (which excludes volatile food and energy cost) is expected to rise 0.4%. In the April report, the overall CPI showed prices growing 0.4% from month-ago levels—an acceleration from the previous month’s reading of 0.1%.

Consumer Price Index

The report comes just as the Fed starts a two-day policy-setting meeting. The market expects the central bank to pause its interest-rate increases for the first time since the Fed started tightening its monetary policy in March 2022.

If the May report comes out in line with forecasts, the Fed will have to make a tough call, according to José Torres, senior economist at Interactive Brokers. “Everyone thinks the Fed is going to pause at the upcoming FOMC meeting,” he says. “But if they do, they’re sending the wrong signal to the market. We still have inflationary pressures to subdue.”

At the same time, Torres says it would take a month-over-month core inflation reading of 0.5% to convince the Fed to raise its target federal-funds rate an additional 0.25% at its June 14 meeting. “If that number comes in hot, we will definitely hear some hawkish voices in the Fed.”

May CPI Report Forecasts

Predictions for the May CPI report expect headline inflation to slow but core prices to keep rising, according to FactSet.

- The CPI is forecast to rise 0.2% in May after rising 0.4% in April.

- Core CPI is forecast to rise 0.4% for the month versus 0.4% in April.

- The CPI, year over year, is forecast to rise 4.2% in May after rising 4.9% in April.

- Core CPI, year over year, is forecast to rise 5.2% versus 5.5% in April.

Torres believes headline inflation will come in softer than the market consensus, but he expects core inflation to stay elevated. He predicts a 0.2% rise in headline CPI from month-ago levels and a rise of 4.1% year over year. He expects a 0.4% increase in month-over-month core CPI, in line with the market’s expectations, and a 5.3% increase from year-ago levels for the core CPI—a touch higher than FactSet’s consensus forecast.

“There will be a decline in headline inflation because oil prices and gas prices were a lot lower in April than they’ve been previously,” Torres says. “But as we move forward into next year, it’s going to be tougher for the Fed to achieve its target. The labor market is too strong, and service prices make up roughly two-thirds of the economy. For that reason, core inflation will likely stay elevated.”

Torres forecasts that by the end of the year, headline inflation will be around 3.2% on a year-over-year basis while core inflation will remain around 4.2%. “Services prices are just not cooling off at all, and that’s having a negative impact on the inflationary outlook,” he says.

Where to Look in the May CPI Report

Under the hood of the report, Torres is expecting commodities and goods prices to slow while services prices remain elevated.

“Food prices should be flat, even as food [at restaurants] continues to come in higher,” he says. “Restaurant prices will drive some of the core inflation.”

Torres also expects prices for shelter and transportation to keep rising. On the flip side, he forecasts that apparel prices will remain flat and that car prices—both new and used—will decline slightly.

Will the Fed Win the Inflation Fight?

The Fed has been battling to get inflation down closer to its target of 2%, as measured by the Personal Consumption Expenditures Price Index. As of the April CPI report, inflation is down to 4.9% from its year-ago levels. That’s well below the 9.0% peak we saw in 2022, but the fight is far from over.

“The hardest work is getting inflation down to 2% from 4%,” Torres says. “Especially since services prices are sticky.”

Distortions in the labor market, exacerbated by the effects of the coronavirus pandemic on the composition and habits of the workforce, are affected by factors beyond the Fed’s control. Torres explains: “Many folks retired early, working moms have gone home due to the pandemic and haven’t returned—lots of distortions like these are causing mismatches between what employers want and what the available employees’ skills are.”

Torres says, “These distortions are contributing to the hotter labor market, and the recent inflationary surge has worked its way into expectations. Landlords expect higher maintenance costs and demand higher rent, and employees are spending more and expecting higher salaries to make up the difference.”

Rissmiller says that getting inflation down to 2% will be difficult, but it may not be necessary. “If we can get inflation down to two and three quarters, that’s much better than where we were,” he says. “Is it worth going through a deeper recession to get all the way down to 2%? I don’t think so.”

Rissmiller thinks the Fed can declare victory if they get close enough to 2%, “and getting there will be the story, really, for the next year.”

Events Scheduled for the Coming Week

- Monday: Oracle ORCL reports earnings.

- Tuesday: May Consumer Price Index report.

- Wednesday: Federal Open Market Committee meeting.

- Thursday: Kroger KR, John Wiley & Sons WLY, Lennar LEN, and Adobe ADBE report earnings.

For the Trading Week Ended June 9

- The Morningstar US Market Index rose 0.4%.

- The best-performing sectors were consumer cyclicals, up 2.1%, and utilities, up 1.8%.

- The worst-performing sector was consumer defensive, down 0.6%.

- Yields on 10-year U.S. Treasuries increased to 3.74% from 3.69%.

- West Texas Intermediate crude prices fell 1.57% to $70.17 per barrel.

- Of the 851 U.S.-listed companies covered by Morningstar, 540, or 63%, were up, and 311, or 37%, were down.

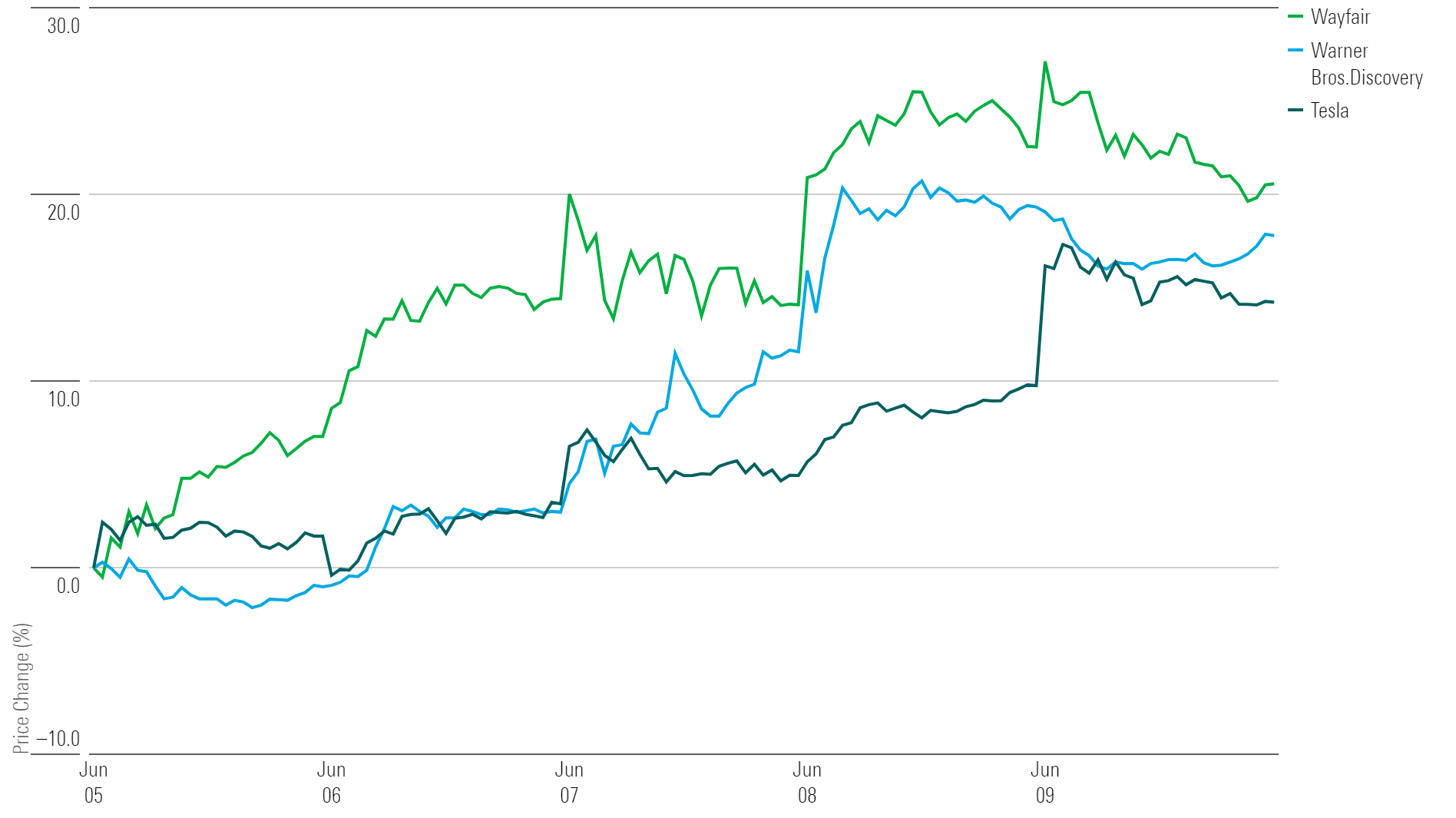

What Stocks Are Up?

Wayfair W stock surged after positive order growth led the home goods company’s revenue to improve this quarter. When the company posted its first-quarter results on May 4, the revenue was dropping at a high-single-digit rate year over year, but it is now falling at a mid-single-digit rate.

The firm previously anticipated demand to improve by nearly 10% during May and June, but Wayfair now projects sequential growth to increase above that estimate.

Warner Bros. Discovery WBD stock rallied after the media conglomerate announced its plan to reduce debt. Subsidiary group WarnerMedia Holdings initiated a cash tender offer for an aggregated principal amount of up to $500 million in floating-rate notes. Additionally, the company says it repaid $750 million from a credit agreement and $800 million from a term loan.

Tesla TSLA stock jumped after General Motors GM announced it will incorporate the automotive and clean energy company’s charging connectors into its electric vehicles starting in 2025. Additionally, Tesla will enable access to its charging network for GM EV owners in 2024. The partnership between the two firms comes weeks after Ford Motor F announced a deal with Tesla for its own EVs.

Highlighted Advancers

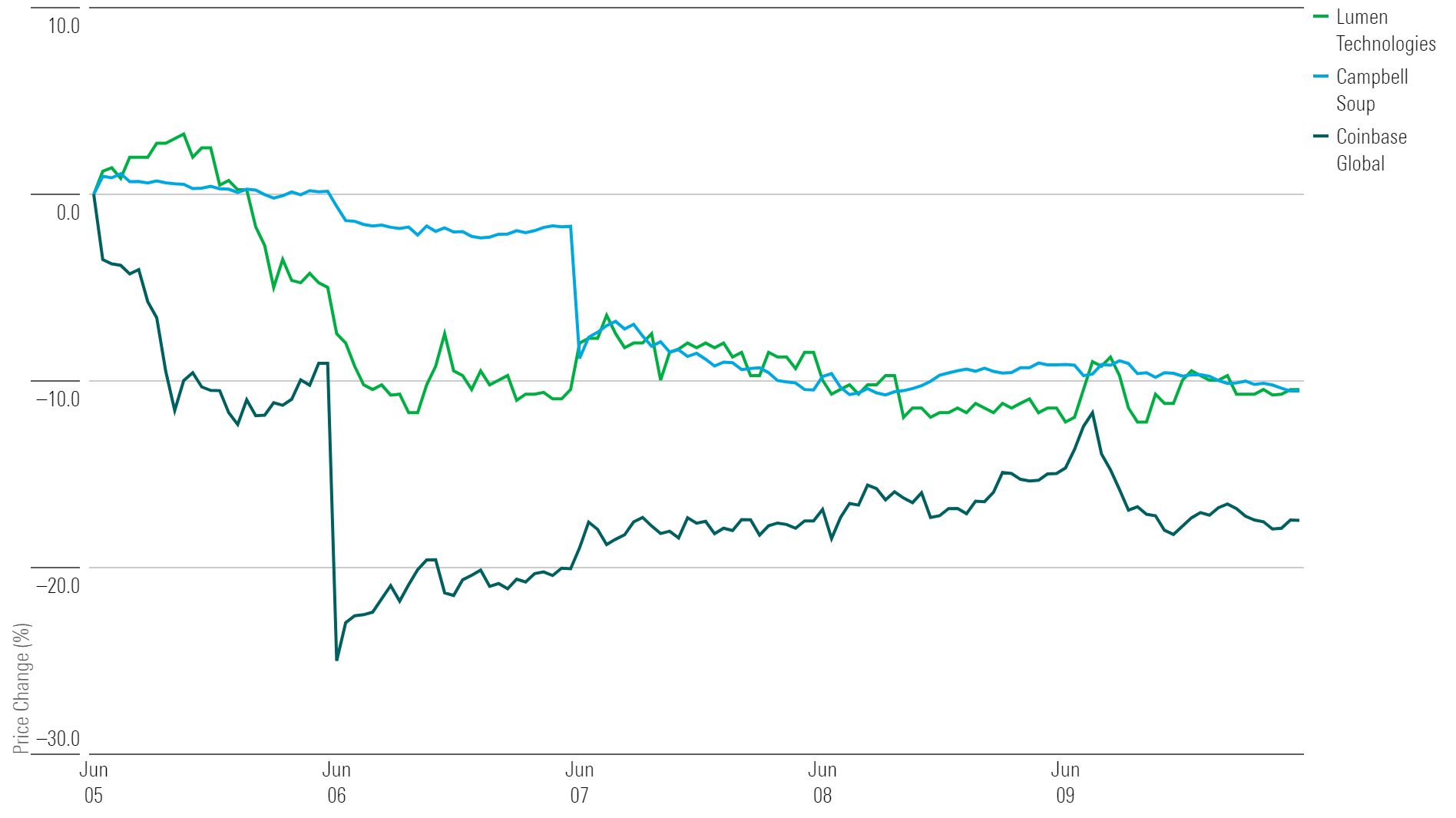

What Stocks Are Down?

Coinbase Global COIN stock plummeted after the SEC filed charges against the platform for operating as “an unregistered national securities exchange, broker, and clearing agency” in addition to not registering the offer and sale of its cryptocurrency assets through its staking service. The regulatory agency previously issued a Wells notice to Coinbase in March following its investigation of the firm.

Although Coinbase intends to fight the SEC’s complaint, “the timeline and outcome of this process are completely unknown,” Morningstar equity analyst Michael Miller says. While the $80 fair value estimate for the platform stands, he highlights its Very High Uncertainty Rating.

Lumen Technologies LUMN stock declined after the telecommunications company maintained during its investor day that a turnaround will occur in 2025. This comes despite the decline in size and profitability of its legacy businesses, in addition to a large debt maturity looming in 2027.

“Here again, if management is close to its projections, we think debt refinancing in 2027 will be no problem. However, after years of hearing similar narratives under past management teams, we believe only results will comfort investors, meaning there’s no substitute for time when contemplating what could calm the market,” Morningstar equity analyst Matthew Dolgin says.

Campbell Soup CPB stock tumbled after the food manufacturing company released its third-quarter results. Erin Lash, director of consumer sector equity research at Morningstar, attributes the reaction to competition and weakened consumer spending owing to rising food product prices.

Lash says Campbell and its rivals will not be able to tap the pricing lever in the near term. As a result, the industry will turn to increased promotional spending to gain market share.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)