Top-Performing Dividend Stocks of 2023

Bloomin’ Brands and Philips 66 are among the year’s high-yielding winners.

Dividend-paying stocks that combine healthy balance sheets with hefty yields can provide steady incomes for investors, cushion against market downturns, and even grow investments at a healthy clip.

In 2023, the top-performing dividend payers included NRG Energy NRG, Bloomin’ Brands BLMN, and Phillips 66 PSX.

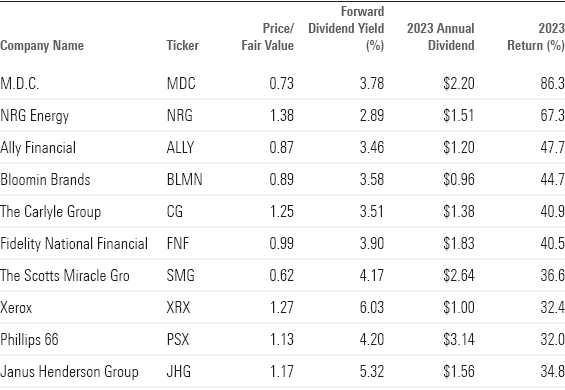

To find the top income-focused stocks for 2023, we screened the companies in the Morningstar Dividend Leaders Index, which tracks the performance of the 100 highest-yielding stocks from a broad basket of consistent dividend payers. Here are the 10 top-performing, highest-yielding dividend stocks of the year.

2023 Top-Performing Dividend Leaders Stocks

- M.D.C. HoldingsMDC

- NRG Energy

- Ally Financial ALLY

- Bloomin Brands

- Carlyle Group CG

- Fidelity National Financial FNF

- Scotts Miracle Gro SMG

- Xerox XRX

- Phillips 66

- Janus Henderson Group JHG

Top-Performing Dividend Leaders of 2023

How Did Dividend Stocks Perform in 2023?

In 2023, the Dividend Leaders Index rose 3.7% as a group. This trailed dividend stocks overall, which rose 11% as measured by the broad Morningstar Dividend Composite Index.

2023 Dividend Performance

Both the dividend leaders and the wider dividend index underperformed the overall U.S. stock market, which gained 26.4% in 2023 as measured by the Morningstar US Market Index.

Yields and Metrics on the Top-Performing Dividend Stock Leaders

Top-Performing Dividend Leaders of 2023

M.D.C. Holdings

M.D.C. Holdings—operator of home construction, mortgage, insurance, and title companies—rose 86.3% in 2023 following a 39.7% decline in 2022. Trading at $54.40 per share, M.D.C. stock has a forward dividend yield of 3.78%. M.D.C. pays investors an annual dividend of $2.20 per share. The no-moat stock is currently trading at a 27% discount to its fair value estimate of $74.92 per share, leaving it significantly undervalued.

NRG Energy

NRG Energy, the operator of an integrated electricity generation and distribution company in the United States, gained 67.25% in 2023 after falling 33.90% the prior year. At $52.24 per share, the forward dividend yield of NRG’s stock is 2.89%, and its annual dividend is $1.51 per share. NRG is significantly overvalued, trading 37.5% above its fair value estimate of $38 per share.

Ally Financial

Ally Financial—provider of banking, non-banking, and investment management services to consumers, businesses, automotive dealers, and corporate clients—rose 47.7% in 2023 after falling 46.1% in 2022. The stock’s $34.7 price gives it a forward dividend yield of 3.46%. Ally Financial pays investors an annual dividend of $1.20 per share. Ally’s price/fair value ratio of 0.87 makes it significantly undervalued.

Bloomin’ Brands

Bloomin’ Brands, which operates a chain of casual, upscale casual, and fine dining restaurants with differentiated concepts primarily in the U.S., gained 44.7% in 2023 following a 1.4% decline in 2022. Trading at $26.80 per share, Bloomin’ Brands stock has a forward dividend yield of 3.58% and an annual dividend of $0.96 per share. With a fair value estimate of $29.97, the stock is moderately undervalued, trading at a 10.6% discount.

Carlyle Group

A provider of private equity investment services that specializes in direct and fund-of-fund investments, Carlyle Group rose 40.9% in 2023 after losing 43.4% the prior year. At $39.87, Carlyle’s forward dividend yield is 3.51% and its annual dividend is $1.38 per share. The firm’s stock is trading 25% above its fair value estimate of $32, making it significantly overvalued.

Fidelity National Financial

Fidelity National Financial—provider of title insurance and transaction services intended to safeguard the rights of both residential and commercial property owners against unexpected legal and financial claims—rose 40.5% in 2023 after it fell 21.0% in 2022. Trading at $49.20 per share, its forward dividend yield is 3.90%. Fidelity stock pays investors $1.83 per share annually. The stock is trading closely in line with its fair value estimate of $49.11.

Scotts Miracle Gro

A manufacturer and marketer of products for lawn and garden care based in Marysville, Ohio, Scotts Miracle Gro gained 36.6% in 2023 after plummeting 68.2% the previous year. Trading at $63.26, the stock’s forward dividend yield is 4.17%, and its annual dividend payout is $2.64 per share. With a fair value estimate of $100, the stock is significantly undervalued.

Xerox

Xerox, which operates a document management company offering multifunction devices and workplace and digital printing solutions for banking, government, educational, healthcare, and retail sectors, gained 32.4% in 2023, following a 31.1% decline in 2022. Trading at $16.59 per share, Xerox stock has a forward dividend yield of 6.03%. The company pays investors an annual dividend of $1 per share. The stock is currently trading at a 27% premium to its Morningstar fair value estimate of $13 per share, leaving it significantly overvalued.

Phillips 66

Phillips 66—a provider of energy refining and transportation services based in Houston, Texas—rose 32.0% in 2023 after gaining 48.9% the prior year. At $133.85, the company’s forward dividend yield is 3.14% and its annual dividend is $4.20 per share. Phillips 66 is trading 12.5% above its fair value estimate of $119, making it moderately overvalued.

Janus Henderson Group

Janus—a provider of investment management services to institutional, retail clients, and high-net-worth clients, which manages separate client-focused equity and fixed-income portfolios—rose 34.8% in 2023 after falling 40.2% in 2022. Trading at $29.33 per share, its forward dividend yield is 5.32%. Janus stock pays investors $1.56 per share annually. The stock is trading at a 17.3% premium to its fair value estimate of $25.

The Year in Dividend Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)