October Jobs Report May Clear the Way for the Fed to End Rate Hikes

Hiring growth slowed last month, but it remains healthy.

The red-hot jobs market cooled in October, strengthening expectations that the Federal Reserve is done with the most aggressive series of interest rate increases in its history.

With the economy growing much faster than expected in 2023, many in the stock and bond markets have seen a slowing of hiring across the U.S. economy as a critical factor that could allow the Fed to shift to an extended pause. Without a softer job market, it may be difficult for recent improvements in inflation to continue.

However, the October jobs news appears to have confirmed a deceleration in hiring, although job growth remains healthy by historical standards. “The uptick in job growth we thought we saw a month ago has disappeared, supporting a no-hike decision for the Fed at its December meeting,” says Preston Caldwell, chief U.S. economist at Morningstar.

Odds of No Rate Hike at the December Fed Meeting

The U.S. economy added a smaller-than-expected 150,000 jobs in October, according to the latest report from the Bureau of Labor Statistics. Nonfarm payroll employment had been forecast to rise by 180,000, according to FactSet. According to the BLS, one factor in the slowdown was a decline in manufacturing hiring during the month due to strike activity.

Meanwhile, the unemployment rate edged up to 3.9% from 3.8% in September. Economists expected the rate to remain at 3.8%.

October Jobs Report Key Stats

- Total nonfarm payrolls increased by 150,000 versus a downward-revised 297,000 in September.

- The unemployment rate edged up to 3.9% from 3.8% in September.

- Average hourly wages rose by 0.2% to $34 after rising 0.3% in September.

- In October, average hourly wages grew by 7 cents, or 0.2%. Over the past 12 months, average hourly earnings have risen by 4.1%.

“A month ago, the data painted a picture that job growth was accelerating a bit, but this was disconfirmed with October’s data,” Caldwell says.

The three-month average for nonfarm payroll employment growth now stands at 1.6% annualized, down from the 2.1% reading in the prior month’s report. “This downtick is due to the weak growth in October, as well as downward revisions to the job growth numbers by a combined 101,000 jobs for September and August,” Caldwell says.

Monthly Payroll Change

“Despite the surge in third-quarter GDP growth, firms haven’t stepped up their hiring, which supports the idea the uptick in GDP growth will be short-lived,” Caldwell says. “We did see a minor uptick in average hours worked in October, but it’s still down 0.6% in year-over-year terms.”

Caldwell expects continued deceleration in job growth in 2024, “with job growth falling to around zero by the second quarter and remaining there through the end of the year.” He expects unemployment to tick up by around 0.5%. “This fall in labor demand should be sufficient to fully return wage growth to normal levels consistent with 2% inflation.”

Unemployment Rate Rises

“Although job growth remains solid, we’ve seen an uptick in unemployment,” Caldwell says. “This contradiction is explained by the fact that the unemployment rate is derived from the household survey, which has its own measure of employment that’s separate from the headline nonfarm payroll figures.”

The unemployment rate averaged 3.8% in the last three months, compared to 3.5% in the first half of 2023.

“The household survey measure of employment showed virtually zero growth the past three months,” Caldwell says. “This is partly explained by conceptual differences (the number of people working multiple jobs has increased), but it could also be that nonfarm payrolls have overestimated job growth recently.”

Unemployment Rate

Wage Growth Slows

“Wage growth continues to trend in a milder direction,” Caldwell says. Average hourly earnings fell to 4.1% year-over-year in October, down from an average of 4.6% in the first quarter of 2023.

Meanwhile, the average workweek for all employees on private nonfarm payrolls fell to 34.3 hours in October, down from 34.4 in September. For manufacturing employees, the average workweek was unchanged at 40.2 hours in October, and overtime fell to 3.0 hours. For production and nonsupervisory employees, the average workweek lengthened to 34.1 hours from 33.8 the prior month.

Monthly Wage Growth

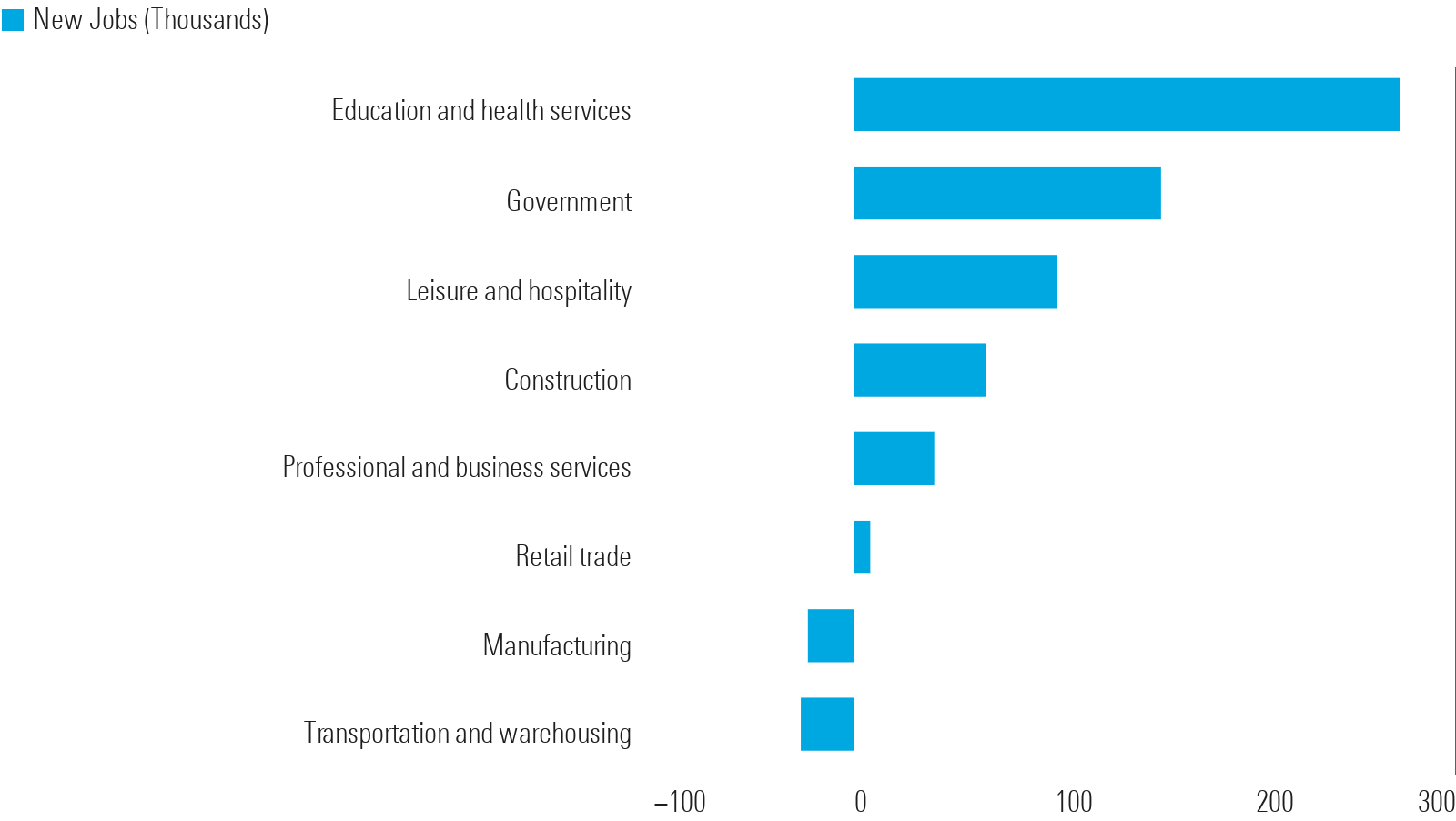

Healthcare and Leisure Sectors Led Job Gains

“At the industry level, growth in the healthcare and leisure industries continues to lead the way, accounting for over one-half of aggregate job growth in the past three months,” Caldwell says.

In October, healthcare added 58,000 jobs, in line with the average monthly gain of 53,000 over the past year. Government jobs grew by 51,000 over the month, and jobs in the sector have returned to their pre-pandemic February 2020 levels.

Manufacturing jobs decreased by 35,000 in October, dragged down by a decline of 33,000 jobs in motor vehicles and parts, largely due to strike activity.

Selected Payroll Categories

The Fed Likely to Leave Rates Unchanged in December

“The Fed should refrain from hiking the federal-funds rate in December,” Caldwell says. “Markets agree with this assessment, as the implied probability of a December hike fell from about 20% one day ago to 7% after the jobs report was released.”

In the wake of the report, 90% of investors expect the Fed to hold the target rate steady at its current range of 5.25%-5.50% come December, according to the CME FedWatch Tool, which tracks bets made by traders on the direction of interest rates.

The day before the report’s release, just 80% of investors expected the Fed to hold the rate at its current target. The remaining 20% foresaw the central bank raising rates by a quarter-point to a range of 5.50%-5.75%. After the report’s release, only 10% expect the Fed to raise rates.

Further out, 84% of participants expect the Fed to hold rates at current levels through January. Roughly 15% expect the target rate to rise by a quarter point. Less than 1% expect the Fed to raise rates by an even further half-point to a range of 5.75%-6.00% by its Jan. 31, 2024 meeting.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)