Strong May Jobs Report Shows Any Recession is Still Out on the Horizon

Powell, Fed seen keeping rates steady in June against a robust economic backdrop.

With yet another strong month of hiring, the May jobs report puts further out on the horizon the prospects for the U.S. economy tilting down into a recession, as well as the timing of any Federal Reserve rate cut.

However, with the pace of job gains—and growth in the economy—expected to slow as 2023 rolls on, the May jobs report leaves Federal Reserve Chair Jerome Powell and other Fed officials perceived as likely to leave interest rates unchanged when they meet later this month. Ultimately, that eventual slowdown should lead the Fed to lower rates in 2024.

For now, however, the May jobs report showed nearly across-the-board strength.

“Today’s job growth is consistent with robust economic growth, certainly not a recession,” says Preston Caldwell, chief U.S. economist at Morningstar. “But we continue to expect a slowdown over the next year.” Caldwell says that despite the strong jobs growth, the Fed is still likely to hold the federal-funds rate at its current levels at the June meeting.

Caldwell says that from the Fed’s perspective, “While the labor market isn’t pointing to anything nearly like a recession, it also isn’t looking severely overheated either.”

May Jobs Report Key Stats

- Total nonfarm payrolls rose by 339,000 versus 294,000 in April.

- The unemployment rate increased to 3.7% from 3.4% in April.

- Average hourly wages grew by 0.3% to $33.44 after rising 0.5% in April.

Jobs Growth Strengthens

The May jobs report from the Bureau of Labor Statistics showed that total nonfarm payrolls rose by 339,000, which was above economists’ consensus expectations for an increase of 191,500 and brought the three-month moving average to 283,333.

“Thanks to strong gains in May and upward revisions to March and April data, our assessment of job growth has improved,” Caldwell says.

Nonfarm payroll employment increased 2.2% annualized in the past three months, according to Caldwell, higher than the 1.7% gain that his forecasts called for a month ago. “Not only is that job growth rate inconsistent with a recession, it’s even faster than normal,” he says. Prepandemic job growth averaged 1.7% per year from 2015 through 2019.

Still, Caldwell says, “There are several reasons why we might discount the nonfarm payroll figures in assessing the health of the economy.” He notes that often, there are large revisions to jobs numbers at business cycle turning points. “This can happen up to a year after the initial data is released.”

Monthly Payroll Change

In addition, Caldwell says pessimists might point to a 400,000-person decrease in household survey employment in May, which caused the uptick in unemployment to 3.7% from 3.4% the prior month. However, his analysis suggests the divergence comes from differences between the household and establishment surveys. “For example, the number of self-employed persons decreased greatly, which depressed household employment but not nonfarm payrolls.”

“The upshot is that the picture of robust job growth from the nonfarm payroll figures shouldn’t be doubted despite the increase in unemployment,” Caldwell says.

Wage Growth is Trending Down

“Wage growth is perhaps moderately above normal depending on the measure, but it is trending down,” Caldwell says. “The constant job hopping in the labor market that prevailed a year ago has subsided, with the quits rate coming back down to normal.” The quits rate has averaged 2.5% in the past three months, compared with a peak of 3% in early 2022 and a prepandemic average of 2.3%.

In May, average hourly wages rose by $0.11—or 0.3%—to $33.44. The average hourly workweek edged down by 0.1 hours to 34.3 hours. Within the manufacturing industry, the average workweek remained unchanged at 40.1 hours and overtime edged up by 0.1 hours to 3.0 hours. The average workweek for production and nonsupervisory employees also remained unchanged at 33.8 hours.

Monthly Wage Growth

(When) Will a Recession Hit?

“Even if actual job growth is as strong as the data shows, there’s still much reason to expect a major slowdown over the next year,” Caldwell says, noting that employment is typically a lagging indicator in the economy.

“Employers are currently hiring at a faster rate than they are expanding output,” he says. “This is unsustainable, and it will ultimately cut into profits if businesses don’t cut back on hiring.” And with banking credit contracting and consumers likely to get more conservative over the next year, Caldwell says, “There’s still much more weakening in economic activity in the pipeline in our view.”

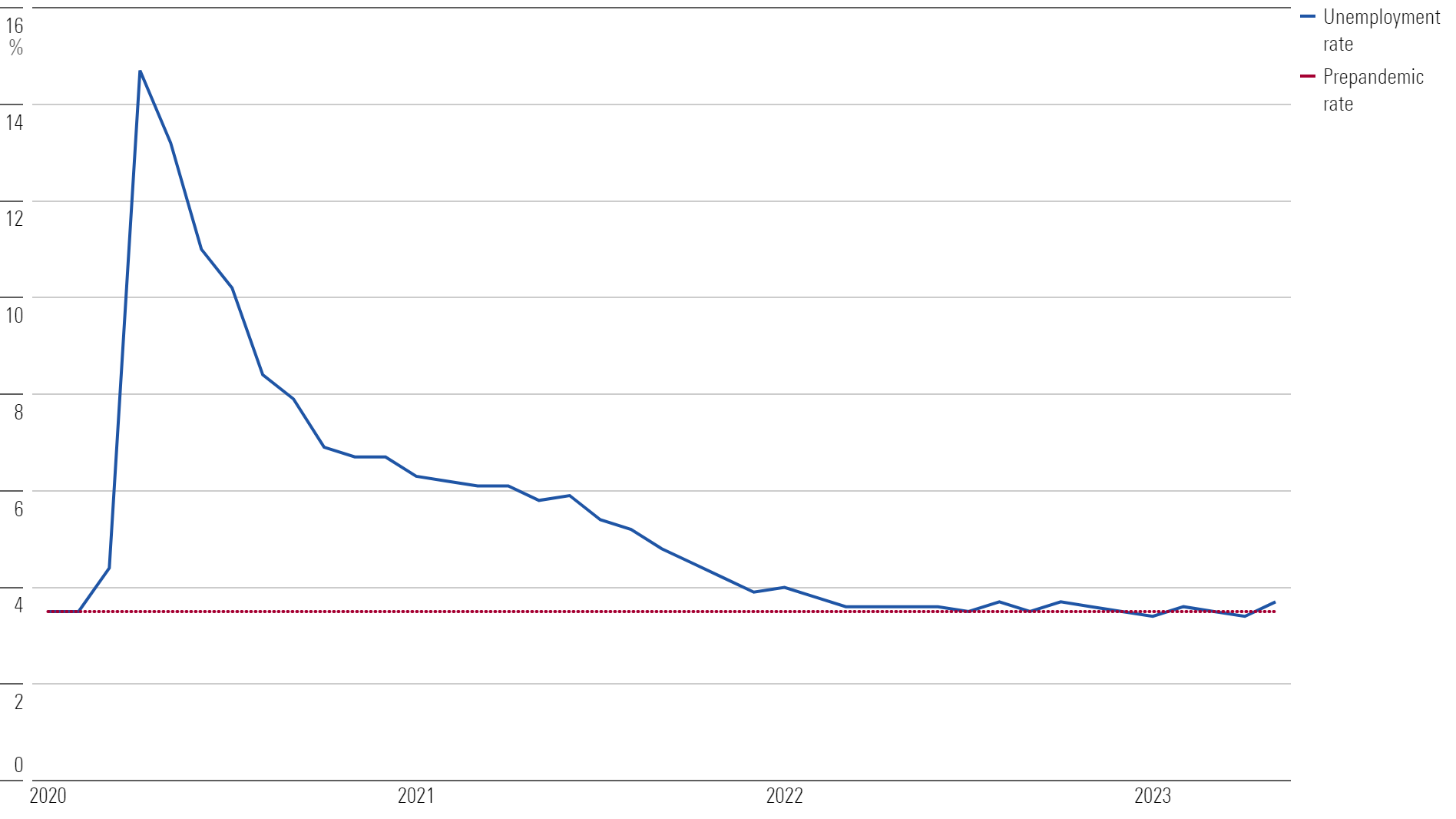

In May, the unemployment rate rose 0.3 percentage points to 3.7%. The rate has ranged from 3.4% to 3.7% since March 2022.

“Ultimately, we expect the slowing economy to cause job growth to come to a halt within the next year,” Caldwell says. That would cause the unemployment rate to tick up to about 4.5% by his measure. “That should be sufficient to remove any excess wage growth fueling the inflation fire, but it would be far milder than recent recessions.”

Unemployment Rate

Pandemic-Era Jobs Recovery is Wrapping Up

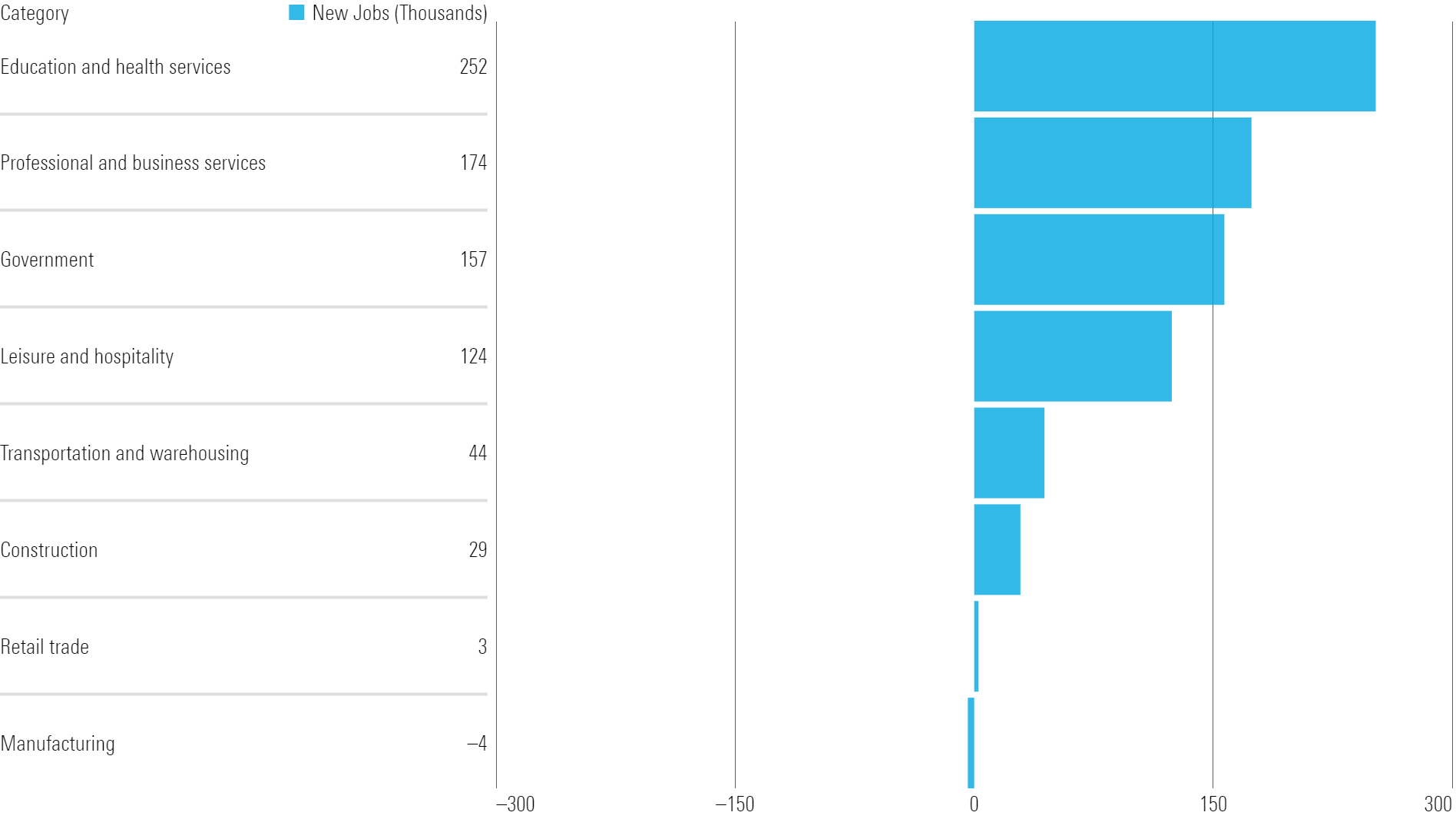

At the industry level, “Job growth in the healthcare and leisure categories has led the way,” Caldwell says. Job growth in the category is up 3.3% annualized over the past three months, according to him. “With employment in these categories now surpassing prepandemic rates, a slowdown in growth becomes very likely.”

Within the jobs report, healthcare jobs rose by 52,000 in May, roughly in line with the average monthly gain of 50,000 over the past 12 months. Employment in leisure and hospitality rose by 48,000 for the month, driven by job gains in food services and drinking places.

Meanwhile, Caldwell says, “We still see no decline in residential construction employment, despite the housing downturn.” In May, construction added 25,000 jobs, above the average of 17,000 jobs added per month over the past 12 months.

Selected Payroll Categories

May Jobs Report Shows Strength in the Economy

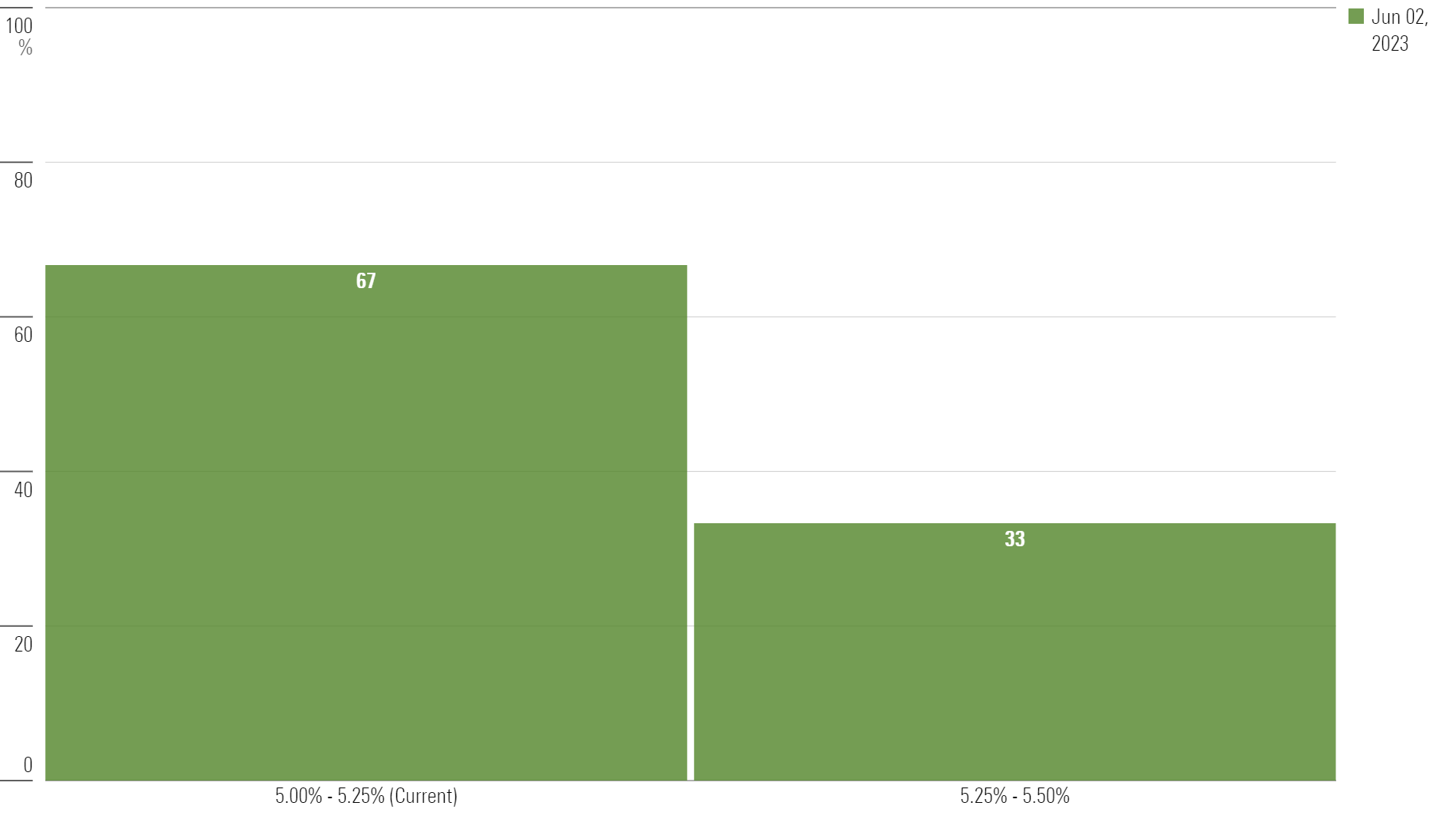

“Today’s data could tip the Fed in a more hawkish direction, depending on what other data from May reveals about the economy,” Caldwell says. “But for now, our forecast is that the Fed is actually done hiking rates altogether in 2023, which is about in line with the market’s view.” Caldwell expects the first rate cut to come in December 2023, followed by aggressive cuts in 2024 and 2025.

The majority of the futures market currently expects that the Fed will pause interest-rate hikes at its June 14 meeting: 66.7% of participants see the rate holding steady at its current 5.00%-5.25% level, while the remaining 33.3% of the market expects the Fed to issue another quarter-point hike, according to the CME FedWatch Tool, which would bring the fed-funds rate to a range of 5.25% to 5.50%. A month ago, expectations were weaker, with 82.8% of market participants foreseeing a pause from the Fed, while the remaining 16.6% of participants expected the Fed to cut rates to a range of 4.75% to 4.00%.

“The Fed will spend more time looking at the inflation data, as well as leading indicators of economic activity,” Caldwell says. “At the very least, a ‘skip’ in rate hikes is in order for the upcoming June meeting.”

Expectations for June 14, 2023, Federal Reserve Meeting

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)