Market Brief: 5 Themes for the Stock Market Heading Into Q4

Key issues include rising bond yields and tech stock performance.

Check out our weekly markets recap at the bottom of this article, with a look at the stocks making some of the past week’s biggest moves, including Splunk and Block.

As stock investors look ahead to the final three months of 2023, the strong rally seen in the first half has run out of steam (for now, at least).

The Morningstar US Market Index climbed more than 20% in the first seven months of 2023, but since the start of August, stocks are down more than 5%. That retrenchment has come with stocks largely holding in a tight 6% range during that same timeframe.

This sideways performance comes despite strong second-quarter earnings, continued strength in the consumer and overall economies, and moderating inflation. What could give the market renewed upward momentum, keep it in a range, or even send it lower again? Here are five issues for investors to watch.

Will Bond Yields Keep Rising?

Bond yields have steadily risen for months, meaning prices have fallen, as the U.S. economy remained resilient. That rise has come even as investors gained confidence that the Federal Reserve’s cycle of raising interest rates will end.

In recent days, yields posted a renewed jump in the wake of the Fed’s monthly policy meeting, when it signaled that investors shouldn’t expect high interest rates to go away any time soon (more on that below). The yield on the U.S. Treasury 10-year note spiked to 4.48% on Thursday afternoon—its highest level since 2007.

That could mean trouble for stocks. When bonds offer more attractive yields than equities, investors tend to favor them because they’re less risky. That can weigh on stock prices and send the market lower.

Treasury Yield and Federal-Funds Rate

How Long Will Rates Stay High?

The Fed may be nearing the end of its hiking cycle, but that doesn’t mean investors should expect the return of rock-bottom rates—especially since the central bank isn’t yet satisfied that its policy tightening has sufficiently cooled the economy. “We need policy to be restrictive so that we can get inflation down to target,” chair Jerome Powell told reporters on Wednesday. “And we’re going to need that to remain to be the case for some time.”

Higher interest rates make it more expensive to borrow money, and that can weigh on corporate bottom lines. Stocks slumped in the wake of the Fed’s latest announcement. “The stock market is trying to come to terms with the idea that rates are going to be higher for longer,” says James Franke, managing director at Rothschild Investment.

Stocks Rallied for Months, But Now They’re Stuck

After a dismal 2022, stocks started 2023 on a tear that abruptly ended in July.

Stock Market Performance

Those doldrums shouldn’t be too surprising, according to Ben Bakkum, senior investment strategist at Betterment. He says that runaway inflation and the Fed’s subsequent rapid rate hikes in the wake of the COVID-19 pandemic were a major shock to the economy and markets, which led to a dramatic selloff in 2022. He characterizes the 2023 rally as a “rebound” from that shock. Companies, the labor market, and the broader economy weathered the headwinds better than almost anyone expected. But now, he says, stocks have “hit a plateau” as the surprises of 2023 fade and investors anticipate a soft landing.

With economic growth slowing, companies are also less confident about their prospects in the months to come. “The market is always pricing expectations for future growth,” Bakkum says. Those expectations of a slowdown could also be contributing to the market’s narrow trading range.

Will There Be a Soft Landing for the Economy?

There were widespread forecasts of a recession throughout 2023 until strong economic data prompted a change of tune. Many experts now believe a soft landing—a best-case scenario wherein growth slows without a recession—is possible, though there’s no guarantee.

Franke says the odds ride on how consumers behave, as they’ve been the primary cause of the economy’s unexpected resilience: “Whether it’s a hard landing, a soft landing, or no landing, the consumer will be the primary driver of how the economy finishes the year.”

He points to a handful of headwinds that may dampen consumer spending in the coming months: the resumption of student loan payments, a major spike in gasoline prices, the depletion of pandemic-era excess savings, and higher interest rates, which can weigh on bottom lines in the form of more expensive mortgages, credit cards, and loans.

“If you have a major contraction in consumer spending,” Franke explains, “it could induce a recession.” That would be bad news for corporate earnings and stock prices.

Will Tech Stocks Resume Their Leadership?

As the market soared earlier this year, analysts were quick to point out that the vast majority of stocks’ double-digit gains were attributable to a handful of mega-cap tech companies like Apple AAPL and Nvidia NVDA, leading to anxiety about the durability of the rally. Experts worried the market’s progress would be fleeting if too few stocks participated.

The gains began to broaden in July, and Bakkum believes more sectors will get in on the action in the months ahead. Energy stocks could see a boost from rising oil prices, for example.

That said, mega-cap tech companies are still so large that their price movements will continue to drive overall returns, according to Bakkum. And that’s not necessarily a bad thing. “It’s natural for the market to have these periods of concentration in certain industries,” he explains.

For the Trading Week Ended Sept. 22

- The Morningstar US Market Index fell 2.8%.

- The best-performing sectors were healthcare, down 1.2%, and consumer defensives, down 1.4%.

- The worst-performing sector was consumer cyclicals, down 5%.

- Yields on 10-year U.S. Treasuries increased to 4.43% from 4.33%.

- West Texas Intermediate crude prices fell 0.8% to $90.03 per barrel.

- Of the 862 U.S.-listed companies covered by Morningstar, 121, or 14%, were up, and 730, or 86%, were down.

What Stocks Are Up?

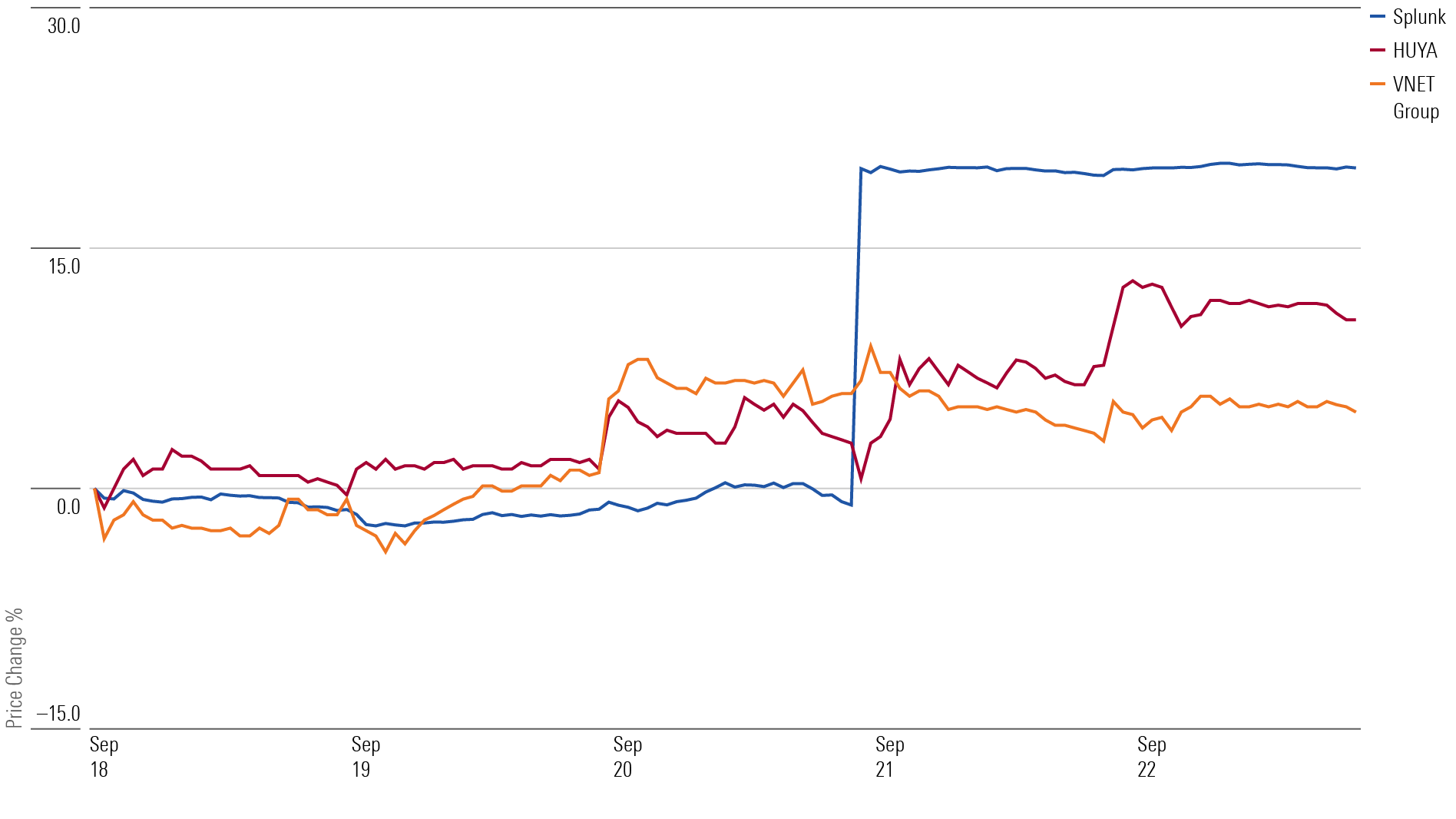

Shares of cloud software firm Splunk SPLK rose 20.1% to $145.10 per share during the week after Cisco CSCO announced its plans to acquire the company for $28 billion ($157 in cash per share), which is a 31% premium to Splunk’s Sept. 20 closing price. Morningstar raised its fair value estimate for Splunk stock to $144 per share. “We believe Splunk’s domestic-leaning business could benefit from Cisco’s global presence,” writes analyst Malik Ahmed Khan.

Stock for Chinese livestreaming company HUYA HUYA rose 10.5% to $2.73 per share. Last month the firm announced a $100 million share buyback program. “We think management is taking the right step to improve the capital allocation decisions,” writes Ivan Su. Morningstar still views the shares as undervalued. Our fair value estimate is $7.70 per share.

Data center service provider VNET Group VNET shares increased 4.9% to $3.19 per share. SEC filings showed Prelude Capital had taken a large stake in the company. “Our fair value estimate is reduced to $8.40 from $8.50 due to Chinese yuan weakness,” writes analyst Dan Baker.

Highlighted Advancers

What Stocks Are Down?

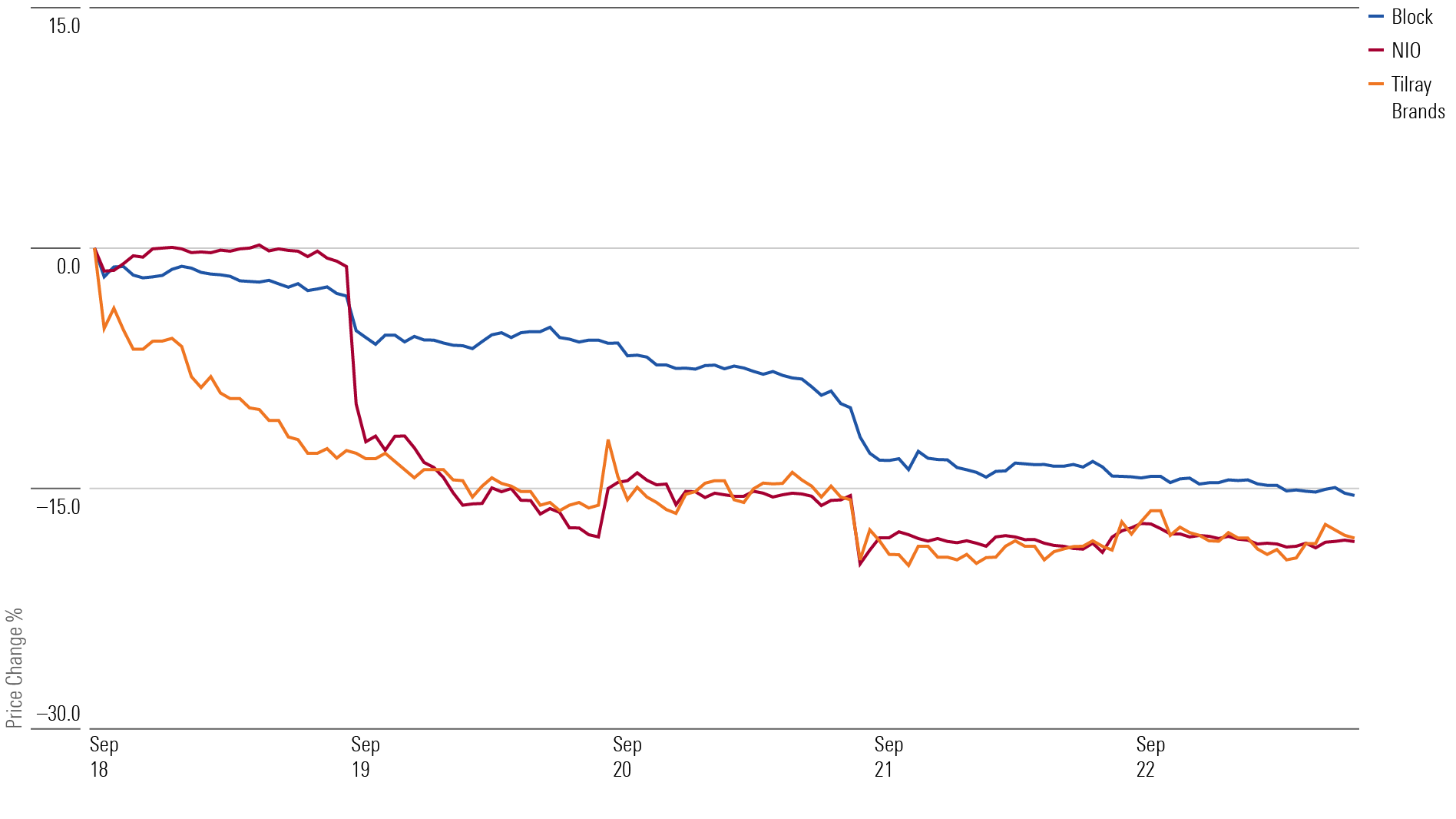

Tilray Brands TLRY stock fell 18.1% to $2.40 per share after Kerrisdale Capital shorted the Canadian cannabis seller and released a negative report on the “failing” company. “Once the buzz over declining craft beers, inflated earnings, and misunderstood rescheduling benefits wears off, investors will realize Tilray shares are worth only a fraction of the current price,” Kerrisdale wrote. Morningstar analysts continue to see the company as undervalued, with a fair value estimate of $5.50 per share.

NIO NIO shares fell 18.2% to $8.53 per share. The electric vehicle maker announced an offering of $1 billion in convertible bonds, which will dilute existing stockholders. Morningstar recently lowered its fair value estimate to $13.30 from $14.00. “With lower vehicle margins and rising operating expense ratio assumptions, we increase our net loss forecast for 2023-24,” writes equity analyst Vincent Sun.

Shares of Block SQ fell on news that the CEO of the company’s payment unit will depart in October and be replaced by Jack Dorsey. The stock dropped 15.4% last week to $44.7 per share. “After reassessing our assumptions in light of the company’s recent performance, we think it is appropriate to lower our long-term margin assumptions given the lack of improvement in profitability,” writes senior equity analyst Brett Horn. “As a result, we are reducing our fair value estimate for Block to $83 per share from $98. We will maintain our narrow moat rating.”

Highlighted Decliners

Correction: (Sept. 25, 2023) A previous version of this story misspelled the name of Morningstar senior equity analyst Dan Baker.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)