How the Largest U.S. Stock Funds Did In Q3 2023

Thanks to a tilt toward value stocks, many of the largest active funds outperformed the biggest index funds.

It was a down quarter for many of the largest U.S. stock funds. But in a twist, for the most part, the biggest actively managed funds offered investors better returns than the largest index funds.

This third-quarter outperformance by some of the biggest actively managed stock funds marks a departure from the long-standing trend of outperformance by index funds.

For example, the $404.7 billion S&P 500 ETF SPY fell 3.3%, the broader $305 billion Vanguard Total Stock Market Index VSTSX lost 3.3%, and American Funds Washington Mutual RWMGX lost 2.1%.

In the background, two previous quarters of stellar returns for growth funds came to an end. As investors came around to the sentiment that interest rates would stay “higher for longer,” growth stocks faltered, according to Morningstar analyst Zachary Evens. “Higher interest rates hurt growth stocks more than value stocks, so it stands to reason that if rates stay high, growth stocks would be disproportionately impacted,” he explains.

Performance data for this article was based on the lowest-cost share class for each fund. Some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

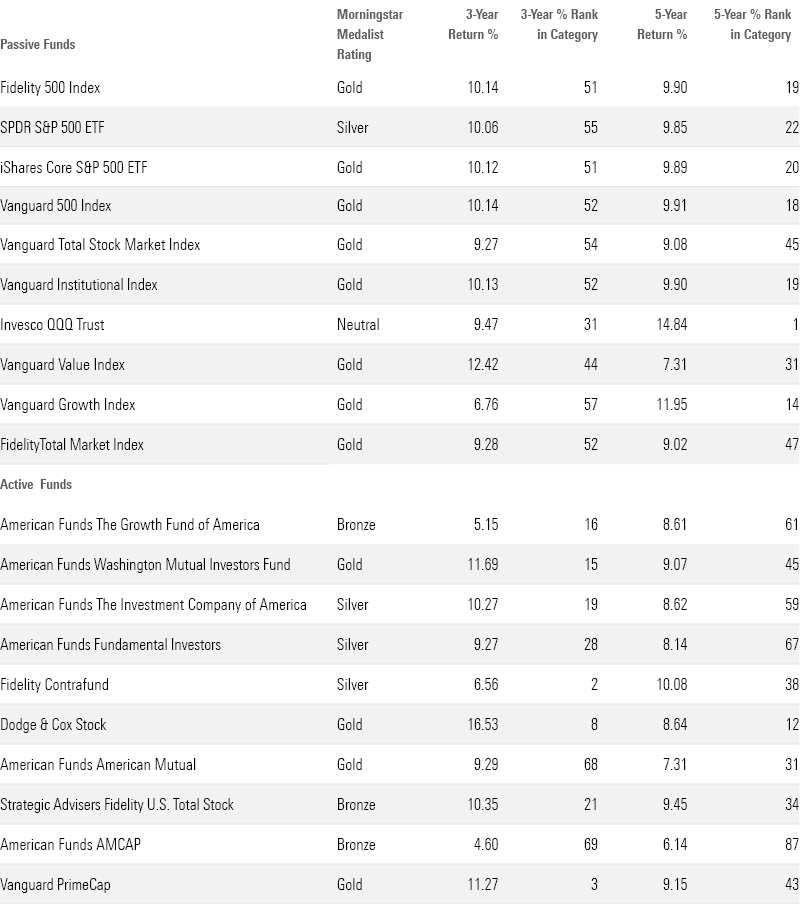

Largest U.S. Stock Funds: Q3 vs. 3-Year Category Ranks

Q3 Performance: The Largest U.S. Stock Index Funds

The $197.5 billion Invesco QQQ ETF QQQ lost 2.9%, hurt by the poor performance of its largest holdings, such as Apple AAPL, which fell 11.6%, and Microsoft MSFT, which declined 7.1%.

The $89.1 billion Vanguard Growth Index VIGIX fell 3.7%. The fund was underweight many of the large healthcare stocks that provided support for other growth funds, says Evens.

On the year, investors in growth funds are up substantially more than value investors. Invesco QQQ ETF is up 35%, while the Vanguard Value Index is up only 0.2%.

Largest Passive Stock Funds Q3 2023 Performance

Q3 Performance: The Largest Active Stock Funds

While performance was generally better for the largest actively managed U.S. stock funds compared to the largest index funds, they still posted negative returns for the quarter.

The $94.2 billion Dodge & Cox Stock Fund DOXGX benefited from the strong performance of its largest holding, Occidental Petroleum OXY, explains Morningstar associate director Tony Thomas. The stock gained 10.6% on the back of higher oil prices. “The fund’s picks in healthcare also benefited the fund, with a nice gain in Regeneron Pharmaceuticals REGN (up 14.5%) and decent showings by larger positions such as its stakes in GSK GSK and Cigna CI,” he says.

Dodge & Cox Stock lost 0.1% during the quarter. So far in 2023, the fund is up 7.1%, while the average large-value fund is up only 1.8%.

Fidelity Contrafund FCNKX posted another strong quarter with a loss of only 0.1%. The $110.3 billion fund is up 25.1% on the year, putting it in the 28th percentile of all large-growth funds. Healthcare picks such as Eli Lilly and Co LLY and Regeneron helped the fund, according to attribution analysis from Morningstar Direct.

The $86 billion American Funds American Mutual RMFGX, lagged in the category, landing in the bottom third. The fund lost 3.2% in the third quarter and is up only 0.3% on the year, placing it in the 64th percentile of all large-value funds. “The strategy straddles the value-blend border, so more growthy picks like Microsoft cooled and slightly weighed on performance in the third quarter,” says Morningstar senior analyst Stephen Welch. Over the past year, not owning stocks like Meta Platforms META and RTX RTX has hurt the fund, he says. Shares of Meta are up 150% in 2023.

Largest Active Stock Funds Q3 2023 Performance

Long-Term Performance Trends

Dodge & Cox Stock is up the most among the largest active stock funds over the past three years, with a return of 16.5%. Among passive funds, Vanguard Value is up the most with a gain of 12.4% on an annualized basis.

However, looking over the last five years, growth funds hold the edge. Invesco QQQ is up the most among the largest index funds with a gain of 14.8% on an annualized basis, while Fidelity Contrafund is up the most among active funds with an annualized gain of 10%.

Largest Stock Funds Long-Term Performance

3 Undervalued Stocks to Buy in Q4 2023

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)