Where Investors Put Their Money in 2022

Despite a bear market for stocks, and the worst bond market in history, fund investors for the most part stayed the course.

Investors could have been excused for retreating to the hills during 2022′s painful markets. Yet, to a large degree, they hung in there with their mutual fund and exchange-traded fund investments.

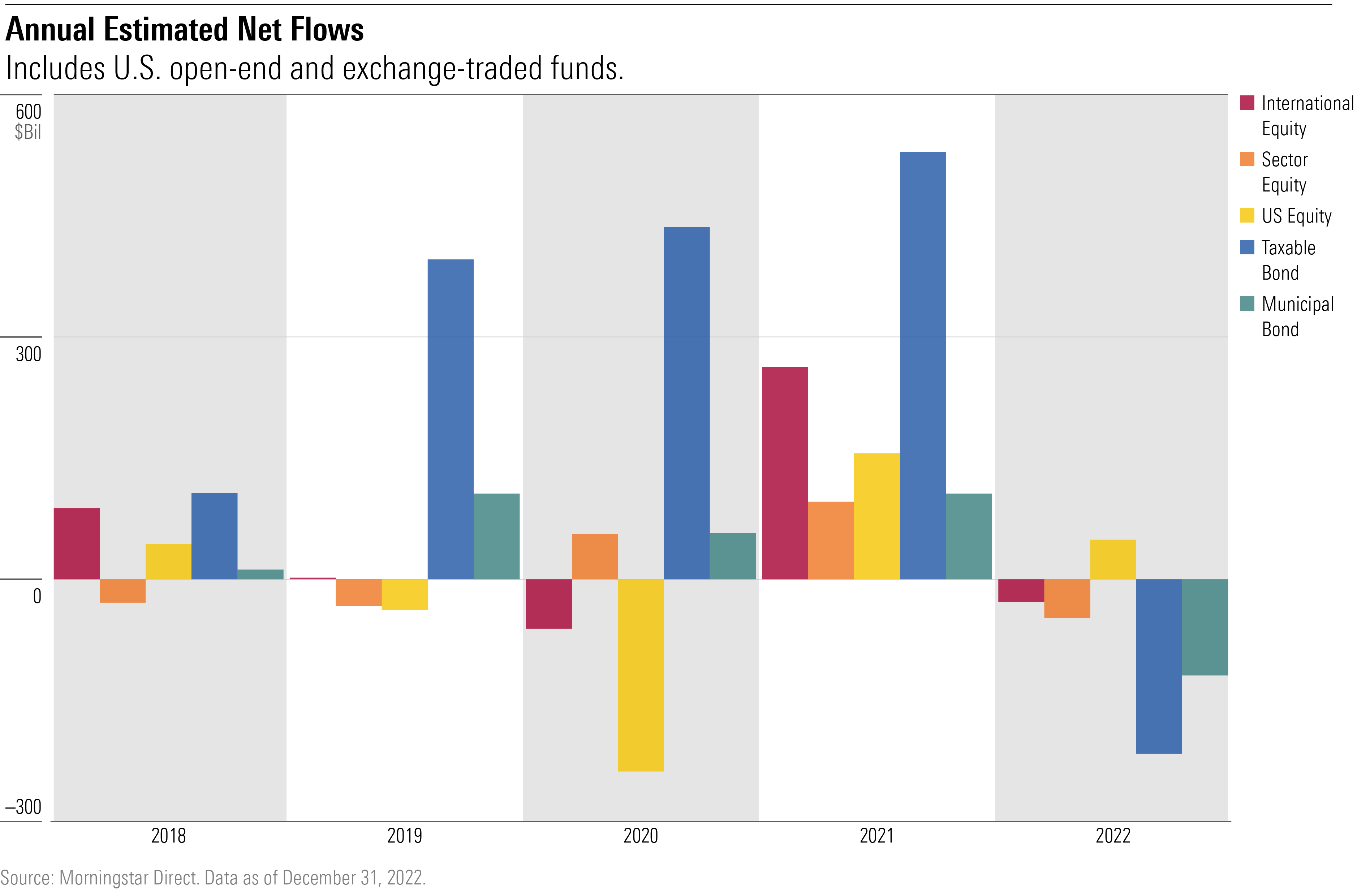

Yes, there was a record exodus from bond funds, but compared with the amount of money plowed into taxable-bond funds, it was a drop in the bucket. That said, it was a different story for tax-exempt bond funds, as investors threw in the towel.

Despite a bear market for stocks and severe losses in household technology names that had been investor favorites, investors put more money into U.S. stock funds than they took out over the course of the entire year. International stock funds and sector stock funds may have seen outflows, but in small proportions.

Meanwhile, investors added money to alternative funds, which promise to provide diversification from stock and bond market movements.

After Record Inflows in 2021, Some Investors Cashed Out

Only U.S. stock and alternative funds avoided outflows among Morningstar’s major fund groups. U.S. stock funds saw $46.1 billion in inflows following a $156.5 billion surge of cash in 2021.

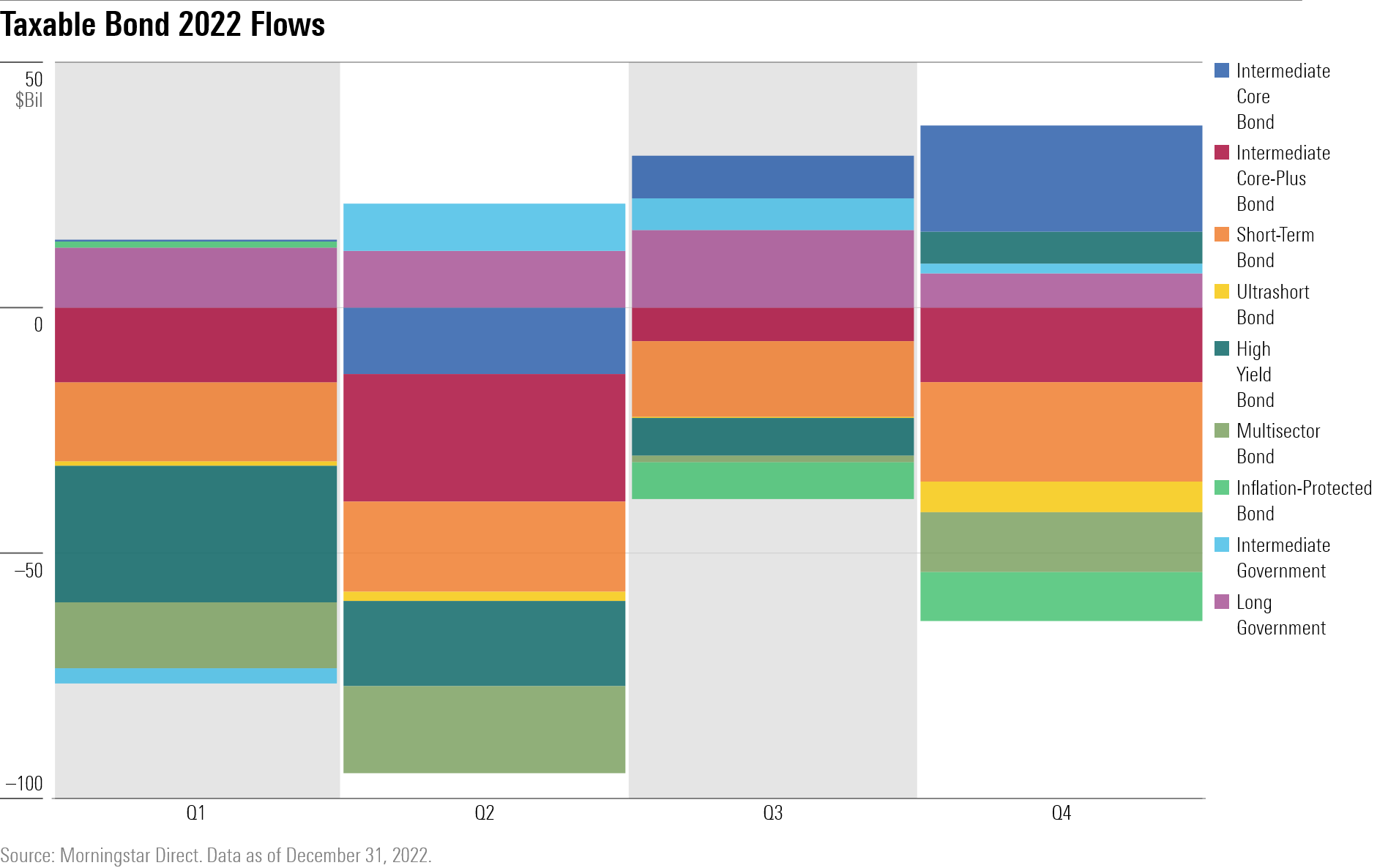

But it was investors’ move out of bond funds that appeared the most dramatic. Following a record year of inflows in 2021, taxable-bond funds saw $216 billion head out the door, the largest outflows for the group in history, according to Morningstar Direct.

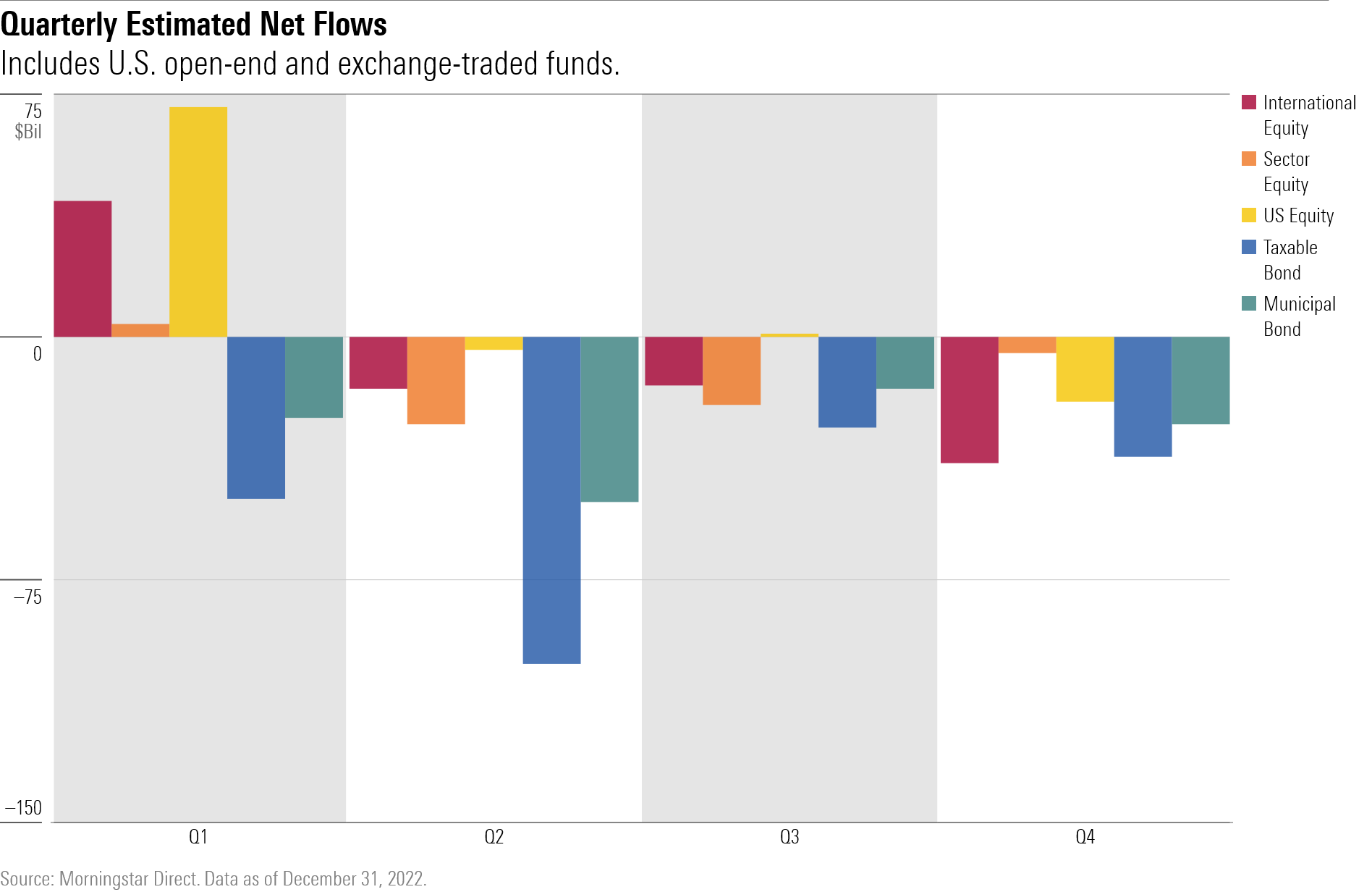

Looked at on a quarterly basis, momentum from 2021, when funds saw record inflows, carried into the first quarter, with both international and U.S. equity funds experiencing strong inflows. But as the year rolled on, investors started to redeem.

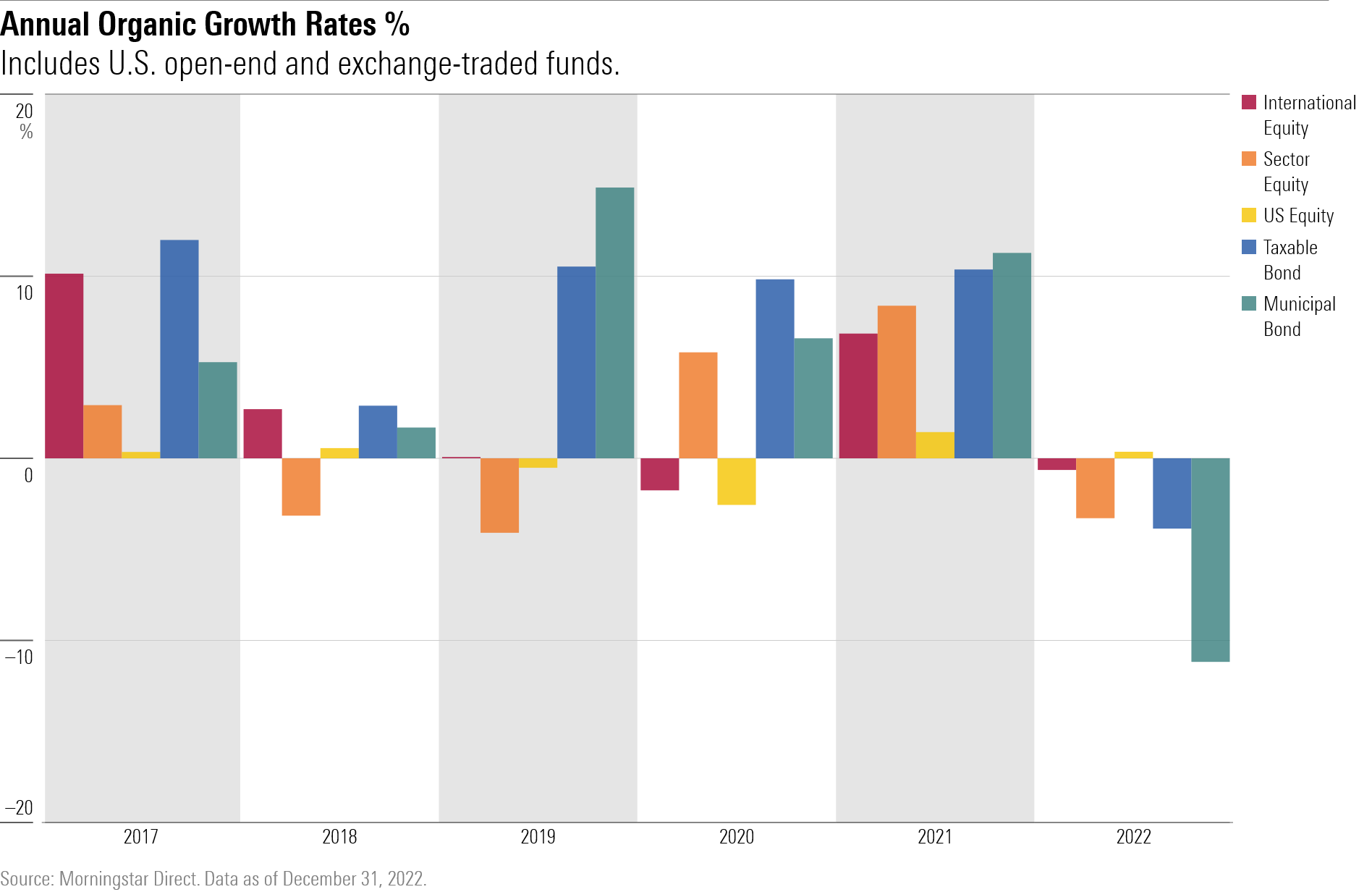

Compared With Assets, Outflows From Funds Were Mostly Contained

Despite the outflows, given the severity of the bear market for stocks and historic losses in bonds, the response among most corners of the fund investing world was relatively muted.

That can be seen when measuring the amount of money put into, or taken out of, funds compared with the amount of money already in the funds.

Known as tracking funds on an organic basis, taxable-bond fund flows saw organic outflows of 3.9%. While that’s the largest annual organic outflows figure in Morningstar’s database, it pales against the organic growth in the previous five years.

In the five years through 2021, investors poured $1.9 trillion into taxable-bond funds, for an organic growth rate of 58%.

For municipal bond funds, outflows were much more drastic: Total assets in the group organically shrank by 11.2%.

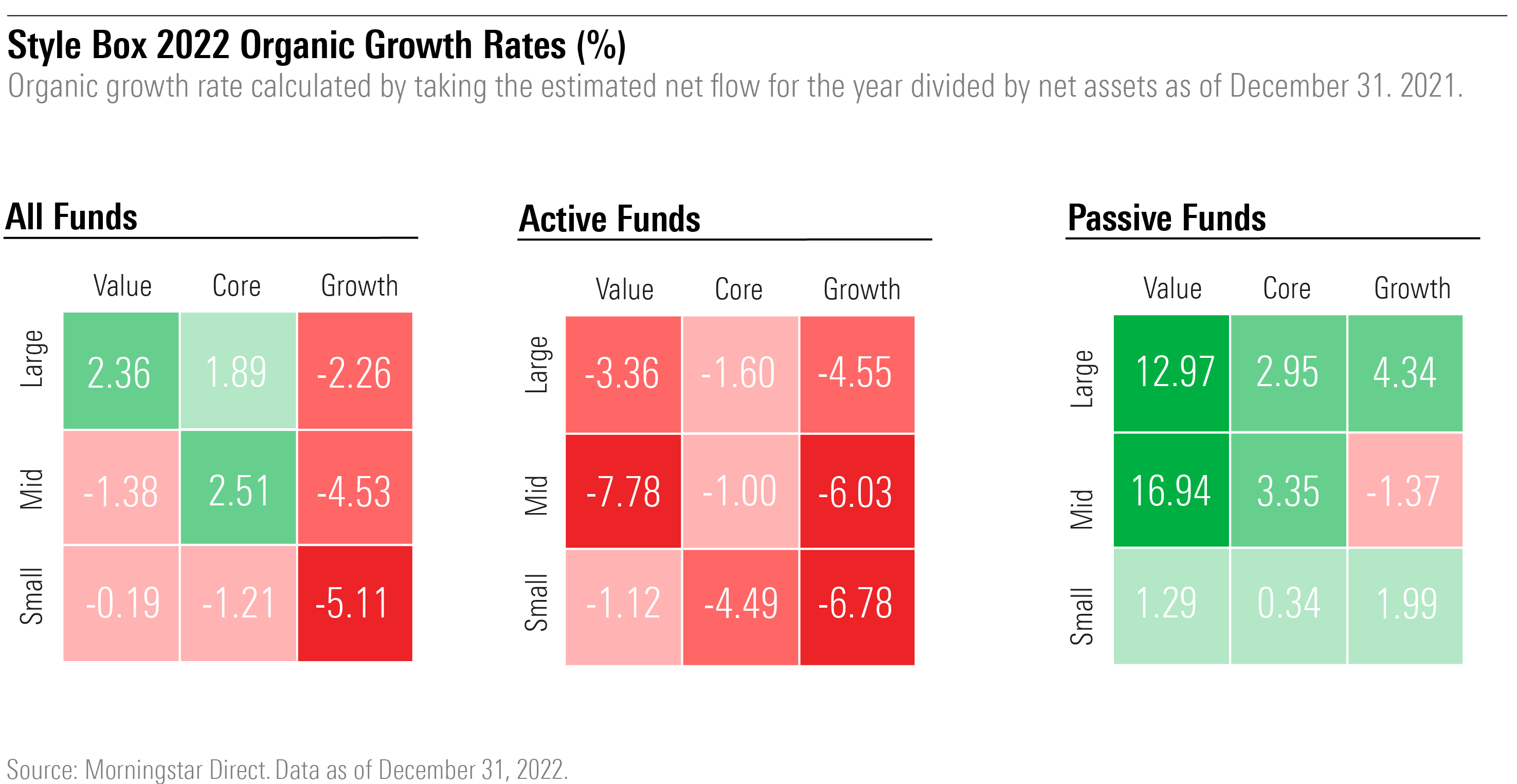

Passive U.S. Stock Funds Saw Inflows

Investors flocked to index-tracking value and blend funds. Among broad-based index funds in the blend Morningstar Categories, Vanguard Total Stock Market Index VTSAX saw inflows of $55.9 billion, Vanguard 500 Index VFINX collected $51.5 billion, and Fidelity 500 Index FXAIX gathered $28.6 billion.

With value stocks taking a much smaller hit in the bear market than growth stocks, Vanguard Value Index VIVAX took in $14.6 billion, and Schwab US Dividend Equity ETF SCHD saw inflows of $15.6 billion.

Growth funds experienced the largest outflows, and the small-growth category shrank by 5.1%.

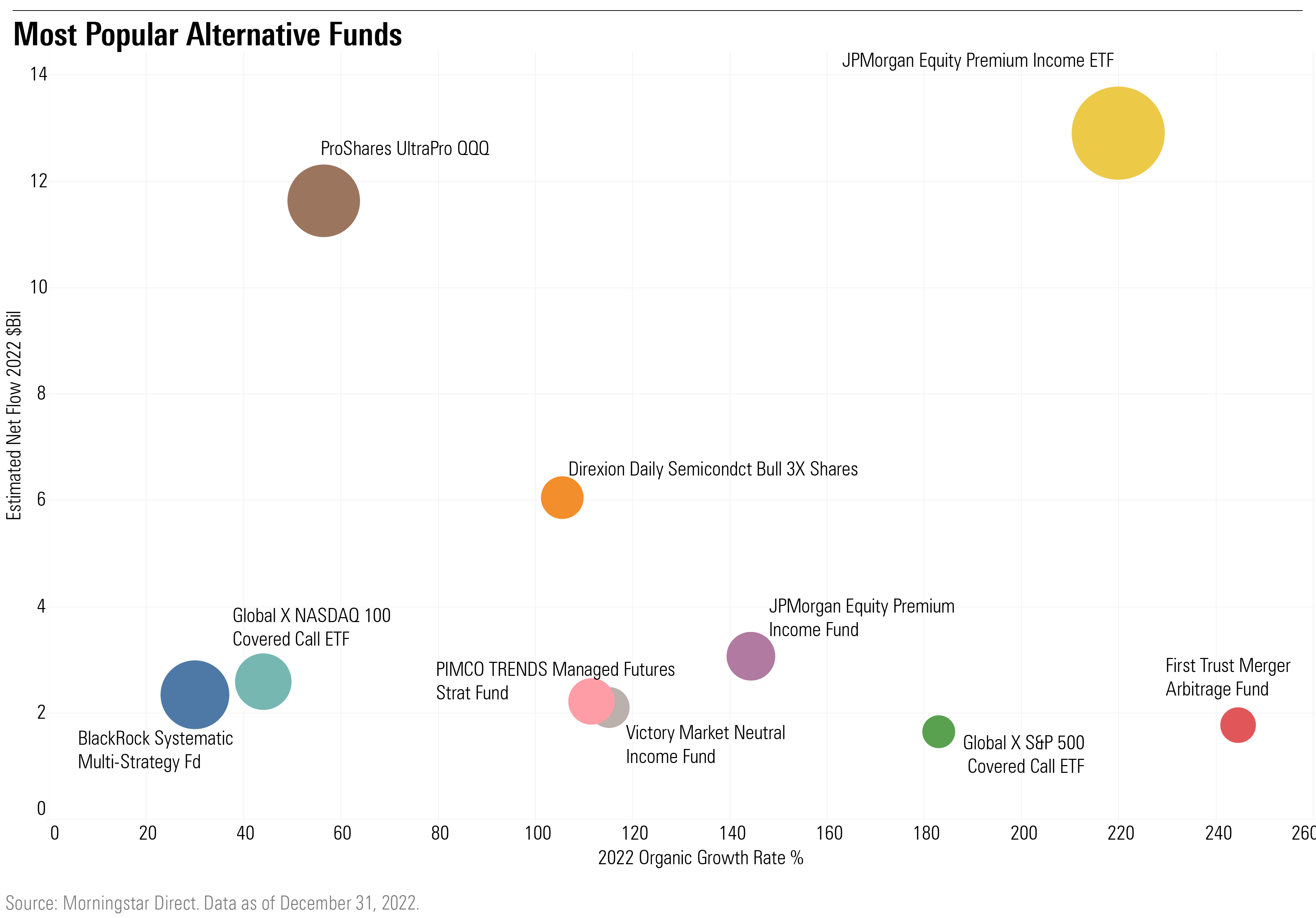

Investors Favored Alternative Strategy Funds

Over the course of 2022, $23.4 billion went to alternative funds; some easily doubled in size. Systematic trend and options-trading funds drew the most interest; the systematic trend category expanded by 70%.

In the nontraditional equity group, derivative income and leveraged equity trading funds were also popular. JPMorgan Equity Premium Income ETF JEPI collected $12.9 billion, and ProShares UltraPro QQQ TQQQ gathered $11.6 billion.

Bond Funds Lost Their Appeal

After piling into bond funds prior to last year, investors backed away as many bond funds recorded their worst year ever. As a group, taxable-bond funds organically shrank by 3.9%.

Short-term bond and inflation-protected bond funds, which saw heavy investor interest in 2021, experienced outflows last year. The largest inflation-protected bond fund, iShares TIPS Bond ETF TIP shrank by 25% after seeing $9.6 billion of outflows.

Instead, investors moved their money into long government and intermediate core bond funds. The amount of money in long government funds grew by 50% in the year.

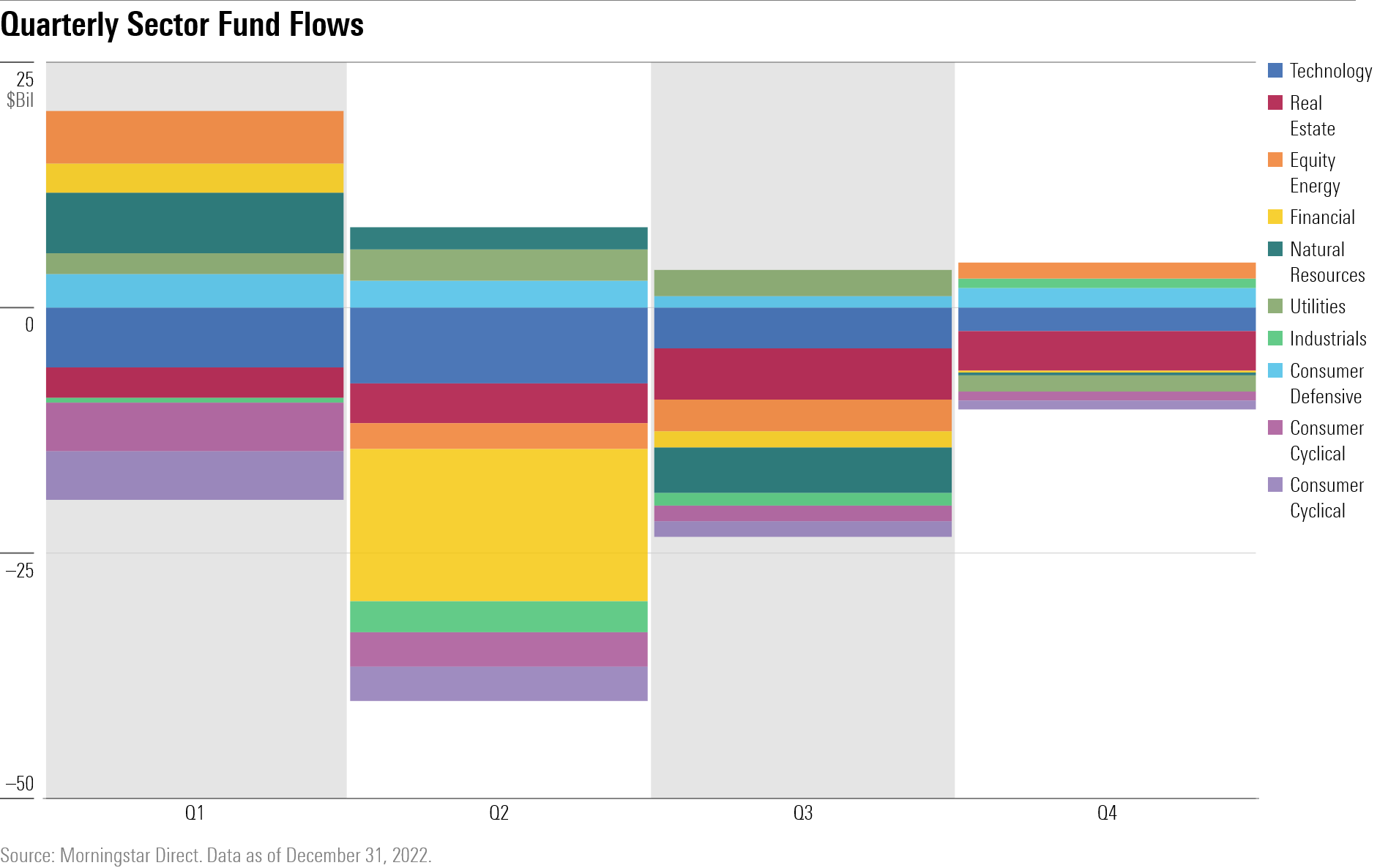

Investors Dumped Financials, Headed to Utilities and Consumer Defensive Funds

Financials sector funds collected $24.2 billion in 2021, but investors sold $14.4 billion net this past year. Similarly, they turned away from real estate funds after pouring $17.9 billion into them in 2021.

Consumer defensive sector funds and utilities stock funds were most popular. Utilities Select Sector SPDR ETF XLU gathered $3.7 billion, and Consumer Staples Select Sector SPDR ETF XLP took in $4.5 billion.

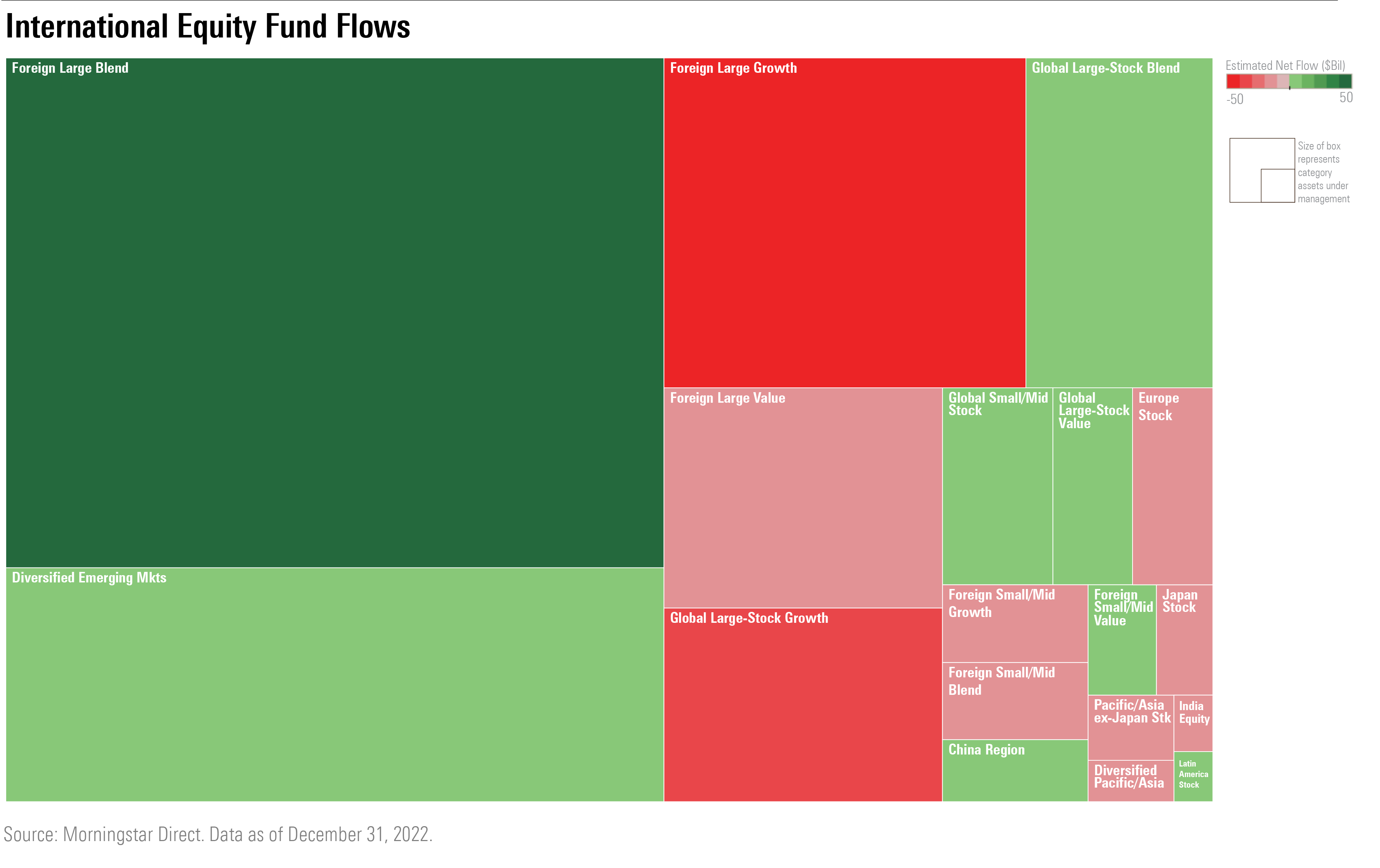

International Stock Fund Flows Turned Negative

Investors turned away from international equity funds, after pouring into them more than other stock categories in 2021. Paralleling U.S. stock funds, global large-stock growth and foreign large-growth funds saw the largest outflows. Inflows to the largest foreign blend funds were steady. Vanguard Developed Markets Index VTMGX collected $11.2 billion, and Vanguard Total World Stock Index VTWIX gathered $5.4 billion.

It was a different story for emerging-markets stock funds. Vanguard Emerging Markets Stock Index VTWAX experienced $4.2 billion of inflows, and iShares MSCI Emerging Market Minimum Volatility Factor ETF EEMV collected $5.1 billion.

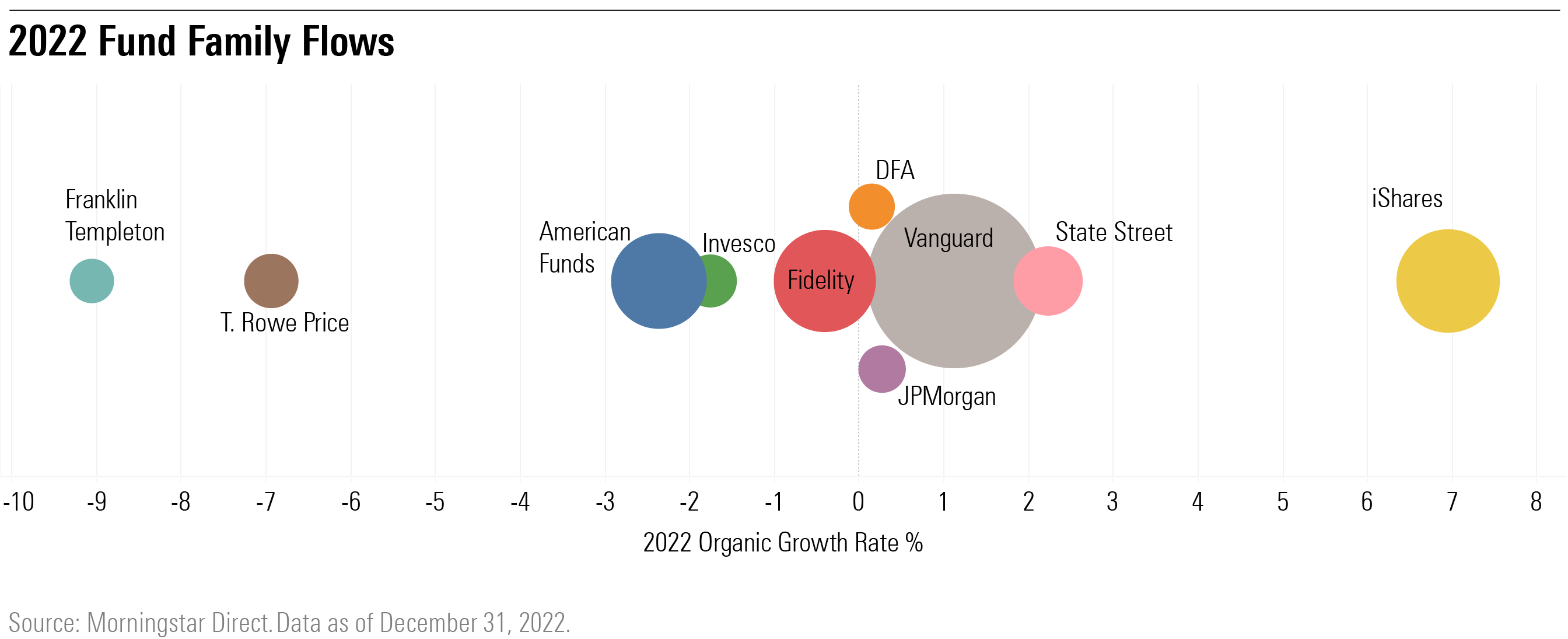

iShares Outpaced Vanguard

For the first time since 2007, another fund company collected more money than Vanguard. BlackRock’s iShares saw $155.7 billion in new money; Vanguard, weighed down by outflows from its active funds, collected $82.7 billion.

In terms of organic growth, iShares and State Street grew the fastest among the largest 10 firms.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)