Vanguard Slipping to Second Place in Fund Flows Race

After 15 years, Vanguard set to yield the top spot to iShares, thanks to active fund outflows.

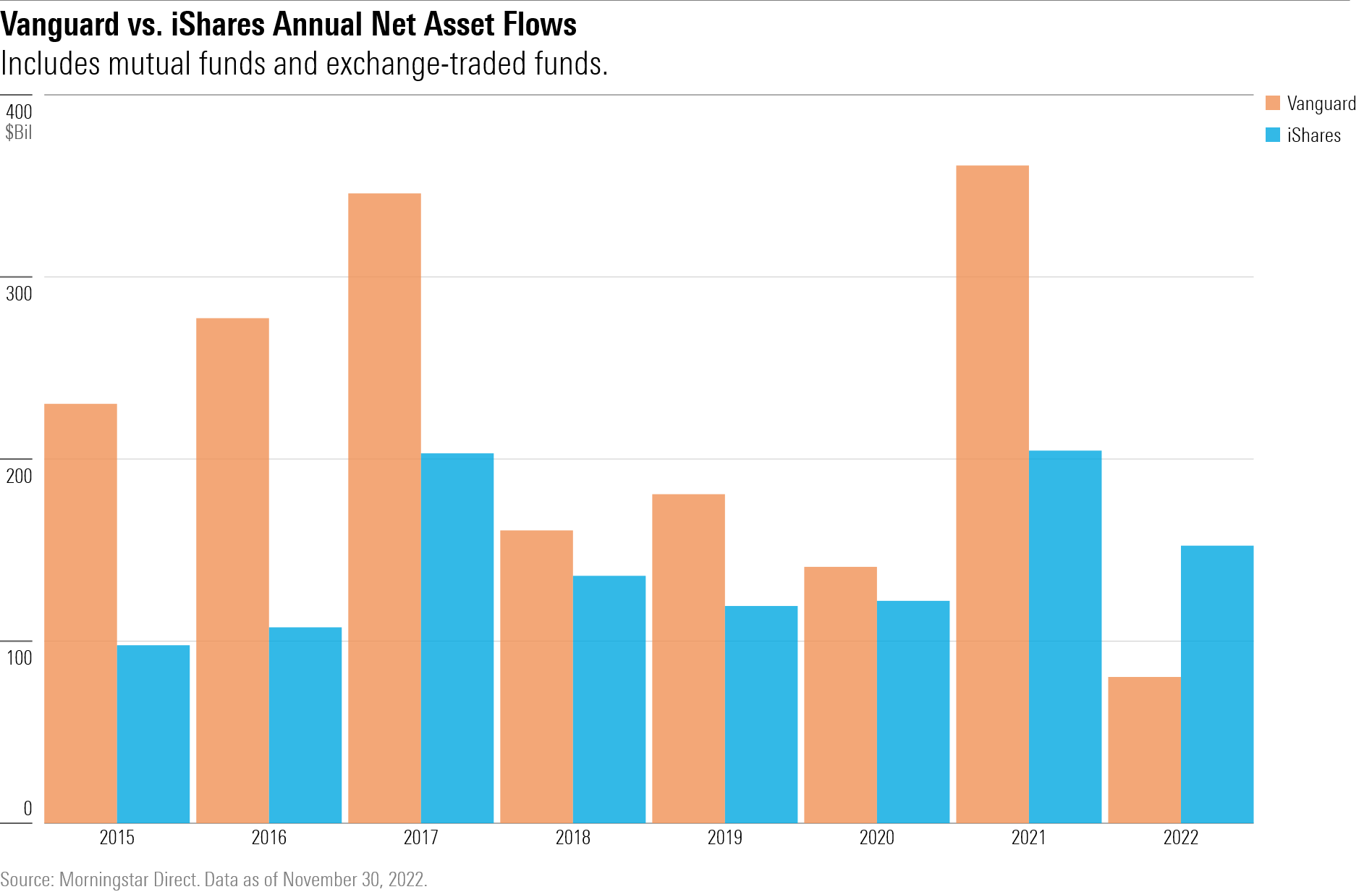

For the first time since 2007, it looks like there’s going to be a new number-one fund company when it comes to where investors are sending their money.

Heading into 2022, Vanguard funds were the top destination for investor money for 15 consecutive years. While there’s still one more month to go to close out the year, BlackRock’s iShares looks poised to snatch the crown from Vanguard.

Through the end of November, iShares’ lineup of exchange-traded funds has collected $152.4 billion compared with Vanguard’s overall inflows of $80.3 billion.

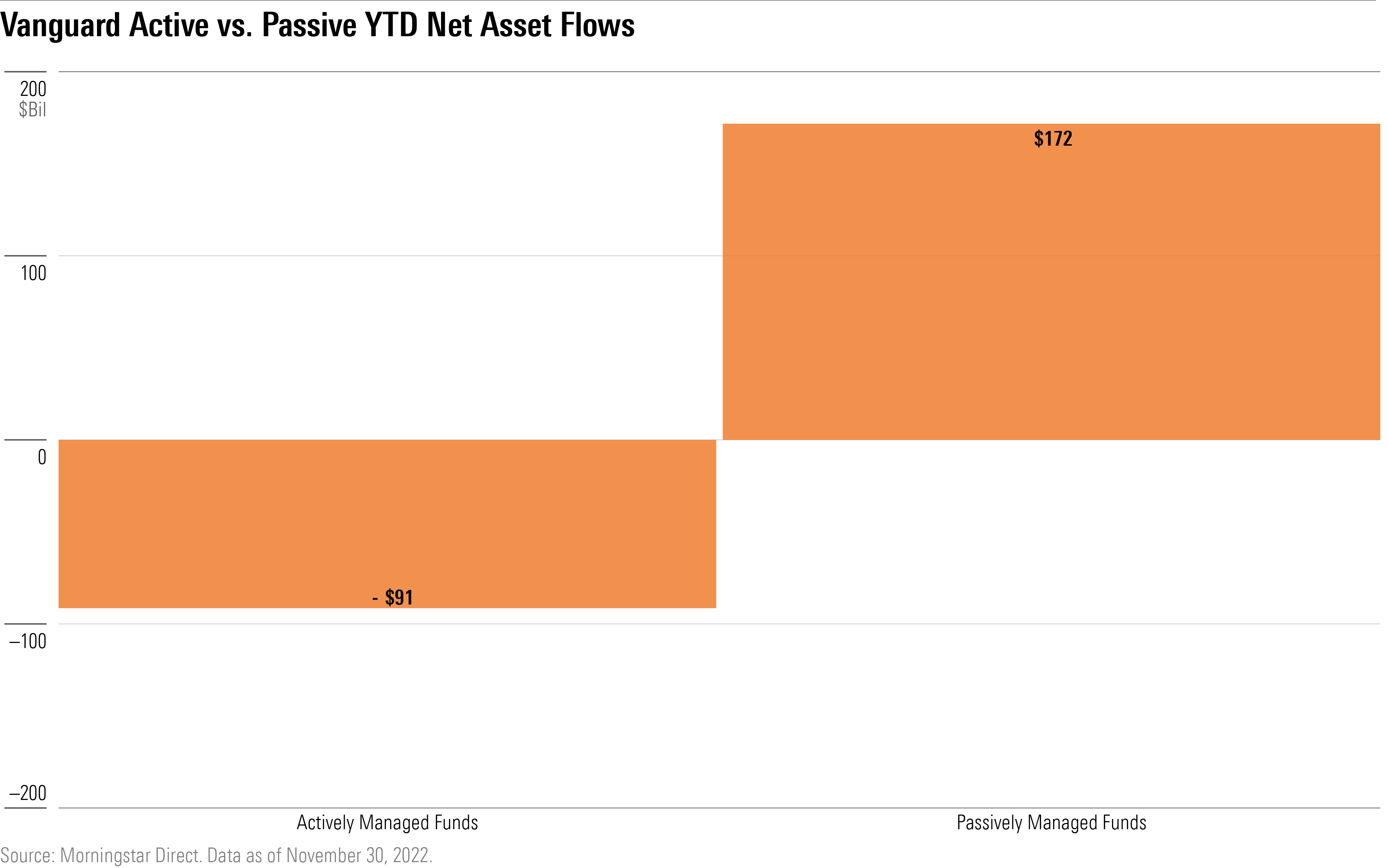

In a bit of irony for the firm that popularized the index fund, it is withdrawals from Vanguard’s actively managed funds that appear to have dethroned the flows champion. At the same time, iShares, where the lineup is entirely ETFs, has captured a hefty amount of money moving into bond ETFs.

Of course, Vanguard isn’t flailing by any means. Its index-tracking funds took in more money than iShares in 2022, and when compared with other fund families that have had severe outflows, it is faring quite well.

But the change in leadership shows a shift in investor preferences and the strength of the iShares lineup. Vanguard has also faced criticism for its customer support and firmwide commitment to ESG investing, which is popular with younger investors, says Morningstar director of manager research Alec Lucas.

Vanguard’s Dominance

Vanguard has been a dominant force in the fund industry, taking in the most money of any fund family for the past 15 years, and in some years seeing inflows exceeding all of its competitors combined. Known for its low-cost index funds, investors have poured more than $2 trillion into Vanguard mutual funds and exchange-traded funds since 2013.

Vanguard’s direct-to-investor, low-fee, and index-oriented approach to investing has been why it’s been so dominant, says Lucas.

In general, investors continue to prefer low-cost, passively managed funds. Even though Vanguard was an original proponent of these investments, iShares’ broad lineup, particularly among fixed-income investments, has made it increasingly competitive with Vanguard.

In most areas, Vanguard still reigns. Vanguard’s passive business has collected more than iShares in 2022, and the Vanguard Total Bond Market ETF BND overtook iShares Core US Aggregate Bond ETF AGG for the largest bond ETF in August. Last year, over 93% of the new money that Vanguard collected streamed into its roster of index products, wrote Morningstar senior manager research analyst Adam Sabban.

“The leadership that Vanguard and iShares have shown is a testament to the dominance of the exchange-traded fund,” says Lucas.

Vanguard’s Active Outflows

It was outflows from actively managed funds that dented Vanguard’s flows. Primarily a manager of passive funds, active funds make up roughly 20% of Vanguard’s mutual fund and exchange-traded fund assets, while iShares almost exclusively offers passively managed funds. (BlackRock’s actively managed, open-end funds are managed separately.) Outflows from Vanguard’s active funds totaled $91.4 billion through Nov. 30.

Vanguard isn’t alone in seeing investors pull out of its active funds. After a brief revival in 2021, 2022 has been one of the worst years for active managers when it comes to flows. Actively managed funds are on track for one of their worst years ever, as $805 billion has exited this year.

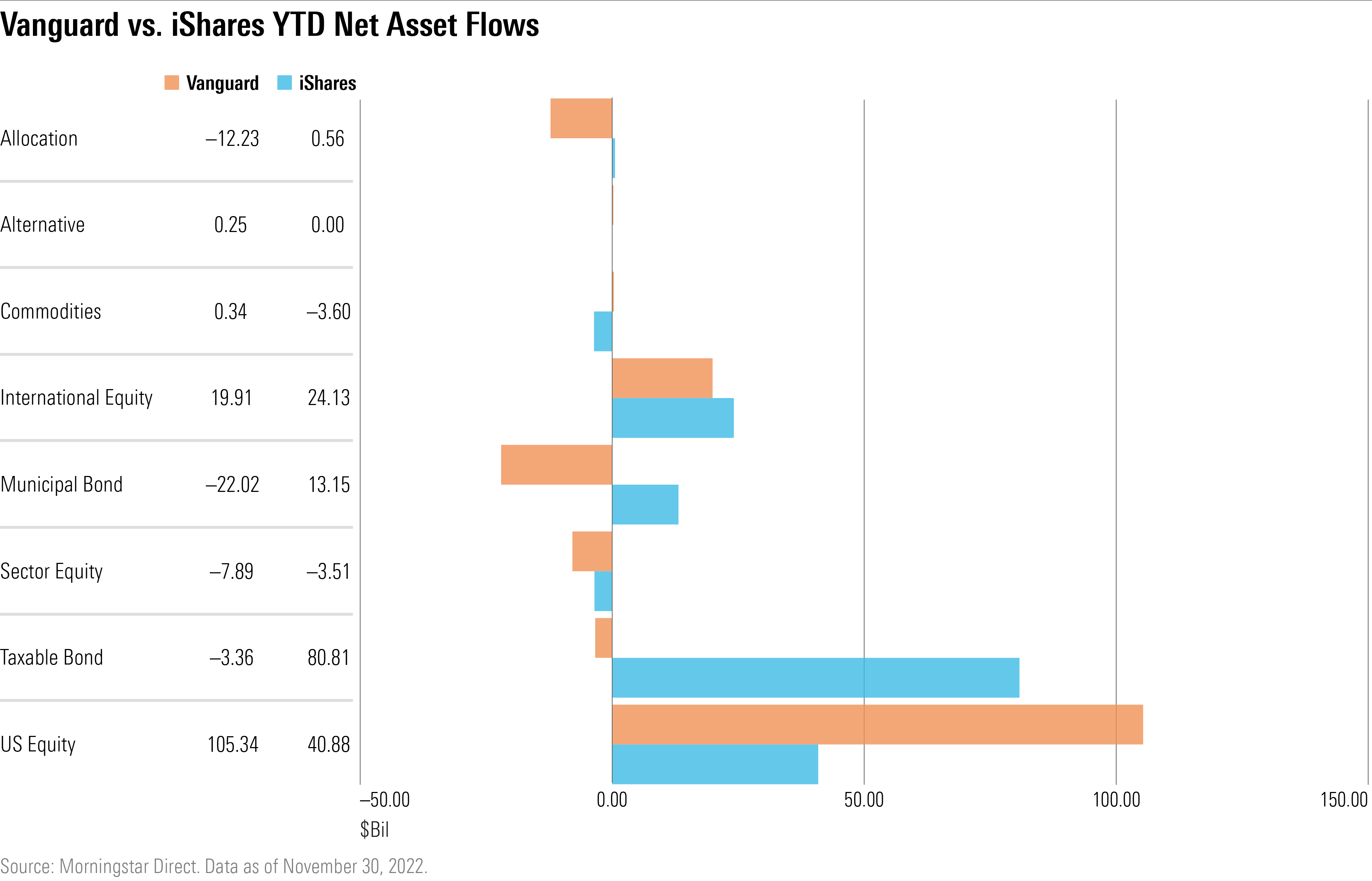

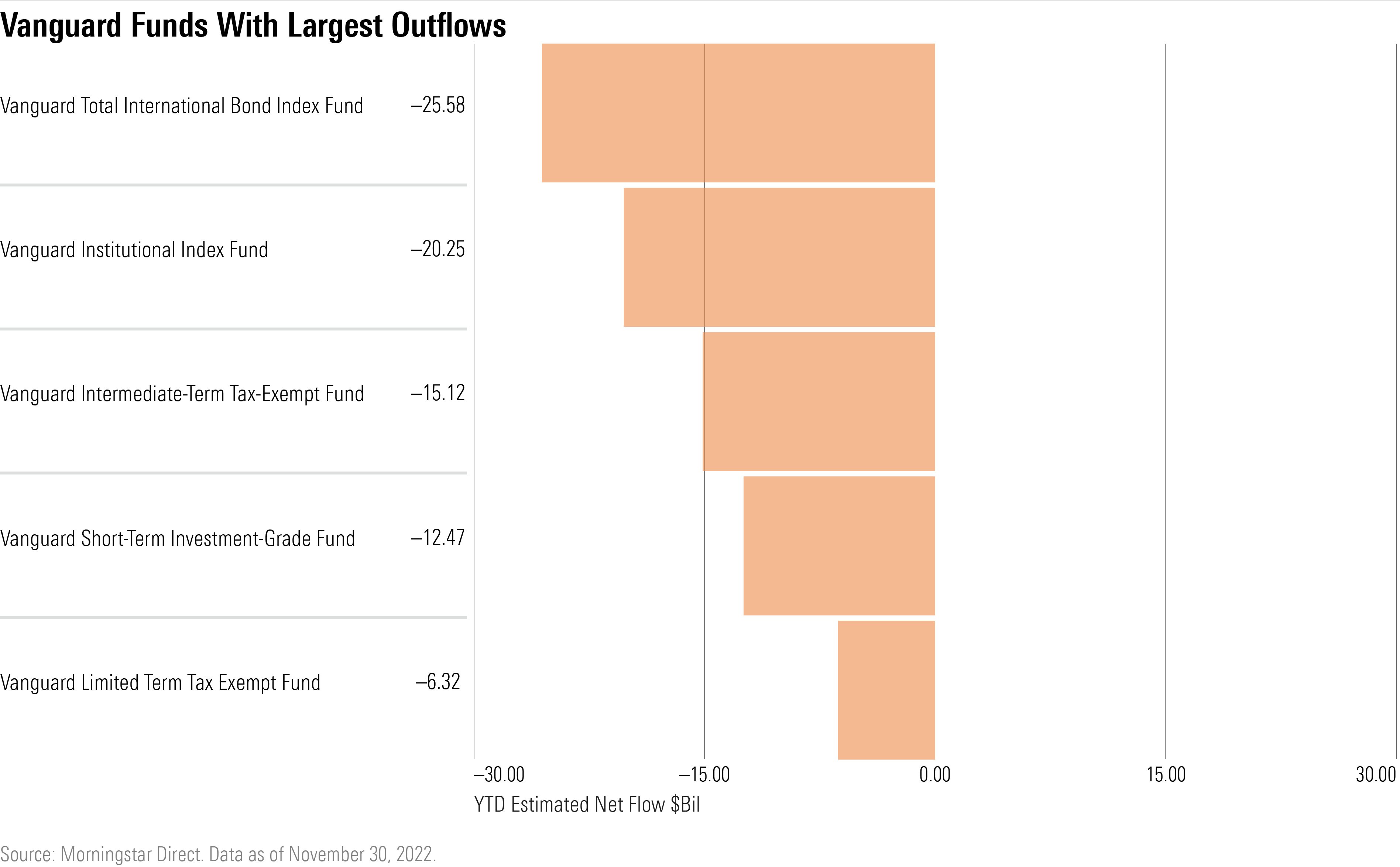

Along with preferring passively managed funds, a broad exodus from taxable-bond funds in 2022 has hurt Vanguard. Taxable-bond funds had been a steady destination for investor dollars. For the past three years the firm’s taxable-bond funds gathered $452.3 billion.

But this year, as bond funds post one of their worst years on record, investors have yanked $29.9 billion from Vanguard’s actively managed taxable-bond funds. Its passively managed bond funds still saw $26.6 billion of inflows.

Outflows from allocation and municipal bond funds were particularly large. The $66.9 billion Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) has recorded $15 billion of outflows.

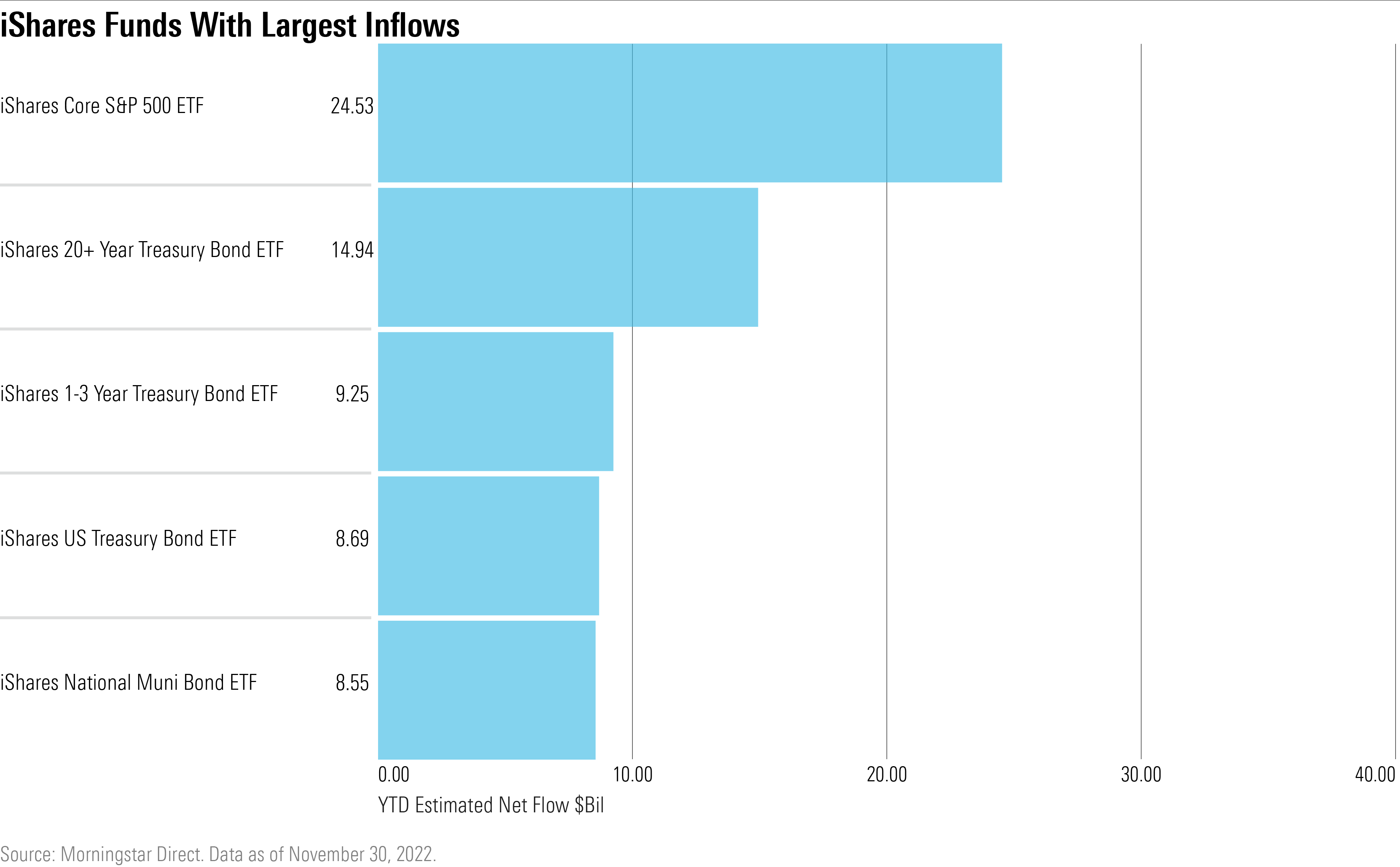

While outflows from bond funds plagued Vanguard, bond ETFs have been a strength for iShares. “IShares has carved out an edge in the fixed-income space,” says Morningstar manager research analyst Ryan Jackson.

“IShares’ most distinct win came in Treasury ETFs that made for popular safe haven investments earlier in the year,” he says. IShares 20+ Year Treasury Bond ETF (TLT), iShares 1-3 Year Treasury Bond ETF (SHY), and iShares US Treasury Bond ETF (GOVT) accounted for almost $33 billion of inflows alone.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)