What Did U.S. Fund Investors Do With Their Money in Q1?

Investors stuck with stocks and bailed on bonds during the first three months of the year.

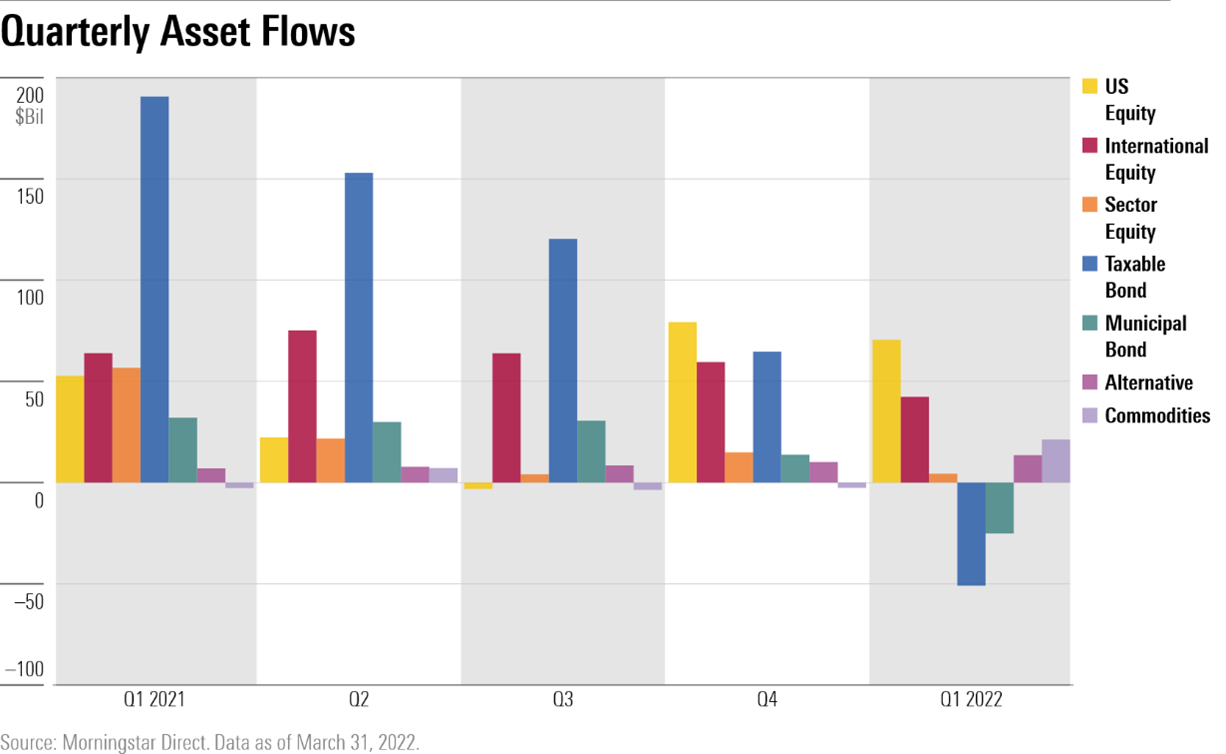

With global markets roiled by rising inflation and war in the first quarter of 2022, U.S. fund investors moved to cash out of bonds as they stayed the course with stocks.

Rising interest rates led to losses for most bond funds, and investors pulled more money out of fixed-income strategies than they put in for the first quarter in two years.

Investors also showed renewed interest in commodities funds as prices surged following Russia's invasion of Ukraine, as well as alternative funds that promised to diversify portfolios away from traditional stock and bond investments.

Here's are some of the highlights from the first quarter's investment trends among mutual funds and exchange-traded funds:

Investors Stuck With U.S. and International Equity and Exited Bond Funds

After seven straight quarters of inflows, investors started to pull their money from bond funds. Only $50.9 billion was withdrawn from the $5.3 trillion category group, but it marked the end of a streak that resulted in $1.1 trillion of inflows. And despite a spike in volatility, investors turned to U.S. equity funds, putting $70.5 billion into the group, and added to their international-equity fund holdings.

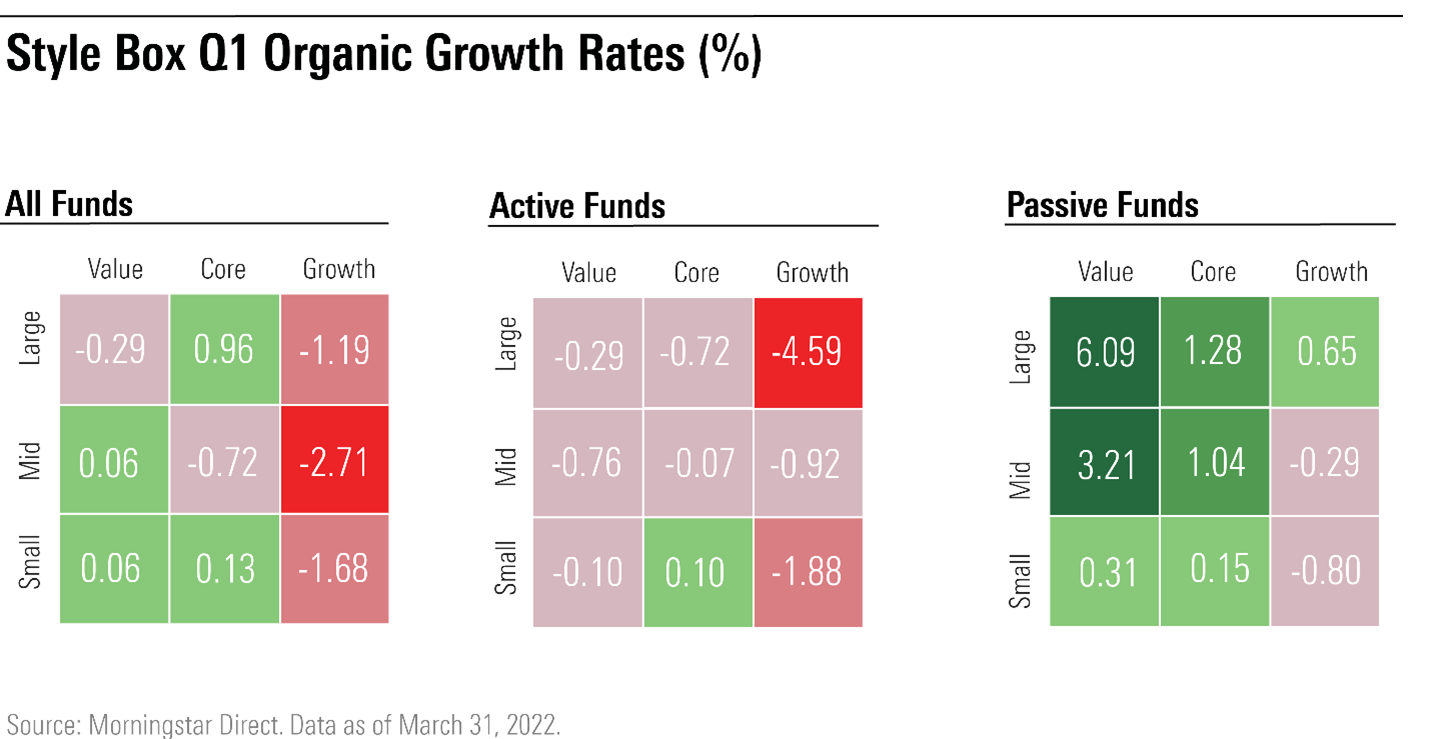

Investors Preferred U.S. Value to Growth Funds

As growth strategies struggled for the second consecutive quarter, investors put more money into value funds. On an absolute basis, investors pulled the most from the large-growth Morningstar Category, taking out $20.1 billion, causing it to shrink by 1.19%. But the $4.9 billion pulled from the mid-cap growth category had a more severe impact. The amount of assets in mid-cap growth funds shrunk by 2.71%. (Organic growth refers to the cumulative flow in or out of a category divided by the assets at the beginning of the measured period, and gives better context to the size of a fund or category's inflow or outflow.)

Vanguard Value Index VVIAX took in $10.3 billion. Dividend-focused funds also generated interest with Schwab U.S. Dividend Equity ETF SCHD and Vanguard High Dividend Yield Index VHYAX experiencing large inflows.

Large-blend funds saw the largest amount of inflows, with Vanguard 500 Index VFIAX and Fidelity 500 Index FXAIX taking in over $15 billion each.

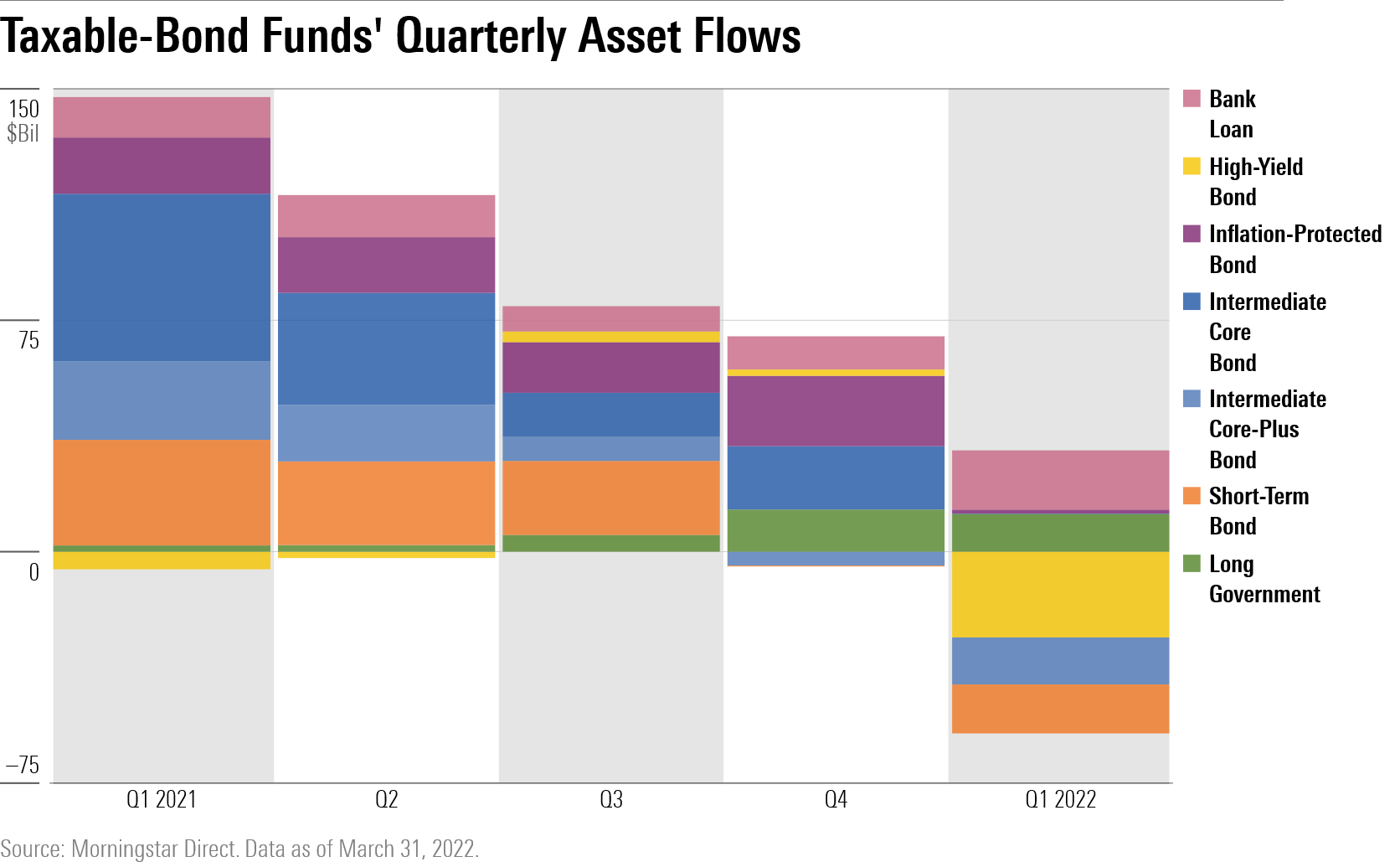

Investors Moved Into Bank-Loan Funds and Out of High-Yield and Short-Term Bond Funds

While bond funds overall saw outflows, investors still sought refuge in strategies that offer some protection from rising interest rates. Bank-loan funds replaced inflation-protected bond funds as the inflation-fighting vehicle of choice, and long government-bond funds saw inflows. Inflation-protected bond fund performance has been volatile this year as yields and inflation expectations rise and fall, and bank-loan funds offer some inflation-protection because they invest in loans with floating rates that adjust as short-term interest rates move.

Nine different bank-loan funds each have seen more than $1 billion of new money this year. PGIM Floating Rate Income FRFAX led that group with $1.9 billion of inflows. Fidelity Advisor Floating Rate High Income FFRAX, the largest fund in the category with $13.1 billion of assets under management, grew by 14%, and SPDR Blackstone Senior Loan ETF SRLN grew by 13%.

Among bond-fund categories, investors pulled the most money from high-yield debt. About $27.8 billion exited the category, with iShares iBoxx High Yield Corporate Bond ETF HYG seeing $5.2 billion of outflows and the BlackRock High Yield Bond BHYIX seeing a decline of $1.8 billion. Short-term and intermediate-core plus bond funds also posted net outflows.

Municipal-bond funds also recorded outflows. Vanguard Intermediate-Term Tax-Exempt VWITX saw $3 billion leave, the worst quarter of outflows for the fund since March 2020.

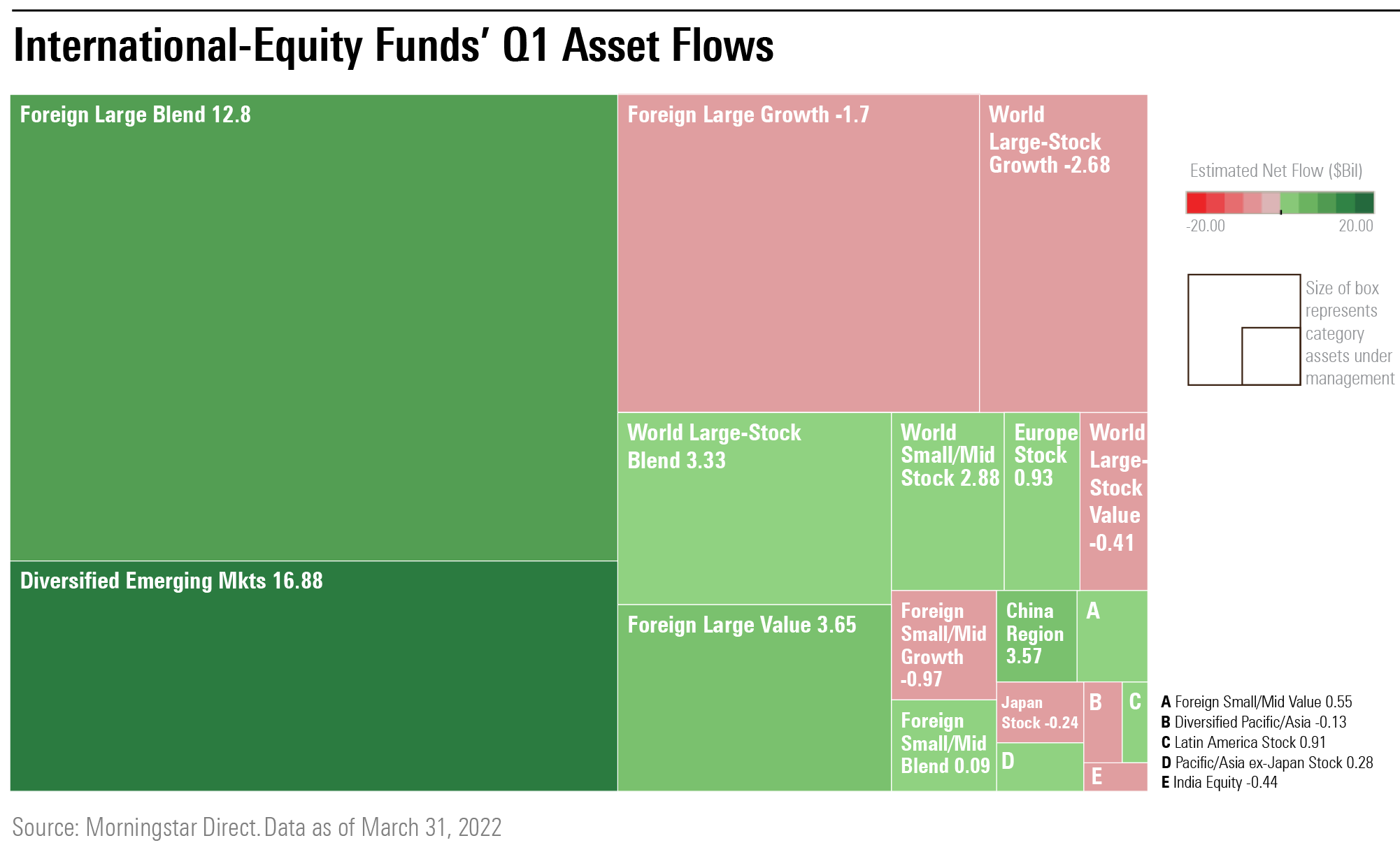

Investors Remain Undeterred When It Comes to International Funds

Russia's invasion of Ukraine caused volatility to spike in international markets and left the future for funds that invest in Russian securities uncertain, but it didn't spook investors from putting their money into broad international-equity funds.

Emerging-markets funds as group recorded $16.9 billion of new money. Vanguard Emerging Markets Stock Index VEMAX added $2.6 billion. China-region funds stayed popular with both iShares MSCI China ETF MCHI and KraneShares CSI China Internet ETF KWEB seeing over $1 billion of new money in the quarter.

Similar to their U.S. counterparts, foreign value strategies gathered more interest than growth funds. Dodge & Cox International Stock DODFX saw $944 million of inflows, while American Funds New Perspective ANWPX saw $1 billion leave.

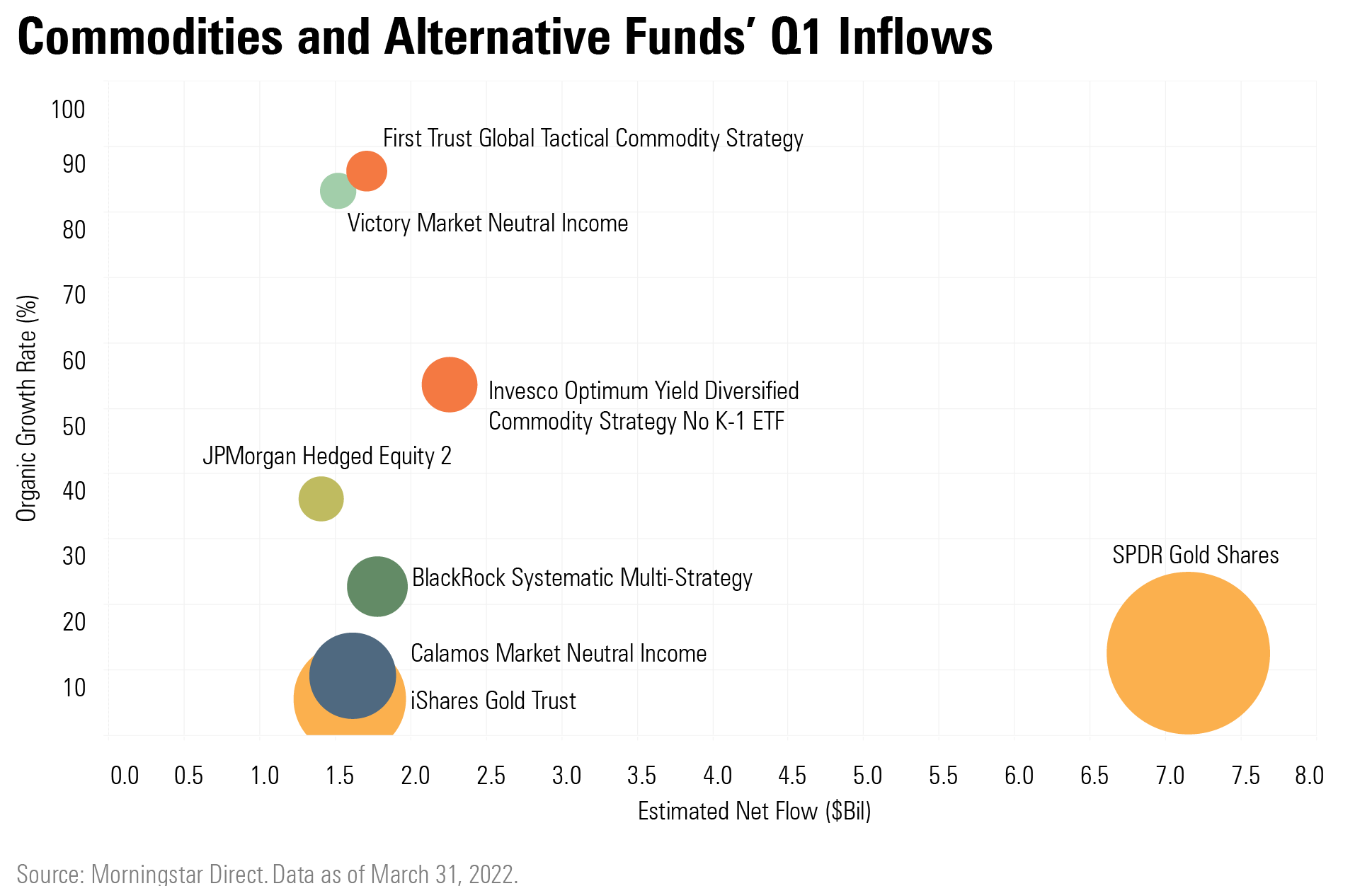

Investors Moved Into Commodities and Alternative Funds

Investors flocked to gold funds as the price of gold rose 6.7% in the first quarter. SPDR Gold Shares GLD saw $7.4 billion of inflows.

Broader commodities funds also saw inflows. Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF PDBC expanded by half, while First Trust Global Tactical Commodity Strategy FTGC almost doubled in size during the quarter after $1.7 billion went into the fund.

Alternative funds also generated interest. Calamos Market Neutral Income CMNIX garnered $1.6 billion of inflows, and JPMorgan Hedged Equity 2 JHDAX saw $1.4 billion of new money.

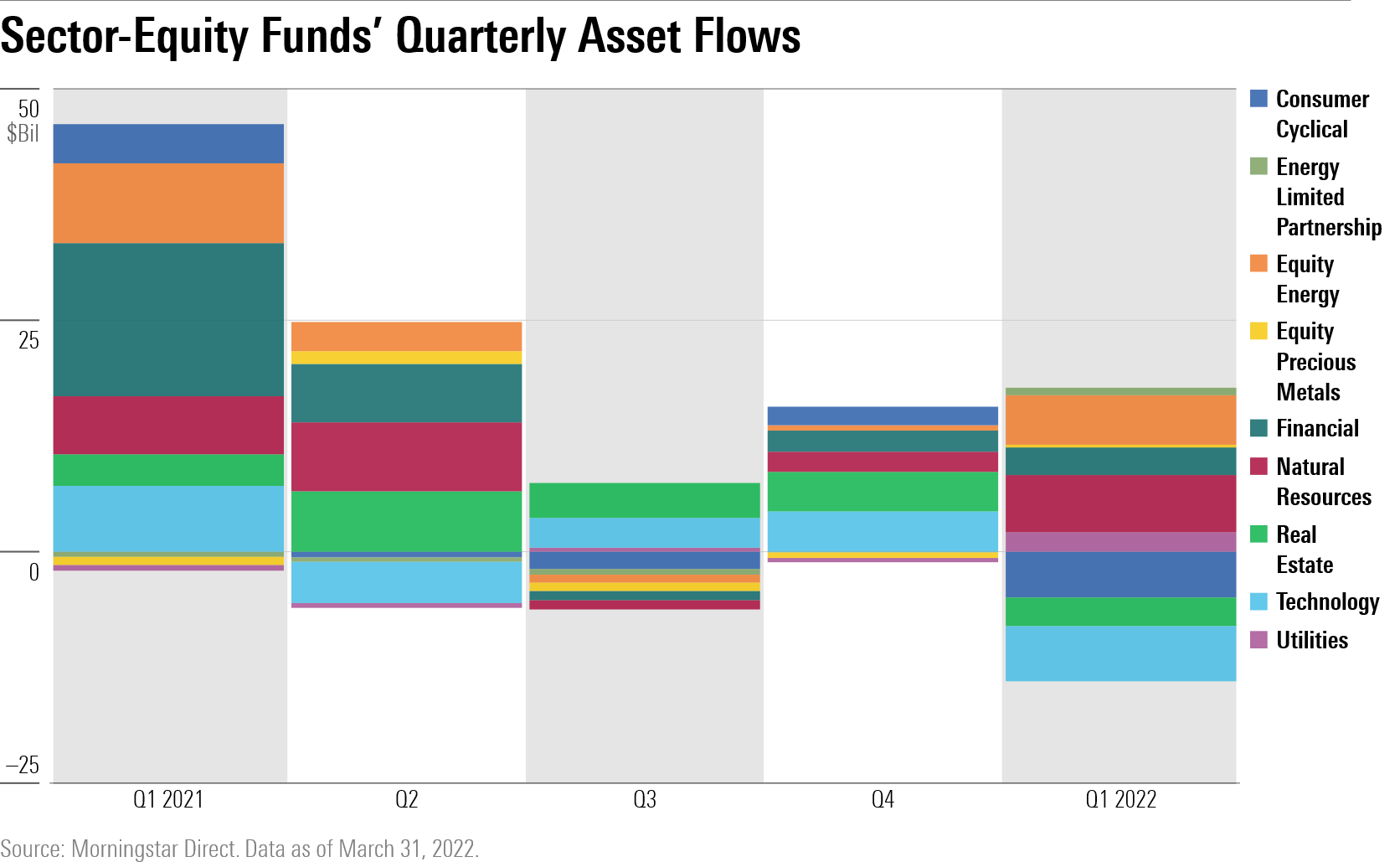

Investors' Interest Cooled on Sector-Equity Funds

Sector funds were popular last year as investors placed bets on financial and real estate funds, but as a whole, investors have cooled on the group, putting in only $4.4 billion this year. They've pulled money from the technology sector, including from First Trust Dow Jones Internet FDN and Vanguard Information Technology Index VITAX.

Energy and natural-resources funds saw inflows with First Trust Materials AlphaDEX FXZ and First Trust Energy AlphaDEX FXN adding more than $1 billion in new money. SPDR S&P Metals and Mining ETF XME and SPDR S&P Oil & Gas Exploration & Production ETF XOP were also popular.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)