Markets Brief: 5 Stocks to Watch During Earnings Season

Exxon Mobil, United Airlines, and Procter & Gamble are among the firms whose earnings could reflect important trends.

Lots of things went wrong for stock investors last year, but corporate earnings wasn’t one of them. As companies report fourth-quarter results, will earnings continue to provide support for the market?

Earnings are widely expected to decline 3.9% year over year in the fourth quarter, according to data systems provider FactSet, as companies continue to grapple with ongoing high inflation and rising interest rates and a possible recession ahead. Revenue growth is also widely expected to slow in the quarter, with estimates now at 3.8% compared with 6.3% at Sept. 30, 2022.

Just four of the 11 market sectors—energy, industrials, real estate, and utilities—are expected to show earnings increases in the quarter. The remaining seven sectors are expected to show a drop in earnings. The worst-performing sector is expected to be basic materials with an anticipated loss of 26.3%, followed by consumer discretionary dropping by an estimated 20.3% and communication services falling by an estimated 19.0%.

“This is likely just the beginning,” says Keith Parker, head of U.S. equity strategy research at UBS. He expects that margin pressures, driven by weakening demand, slowing price gains, and rising wages, will weigh on earnings.

Parker also highlights the disconnect between earnings, including depreciation and amortization, and operating cash flows. Earnings on this basis typically move in sync with operating cash flows, he says, but this year earnings have risen much faster than cash flows in all sectors, excluding financials and energy. As earnings come into better alignment with cash flows, “the risk to earnings is considerable,” says Parker.

Parker does have a rosier view of fourth-quarter results than the Wall Street consensus, expecting a slight dip in earnings on a seasonally adjusted basis. But for 2023, he is forecasting an 11% drop in earnings per share based on UBS’ outlook for a recession in the second quarter.

Key Earnings Trends to Watch

For investors, the flood of information during earnings season can be overwhelming. It can be helpful to focus on key trends and stocks that reflect those trends.

Parker says financials, especially the big banks, communication services, healthcare, particularly healthcare equipment and services, and the food and beverage subgroup of consumer staples are well positioned to see improving earnings trends relative to the rest of the market. He’s closely watching pricing trends, volumes and demand, and cost pressures, and he is listening to corporate commentary for trends and guidance on inventories, labor and wages, orders and changes in backlogs, and margin expectations.

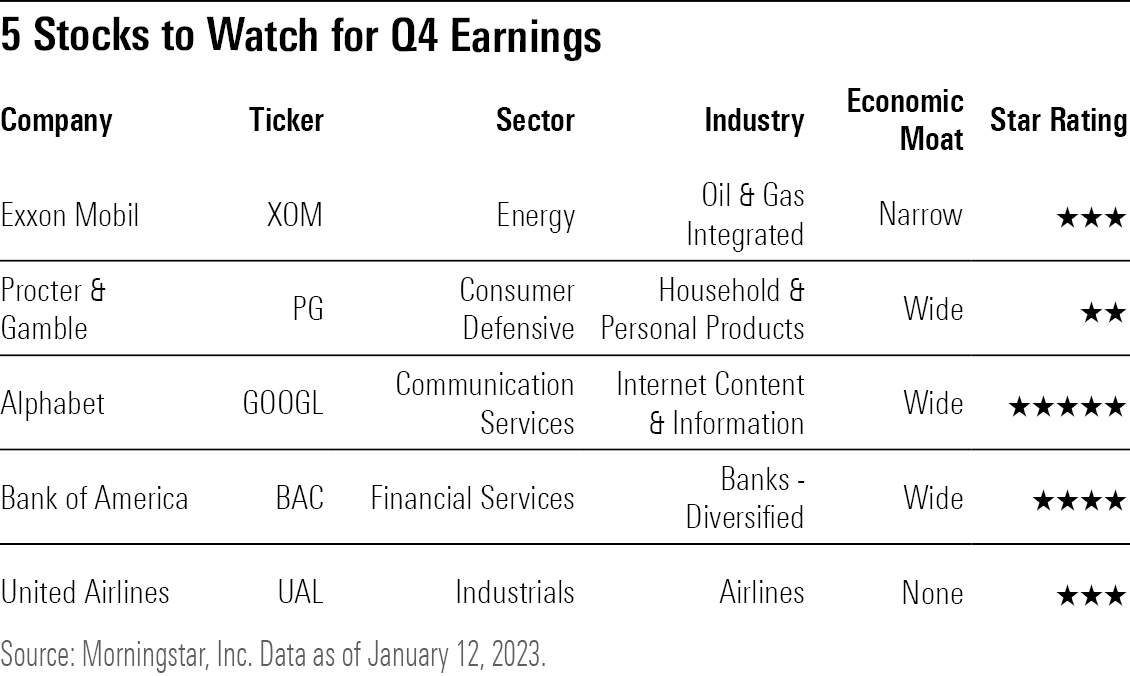

For fourth-quarter earnings, here are five stocks to watch from Morningstar’s equity analysts.

- Exxon Mobil XOM: There is strong growth in energy stocks’ cash flow and earnings, along with capital discipline.

- Procter & Gamble PG: Has pricing power and the ability to maintain high margins.

- Alphabet GOOGL: Robust cash flows and cost-cutting will lead to earnings gains.

- Bank of America BAC: Net interest margins are likely peaking while expenses inch up.

- United Airlines UAL: A rebound in travel and capacity expansion will support margins.

Another Strong Year for Energy

The anticipated decline in fourth-quarter earnings would be more than double if not for the positive contribution of the energy sector, which is on track to report earnings growth of 63% in the quarter, according to FactSet senior earnings analyst John Butters.

Looking ahead, Morningstar energy strategist Allen Good expects “another strong year” from the sector, though earnings growth will likely not match the level of 2022. Continued capital spending discipline, oil price support, and strong refining margins should enable the group to continue to deliver. The reopening of China’s economy should offset any weakness in Europe or the United States.

Exxon Mobil is “best positioned” in the group, says Good, based on “its ability to grow earnings and cash flow in the next five years and boost returns to shareholders.” Current plans call for a doubling of earnings and cash flow from 2019 levels by 2027, thanks to cost efficiencies and high-margin new projects, he says. At a recent $112.89 a share, Exxon Mobil trades at about a 10% premium to Good’s fair value estimate of $102.00, yet he notes that his fair value estimate is based on an oil price of $60. West Texas Intermediate crude is currently trading at about $78 a barrel, and Brent is at $83 a barrel.

Consumer Staples and a Weakening Economy

For Morningstar sector director Erin Lash, consumer product giant Procter & Gamble readily comes to mind as an example of a company that can maintain its “competitive prowess” against a weakening macro backdrop. It’s a wide-moat company with pricing power, she says, noting the company has produced mid- to high-single-digit organic sales growth for an impressive 17 consecutive quarters. She expects the company to continue to produce annual sales growth of 3% to 4% in the long term and maintain operating margins in the low to mid-20s.

The company still has opportunities to unlock several billion dollars in savings by reducing overhead, boosting productivity, and lowering material costs in addition to the $20 billion in efficiency improvements that Procter & Gamble has made since 2012.

When it reports fiscal second-quarter results on Jan. 19, 2023, Lash will be focused on supply chain commentary and the company’s ability to continue to heavily support innovation, research, and marketing. She expects P&G to allocate 13% of sales to developing and marketing its brands annually.

Communication-Services Cash Cows

Another area that appears set to show improvement is the beaten-up communication-services sector, whose 41% loss in 2022 put it dead last in the performance rankings. The group, which comprises media and entertainment giants such as Alphabet, Meta Platforms META, and Walt Disney DIS, saw its businesses boom during the stay-at-home pandemic years and ramped up hiring and spending, only to see fortunes falter last year amid interest-rate tightening and pullbacks in advertising spending.

As earnings weakened, operating cash flows in the sector have remained robust. That disconnect between earnings and cash flow ratios to the historical median suggests room for considerable improvement in earnings, says Parker.

One stock in the communication-services sector well positioned to ride out a recession is Alphabet, says Morningstar senior equity analyst Ali Mogharabi. Its shares have been hit hard in the past year because of a drop in earnings, but with its Google unit the dominant player in the online search market, it continues to generate strong revenue and cash flows.

Alphabet has a variety of options to help preserve margins and maintain free cash flow should conditions worsen, ranging from layoffs, which have been announced at its health and robotics ventures, to scaling back capital spending, particularly on futuristic “moonshot investments,” Mogharabi says.

At a recent $92 a share, the stock trades at a 42% discount to Mogharabi’s fair value estimate of $160.

In Alphabet’s fourth-quarter results, Mogharabi will be looking for continued ad revenue growth in search and an acceleration of YouTube advertising sales, which had disappointed during the third quarter. Cloud-services revenue growth is another area he’ll be watching closely. Given the tough macroeconomic environment, the company may also provide more details about its cost-control strategies to protect margins.

Watching Interest Rates and Bank Stocks

A year into rising rates and inflation, investors will be paying close attention to bank results, particularly trends in net interest margins and consumer lending.

Morningstar strategist Eric Compton notes that net interest margins are at a turning point and likely peaking.

“Everyone will be watching how the banks guide on net interest margins,” he says. “We expect minimal expansion in 2023 from levels reported in the fourth quarter of 2022. Any big deviations from this, either a solid expansion or a big decline in 2023, will likely be interpreted as good or bad.”

There will also be a lot of attention paid to loan growth after a strong 2022, especially amid concerns of a recession, he says.

“Anything around 3% to 5% we would view as reasonable,” says Compton.

Expenses will be closely monitored as well, especially wages since that line item began moving up in the second half of 2022.

Bank of America is the bank that is most representative of industry trends, says Compton, with its strong position in commercial and consumer lending, global investment banking, and retail brokerage activities. At a recent $34.40, the stock trades at a 12% discount to Compton’s fair value estimate of $39.00 per share.

Importantly, Bank of America’s results showed some warning signs when it came to net interest income, Compton recently wrote. Expenses came in higher than he expected.

Investors will also be keen to hear bank managements’ views on the potential for a recession and the outlook for credit losses. Bank of America’s chief executive Brian Moynihan said the economy is “increasingly slowing.” The bank added to its loan-loss provision but said net charge-offs “remain below prepandemic levels.”

Airlines Taking Off

The industrials sector is on track to report the second-highest year-over-year earnings growth in the fourth quarter, behind energy. That performance has been led by a rebounding Boeing BA and the airline carriers as their businesses take flight following the difficult pandemic years.

Brian Bernard, Morningstar’s sector director for industrials, points out that earnings per share growth in the airline industry is benefiting from easy comparisons as the prior-year results were heavily affected by the coronavirus and the resulting demand shock. But growth will continue as demand continues to improve.

“We think the space is undervalued, and fourth-quarter results should be solid,” says Bernard. The exception is Southwest Airlines LUV, which will report a loss related to its recent travel disruptions and will be investing about $1.5 billion to overhaul its operating systems in the next few years to address the problems.

The industry will continue to benefit in 2023 as travel continues to bounce back.

“We’re expecting a full recovery in capacity and an 80%-90% recovery in business travel that subsequently grows at GDP levels over the medium term,” says Bernard.

United Airlines, which has a Morningstar Rating of 3 stars and is trading at a 10% discount to Bernard’s $57 fair value estimate, is a good entry point to the airline industry’s takeoff.

In December, United announced that it had ordered 100 Boeing 787 Dreamliners with an option to add 100 more. The airline now expects to add 700 narrow- and wide-body aircraft to its fleet by 2032. “We expect the addition of these more efficient aircraft will boost United’s capacity and support margin expansion,” says Bernard.

With the most international exposure among carriers—40% of prepandemic revenue was derived from international routes—United should benefit as travel restrictions diminish.

“Over the near term, we’re expecting robust domestic leisure travel to continue, a strengthening business travel recovery as workers return to offices, and rebounding international travel without travel restrictions,” says Bernard.

United will report fourth-quarter results on Jan. 18.

Events scheduled for the coming week include:

- Tuesday: Morgan Stanley MS and Goldman Sachs GS report earnings.

- Wednesday: United Airlines, Kinder Morgan KMI, and Charles Schwab SCHW report earnings.

- Thursday: Netflix NFLX and Procter & Gamble report earnings.

- Friday: Huntington Bancshares HBAN reports earnings.

For the trading week ended Jan. 13:

- The Morningstar US Market Index rose 3.0%.

- The best-performing sectors were consumer cyclicals, up 6.1%, and technology, up 5.2%.

- The worst-performing, and the only down sector for the week, was consumer defensive, which fell 1.0%.

- Yields on the 10-year U.S. Treasury fell to 3.51% from 3.56%.

- West Texas Intermediate crude-oil prices rose 8.3% to $79.86 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 674, or 80%, were up, and 173, or 20%, declined.

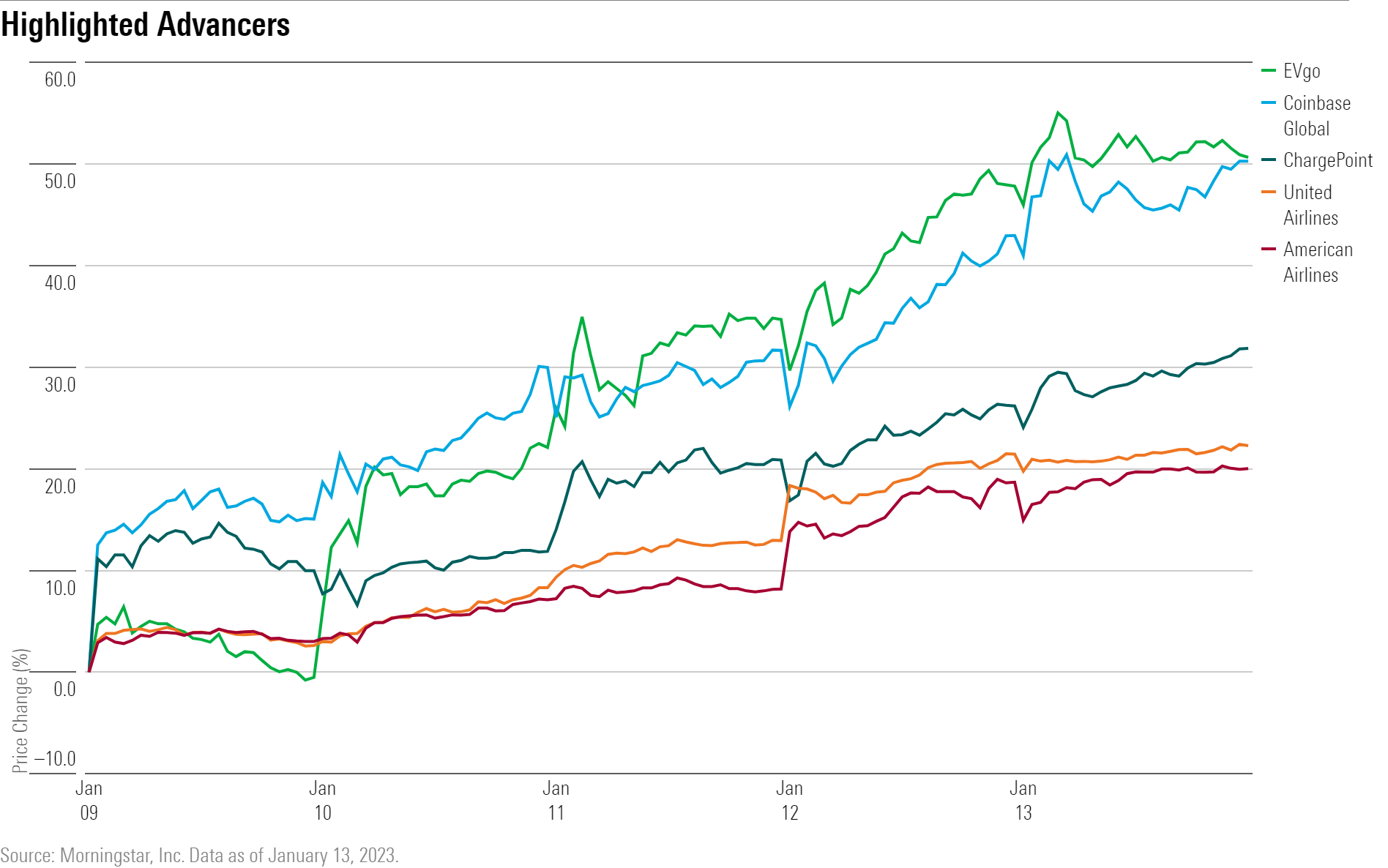

What Stocks Are Up?

Technology stocks surged as data from the Consumer Price Index report showed inflation slowing for the third month in a row, bringing up expectations that the Federal Reserve may scale back the intensity of future rate hikes.

Among the best performers were those in the growing renewable power industry, including electric vehicle charging companies EVgo EVGO and ChargePoint CHPT. Plug Power PLUG and Bloom Energy BE also rallied.

Shares of Coinbase COIN jumped following news that the cryptocurrency firm would be reducing its head count by about 950 jobs, or 20% of its workforce.

American Airlines AAL revealed in an SEC filing that it now forecasts revenue to have increased 17% during the fourth quarter from a year ago, up from a previous forecast of 13%, CNBC reports. The carrier, along with competitor United Airlines, rallied.

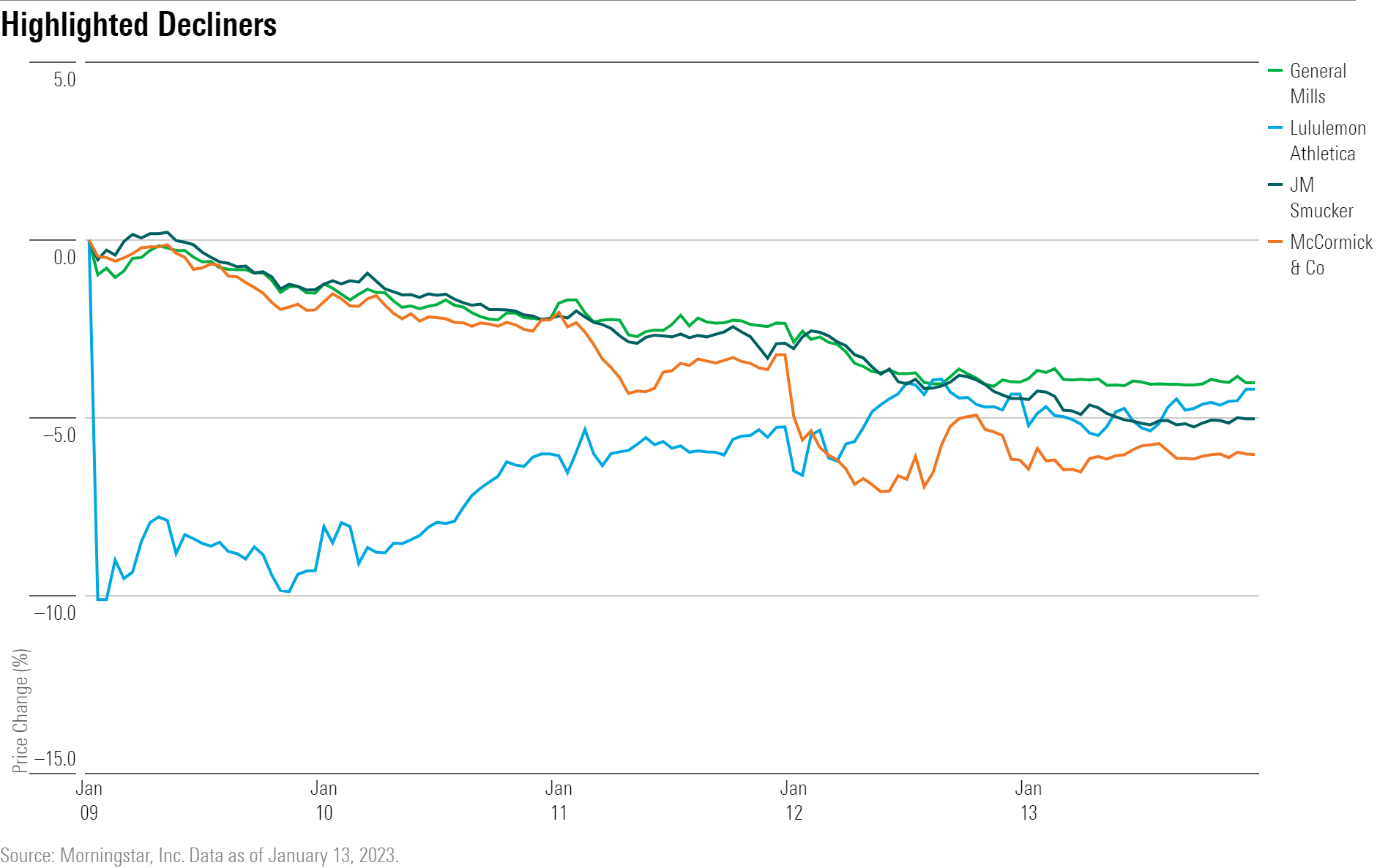

What Stocks Are Down?

Shares of Lululemon Athletica LULU declined after the apparel retailer issued an update to its gross margin guidance. It now expects margins to have declined between 90-110 basis points during the fourth quarter, versus prior expectations for a decline of 10-20 basis points.

Consumer defensive stocks broadly underperformed during the week, with packaged food brands McCormick MKC, J.M. Smucker SJM, and General Mills GIS among the worst performers.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)