Markets Brief: Why Your Portfolio Might Need Stocks With High Cash Flows

While a Fed pause seems at hand, the environment could be right for companies that churn out cash.

Check out our weekly markets recap—including a look at stocks making some of the week’s biggest moves—at the bottom of this article.

Investors seem convinced that the Federal Reserve will pause the rate hike campaign that it’s been on for over a year, removing one headwind from the stock and bond markets. But plenty remains murky about the outlook.

The chief unknown: recession. But there are also uncertainties about the course corporate earnings will take.

In this uncertain economic environment, many strategists are advising clients to invest in “high-quality” companies in addition to defensive stocks, such as consumer staples, healthcare, and utilities, that provide essential goods and services. Dividend-paying stocks are also important. There can be a lot of overlaps between these safe-haven stocks.

“Our view is the economy is headed for recession,” says Josh Jamner, investment strategy analyst at ClearBridge Investments, and he thinks investors should “tilt their portfolios to high-quality equities.”

What precisely do strategists mean by high-quality stocks?

“High cash flow companies,” says Jamner.

Stocks Stuck in a Range

You wouldn’t think the outlook is that murky when looking at the 6.9% year-to-date gain in the Morningstar US Market Index. But stocks have been stuck in a narrow trading range for months now amid a pitched battle between bulls and bears about whether the worst is over.

What’s keeping a lid on the market? Regional banks are still under pressure following three bank failures in the past few months. The banks continue to tighten lending standards, putting a damper on economic activity.

The manufacturing sector contracted for a sixth straight month in April, weighed down by higher borrowing costs and lower demand. In April, inflation inched lower to 4.9% from 5% in March and a peak of 9.1% last June, but it remains uncomfortably high and far from the Fed’s goal of 2%.

The job market is still tight, though jobless claims have ticked higher recently. At 3.4%, unemployment is still far from the Fed’s projection of 4.5% by year-end.

On top of everything else, the U.S. government is bumping against a debt cap that limits its ability to borrow, putting it at risk of defaulting on its obligations unless Congress passes an extension.

But Jason Trennert, chief investment strategist at Strategas Research Partners, argues that there are more than just short-term headwinds at play.

Trennert says stock investors have been significant beneficiaries of exceptionally low interest rates that have been in place since the 2008 financial crisis. In particular, two bouts of quantitative easing, known as QE, by the Fed helped fuel economic growth and stock returns, especially among high-growth stocks.

He says that era is over.

“Investors should steel themselves for the idea that returns are very unlikely to be at the level that they were over the past 13 years,” says Trennert.

“The Fed may be close to stopping its tightening program, but it’s not close to easing either,” he notes. “That means so much of what drove the market and the leadership of the market during QE world would be difficult to repeat. Those companies that were just going for growth, they’re not going to be able to rely on the kindness of strangers or cheap capital to grow.”

Trennert says, “What we’re telling people is that you want to focus on companies that can generate their own cash flows to grow.”

What Are High-Quality Stocks?

That means looking beyond a company’s income statement and paying attention to its cash flow statement, which provides critical details about its spending and financing activities and gives a truer snapshot of its financial health.

Companies that can consistently generate high cash flow and manage that cash wisely are well positioned to reinvest in their businesses, meet their debt obligations, return money to shareholders through share buybacks and dividends, seize growth opportunities, and survive the most difficult times.

Investors can size up how well a company is managing its cash flow by looking at what’s left after operating expenses. This figure is that company’s free cash flow. Free cash flow gives companies the latitude and flexibility to return capital to shareholders, make acquisitions, and maintain a protective buffer in a downturn.

A company’s operating performance can also be measured by looking at its free cash flow yield. This is calculated by dividing free cash flow by market capitalization. The higher the free cash flow yield, the stronger the company.

Though some of the U.S. companies generating the most operating cash flow—including Apple AAPL, Alphabet GOOGL, and Meta Platforms META—are formidable and have outperformed so far this year after a rough 2022, they don’t score as high when measuring their performance based on free cash flow yields. That suggests investors should look for safer havens.

This is just one starting point. You can also screen for companies that are increasing their dividends each year, or look at a company’s amount of leverage to cash flow.

Companies such as Broadcom AVGO, Pfizer PFE, and AT&T T are both generating high levels of operating cash and sporting high free cash flow yields.

Events Scheduled for the Coming Week Include:

- Monday: Catalent CTLT reports earnings.

- Tuesday: U.S. Retail Sales April report. Home Depot HD reports earnings.

- Wednesday: Target TGT and Cisco CSCO report earnings.

- Thursday: Applied Materials AMAT, Alibaba BABA, and Walmart WMT report earnings.

- Friday: Deere DE reports earnings.

For the Trading Week Ended May 12:

- The Morningstar US Market Index was flat, ending the week down 0.30%.

- The best-performing sector was communication services, up 3.01%.

- The worst-performing sectors were basic materials, down 1.98%, and energy, which fell 1.91%.

- Yields on 10-year U.S. Treasuries inched upward to 3.46% from 3.44%.

- West Texas Intermediate crude prices fell 1.82% to $70.04 per barrel.

- Of the 846 U.S.-listed companies covered by Morningstar, only 289, or 34%, were up, and 557, or 66%, declined.

What Stocks Are Up?

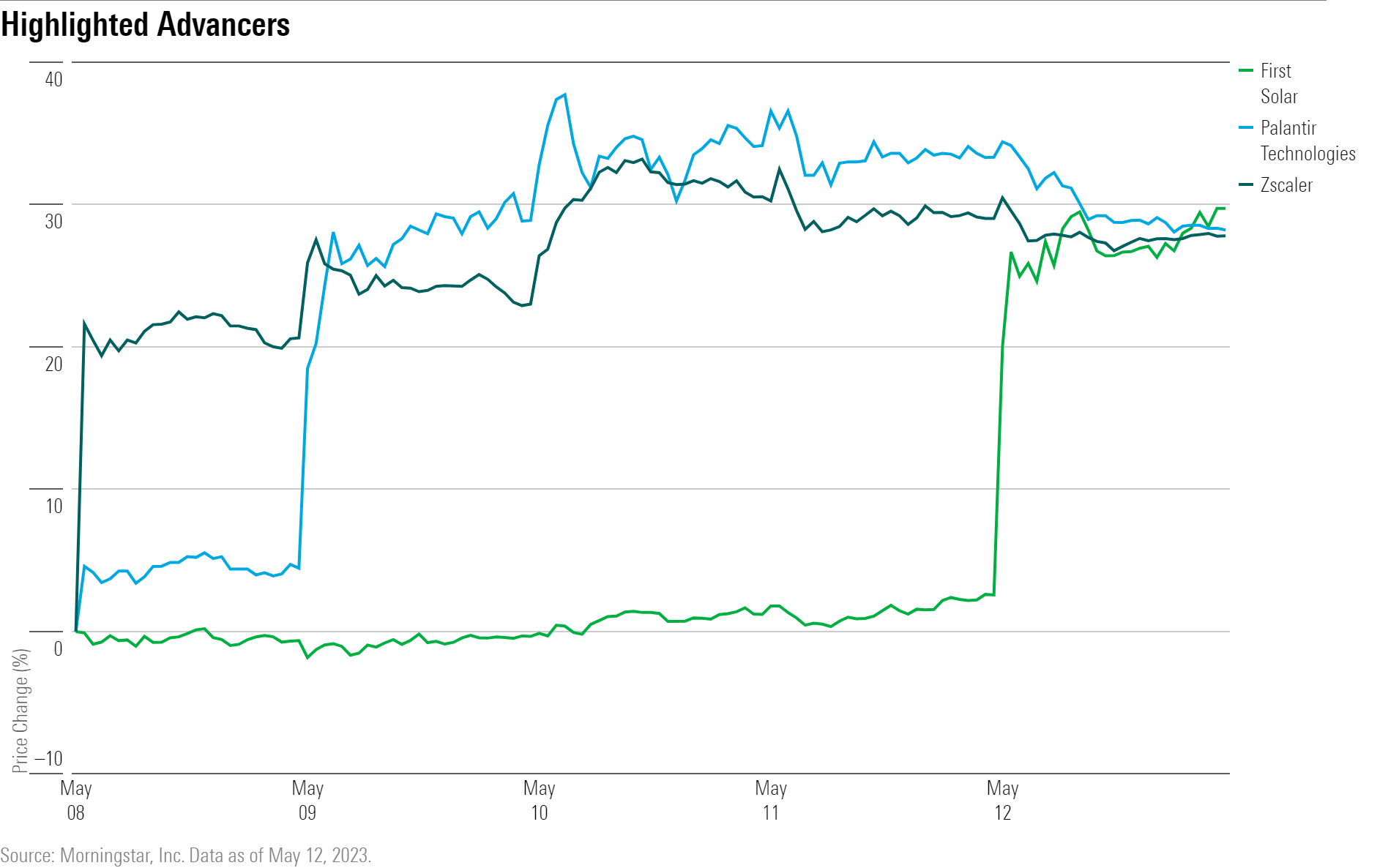

Palantir Technologies PLTR stock rallied after the company reported its earnings, which showed a good first quarter with robust top-line growth, strong billings, and generally accepted accounting principles profitability, according to Morningstar analyst Malik Ahmed Khan.

“Palantir’s top line came in at $525 million, up 18% year over year, with governmental sales spearheading the growth at 20% year over year.” Khan says investors had been keeping a keen eye on Palantir’s billings—a forward-looking metric which rose 25% from year-ago levels. The billings growth showcased the firm’s ability to drive spend on its solutions despite the murky macro conditions.

Shares of Zscaler ZS also jumped following the release of the company’s preliminary quarterly results. The firm’s profitability and sales exceeded Morningstar’s analyst estimates. Zscaler indicated that third-quarter sales would be around $417 million, up from prior guidance of $397 million. Despite the accompanying pop in its stock price, Morningstar believes Zscaler is undervalued, trading at an attractive price for long-term investors willing to stomach near-term volatility, according to Khan.

First Solar FSLR shares rose sharply following the U.S. Department of the Treasury guidance on domestic content requirements for solar panels, Morningstar analyst Brett Castelli writes. “We view the sharp move in First Solar’s share price as attributed to expectations that the final rules will require solar cell plus module assembly in the U.S. to qualify,” he says.

What Stocks Are Down?

Plug Power PLUG shares plummeted following the release of the company’s quarterly earnings results. “We continue to view [Plug Power] shares as attractive for investors looking to capitalize on the growth potential of hydrogen, albeit with a high risk-reward,” writes Castelli.

“In conjunction with releasing results, Plug provided a downside case for its 2023 financial guidance. Under the lower case, revenue would be $1.2 billion and gross margin would be $50 million versus $1.4 billion and $140 million under original guidance,” Castelli writes. “We see risk that results come in line with the lower case, but view this as immaterial relative to our fair value estimate given Plug’s early stage.”

Fellow clean energy company Bloom Energy BE also lost ground after communicating its plans to fundraise $500 million in convertible notes. Bloom also released its quarterly earnings results last week, which showed “solid year-on-year improvement in product gross margins—increasing to 34% from 22.5% in the prior-year quarter,” Castelli writes. “For the full-year 2023, Bloom expects relatively stable average selling prices, while product costs are expected to decline 12%, supporting gross margin expansion.”

PayPal PYPL stock fell after the company released its quarterly earnings, revealing that active account growth remained stalled and accounts declined slightly, according to Morningstar analyst Brett Horn. “However, we think management’s strategy to pivot toward driving more transactions from its existing consumer base makes sense,” Horn writes. “To this end, we are encouraged by the fact that transactions per active account grew 13% year over year, maintaining the strong growth we’ve seen in recent quarters.”

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BAG2H5VQKBERZKT5SM7JTWM6CY.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)