Kenvue IPO: A Dividend-Paying, ‘High-Caliber’ Company

The Johnson & Johnson consumer healthcare spinoff was priced at $22 per share.

This article has been updated to include the results of the Kenvue IPO.

A rocky stock market and rising risks of recession usually don’t make for a great time for a new stock to come to market. But it may be a different story for Kenvue, the consumer healthcare spinoff from Johnson & Johnson JNJ.

Kenvue’s IPO, which began trading Thursday under the symbol KVUE, offers investors access to a stable and profitable company with strong cash flows at a time when those characteristics are at a premium in the stock market.

“This is a super high-caliber company,” says Damien Conover, director of equity strategy at Morningstar, and who covers Johnson & Johnson.

Conover notes that Kenvue’s brands span beauty, baby care products, and over-the-counter medicines, and include Tylenol, Aveeno, Band-Aid, Neutrogena, and Desitin. “These are incredibly powerful brands and stuff that holds up in down markets,” he says.

The IPO of 172.8 million shares was priced at $22 per share, giving Kenvue a market value of roughly $40 billion. The deal reaped some $4 billion in proceeds for JNJ, the company said.

Kenvue Stock Trades at a Discount to Competitors

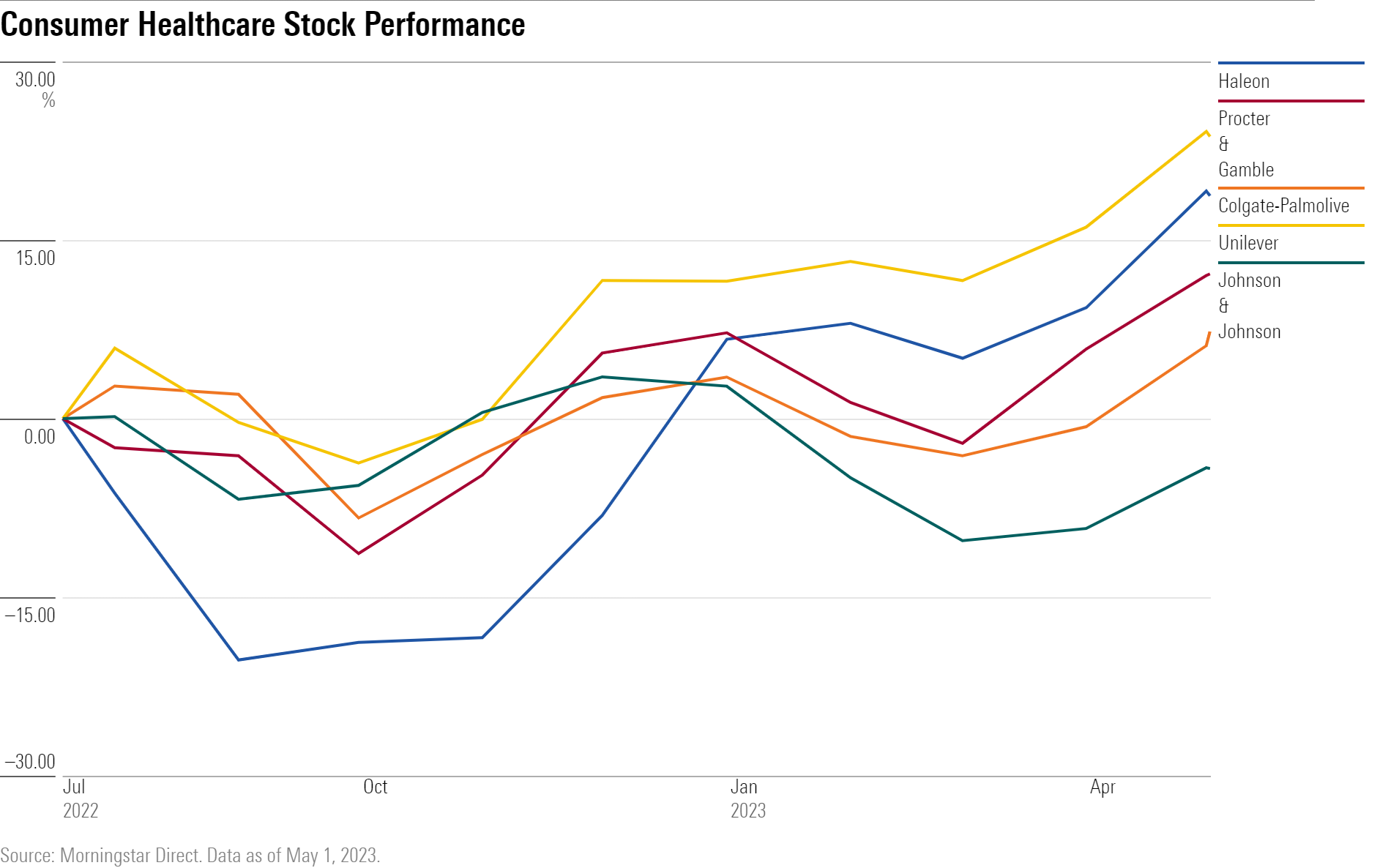

Investors can expect good value in Kenvue shares, which was expected to come to market at a discount of at least 10% to 15% to that of its competitors, as is typical for new issues, says Matt Kennedy, senior strategist at Renaissance Capital, a provider of pre-IPO research and IPO-focused exchange-traded funds. Kenvue’s competitors include Haleon HLN, the consumer healthcare group spun out of GSK GSK in July 2022, as well as Procter & Gamble PG, Colgate-Palmolive CL, and Unilever UL.

“Kenvue will have some upside,” says Kennedy.

Kenvue generated $15 billion in sales in 2022. The company plans to pay a quarterly dividend with a 3.7% annualized yield.

In the first quarter ended March 31, it reported $3.85 billion in sales, up 7.4% from $3.59 billion in 2022, as pricing power and volumes remained strong, though margins were “flattish,” according to Conover. Adjusted operational sales, which exclude acquisitions and divestitures and currency translations, were up 11.3% in the quarter.

The company said the major contributors to growth were pain relievers Tylenol and Motrin; digestive health aid Imodium; and smoking cessation products, including Nicorette. Other hot lines were Neutrogena and Aveeno in skin and beauty products, and Johnson & Johnson’s baby care products.

Johnson & Johnson first announced its intentions to spin off Kenvue in 2021, and as recently as January an offering was expected to come in the second half of this year at a price of about $15.50.

Kenvue Shows Strong Cash Flows

“The accelerated schedule and pricing is a sign of good demand,” says Kennedy. “This is a fundamentally strong business, that pays a dividend and has strong cash flow.”

Johnson & Johnson initially will retain slightly more than 90% in Kenvue and spin off the rest to shareholders later this year. The parent company will assume most of the liabilities associated with litigation surrounding claims that its talcum powder causes cancer. Earlier this month Johnson & Johnson agreed to pay $9 billion to settle those legal claims. Kenvue would be responsible for any talcum powder liabilities abroad.

Kenvue would assume $9 billion in debt and about $1 billion in cash.

“That’s a comfortable net debt-to-EBITDA ratio,” says Kennedy.

With Kenvue, Johnson & Johnson Joins Spinoff Trend

With IPO activity still lackluster and the uncertain market diminishing the prospects for mergers and acquisitions, spinoffs offer a way for companies to restructure, refocus, and attempt to revitalize returns.

In the past year a host of iconic brand-name blue-chip companies and others have spun off business units to try to spur growth, boost returns, and create shareholder value.

Peer pressure is also at play within certain industries, as boards of directors and chief financial officers feel compelled to follow the lead of their competitors.

With the Johnson & Johnson spinoff, the Kenvue IPO was a bright spot in an otherwise moribund IPO market. Kenvue’s debut, which trades on the New York Stock Exchange, marks the largest U.S. IPO since late 2021.

The expected proceeds from this one deal would be more than the $2.4 billion raised by the 40 IPOs launched so far this year tracked by Renaissance. Renaissance tracks U.S. IPOs that raise $5 million or more with market capitalizations of $50 million or more and doesn’t include special-purpose acquisition companies or unit offerings.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)