Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds sell technology, buy basic materials and financial services.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the third quarter of 2020. The piece was an early read on individual purchases--focused on high-conviction and new-money buys--made during the period, based on the holdings of almost all our top managers. Now that all but two Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We think that this trend is likely primarily driven by the shift toward passive products. Despite the net selling, our Ultimate Stock-Pickers still made several high-conviction purchases and sales.

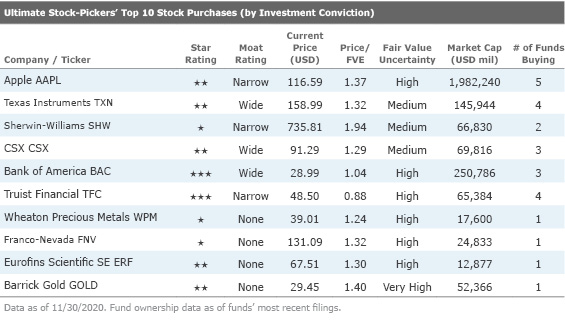

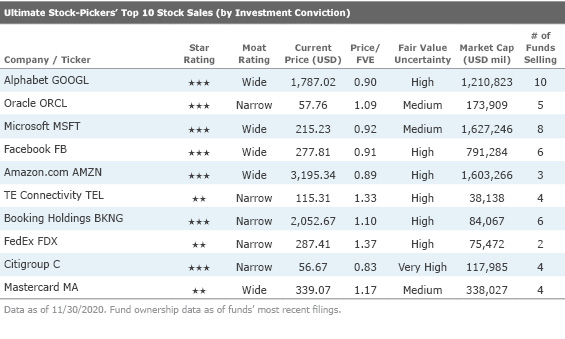

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that eight of the top 10 conviction holdings have a wide economic moat. Additionally, six of the 10 companies composing the top 10 high-conviction purchases and all the companies on the top 10 high-conviction sales lists have been assigned either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the real estate, technology, communication services, and utilities sectors relative to the S&P 500. There has been a shift away from the communication services sector and toward the basic materials sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers remain meaningfully overweight in the industrials and financial services sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter—the only change was Mastercard MA replacing Pepsi PEP. We noticed that the relative ordering of the top 10 stock holdings changed somewhat, with Apple AAPL moving up the list, and Microsoft MSFT and Berkshire Hathaway BRK.B moving down the list. Our Ultimate Stock-Pickers indicate a preference for financial services with three financial companies on our top 10 list. Managers also continue to hold companies from the communication services, technology, and healthcare sectors with conviction, each contributing two stocks to our list. Our current fair value estimates suggest that only two of the top 10 conviction holdings list, Alphabet GOOGL and Amazon AMZN, are marginally undervalued; our research indicates that wide-moat Mastercard and narrow-moat Apple and UnitedHealth UNH are overvalued at the time of writing. As Alphabet topped our top 10 conviction holdings list while also topping our top 10 sales list, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Ali Mogharabi’s outlook on the company.

Wide-moat Alphabet resides on the top 10 stock holdings list and is currently held by 14 funds. This high-uncertainty stock currently trades at about a 10% discount to Morningstar analyst Ali Mogharabi’s fair value estimate of $1,980.

According to Mogharabi, Alphabet has developed the ability to generate excess returns for an extended period of time as a result of its intangible assets and the network effect. With Google, Alphabet’s wholly owned subsidiary, accounting for more than 80% of the global online search market, the company is a leader in the search market space. Mogharabi expects this leadership position to persist as a result of strong top-line growth. Google’s network effect is such that as more users adopt its products, its online advertising services are made more attractive to advertisers seeking to target the new users. Increased adoption and usage time of smartphone devices across the globe also provide economic tailwinds for the business. With more eyes on Google’s search function for a larger amount of time, the company benefits from advertisers following users onto the mobile platform. YouTube is another area of growth, with Alphabet benefiting from the platform’s impressive reach and video-only content format, a mode attractive to advertising companies. Other than advertising, YouTube also offers YouTube Premium and YouTube TV as potential avenues of growth for Alphabet as users across the globe increasingly cut the cord and opt for online video entertainment services.

Alphabet was recently in the news for all the wrong reasons as the Department of Justice (DOJ) filed an antitrust suit against the company on Oct. 20, claiming that Google has engaged in monopolistic practices, helping it dominate the online search market. Mogharabi believes that any decision to force a breakup of Alphabet is unlikely and that fines, similar to those imposed on Alphabet by the European Union, are more likely. With Google’s argument benefiting from the consumer welfare interpretation of antitrust law, prior large antitrust cases have set precedent that could benefit Google in any protracted legal battle. Mogharabi goes on further to argue that even if regulators were to successfully force a breakup of Alphabet, the company, as a whole, is at least as valuable as the sum of its individual parts.

Mogharabi points out the threat that antitrust enforcement and further regulations pose to Google’s use of data. At the same time, however, it is important to note that if any widespread changes in data access and usage do come about—they would apply to all players in the field and not just to Google. Lastly, it is important to note that Google’s networks effects are of the degree that enforcement of old antitrust laws or passing of new antitrust laws would not materially impact Google’s ability to generate excess returns in the future.

Alphabet has made a high-risk, high-reward investment in autonomous vehicle technology through Waymo. In its most recent annual report, Alphabet claimed that such investments are, in fact, key to long-term success. Whereas Waymo’s commercialization is still in a nascent stage, Mogharabi’s bull-case scenario for Alphabet includes revenue generated from Waymo. While investments in areas such as Waymo could be curbed to increase near-term economic profit, the capital invested in Waymo is not dissimilar to the purchase of a call option from Alphabet’s perspective. If Waymo turns out to be a success, that would represent more upside to Alphabet’s intrinsic value.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers made four purchases in the basic materials sector, two in the financial services and technology sectors, and one each in the industrials and healthcare sectors. From a valuation and quality perspective, the cheapest moat-rated stock is Truist Financial TFC , which received purchases from four funds.

Narrow-moat rated Truist Financial currently trades at around a 12% discount to Morningstar analyst Eric Compton's fair value estimate of $55. The company was formed after BB&T and SunTrust completed their merger in December 2019. BB&T’s conservative lending culture, one of the best in Morningstar’s coverage, and SunTrust’s impressive investment banking division have led to Compton’s opinion that this merger can lead to cost savings and revenue synergies.

Compton argues that while dealing with the economic headwinds brought on by pandemic will eat up time and effort on Truist’s part, the firm can remain focused on executing a successful integration. The integration could also lead to material cost saving and therefore operating improvements. These additional efficiencies are part of the reason why Compton rated Truist as a narrow-moat company. Before the merger, BB&T had a narrow moat rating and SunTrust did not have an economic moat. However, since BB&T was the larger of the two franchises, coupled with the cost saving mentioned above, we believe that Truist’s business warrants an economic moat. That cost saving can be attributed to BB&T’s impressive underwriting as displayed by the business’s net charge-off ratio, essentially how much of a company’s debt is unlikely to be paid back relative to the overall debt the company holds. This conservative underwriting was also on display during the 2009 financial crisis when BB&T’s 60% net interest revenue was far below other regional banks that experienced net interest revenue of over 100%. Net interest revenue is simply the difference between a bank’s interest revenue and its interest costs. A 60% peak during the financial crisis is a testament to the bank’s ability to minimize risk that we see as carrying over to Truist, as well.

Apart from cost advantages, we also believe implicit switching costs in retail and commercial banking also strengthen Truist’s ability to maintain its deposit base and banking relationships. Due to the lack of incentive to move banks, many customers view changing banks as troublesome. This is especially true for customers that have purchased multiple products from the same bank. Truist’s credit card, trust and wealth management, investment banking, and insurance operations all lead to increased stickiness in its customer base.

Truist also has significant nonbank operations, most notably its insurance brokerage business (from BB&T). For insurance brokerage, the size and depth of the network matter, and Truist is the fifth-largest broker in the world by revenue. We believe this is an attractive business for Truist, and its network is an asset. Compton argues that Truist earns margins on this business comparable with some of the largest players and that this segment boosts overall returns on equity for Truist, complementing its moat.

Finally, despite the potential synergies mentioned above, Compton also believes that an unsuccessful merger of the two banks, SunTrust and BB&T, could prove to be a major risk for Truist. Watching the cultural integration while expense savings are pursued will be key. The latest developments around COVID-19 do not help here and will likely push back the timing for expense savings targets and increase the execution risk.

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Four of the conviction sales are also conviction holdings—wide-moat Alphabet, Microsoft, Amazon, and Mastercard appear on both lists. Much of the selling activity came from the technology sector, which contributed three names to the conviction sales list. Five of the 10 names on this list are overvalued according to Morningstar estimates—wide-moat Oracle ORCL and Mastercard, and narrow-moat TE Connectivity TEL, Booking Holdings BKNG, and FedEx FDX all currently trade at a premium to their respective fair value estimates. As our Ultimate Stock-Pickers sold out of their technology sector positions the most, we find it pertinent to discuss a technology stock. One name that four managers have sold is narrow-moat rated TE Connectivity, which trades at a 33% premium to Morningstar analyst Brian Collelo’s fair value estimate of $87.

TE Connectivity is a leader in the global connectors and sensors industry. It manufactures and designs products that connect and protect the flow of power and data inside millions of products used by consumers and industries, particularly in mission-critical applications that face harsh environments and require unwavering reliability. With secular and technological trends driving increased demand for TE’s products, Collelo foresees steady growth and profitability for the firm over the next decade. TE has a significant market share in key components for automotive, commercial transportation, industrial equipment, and aerospace markets that leads to customers facing significant switching costs if they wish to switch to any competitor’s sensor and interconnect offerings. These switching costs also form the basis for Collelo’s narrow moat rating for the company.

The switching costs enable strong customer retention numbers while technological tailwinds allow TE to capture and expand market share in several applications in major end markets, helping the firm generate returns above its cost of capital over the next decade. In our opinion, TE’s products in the automotive market are a particular area of strength. Currently, TE’s transportation solutions segment accounts for over 55% of total sales. With an increased emphasis on content gains in the automotive and commercial transport markets, we believe that TE will outpace global production while its organic sales keep up with their respective geographic markets. These gains could also potentially increase switching costs for TE’s customer base.

At the same time, however, it is worth recognizing downside risks TE faces. While TE has benefited from positive economic conditions that have led to an increased demand for its products, this top-line growth and profitability are susceptible to cyclicality and economic downturns. A weak automotive production environment coupled with poor execution in content expansion could impact the company’s top and bottom lines. These risks may have seemed improbable at best a year ago, but in a pandemic-hit global economy that is only gradually recovering from the demand slowdowns in the automotive industry, these risks are far from improbable.

Disclosure: Malik Ahmed Khan and Eric Compton have no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)