After Earnings, Is Zscaler Stock a Buy, a Sell, or Fairly Valued?

With continued top-line growth, here’s what we think of Zscaler stock.

Zscaler ZS released its fiscal second-quarter earnings report on Feb. 29. Here’s Morningstar’s take on Zscaler’s earnings and the outlook for its stock.

Key Morningstar Metrics for Zscaler

- Fair Value Estimate: $213.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of Zscaler’s Q2 Earnings

- We were pleased to see continued top-line growth, as well as the firm’s laser focus on profitability. Both numbers came in ahead of our prior estimates.

- We think Zscaler’s continued strong execution strengthens our broader cybersecurity consolidation thesis. We think that as the firm expands its security portfolio, it can land larger customers and expand more within its current installed base, leading to higher switching costs. We think this is crucial, as we believe Zscaler would be a strong investment if an investor has a multi-year horizon as the consolidation thesis plays out and larger vendors benefit.

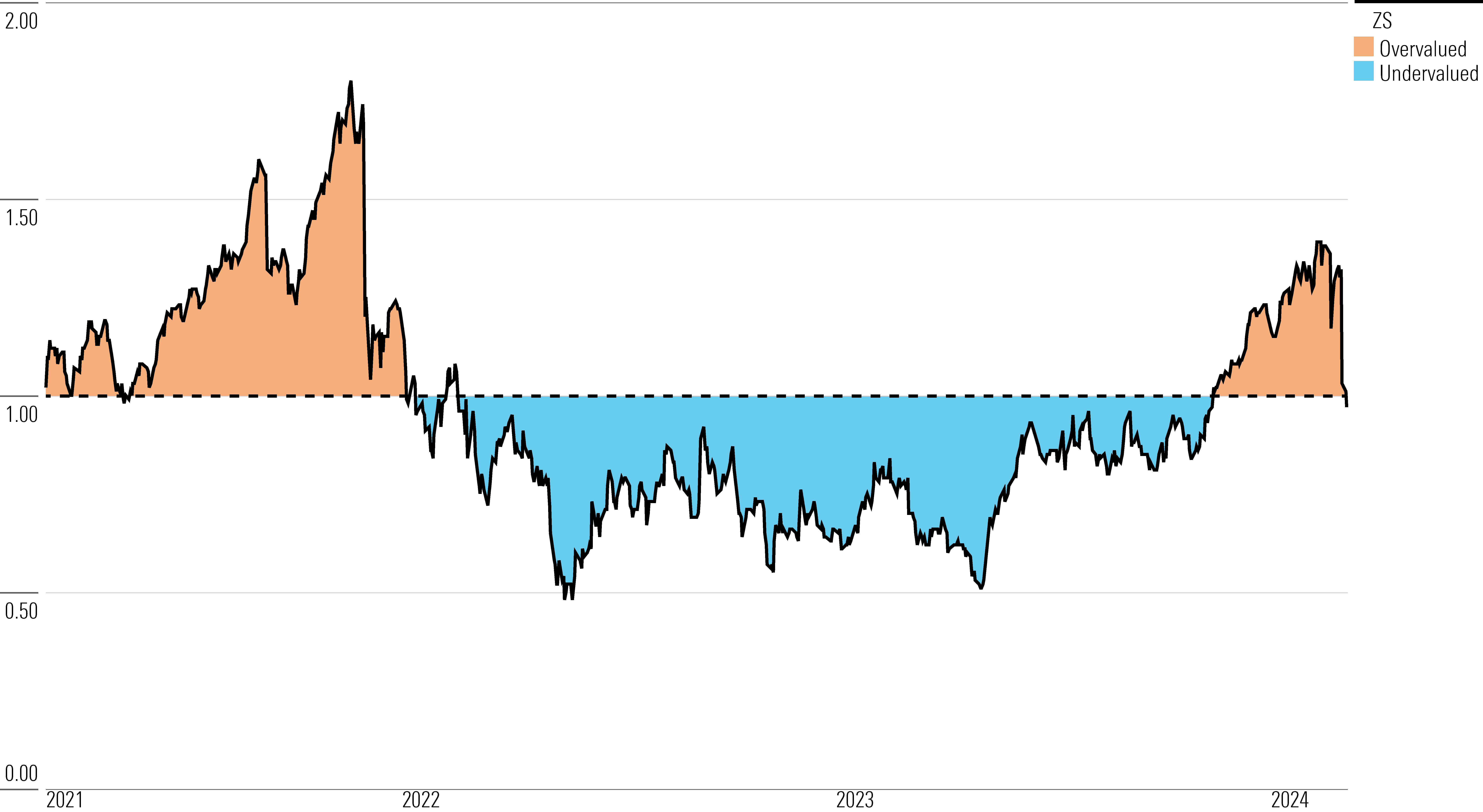

- Zscaler has seen a pullback over the last few months, with shares down 16% since earnings on Feb. 29. Along with our fair value raise, this has put the stock back in 3-star territory, meaning we now see it as fairly valued.

Zscaler Stock Price

Fair Value Estimate for Zscaler

With its 3-star rating, we believe Zscaler stock is fairly valued compared with our long-term fair value estimate of $213.

We forecast revenue to grow at a 28% compound annual growth rate over the next five years. As enterprises increasingly shift network traffic routing directly to cloud applications, we see massive greenfield opportunities for the firm to take advantage and grow its business. Additionally, we think Zscaler’s “land and expand” model will continue to bear fruit. The firm has shown great success at upselling its existing customers by either offering additional modules within a platform or cross-selling its Private Access offering after initially landing them with Internet Access. Going forward, we project continued up/cross-selling activity for the firm.

Zscaler has spent heavily on research and sales in the past. However, as the company scales, we expect these line items to decrease as a percentage of sales. While we do not model Zscaler hitting GAAP profitability until fiscal 2027, we forecast strong cash flow margins for the business as the firm scales.

Read more about Zscaler’s fair value estimate.

ZS PF

Economic Moat Rating

We assign Zscaler a narrow moat, owing primarily to strong switching costs and a network effort associated with its offerings. We believe the company’s industry-leading zero-trust security solutions will continue to see robust enterprise adoption, allowing it to both retain and expand its footprint within existing organizations, while also allowing the company to land new customers. As a result, we forecast Zscaler to generate excess returns over invested capital over the next decade.

As we look at the broader cybersecurity space, we believe the complexity and intensity of threats are always increasing. Enterprises continue to adopt software-as-a-service solutions, undergo digital transformations, and migrate to the cloud, all while employees continue to work remotely part-time. In turn, we see the number of attack vectors rapidly growing. Similarly, the intensity of digital threats is on the rise, with higher costs for a data breach, including punitive fines.

Read more about Zscaler’s moat rating.

Risk and Uncertainty

We assign Zscaler a High Uncertainty Rating, as it competes in the ever-shifting cybersecurity space.

While Zscaler has positioned itself well to benefit from secular tailwinds, such as the shift to zero-trust security and the convergence of networking and security, the cybersecurity space is known for its rapid pace of development. Large incumbents like Zscaler that have performed well in particular verticals stand to be disrupted by upstarts that could offer better performance in key modules. To stay ahead of the pack, Zscaler has invested a great deal of capital in building out its ZIA and ZPA solutions. However, a shifting demand landscape and newer products that impact Zscaler’s competitive positioning are risks for the firm.

Read more about Zscaler’s risk and uncertainty.

ZS Bulls Say

- Zscaler has strong secular tailwinds, as the convergence of networking and the security market is in its early innings.

- Zscaler has market leadership and high enterprise penetration through its offerings related to secure web gateways and zero-trust network access.

- The consolidation of security vendors should benefit Zscaler, which has a wide array of solutions across an enterprise’s network security stack.

ZS Bears Say

- Large public cloud vendors often offer their own cybersecurity solutions, which could hamper Zscaler’s growth opportunities.

- Zscaler faces competition from vendors like Palo Alto Networks PANW and Fortinet FTNT, which have increasingly made investments in the key areas where the firm has market-leading positions.

- There always remains a risk that Zscaler may miss out on the next big technology, allowing competitors to catch up.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)