Going Into Earnings, Is Palantir Stock a Buy, a Sell, or Fairly Valued?

With expectations on billings and customer additions, here’s what we think of Palantir stock.

Palantir PLTR is set to release its fourth-quarter earnings report on Feb. 5, after the close of trading. Here’s Morningstar’s take on Palantir’s earnings and stock.

Key Morningstar Metrics for Palantir

- Fair Value Estimate: $13.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What to Watch for In Palantir’s Q4 Earnings

- Billings: To gain insight into Palantir’s supposed AI success, investors will be keenly looking for a material uptick in demand for its solutions.

- Customer additions (particularly in commercial): Just like last quarter, we are going to keep a close eye on whether new customers are onboarding Palantir’s platforms, and to what degree the AI platform, or AIP, is helping the firm land new customers.

- Earnings guidance: It’s one thing to provide soundbites; it’s another to demonstrate hard near-term financial targets for investors to hold you to. Palantir will provide its first outlook for the calendar year 2024, another important indicator for the firm’s sales after an ordinary year.

- Longer-term guidance on AI’s impact on financials: We are looking for more color on how AIP will impact Palantir’s growth opportunities in the next couple of years.

Palantir Technologies Stock Price

Fair Value Estimate for Palantir

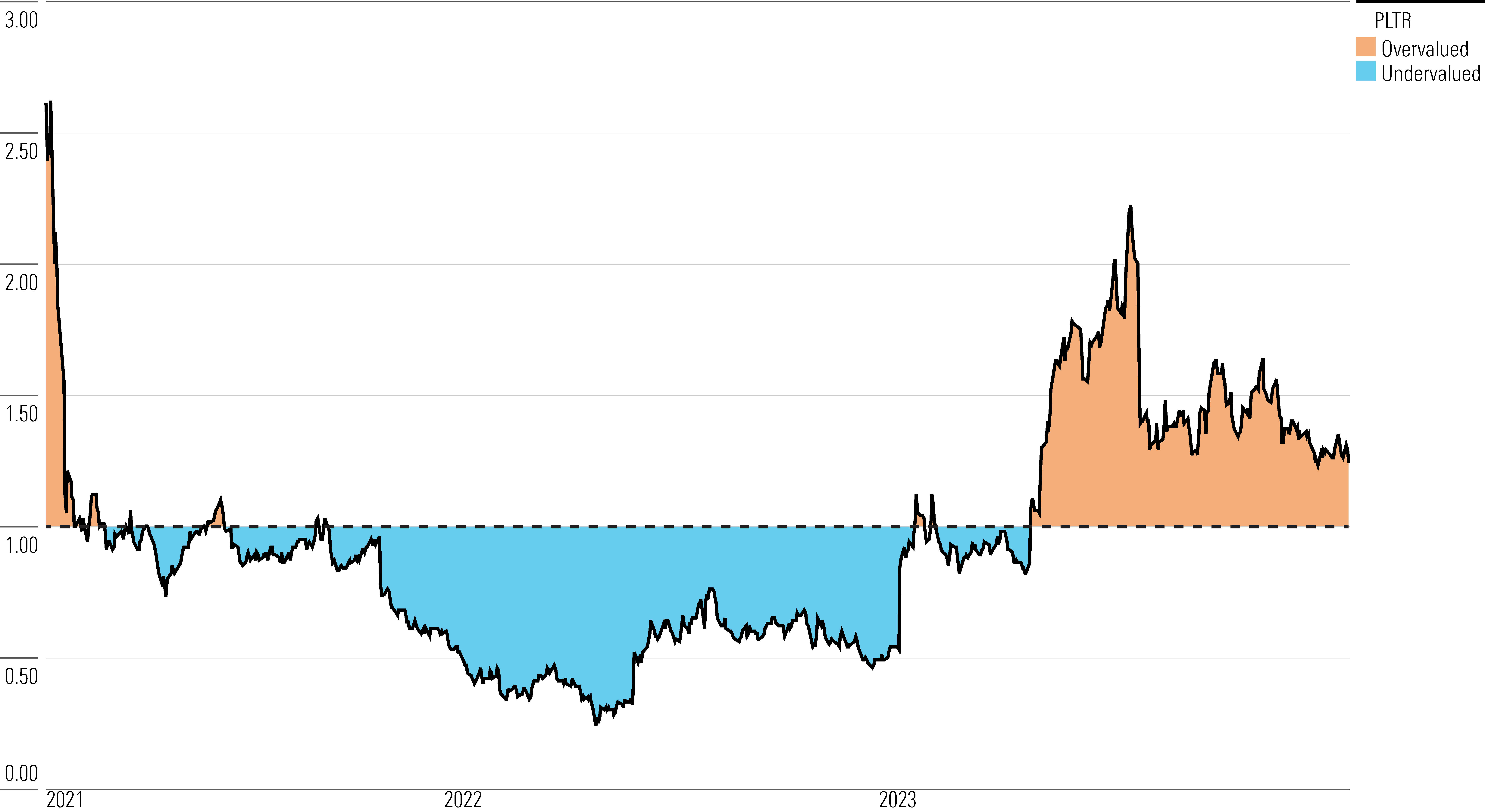

With its 2-star rating, we believe Palantir’s stock is overvalued compared with our long-term fair value estimate.

We forecast Palantir’s revenue to grow at a 23% compound annual growth rate over the next five years as it expands both its governmental and commercial operations. We expect the majority of this top-line growth to be driven by commercial clients as the firm seeks to broaden that base. While government clients can be sticky, large governmental contracts create lumpiness in revenue. As a result, the shift to more commercial clients should create a more ratable revenue mix. We also expect the firm to continue expanding sales within its existing client base. We view Palantir’s strong net retention rate as an indicator of this.

Palantir’s GAAP gross margin has varied widely over the last few years and clocked in at 78.6% in 2022. As the firm grows, we expect gross margin expansion. Our forecast is based on Palantir landing higher-margin commercial contracts and scaling its operations (thereby leading to its costs being divided over a larger base). We see this phenomenon across our coverage, as software companies can distribute their costs over an increasing revenue base. As a result, we model GAAP gross margin to expand to the low 80s over our 10-year explicit forecast. Palantir has spent heavily on research and sales in the past.

Read more about Palantir’s fair value estimate.

PLTR PRICE FAIR VALUE

Economic Moat Rating

We assign Palantir a narrow economic moat owing primarily to strong switching costs associated with its platforms, as well as intangible assets from the strong customer relationships the firm has built over the years. We think Palantir’s two main platforms, Gotham and Foundry, both benefit from high customer switching costs, as evidenced by the firm’s strong gross and net retention metrics. The company has exhibited strong customer growth while diversifying its business away from lumpy governmental contracts toward commercial clients. As a result, although we forecast a couple of more years of hefty operating losses, we expect the firm to generate excess returns over invested capital over the next decade.

We think Palantir is still in the early stages of customer penetration and platform adoption. As the increased digitization of large organizations continues to drive clients toward AI/ML platforms, we believe the firm has a long runway for growth. We see major opportunities for it in both commercial and governmental end markets as organizations shift away from in-house solutions that are expensive and unscalable over the long run.

Read more about Palantir’s moat rating.

Risk and Uncertainty

We assign Palantir a Very High Uncertainty Rating due to some key risks that we view as potentially impeding its growth trajectory.

While the firm has landed high-value commercial and government clients over the years, we have found the executive team’s execution to be questionable at best. Their sales strategy has led to relatively poor customer acquisition; despite the company being in the commercial space for many years, its commercial customer count is only slightly more than 200. While Palantir has pivoted to a module-based sales model that should bolster commercial customer additions, the follow-through on this strategy remains to be seen.

We do not foresee any material environmental, social, or governance issues. Notable potential risks include attracting and retaining talent, primarily in Palantir’s sales and research divisions. Also, since the firm manages critical data for its clients, data privacy and security are relevant ESG risks.

Read more about insert Palantir’s risk and uncertainty.

PLTR Bulls Say

- Palantir has strong secular tailwinds, as the AI/ML market is expected to grow rapidly due to the exponential increase in data harvested by organizations.

- With products targeting both commercial and governmental clients, Palantir has a distributed top line, with noncyclical governmental revenue insulating the overall top line during lean times.

- Palantir’s focus on modular sales could lead to substantially more commercial clients, which the firm could subsequently upsell.

PLTR Bears Say

- By not selling to countries or companies that are antithetical to its mission and cultural values, Palantir has restricted its growth opportunities.

- It will likely be several years before Palantir achieves GAAP profitability.

- Palantir’s executive team has made questionable strategic decisions. While past performance isn’t necessarily indicative of future results, the missteps could merit caution for potential investors.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)