After Earnings, Is MongoDB Stock a Buy, a Sell, or Fairly Valued?

With a big runway for growth but a lofty valuation, here’s what we think of MongoDB’s stock.

MongoDB MDB released its fourth-quarter earnings report on Mar. 7. Here’s Morningstar’s take on MongoDB’s earnings and outlook for its stock.

Key Morningstar Metrics for MongoDB

- Fair Value Estimate: $370.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

What We Thought of MongoDB’s Q4 Earnings

- Since 2007, MongoDB has amassed millions of users of its document-based database, as workload shifts to the cloud have accelerated data collection and thus the need for architectures to store data. MongoDB has remained the most desirable database for professional developers to learn for years, according to Stack Overflow. We think such interest will persist as the firm’s more recent cloud database-as-a-service and data lake offerings help ensure its rich features transform to meet new technological needs.

- MongoDB stock has a high valuation and would need strong growth to be worth it. A big part of its thesis is a big growth runway as more companies switch from legacy database infrastructure providers to modern ones like MongoDB. The latest results call this into question somewhat. Our take is that the company will need to reaccelerate growth in 2025, or else the growth thesis will unravel. There’s no magic number, but we think that after falling to only 14% growth guidance for 2025, MongoDB needs to return to a topline growth rate of over 20% in 2026. Unless investors have good confidence that the firm can do this, they should be wary. Relatedly, as we have highlighted, investors have to believe the slowdown in current growth is due to one-time factors and not a sign of worsening competitive positioning.

- With significant opportunity remaining to convert customers to MongoDB’s cloud database-as-a-service product, Atlas, which represents over 60% of all revenue, along with brand-new opportunities for the company’s new Data Lake offering, we think it is set to grow at a robust pace and profit from such scale. We also believe MongoDB has a sticky customer base and could eventually merit a moat.

MongoDB Stock Price

Fair Value Estimate for MongoDB

With its 3-star rating, we believe MongoDB’s stock is fairly valued compared with our long-term fair value estimate of $370 per share. Our valuation implies a forward fiscal-year enterprise value/sales of 16 times. Our assumptions are based on our expectations that MongoDB will achieve a compound annual growth rate of 21% over the next five years.

MongoDB is in its infancy but has a massive market opportunity and a large runway for growth, in our view. We expect this substantial growth to be driven by continued workload shifts to cloud environments, prompting the database market to grow robustly as companies realize how much easier it is to scale data storage in the cloud. In turn, this implies substantial usage growth per customer for MongoDB. Additionally, we think Atlas and Data Lake will bring in significant new revenue streams, as Atlas’ revenue eclipsed on-premises sales in early fiscal 2022.

We forecast that MongoDB’s gross margins will stay relatively the same, as its increasing mix of Atlas revenue is somewhat margin-dilutive in the near term. We expect GAAP operating margins to increase from negative 14% in fiscal 2024 to positive 32.5% in fiscal 2034 because of operating leverage as revenue growth exceeds operating expenses.

Read more about MongoDB’s fair value estimate.

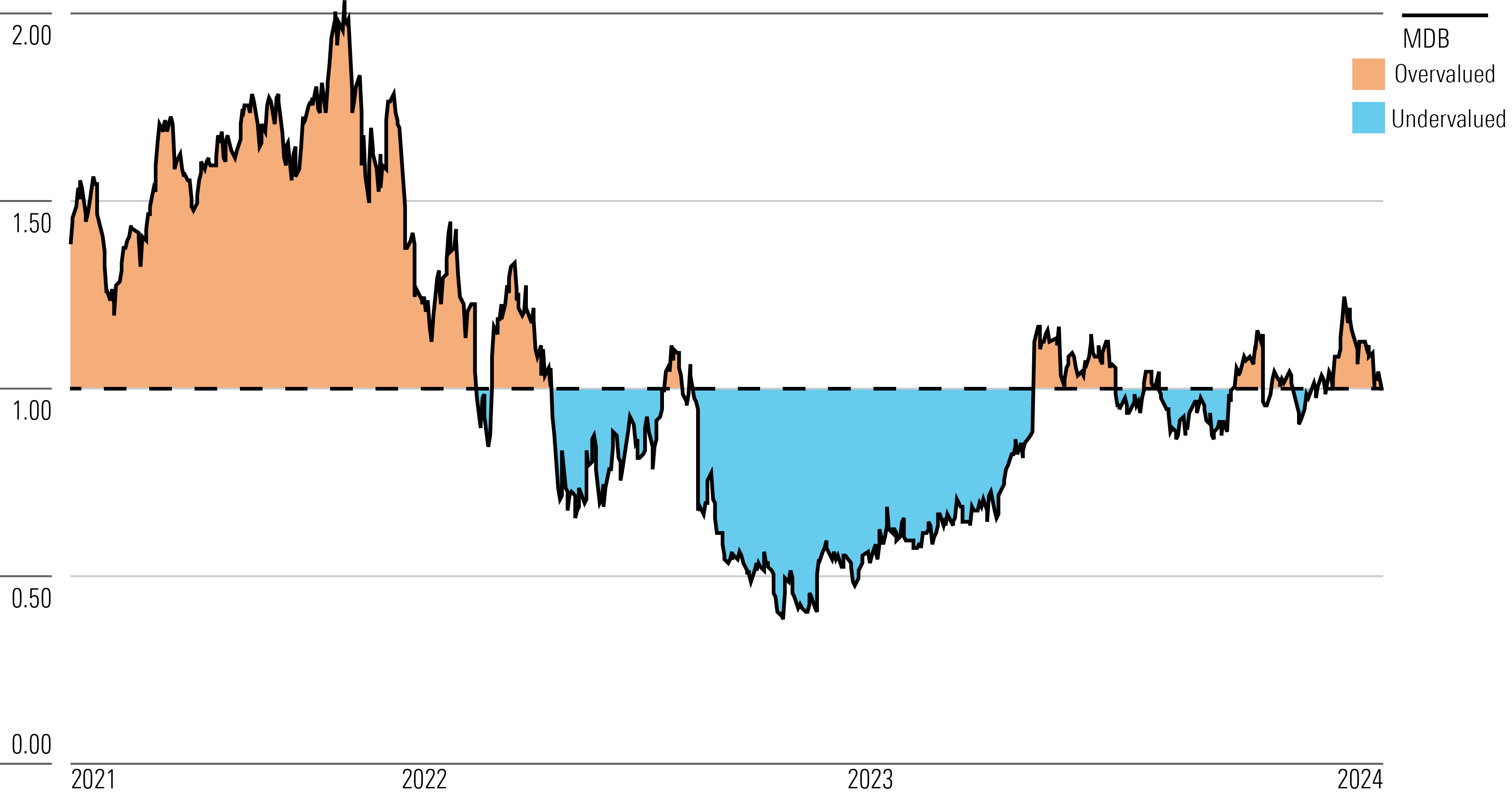

MongoDB Historical Price/Fair Value Ratio

Economic Moat Rating

We do not assign MongoDB a moat. We think the company benefits from significant switching costs with the customers it has captured thus far. However, it is still in its customer acquisition phase, and it’s unclear whether this will lead to excess returns on invested capital over the next 10 years, as MongoDB lacks profitability and continues to aggressively spend on sales and marketing.

We believe MongoDB benefits from switching costs with its existing customer base, as we think data is increasingly mission-critical to enterprises, which makes choosing a database vendor an important task. With increasingly complex enterprise IT infrastructures, businesses need to think twice before switching databases, which are interconnected to many systems, thus requiring much time and money for reintegration.

MongoDB has not yet reached enough size and scale to generate excess returns on capital, even when considering a good portion of its sales and marketing costs as an asset with future benefits rather than a wasteful expense. We think it will take a few more years for MongoDB to reach such excess returns, as the company will likely continue to generate operating losses as it continues to invest in customer acquisition.

Read more about MongoDB’s moat rating.

Risk and Uncertainty

We assign MongoDB a High Uncertainty Rating due to its place in a technological landscape that could shift rapidly. However, we do not foresee any material environmental, social, or governance issues.

The firm faces uncertainty based on future competition. It runs the risk of Amazon AMZN encroaching on its abilities. Amazon’s DocumentDB service claims it can help companies deploy MongoDB at scale in the cloud, similar to Atlas. At the moment, DocumentDB has significant limitations compared with Atlas—with its inability to support rich data types, interoperability only with AWS, and only 63% compatibility with MongoDB. While many open-source software companies have suffered from Amazon reselling their software for a profit (for example, Elastic was repackaged into Amazon Elasticsearch), MongoDB is protected from this risk, as its software license bans Amazon from doing this.

On the ESG front, MongoDB is at risk of its stored data being compromised by breaches. If any of its security features were to fail, the company’s brand could suffer significantly, possibly leading to diminished future business.

Read more about MongoDB’s risk and uncertainty.

MDB Bulls Say

- MongoDB’s database is best-equipped to remove fears of vendor lock-in, and it’s poised for a strong future.

- Data Lake could gain significant traction, making MongoDB even stickier, as we believe data lakes have greater switching costs than databases. In turn, this could further boost returns on invested capital.

- MongoDB could eventually launch a data warehouse offering, which would further increase customer switching costs.

MDB Bears Say

- Document-based databases could decrease in popularity if a new NoSQL variation arises that better meets developer needs.

- Cloud service providers like AWS could catch up to MongoDB in terms of its rich features.

- If MongoDB can’t reaccelerate growth in fiscal 2026 after a slower 2025, its current valuation would seem too rich, and there could be a significant downside.

This article was compiled by Freeman Brou.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)