Technology Sector Outlook: A Top Performer With Limited Buying Opportunities

We believe the best tech stocks include Snowflake, Cognizant, and Teradyne.

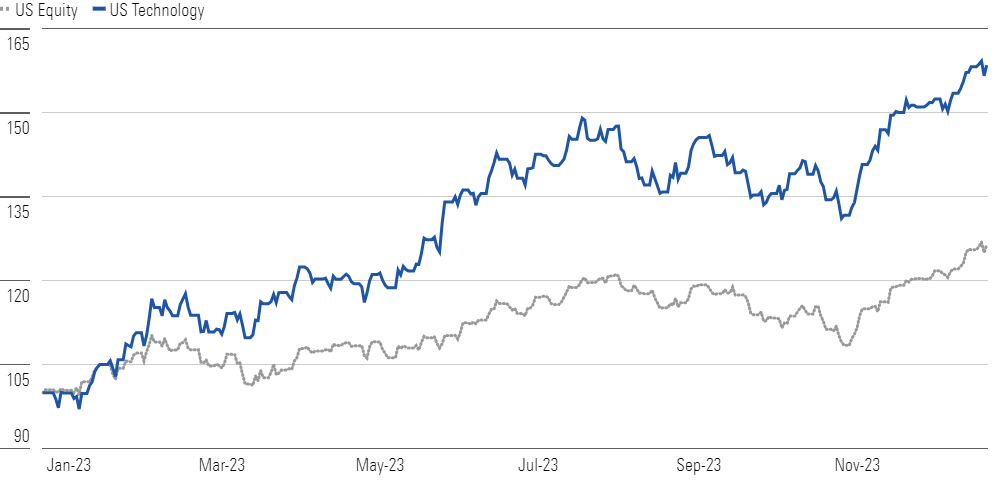

After a challenging 2022, tech began to recover early this year, and after a pause in the autumn, these stocks rallied sharply into early December. Technology companies generally reported solid third-quarter results, but we think it would be naive to think that fundamentals are driving shares more recently, as investors are contemplating rate cuts from the Federal Reserve in 2024. As a result, tech is the best-performing sector both for the year to date and so far in the fourth quarter.

While mega-cap stocks were driving performance earlier this year, smaller and lower-quality stocks have been stronger more recently. Cybersecurity names in particular have been very strong. We remain confident in secular tailwinds in technology, such as cloud computing, artificial intelligence, and rising semiconductor demand. That said, after a strong performance for most of the year, we see fewer obvious buying opportunities within the sector.

Our top picks among technology stocks are:

Technology Has Been a Strong Outperformer In 2023

The most important catalyst we currently see across technology revolves around generative AI. Software companies are developing and incorporating next-generation AI capabilities within their solutions, cloud providers are introducing new services and ramping up capacity, and semiconductor firms (notably Nvidia NVDA) are experiencing surging demand for AI and data center chip applications.

The Morningstar US Technology Index is up 58.5% on a trailing 12-month basis compared with the U.S. equity market, which is up 26.4%. Over the past quarter, both the U.S. equity market and the tech sector were strong, but tech outperformed. The median U.S. technology stock is slightly overvalued, trading at a 7% premium to its fair value estimate and with less of a margin of safety than when these stocks were 20%-25% undervalued at the start of the year.

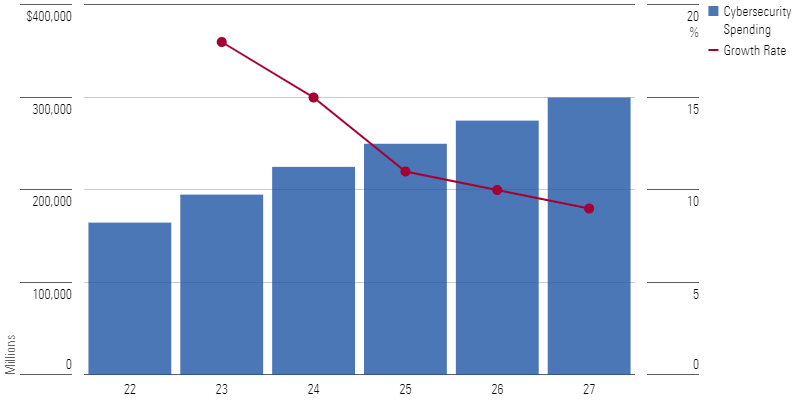

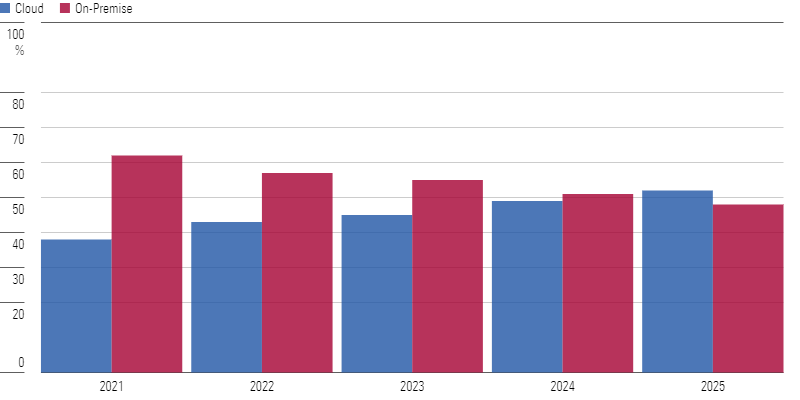

We Foresee Strong Growth In Cybersecurity Spending

We project cybersecurity sales to expand at a 13% compound annual growth rate through 2027. We forecast significant growth in key areas, such as endpoint, identity, and cloud, while areas such as firewalls and consumer are slated to grow at a more moderate pace. Over the last few years, customers have been shifting their spending from on-premises to the cloud. This shift is helping create a more complex threat landscape, necessitating increased investments in new security solutions built for the cloud. We expect cloud-native security solutions to outpace their on-premises peers as cloud migrations and digital transformations continue unabated, creating demand for cloud-native security solutions.

The Shift to the Cloud Presents an Opportunity for Vendors

Top Technology Sector Picks

Snowflake

- Fair Value Estimate: $231.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

In our opinion, Snowflake is well positioned to capitalize on the data explosion and the underlying data needed to make AI a reality. We think the market is significantly discounting the firm’s potential by underestimating three key areas: datasphere (the total data in existence) growth, how differentiated Snowflake’s technology is, and the powerful potential of its small but mighty data marketplace. This leaves a meaty opportunity for investors, thanks to what we believe is a lack of understanding of this complex space and our expectation that Snowflake will grow significantly over the next five years.

Cognizant Technology Solutions

- Fair Value Estimate: $94.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We think Cognizant is well positioned to continue to evolve from a back-office outsourcer to making higher-value technical offerings—like digital engineering and AI solutions—as well as providing digital transformation consulting. In our view, smaller IT providers for digital transformation services will be squeezed out because of the consolidation of accounts with larger vendors, like Cognizant. We bake in a five-year revenue CAGR of 8% for Cognizant, an acceleration of 5% over the last five years.

Teradyne

- Fair Value Estimate: $147.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Teradyne is a chip-testing behemoth that uses a large research and development budget to produce top-tier automated test equipment and attain a leading market share, all while posting better profitability than its peers. The firm boasts especially strong relationships with Apple and Taiwan Semiconductor Manufacturing TSM, but we think the breadth and depth of its capabilities across many chip types and end applications represent impressive intangible assets that inform our wide economic moat rating.

Top Technology Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)