After Earnings, Is Zscaler Stock a Buy, a Sell, or Fairly Valued?

With strong underlying drivers and earnings, here’s what we think of Zscaler stock.

Zscaler ZS released its fiscal first-quarter earnings report on Nov. 27. Here’s Morningstar’s take on Zscaler’s earnings and stock.

Key Morningstar Metrics for Zscaler

- Fair Value Estimate: $183.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of Zscaler’s Q1 Earnings

- Results were pretty strong for the quarter. Zscaler’s only overhang was maintaining its billing guidance despite its strong revenue outperformance. We attribute this lack of upward revision to prudence amid a tough macro environment and the firm giving its new CRO and CMO time and space to take charge of their units.

- We think the underlying drivers of Zscaler’s business remain strong. The quarter saw strong new business, with a record number of deals with an annual contract value of $1 million, demonstrating that Zscaler’s solutions are popular even during the tough macro.

- The stock is trading in the 3-star range after a long period in 4-star territory. We think investors are increasingly focusing on cybersecurity, which is set to expand materially, especially with AI becoming more prevalent. Vendor consolidation remains on customers’ minds.

Zscaler Stock Price

Fair Value Estimate for Zscaler

With its 3-star rating, we believe Zscaler’s stock is fairly valued compared with our long-term fair value estimate. Our fair value estimate for Zscaler is $183 per share, implying a 2023 enterprise value/sales multiple of 12.5 times.

We forecast that Zscaler’s revenue will see a 28% compound annual growth rate over the next five years. As enterprises increasingly shift network traffic routing directly to cloud applications, we see massive greenfield opportunities the firm can use to grow its business. Additionally, we think Zscaler’s “land and expand” model will continue to bear fruit. The firm has shown great success in upselling its existing customers by either offering additional modules within a platform or cross-selling its Private Access service after initially landing with Internet Access. Going forward, we project continued up/cross-selling activity.

Read more about Zscaler’s fair value estimate.

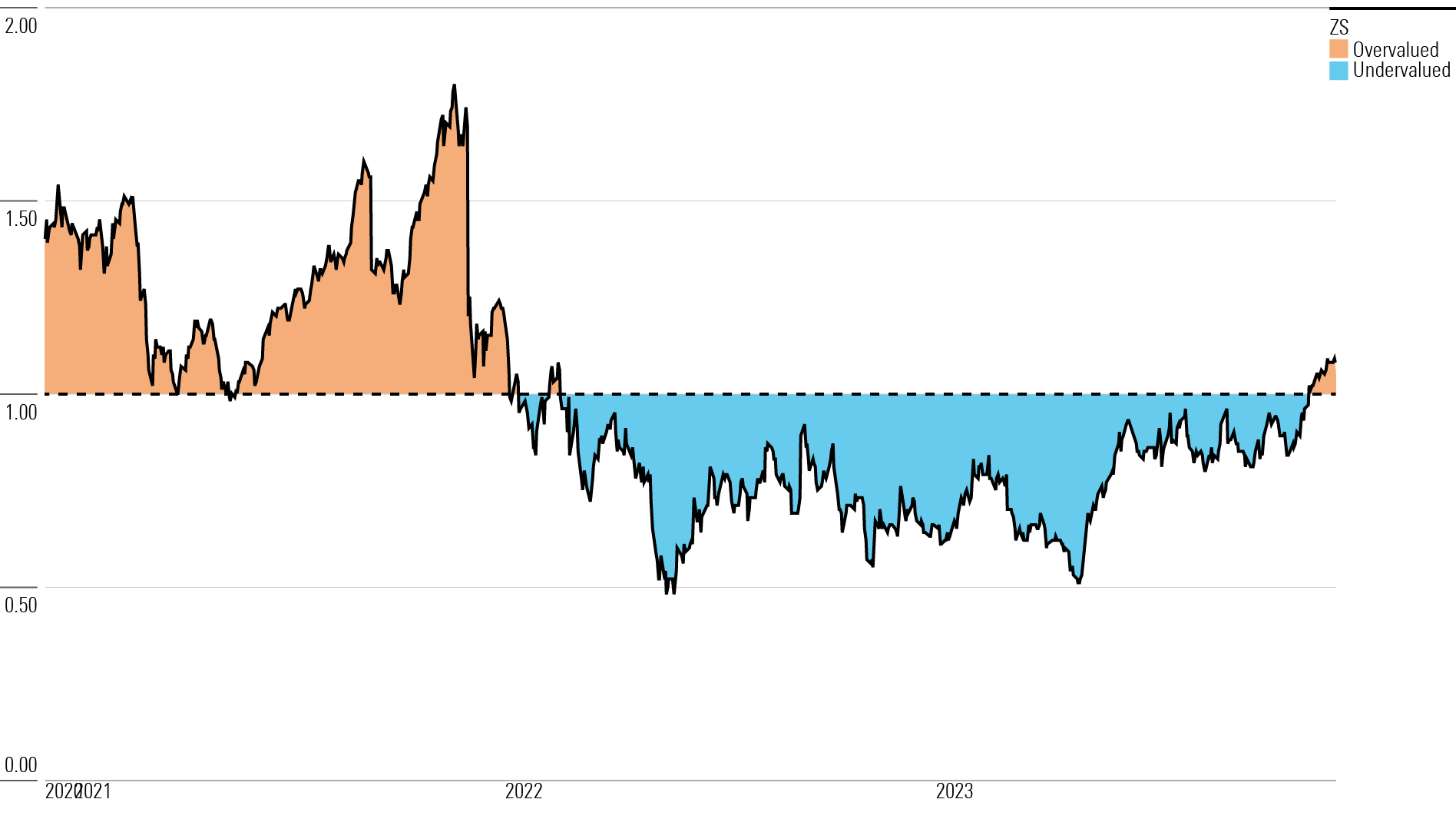

Zscaler Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Zscaler a narrow moat owing primarily to strong switching costs, as well as a network effort associated with its offerings. We believe the firm’s industry-leading zero-trust security solutions will continue to see robust enterprise adoption, allowing it to retain and expand its footprint within existing organizations while also landing new customers.

Zscaler’s zero-trust infrastructure allows enterprises to not only maintain a robust security posture but also eliminate excessive IT spending by reducing reliance on costly hardware appliances. While the need remains for hardware firewalls, we think that market buying activity has heavily tilted toward cloud-based solutions like Zscaler’s. We believe the shift is part of a broader convergence of networking and security, which will materially benefit Zscaler’s products.

We often see high switching costs for enterprise-focused cybersecurity vendors, which tend to have an expansive footprint across an enterprise. Uprooting such a vendor requires a competitive offering, and also often entails retraining staff to use the new set of security solutions, creating a period of increased vulnerability.

Additionally, we believe security-related IT decisions are driven by analysts and engineers who focus on performance rather than price, so enterprises are unlikely to rip out cybersecurity solutions for potential savings. Zscaler’s stickiness is evidenced by its high-90% gross retention rate and a solid net retention rate above 120%. Both metrics highlight how existing customers not only keep using Zscaler’s solutions, but also spend more on the company over time.

We believe a network effect reinforces Zscaler’s economic moat. Cybersecurity is essentially a data problem, and attacks are now too overwhelming to be handled manually. Vendors have developed AI solutions to automate processes and pick up threats (especially never-before-seen zero-day attacks). By collecting and analyzing this rich data, a vendor like Zscaler can uncover threats and new threat signatures, which can then be used to update its entire client base’s security posture.

As more data comes in, Zscaler’s platforms become better at detecting and mitigating cyber threats. As a result, more customers opt for the company’s solutions due to superior products, which in turn leads to more data, and the flywheel spins faster. We see this network effect as reinforcing switching costs as well—customers are hesitant to leave Zscaler, as doing so may entail losing this shared capability for threat detection and response.

Read more about Zscaler’s moat rating.

Risk and Uncertainty

We assign Zscaler a High Morningstar Uncertainty Rating, as it competes in the ever-shifting cybersecurity space.

While Zscaler has positioned itself well to benefit from secular tailwinds, such as the shift to zero-trust security and the convergence of networking and security, the cybersecurity space is known for its rapid pace of development. With this in mind, large incumbents such as Zscaler that have performed exceptionally well in particular verticals stand to be disrupted by upstarts that could offer better performance in key modules. To stay ahead of the pack, Zscaler has invested a great deal of capital in building out its ZIA and ZPA solutions. However, a shifting demand landscape and newer products that impact Zscaler’s competitive positioning are risks for the firm.

Read more about Zscaler’s risk and uncertainty.

ZS Bulls Say

- Zscaler has strong secular tailwinds, as the convergence of networking and the security market is in its early innings.

- Zscaler has market leadership and high enterprise penetration through its offerings related to secure web gateways and zero-trust network access.

- Consolidation of security vendors should benefit Zscaler, which has a wide array of solutions across an enterprise’s network security stack.

ZS Bears Say

- Large public cloud vendors often offer their own cybersecurity solutions, which could hamper Zscaler’s growth opportunities.

- Zscaler faces competition from vendors like Palo Alto and Fortinet, which have increasingly made investments in the key areas where Zscaler has market-leading positions.

- There always remains a risk that Zscaler may miss out on the next big technology, allowing its competitors to catch up.

This article was compiled by Adrian Teague

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)