After Earnings, Is Palantir Stock a Buy, a Sell, or Fairly Valued?

With strong momentum for the artificial intelligence platform, here’s what we think of Palantir’s stock.

Palantir PLTR released its fourth-quarter earnings report on Feb. 5. Here’s Morningstar’s take on Palantir’s earnings and stock.

Key Morningstar Metrics for Palantir

- Fair Value Estimate: $15.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Very High

What We Thought of Palantir’s Q4 Earnings

Palantir saw strong results in the quarter, with good momentum for its artificial intelligence platform in the U.S. commercial market. We see this as a promising leading indicator, since these customers are often early adopters of software solutions, ahead of their global peers.

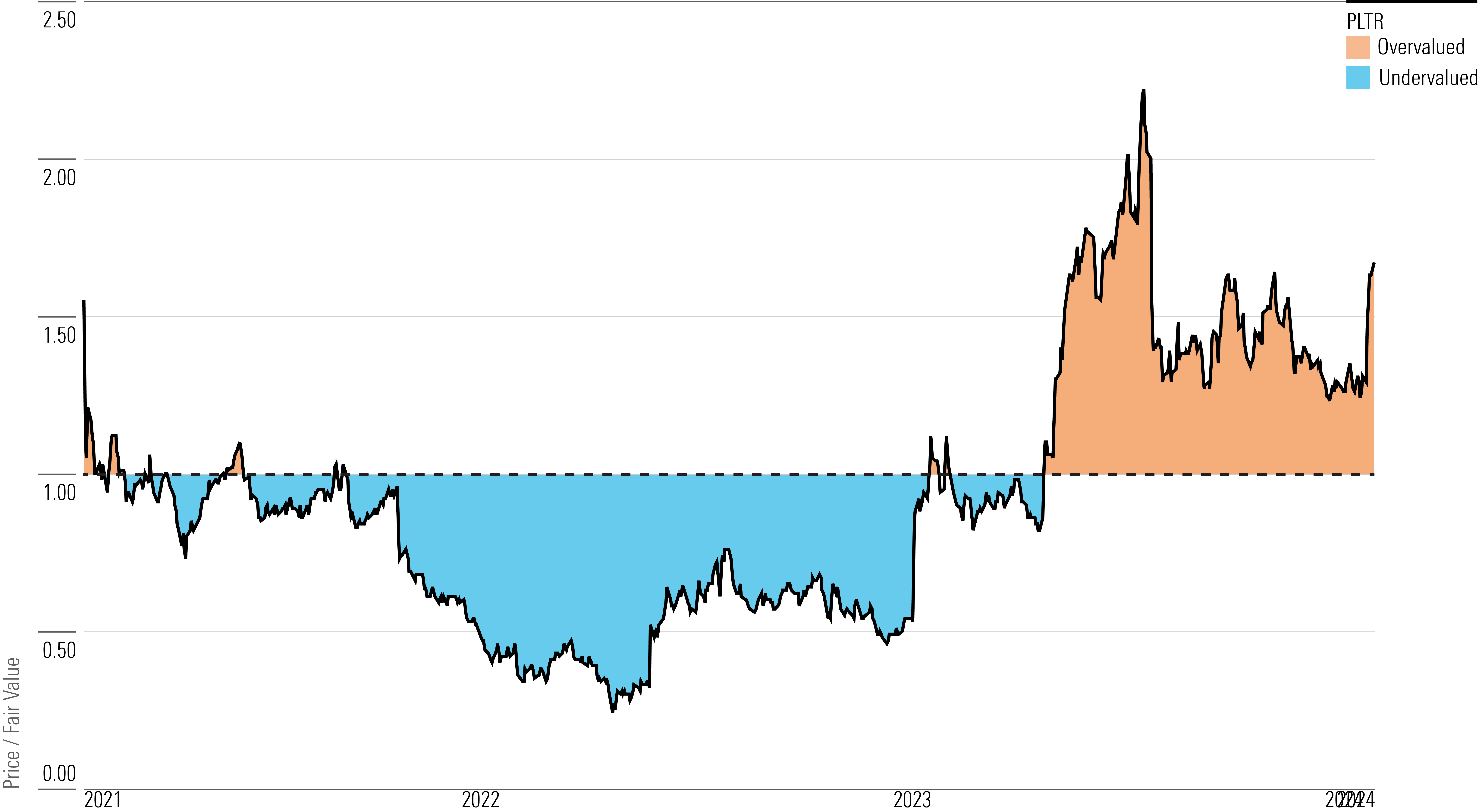

There appears to be a clear delineation between the fundamentals-focused perspective on Palantir and how the street is valuing it. We are very bullish on the firm, but we cannot justify its current market price. While our near-term estimates are ahead of consensus on both growth and profitability, our fair value estimate is markedly below the street. We saw Palantir trade at elevated multiples before the wind was taken out of its sails (and sales), so we’d be wary of a repeat of 2022/early 2023.

Palantir Stock Price

Fair Value Estimate for Palantir

With its 2-star rating, we believe Palantir’s stock is overvalued compared with our long-term fair value estimate.

We forecast that Palantir’s revenue will see a 21% compound annual growth rate over the next five years as it expands both its governmental and commercial operations. We expect the majority of this top-line growth to be driven by commercial clients as the company seeks to broaden that base. While government clients can be sticky, large governmental contracts create lumpiness in revenue. As a result, Palantir’s shift to more commercial clients should create a more ratable revenue mix. We also expect the firm to continue expanding sales within its existing client base, based on its strong net retention rate.

Read more about Palantir’s fair value estimate.

Palantir Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Palantir a narrow moat, owing primarily to strong switching costs associated with its platforms and secondarily to intangible assets in the form of strong customer relationships it has built over the years. We think Palantir’s two main platforms, Gotham and Foundry, both benefit from high customer switching costs, as evidenced by the firm’s strong gross and net retention metrics.

Palantir has exhibited strong customer growth while diversifying its business away from lumpy governmental contracts toward commercial clients. As a result, although we forecast a couple of more years of hefty operating losses, we expect the firm to generate excess returns over invested capital on the whole over the next decade.

Read more about Palantir’s moat rating.

Risk and Uncertainty

While Palantir has landed high-value commercial and government clients over the years, we have found the executive team’s execution to be questionable at best. The firm’s sales strategy has led to relatively poor customer acquisition. Even though Palantir has been in the commercial space for many years, its commercial customer count is only slightly more than 200. While the firm has pivoted to a module-based sales model that should bolster commercial customer additions, the execution of this strategy remains to be seen.

Read more about Palantir’s risk and uncertainty.

PLTR Bulls Say

- Palantir has strong secular tailwinds. The artificial intelligence/machine learning market is expected to grow rapidly due to the exponential increase in data harvested by organizations.

- With products targeting both commercial and governmental clients, Palantir has a distributed top line, with noncyclical governmental revenue insulating the overall top line during lean times.

- Palantir’s focus on modular sales could lead to substantially more commercial clients, which the firm could subsequently upsell.

PLTR Bears Say

- By not selling to countries or companies that are antithetical to its mission and cultural values, Palantir has restricted its growth opportunities.

- Palantir’s AI platform is off to a good start, but we anticipate robust AI competition in the years ahead.

- Palantir’s executive team has made questionable strategic decisions in the past. While past performance isn’t necessarily indicative of future results, the missteps could merit caution from potential investors.

This article was compiled by Bella Albrecht.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)