After Earnings, Is Snowflake Stock a Buy, a Sell, or Fairly Valued?

With earnings below expectations, here’s what we think of Snowflake stock.

Snowflake SNOW released its fourth-quarter earnings report on Feb. 28. Here’s Morningstar’s take on Snowflake’s earnings and our outlook for its stock.

Key Morningstar Metrics for Snowflake

- Fair Value Estimate: $187.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of Snowflake’s Q4 Earnings

- Overall results came in below projections. The biggest miss was the outlook for 22% growth versus our expectations of more than 30% and consensus estimates of 29%-30%. Margins were also guided to decline next year, which is not what you want to see for a growing software company.

- The results highlight some likely fundamental weaknesses in Snowflake’s business, including pricing pressure/concessions, the need to hire more people (particularly artificial intelligence engineers) to compete, and clients moving certain workloads and/or data off the company’s platform onto presumably cheaper ones. The sudden change of CEO also implies some disappointment and a desire for change behind the scenes.

- Management will have to figure out how to reinvigorate growth, and a large part of that depends on current AI-related products. If these endeavors become great successes, Snowflake can reinvigorate growth. Until then, expect the market to focus on the deceleration in growth and the firm’s weaknesses.

Snowflake Stock Price

Fair Value Estimate for Snowflake

With its 3-star rating, we believe Snowflake’s stock is fairly valued compared with our long-term fair value estimate of $187 per share. Our valuation implies a forward fiscal-year enterprise value/sales of 17 times, and is based on our expectations for the company to achieve a compound annual growth rate of 23% over the next five years and 21% over the next 10 years.

The firm is in its infancy, but it has a massive market opportunity and a large runway for growth. This substantial growth is driven by workloads continually shifting to cloud environments—the use case Snowflake caters to—letting it accumulate more share of the overall database management system market. Our forecasts also assume substantial usage growth per customer, as we expect customers to scale their data storage significantly after migrating to the cloud, due to reduced costs and the ease of such scaling.

We forecast that gross margins will expand from 68% in fiscal 2024 to 80% in fiscal 2033. As the company attains customers, this will give it leeway to raise the cost of its offerings, especially after switching costs increase—which could eventually involve moving from a consumption model to a subscription one. We expect GAAP operating margins to increase from negative 39% in fiscal 2024 to 30% in fiscal 2033, as we see operating leverage from improved scale and lower sales investment needs.

Read more about Snowflake’s fair value estimate.

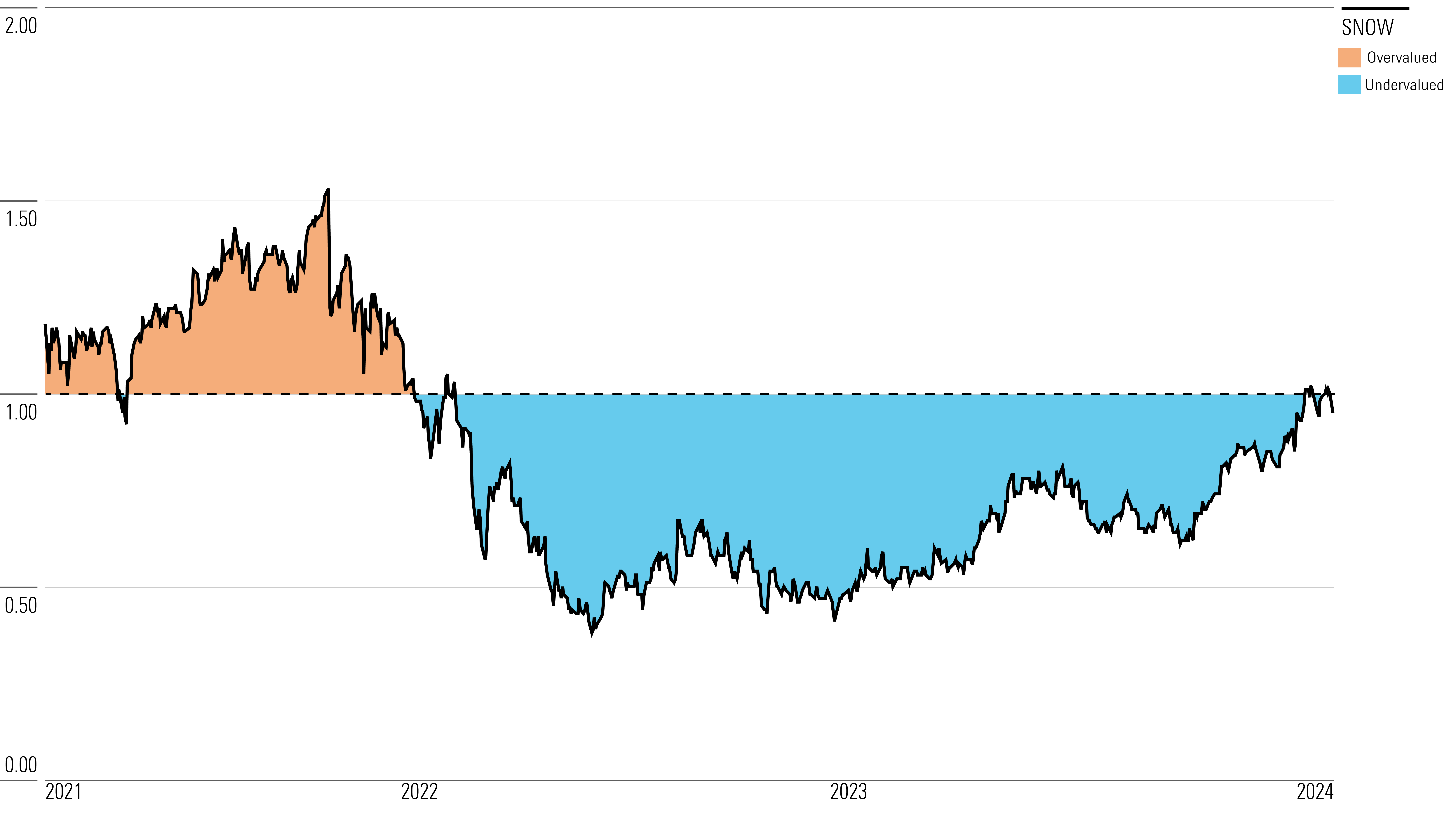

Snowflake Historical Price/Fair Value Ratio

Economic Moat Rating

We do not assign Snowflake an economic moat. We think the firm benefits from switching costs and a network effect, protected by its unique multi-cloud strategies throughout its data lake, data warehousing, and data sharing offerings. However, we cannot say with complete certainty that these advantages will lead to excess returns on invested capital 10 years from now, given Snowflake’s limited history as a public company as well as its significant current lack of profitability.

Snowflake is a fast-growing provider of data lake, data warehousing, and data sharing solutions. The company’s value proposition lies in overturning the faults of existing data storage architectures and even more recent methods of storing data in the cloud through its combined data lake and data warehouse platform. Traditionally, data has been recorded in and accessed via databases, such as the Oracle database or SAP’s HANA. However, the rise of the public cloud has resulted in an increasing need to access data from different databases in one place. A data warehouse serves this need.

We believe Snowflake is a key supplier for a host of enterprises today. We ultimately foresee the company achieving massive growth, as it is well-positioned within the large and growing Big Data market. However, the company is racking up significant operating losses in its growth phase. Such growth is necessary for it to generate excess returns on capital, and the firm is a bit too early in its lifecycle for us to have absolute certainty that it can earn these returns in the long run.

Read more about Snowflake’s moat rating.

Risk and Uncertainty

Snowflake runs the risk that other cloud-neutral software will enter its market, or that a public cloud company will make its data warehouse interoperable outside its cloud. While we think it’s unlikely that either AWS or Azure will open their ecosystems to compete with Snowflake, these two tech titans have vastly greater resources to compete in this space if they so choose.

Furthermore, Snowflake is at risk of compromising the data on its platform, either through breaches or the inability of compliance tools to do their job. For example, the firm offers several features to ensure data is compliant with regulations such as GDPR. However, if any of these tools were to fail, the company’s brand could suffer, possibly diminishing future business.

We think Snowflake’s main environmental, social, and governance risks concern the possibility that customer data is compromised. But even if such attacks were to occur, we think its business would not be affected in the long run.

Based on these factors, along with the higher valuation uncertainty seen by any company expanding this fast, we assign the company a Very High Uncertainty Rating.

Read more about Snowflake’s risk and uncertainty.

SNOW Bulls Say

- Snowflake could remain the only multi-cloud offering of its kind for much longer than anticipated, allowing it to increase its top line more with minimal pricing pressure.

- Snowflake could move to a subscription model from a usage-based model, boosting the monetization of its products.

- Snowflake could expand to other multi-cloud data needs, pushing spending per customer to greater heights.

SNOW Bears Say

- Other multi-cloud data providers may emerge to compete with Snowflake, or in-house data warehouses at AWS or Azure could potentially adopt a multi-cloud strategy.

- Snowflake could fail to expand its data-sharing network extensively, leaving it vulnerable to competition with larger networks.

- Migration of existing workloads to the cloud could occur at a slower pace, extending Snowflake’s unprofitable years.

This article was compiled by Freeman Brou.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)