U.S. Sustainable Funds Suffer a Worse Quarter Than Conventional Peers

Fourth-quarter outflows cap a roller-coaster year for sustainable funds.

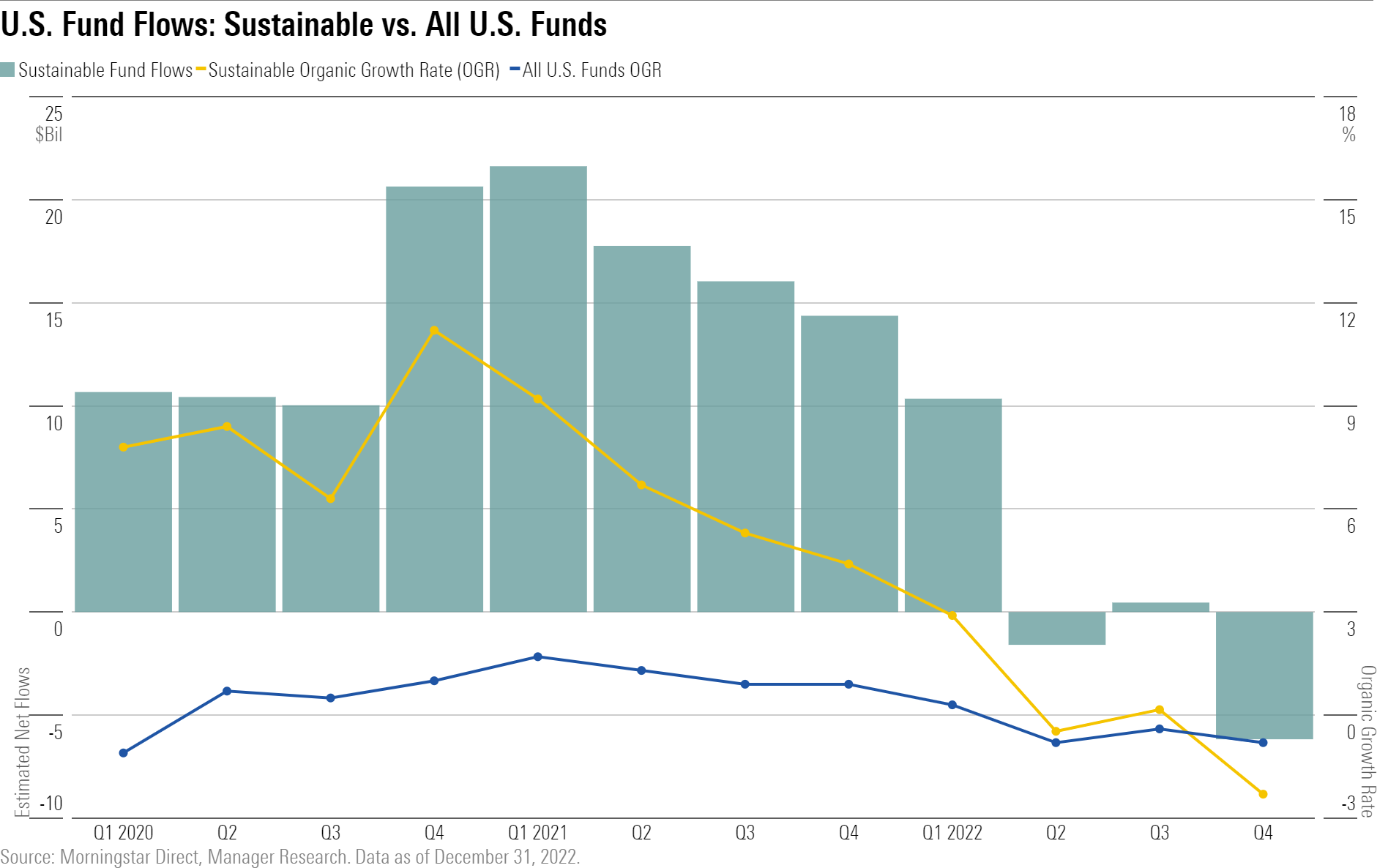

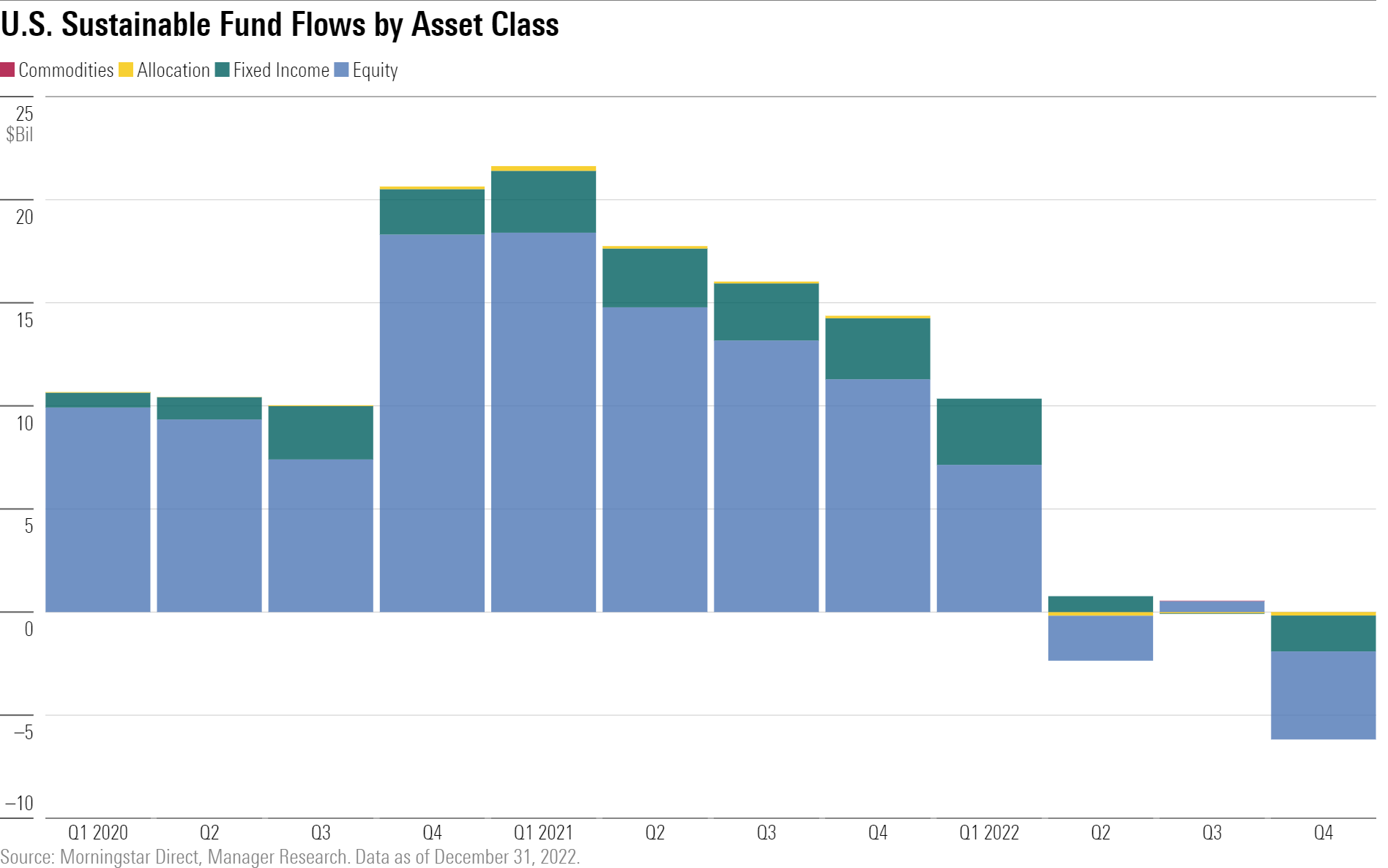

U.S. sustainable-fund flows sank to their lowest level in more than five years, shedding more than $6 billion during the fourth quarter of 2022. Although U.S. sustainable funds ended 2022 in positive territory—a departure from the broader U.S. fund universe, which suffered the worst flows year on record—demand for these funds has declined steadily since their peak nearly two years ago. Aside from persistent global macroeconomic pressures, this appears to be driven by the growing politicization of social and environmental issues and investment strategies that prioritize them.

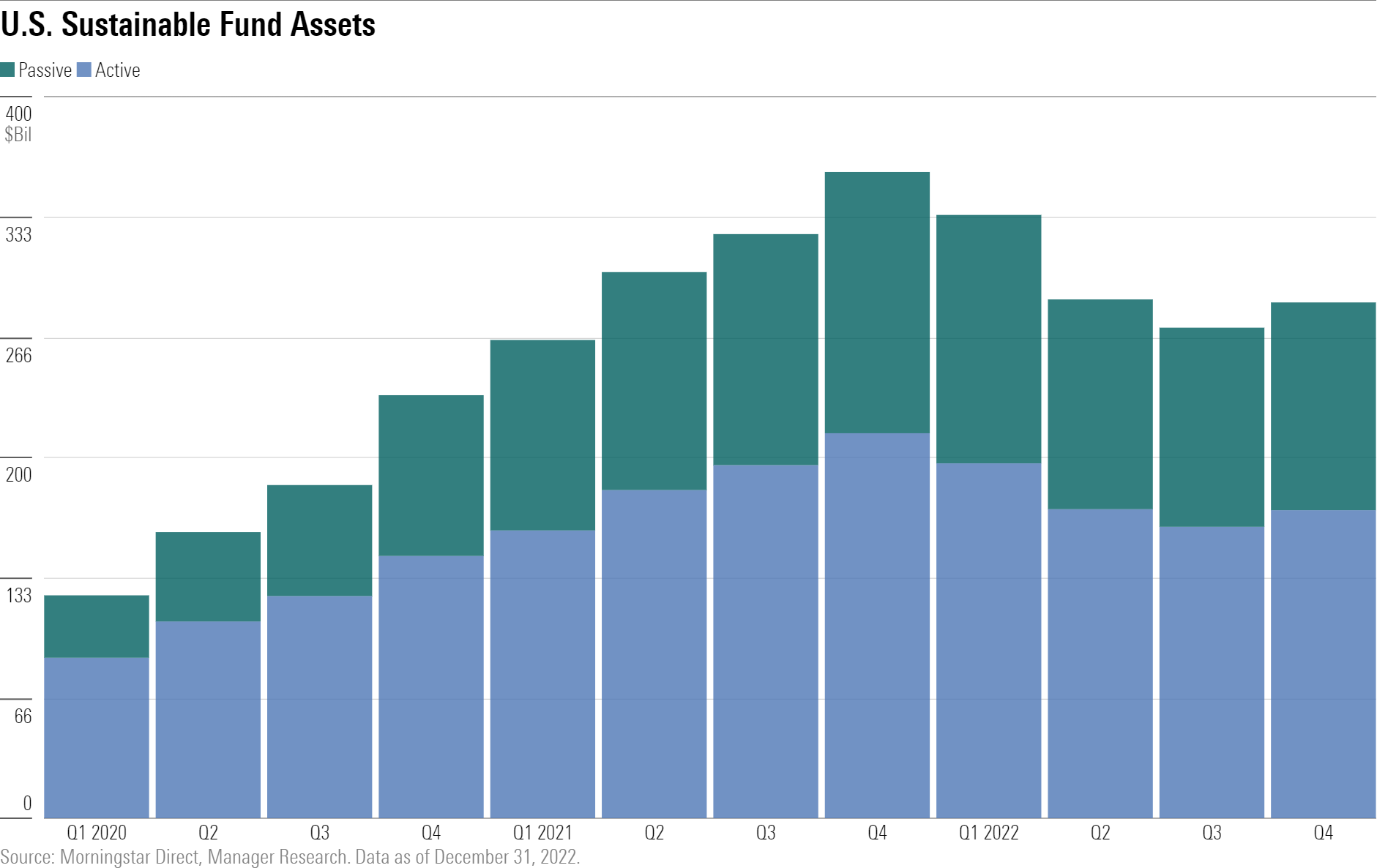

On an annual basis, sustainable funds netted more than $3 billion for the year, knocking their nonsustainable peers out of the park. The typical sustainable U.S. large-blend fund returned more than 8% during the fourth quarter, offsetting outflows to boost assets to $286 billion by the end of the year.

Sustainable Funds Suffer Fourth-Quarter Outflows Amid Market Headwinds and Shifting Public Sentiment

Sustainable funds shed nearly $6.2 billion during the fourth quarter to cap off the roller-coaster ride that was 2022. After a $10.4 billion intake during 2022′s first quarter, sustainable funds lost $1.6 billion in the second quarter and netted a modest $459 million in the third quarter. For the full year, sustainable funds collected net inflows of more than $3 billion.

Flows into sustainable funds have fallen steadily since their all-time high in 2021′s first quarter. Much of this was driven by the broader market environment. In 2022, U.S. funds suffered more than $370 billion in withdrawals, cementing their first calendar year of outflows since Morningstar began tracking data in 1993. Investors generally pulled out of actively managed funds and fixed-income funds amid persistent inflation and rising interest rates, risk of an impending recession, and poor market returns.

Sustainable funds showed resilience in the face of some of these headwinds—sustainable fixed-income funds fared better in terms of flows than nonsustainable peers. But in terms of market returns, sustainable funds fared worse. In 2022, the energy sector was the best-performing unit of the S&P 500 index, gaining a remarkable 66%. On the other hand, communication services, consumer discretionary, and information technology suffered the most, losing 40%, 37%, and 28%, respectively. Funds with a structural underweighting to the energy sector, including many sustainable funds, suffered as a result. The opposite was true in 2020, when the tech sector gained 44% compared with energy’s 34% loss. Investors may have favored traditional energy exposure over energy-light sustainable funds given relative return expectations.

Finally, the conversation around sustainable investing was increasingly marked by concerns about greenwashing and a political backlash against environmental, social, and governance investing. In the United States, prominent politicians have spoken out against ESG investing, and some have taken measures to limit state investment funds from doing business with asset managers based on perceptions of those managers’ ESG approaches.

Although both sustainable funds and their conventional counterparts saw outflows in the fourth quarter, the short-term withdrawals were more severe for sustainable funds. For the first quarter in more than three years, the U.S. sustainable-funds landscape saw a lower organic growth rate than the total U.S. fund universe. Calculated as net flows as a percentage of total assets at the start of a period, the organic growth rate puts the magnitude of fund flows into perspective. During the fourth quarter, sustainable funds shrank by 2.2% compared with an 0.8% shrinkage in the overall U.S. landscape.

The organic growth rate becomes a more meaningful measure over longer periods of time, and sustainable funds still beat the total U.S. funds landscape for 2022. During the year, sustainable funds grew by 0.7%, while the overall universe shrank by 1.3%. Although sustainable funds maintained stronger growth than nonsustainable peers, this pales in comparison to the two previous years. In 2021 and 2020, sustainable funds outgrew the broader universe by 22 and 31 percentage points, respectively.

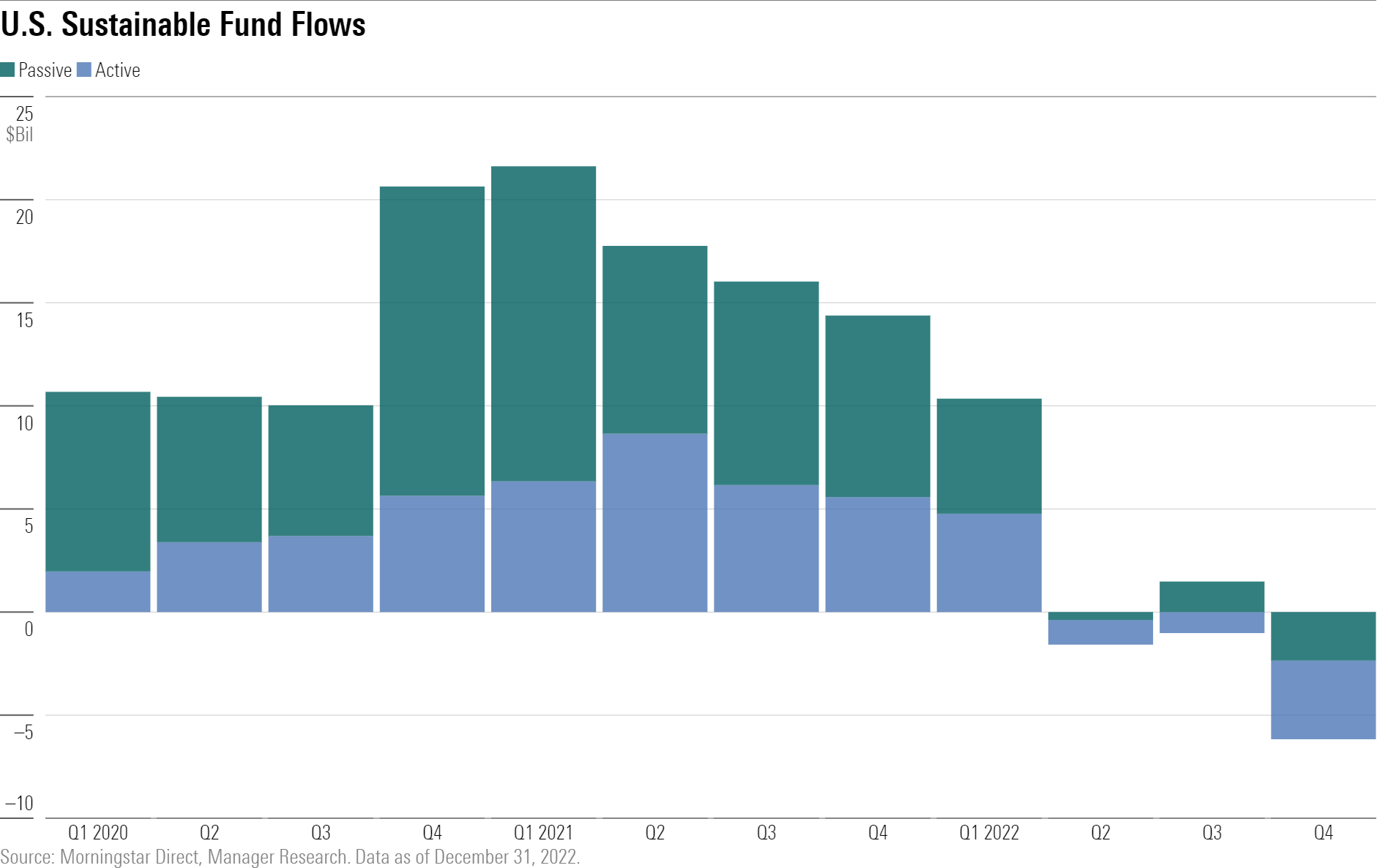

Investors Pulled Out of Passive Sustainable Funds

Passive sustainable funds bled $2.4 billion during the fourth quarter, their steepest outflows in more than three years. One fund—iShares ESG Aware MSCI USA ETF ESGU—constituted more than three fourths of the total loss with a $1.8 billion withdrawal over the period. Historically a fan favorite, this fund landed among the top 10 flow-getters each quarter for the past three years. But the tide turned halfway through 2022.

Demand for sustainable passive funds lagged that of conventional peers in 2022. In the overall U.S. fund universe, index-tracking funds collected $556 billion, down more than 40% from their record haul in 2021 but still a bright spot in an otherwise gloomy flows picture for the year.

Actively managed sustainable funds posted their third consecutive quarter of outflows, shedding $3.8 billion during 2022′s fourth quarter. The withdrawals offset the first quarter’s inflows, and these funds landed in negative territory for the full year with a $1.3 billion net outflow. Still, this is relatively minor compared with active funds in the U.S. overall, which lost an incredible $926 billion in 2022, roughly triple their second-worst calendar-year outflow in 2018.

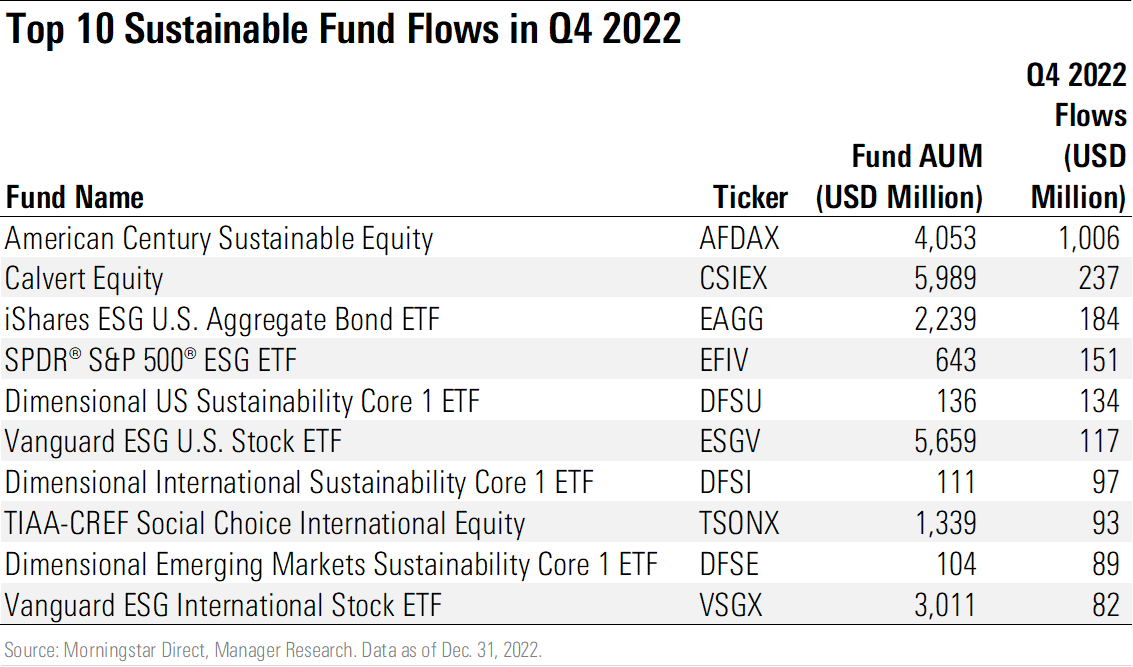

A Familiar Face Among the Top Flow-Getters

Just one fund has managed to place in the top 10 for inflows during each quarter in 2022. Vanguard ESG US Stock ETF ESGV features a straightforward approach to portfolio construction that harks to the early days of socially responsible investing. The fund tracks a diversified equity approach but screens out firms involved in tobacco, cannabis, civilian firearms, and coal and oil. The fund’s popularity is largely driven by its low fee of just 9 basis points.

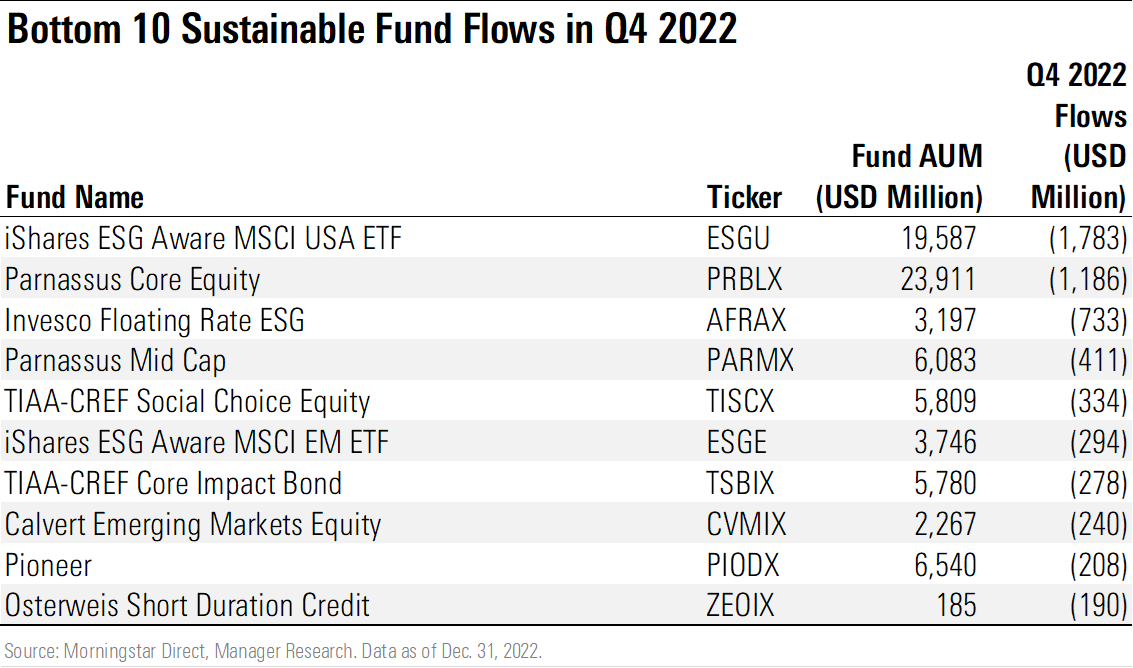

Two Funds Accounted for Nearly Half of the Quarter’s Outflows

Two funds that have consistently placed among the top flow-getters accounted for nearly half of the quarter’s outflows from U.S. sustainable funds. IShares ESG Aware MSCI USA ETF and Parnassus Core Equity PRBLX bled $1.8 billion and $1.2 billion during the quarter, respectively. These outflows were not insignificant; they accounted for nearly 9% of iShares ESG Aware MSCI USA ETF’s assets and more than 5% of Parnassus Core Equity’s assets coming into the fourth quarter.

Fixed Income Fell Out of Favor

Flows into sustainable fixed-income funds were on a steady upward trajectory until the Fed started raising rates in early 2022. During the fourth quarter, sustainable bond funds lost $1.7 billion, their second-consecutive quarter of outflows in more than three years. Still, a strong first-quarter showing kept these funds above water to net $2.4 billion for the year. This paled in comparison to nonsustainable taxable- and municipal-bond funds, which surrendered a record $335 billion during the year.

As for equities, flows into sustainable equity funds seesawed throughout 2022, and fourth-quarter outflows nearly erased the year’s gains. These funds bled for each of the last four months and registered the second quarter of outflows in more than five years. Still, conventional U.S. equity funds fared worse, shedding assets in half of all quarters over the past three years.

Market Appreciation Boosted Assets in U.S. Sustainable Funds

Despite outflows, assets in sustainable funds rose to round out the year. The typical sustainable U.S. large-blend fund returned 8% during the quarter, and assets in these funds grew to $286 billion, almost fully recovering from the third quarter’s losses. Still, this represents a 20% decline from the all-time record of $358 billion at the end of 2021. By comparison, assets in the broader U.S. fund universe also peaked at the end of 2021 (at $28 trillion) and slid by 19% to $22.7 trillion at the end of 2022.

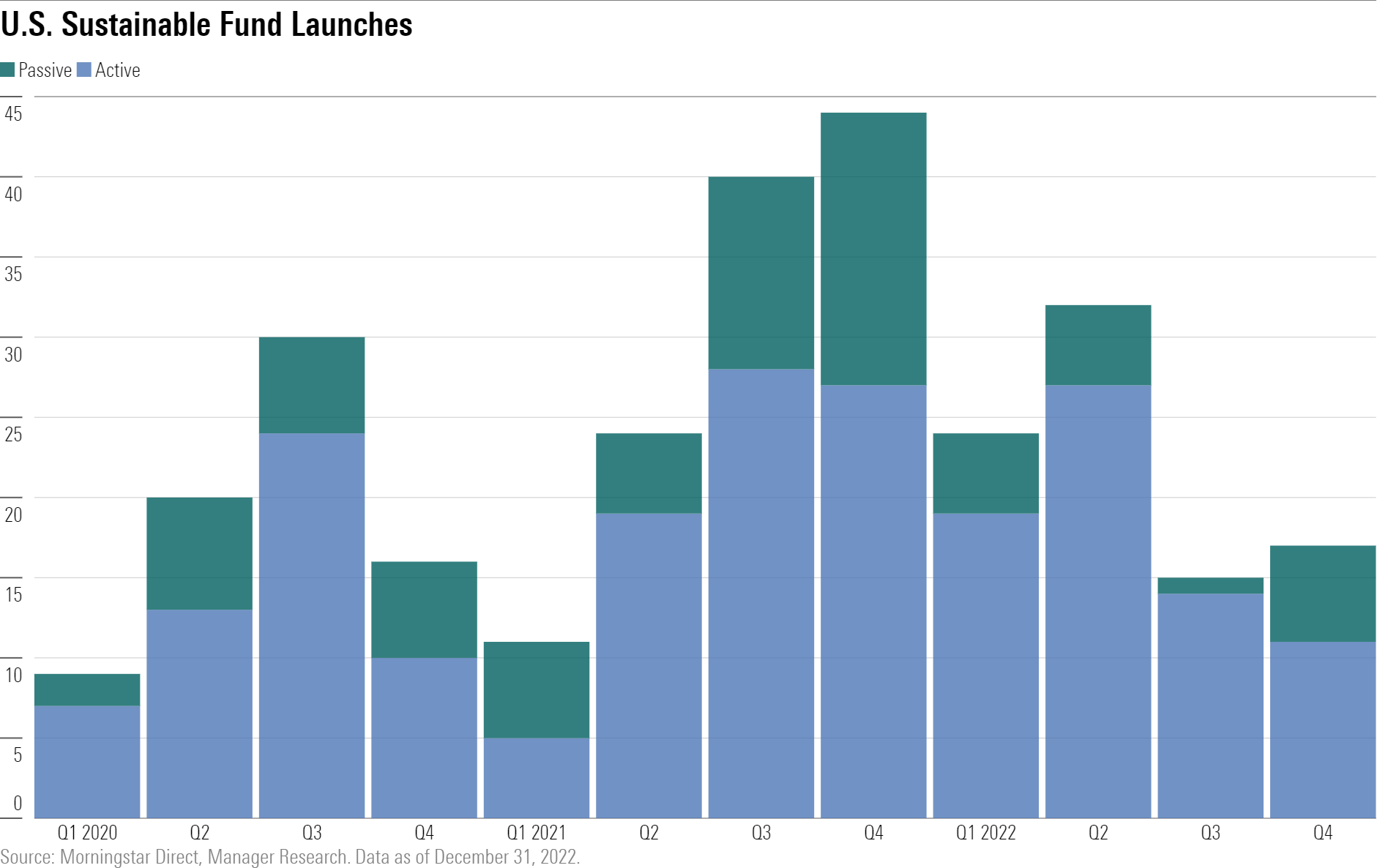

Active Funds Dominated New Launches Once Again

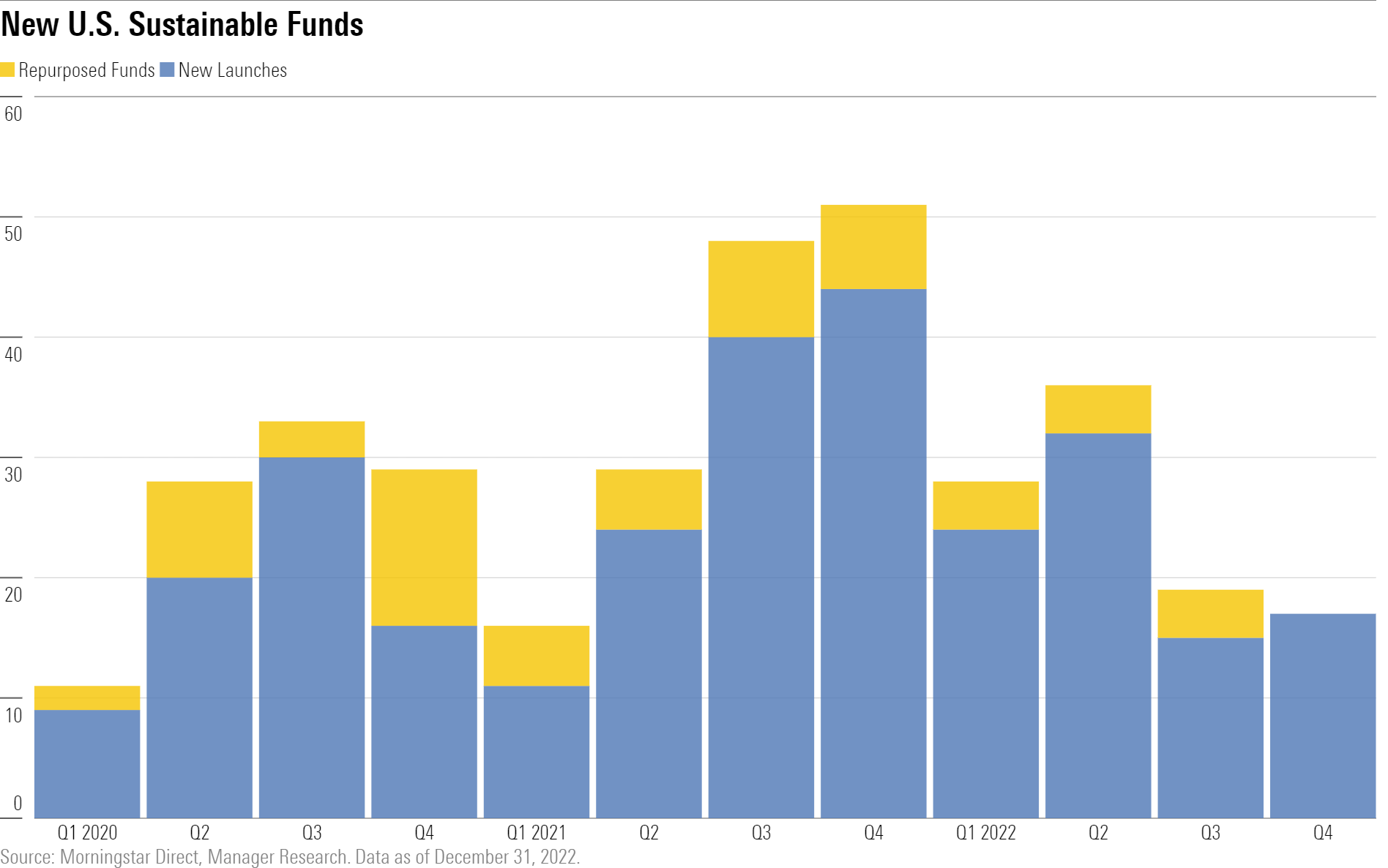

Despite persistent investor preference for passive funds, 11 of the 17 sustainable funds launched in the U.S. during 2022′s fourth quarter are actively managed. On average over the past three years, active funds have accounted for two thirds of sustainable fund launches, and this quarter’s 65% matched that trend.

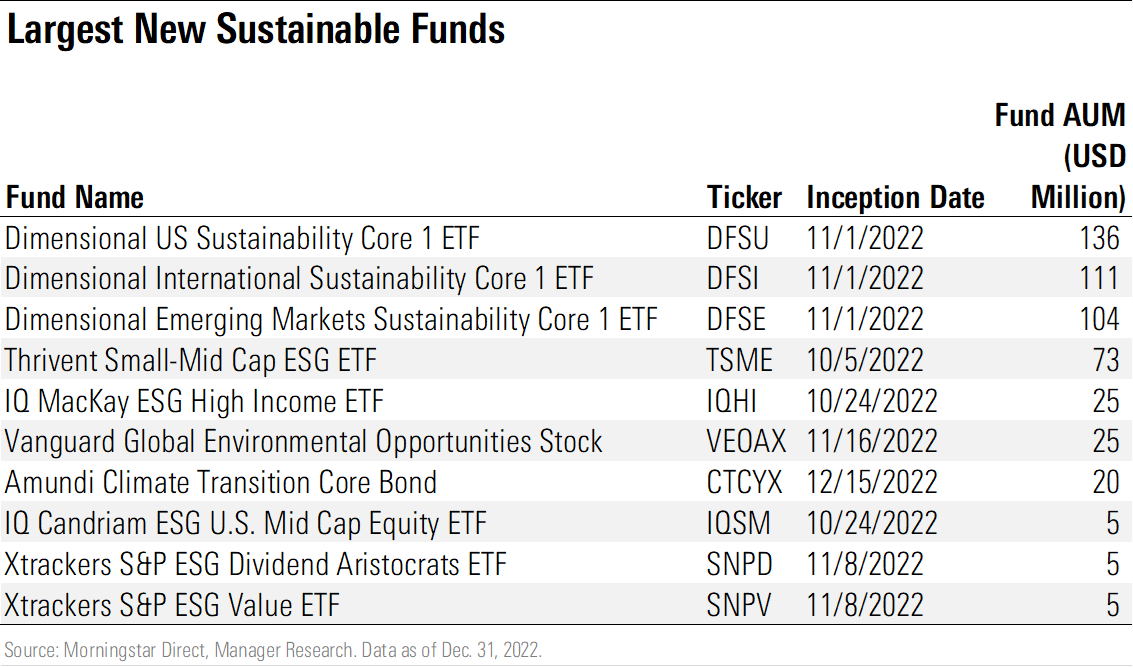

Only two of the new sustainable offerings were launched as open-end funds, and both focus on climate transition. Amundi Climate Transition Core Bond CTCYX is the firm’s first sustainable thematic offering in the U.S.; Amundi’s other funds serve as diversified core building blocks of a portfolio. The fund invests in green bonds and those whose issuers have relatively low carbon emissions or are implementing robust sustainability strategies. Vanguard Global Environmental Opportunities Stock VEOAX invests in companies that derive a majority of revenue from climate-related activities such as renewable energy development and waste reduction in manufacturing.

New Sustainable Funds Targeted a Core Portfolio

The three largest new U.S. sustainable funds were core portfolio holdings launched by Dimensional. These funds follow the firm’s hallmark investment philosophy, which focuses on smaller and less expensive companies, and adds an overlay of sustainability factors including biodiversity, fossil fuel involvement, and ownership of private prisons.

Firms occasionally change the investment strategies of existing funds to target sustainable outcomes, but in the fourth quarter, all of the new options available to investors were launched with sustainable mandates.

The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the U.S. to 598 at the end of the quarter.

For global sustainable fund flows for the fourth quarter, read our full paper.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)