The Risks and Rewards of Investing in the Clean Energy Transition

Plus, our picks from the utilities, energy, and basic materials sectors.

Achieving a climate goal like the Paris Agreement’s quest to limit global warming to 1.5 degrees Celsius will require generational changes in how we produce and consume energy.

Given the uncertainty around how these changes will take shape, we think investors should approach the clean energy transition with a risk/reward mentality.

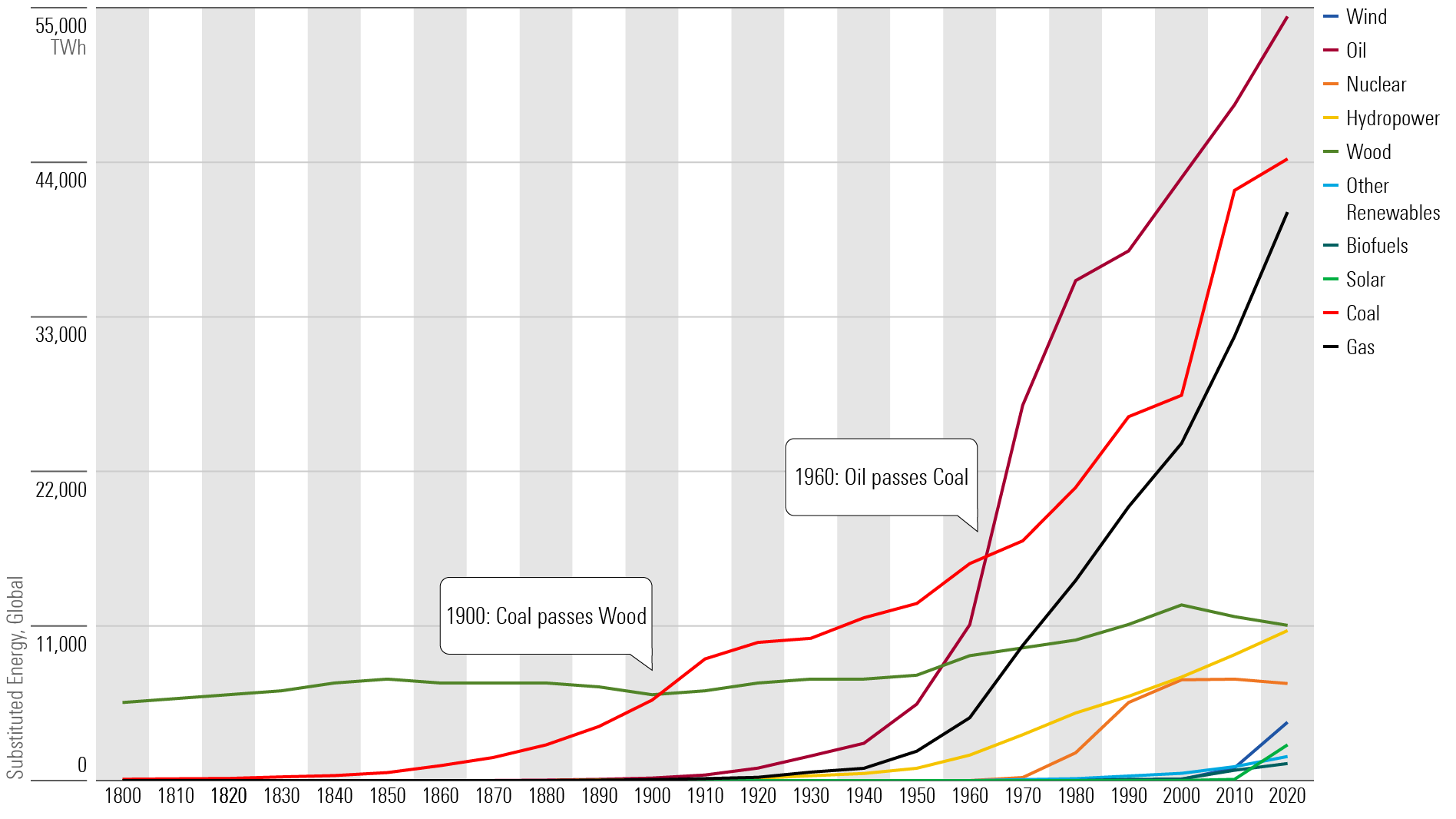

The main risk is if the world can’t eliminate carbon emissions from energy use by 2050. The world’s leading energy source has only changed twice since the 1800s (from wood to coal in 1900, and from coal to oil in 1960)—and both transitions have taken decades longer than the pace needed to eliminate carbon emissions from energy use by 2050. Is there reason to believe this time will be different?

Energy Transitions Can Take Decades; Renewable Energy Must Play Catch-Up

On the reward side, we seek to understand whether incumbent companies with competitive advantages or aspirational newcomers will prove to be the biggest winners.

In our recent report, we unpack the scale and scope of this energy transition to help investors understand how to minimize risk and maximize investment returns.

The Risk: Will Carbon Emissions Fall Fast Enough?

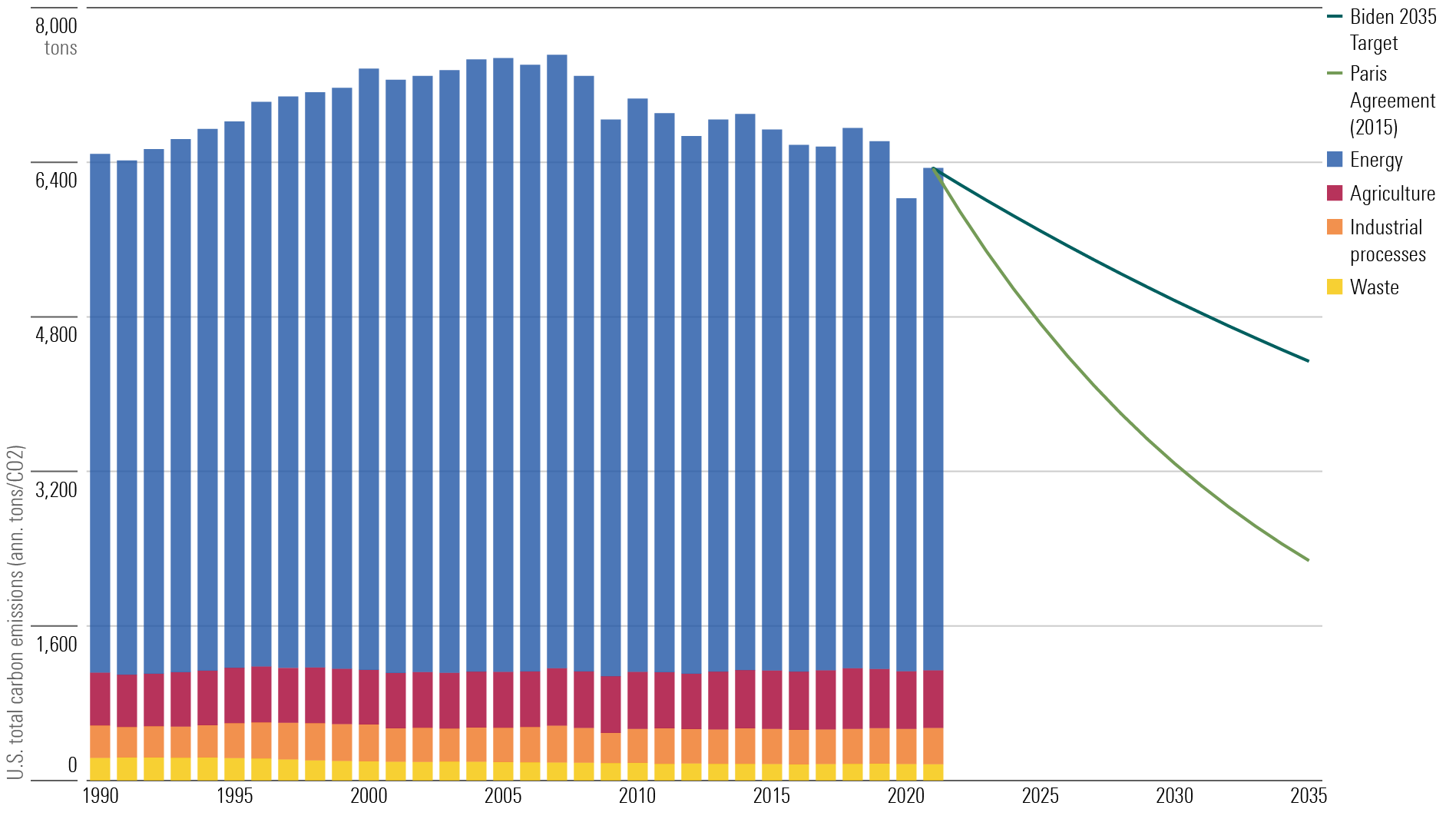

In the United States, carbon emissions have fallen 15% since the peak in 2005 entirely owing to lower emissions from energy production and consumption. However, the energy sector still accounts for 80% of U.S. carbon emissions, making it the primary target for further emissions reductions.

Energy Sector Emissions Must Continue To Fall Rapidly To Meet Certain Targets

If energy sector carbon emissions continue to fall at the same rate as the last 20 years, energy will remain the largest source of carbon emissions for many years. No current U.S. policy will change that decline rate materially.

We estimate that energy sector carbon emissions will account for 70% of all U.S. carbon emissions by 2035 even if the U.S. hits the Biden Administration’s most aggressive clean energy targets. We estimate energy sector emissions would fall to just 50% by 2035 if the U.S. followed the Paris Agreement’s 1.5 degrees Celsius global warming limit pathway to net-zero emissions by 2050.

That said, the Biden Administration’s initial ambition to decarbonize the power sector by 2035 is aggressive. Reaching that goal would require the U.S. to triple its current carbon-free generation. Constraints include financing, manufacturing, and developing the number of wind and solar projects necessary to reach that goal. Another constraint is electric grid reliability with high levels of intermittent wind and solar energy. The U.S. Energy Information Administration forecasts that only 51% of U.S. electric generation will be carbon-free by 2035. We forecast only 65% carbon-free power generation by 2030, leaving a huge gap to fill between 2030 and 2035 to meet Biden’s target. More recent policymaking proposals from the administration suggest they think 2040 is a more realistic target, but we think even that is aggressive.

Still, our renewable energy forecast remains more bullish than others, including the EIA and the U.S. National Renewable Energy Laboratory. We expect more coal plant closures, more wind and solar growth, more small-scale solar, and more clean energy imports than other forecasts.

New solar and wind generation investments will drive the clean energy transition. Wind generation led the first wave of renewable energy investment, but developers are quickly shifting capital investment toward solar. Solar represents roughly two thirds of all planned renewable energy projects during the next three years based on government data and grid operator generation access request queues.

We expect solar generation will be the renewable energy technology of choice during this decade. In 2020, wind energy generation was more than 3.5 times higher than solar energy generation. However, we estimate that improving economics for solar, tax policy, greater solar system efficiencies, and adoption of battery storage will push electricity output from solar past wind by the end of the decade.

The Reward: Our Picks for Investing in the Energy Transition

Entergy ETR

- Morningstar Rating: 4 Stars

- Price/Fair Value: 0.85

- Morningstar Uncertainty Rating: Low

- Morningstar Economic Moat Rating: Narrow

Entergy’s 4% dividend yield and our outlook for 7% earnings growth is one of the best total returns in the sector. Entergy’s 15 P/E is a 15% discount to the sector. Above-average electricity demand growth, clean energy investments, and reliability/resiliency network investments are core growth drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development.

Duke Energy DUK

- Morningstar Rating: 4 Stars

- Price/Fair Value: 0.87

- Morningstar Uncertainty Rating: Low

- Morningstar Economic Moat Rating: Narrow

After divesting its renewable energy business, Duke has a clear pathway to achieving management’s 5%-7% earnings growth target. Duke’s $65 billion capital investment plan for 2023-27 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports the clean energy transition. Florida offers opportunities for solar growth. Duke’s 4.4% yield is among the highest in the sector, but dividend growth will lag earnings growth given the company’s higher payout ratio.

Albemarle ALB

- Morningstar Rating: 5 Stars

- Price/Fair Value: 0.63

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Narrow

Albemarle is one of the largest lithium producers globally, with nearly 90% of companywide profits coming from lithium. The company produces lithium from three of the best resources globally, which underpins our narrow moat rating from the firm’s strong cost advantage. Albemarle is in the midst of a major capacity expansion, aiming to quadruple its lithium production capacity by 2030 from 2022 levels. We view it as one of the best ways to invest in growing lithium demand and higher prices as a direct result of rising electric vehicle adoption.

Exxon Mobil XOM

- Morningstar Rating: 3 Stars

- Price/Fair Value: 0.91

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Narrow

Exxon plans to double earnings from 2019 levels by 2025 and double cash flow by 2027 through structural operating cost reductions; portfolio improvement; and growth across its upstream, downstream, and chemical segments. Exxon estimates that its plan will generate about $100 billion in surplus cash, after funding investment and paying the dividend, during the next five years. Combined with currently higher-than-expected commodity prices, its current repurchase program of $30 billion through 2023, is likely just the beginning.

TotalEnergies TTE

- Morningstar Rating: 3 Stars

- Price/Fair Value: 0.89

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: None

TotalEnergies’ latest strategic plan remains the same, aiming to achieve net-zero emissions by 2050 while delivering near-term financial performance. Its emissions-reduction goal is in line with many of its European peers, but in contrast to some, TotalEnergies does not plan a quick retreat from oil and gas. Instead, it plans to reduce emissions over time by expanding its ownership of renewable power assets. Its plan to return 35%-40% of cash flow to shareholders through the cycle rates is one of the highest payouts among peers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)