Why Are Climate Funds In the Dumps?

As the biggest climate law in U.S. history turns one year old, solar and renewable energy stocks face new hurdles.

The Inflation Reduction Act—the biggest climate law in U.S. history, which pumped hundreds of billions of dollars into clean energy projects—has just marked its one-year anniversary. But that isn’t apparent when looking at the returns on climate-focused mutual funds.

The estimated $400 billion spending plan in the IRA contained a wide array of initiatives to support the development and buildout of clean energy, including tax breaks for solar energy, electric vehicles, and batteries. In the past year, according to a statement from the White House, the law has created an estimated 170,606 jobs and 272 new clean energy projects.

But the climate-focused funds in Morningstar’s database have taken a pasting, and the reason for this has nothing to do with the new law. Investors can instead blame high interest rates and elevated valuations that persisted in 2021.

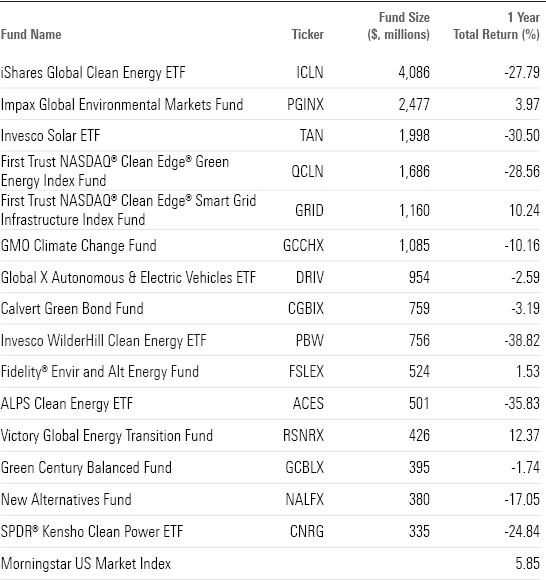

Climate Fund Performance

We looked at the performance of the largest U.S. climate funds, ranked by size. The funds comprise a hodgepodge of approaches and asset classes. They include low-carbon funds, green bonds, climate solutions, clean energy/tech funds, and climate-conscious funds, which focus on reducing climate-related risks in portfolios and investing in companies that positively align with the transition to a low-carbon economy.

We included only funds with one-year track records. As a result, the $2.2 billion Xtrackers MSCI USA Climate Actin Equity ETF USCA didn’t make the cut, since it launched in April. Nor did the $420 million GMO Resource Transition GMOYX, which launched in February.

One Year After the IRA, Climate Funds Get a Drubbing

High Interest Rates Dent Enthusiasm for Solar Stocks

Despite the tailwind of the IRA, higher interest rates have hit demand in rooftop solar, notes Morningstar analyst Brett Castelli. That was compounded by new California solar-related rules that took effect on April 15. The rules revised the state’s net metering policy, effectively decreasing the value of solar energy credits and making solar less affordable. The goal is to push customers to adopt battery storage.

The funds extended their declines in August, as stocks got hammered by inflation fears and concerns about China. So while the market is down just 2.2% since the end of July, Invesco Solar ETF TAN is down nearly 10%.

In addition, over the past few weeks, solar companies have reported disappointing second-quarter earnings, says Castelli. A typical example is SolarEdge SEDG, whose third-quarter revenue is now expected to fall 8% sequentially as Europe and the United States are plagued by excess inventory. Meanwhile, in California, Sunrun RUN saw new sales down by one-third year on year in July. As a result, analysts have chopped earnings forecasts for the group. “A wide swath of publicly traded companies in the rooftop solar space have had a difficult year to date,” Castelli says.

However, the chief issue has been higher interest rates, which have impacted home demand and subverted the IRA’s tailwinds. Bloomberg reports that panel demand is surging worldwide, driven by government targets and supply chain improvements. The site forecasts the world is on track to have a total of 5,300 gigawatts of capacity by 2030—about the volume of solar that is required in scenarios under which global net zero targets are met. But prices have also declined as new factories came online.

Elevated rates also hit prospects for renewables, impacting what Castelli calls “the customer value proposition.” For the group, valuations have contracted as rising interest rates reduce the value of cash flows.

“The key challenge for investing in this space is there are very few moats in renewables,” says Castelli. “The trajectory of interest rates is a key factor for renewables investors.”

Castelli is a fan of Solaredge, rated 4 stars by Morningstar, which has sold off sharply but remains well-diversified across the U.S. and Europe. In renewables, he likes 4-star Brookfield Renewable Partners BEP, which he describes as “very strong allocators of capital.”

The best-performing climate fund was the unusual Victory Global Energy Transition RSNRX. Manager Ken Settles of Sailingstone Capital notes that the fund focuses not on solar companies, but on long-term energy storage, zero-carbon conventional power (such as nuclear), and natural gas coupled with blue hydrogen and carbon sequestration. (That could be helped by the greater U.S. emphasis on carbon capture.)

A Fan of Nuclear Energy

Settles expects big growth in the adoption of nuclear energy. One of Victory Global’s largest positions is uranium producer Cameco CCJ. “We don’t want to speculate on which technology is going to win. We will need nuclear, wind, and solar. Even natural gas will be critical particularly when coupled with carbon sequestration. We need all of the above to get away from coal and oil,” says Settles. All this is “a lower-risk way to benefit from the trends on decarbonization.”

Plenty of investment opportunities will arise as the sector revives. Nevertheless, as the past year’s returns have shown, an investor must pay attention to the risks associated with thematic funds, which often bear a higher standard deviation than the broad global equity market. The past year’s performance shows that while investors increasingly recognize the importance of activities like renewable energy development and climate risk mitigation, the classic dynamics of supply and demand still apply.

In terms of investment flows, the climate funds group as a whole has shown resilience compared to general ESG funds. “‘ESG’ as an investment strategy has lost some of its shine in recent years, but investors recognize topics like climate change adaptation and workforce diversity as enduring themes that will affect markets for years to come,” says Alyssa Stankiewicz, associate director for sustainability research at Morningstar.

The IRA is a drop in the bucket of how much investment will be required to address climate change, but it has already led to massive developments in innovation, adds Stankiewicz. “More turbulence, for better and worse, certainly lies ahead.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IJKB5DGDNJFLPP6SBNF27R3UEA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)