Want to Invest in Nuclear Energy? The True Winner Is Found in These Funds

Nuclear power is undergoing a renaissance but won’t be a big theme for most utilities.

The fight against climate change and the consequent phasing out of fossil fuels, combined with Europe’s need to become independent of Russian oil and gas imports, have led to a revival of interest in nuclear energy.

In July 2022, Europe included nuclear energy as part of its sustainable-investment taxonomy, recognizing its role as a transition fuel to a fully renewable power grid. The Joint Research Centre—the European Commission’s science and knowledge service—said its analysis prior to its decision “did not reveal any science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies already included in the taxonomy as activities supporting climate change mitigation.”

France is the most advanced European country in this respect: In June, it announced a commitment of more than EUR 100 million to revitalize its nuclear industry. The United Kingdom also aims to increase energy security through nuclear power, in particular through small modular reactors.

Nuclear Power Makes a Comeback in Many National Energy Programs

Indeed, nuclear power is making a comeback in the energy programs of many countries. In the United States, for example, the recently introduced Advance Act aims to support the development of new nuclear technologies domestically and abroad. These include converting conventional energy sites and “regulatory support for the development of advanced nuclear technologies,” says Roberta Caselli, commodity research analyst at Global X.

Even more significant is the example of Canada, which, after a 30-year hiatus, is reviving its nuclear production. Caselli notes that Ontario province plans to expand an existing plant “that will become the largest in the world” and build three new compact modular reactors.

The nuclear revival is also of interest to emerging countries. Among them, Caselli notes, Pakistan is collaborating with China to build a nuclear power plant called Chashma 5. The government of India is weighing whether to allow private companies to enter the nuclear industry, which is currently controlled by the state, Caselli says. Meanwhile, Saudi Arabia is also considering an offer from a Chinese state-owned company to build a nuclear power plant. “This move could provide the Arab kingdom with strategic leverage in its ongoing discussions with the United States to create its own civil nuclear industry,” says Caselli.

The Pros and the Cons of Nuclear Energy

Nuclear energy remains controversial, in part because of nuclear accidents, use of uranium in nuclear weapons, and the high costs of plant construction. However, it offers a number of advantages over other clean energy technologies: It provides a clean and constant base load (the minimum level of demand on an electricity grid over a period of time), which renewables may struggle to offer. It can reliably supply energy at any time of day and regardless of weather conditions, and it requires less material than other transition technologies, which also lowers associated carbon emissions.

“In terms of clean and reliable energy generation, nuclear power has no equal,” says Cindy Paladines, senior vice president ESG at TCW. Like renewables, nuclear power produces no direct carbon or greenhouse gas emissions. “However,” Paladines adds, “when evaluating the emissions costs of different power generation options over their lifecycle, nuclear power clearly wins.”

Of course, radioactive waste and nuclear accidents, such as the Chernobyl disaster and the more recent Fukushima Daiichi disaster, have made the public suspicious of this technology.

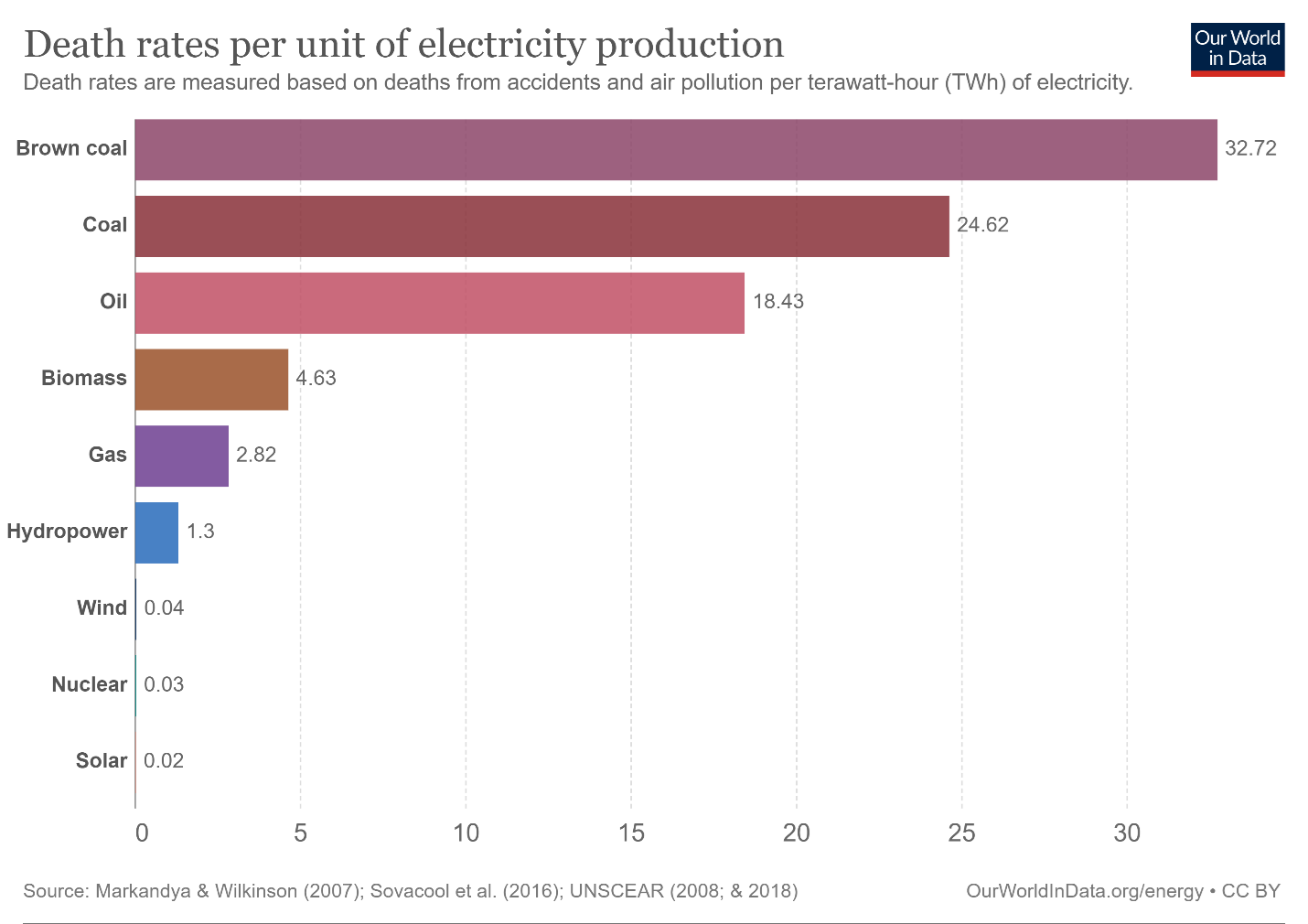

However, even using conservative mortality totals (which include deaths from radiation exposure and, in the case of Fukushima, from the effects of the evacuation of the city), estimates from Our World in Data show that nuclear is second only to solar power in safety when viewed on the basis of per terawatt-hour of electricity generation.

Death Rates per Unit of Electricity Production

How to Invest in Nuclear Energy

We’ve written about investing in nuclear power before, most notably here and here.

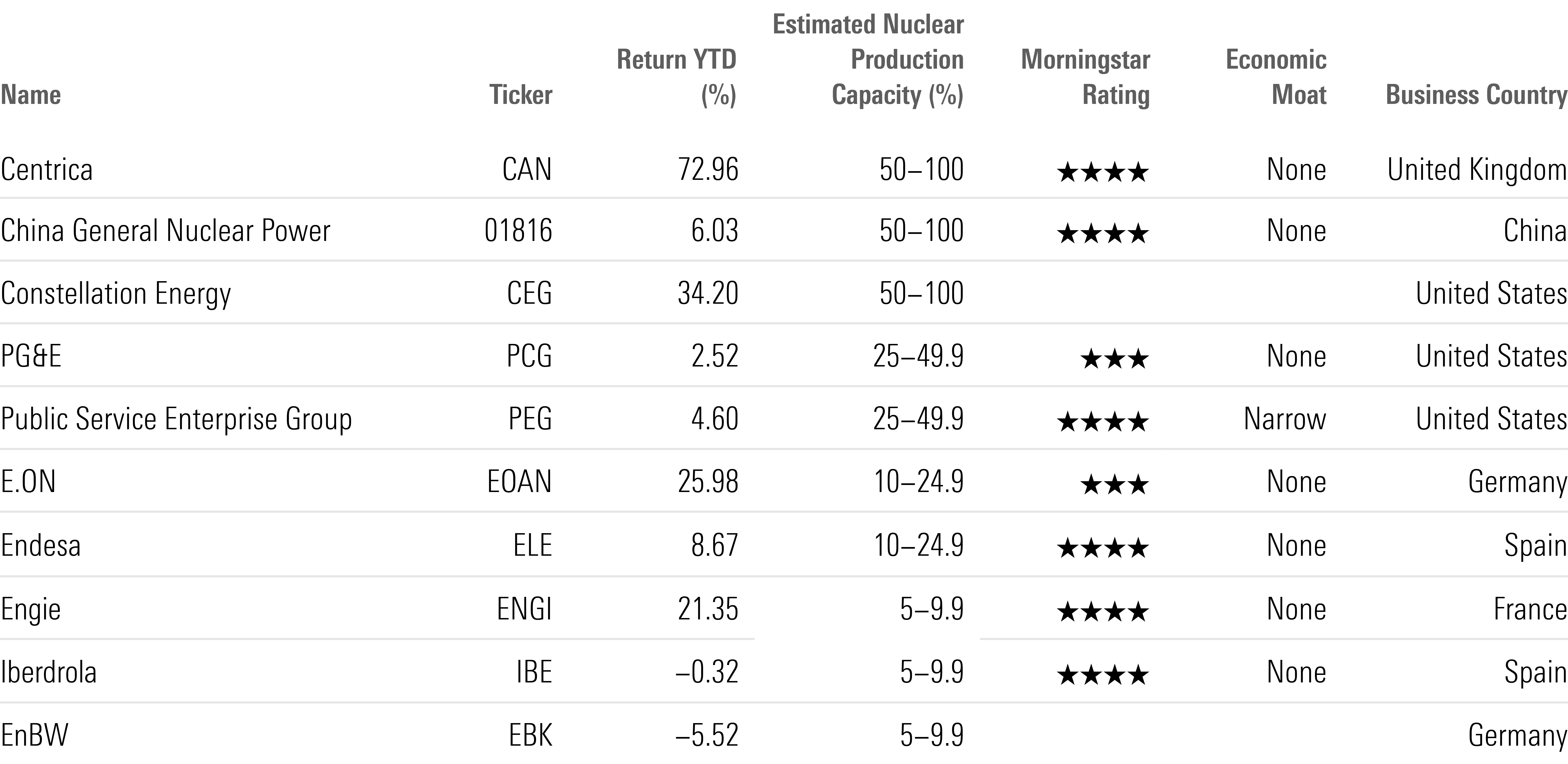

Several companies covered by Morningstar equity analysts are worth keeping on your watchlist to gain exposure to renewed nuclear growth. Using product involvement data from Sustainalytics, we found that the largest production exposure stems from international players, particularly in Asia and Europe. These include China General Nuclear 01816 and the U.K.-based Centrica CNA. The U.S. firm with the largest contribution from nuclear is Constellation Energy CEG, a spinoff from Exelon EXC, with nearly two thirds of its generation from nuclear, though it’s not covered by Morningstar.

The largest global nuclear company is Electricité de France SA EDF, which is currently building four new nuclear reactors in France and in the United Kingdom. The stock was delisted in June, as the French government nationalized the power company, partly because of its debt burden and its high funding needs related to building 14 French nuclear reactors by 2050.

Some Nuclear-Related Stocks

Centrica has a 20% stake in EDF’s U.K. nuclear plants. Most of these plants are supposed to close by 2030, but one, Sizewell B, is targeted to be extended to 2055 by EDF, says Tancrede Fulop, senior equity analyst at Morningstar. “As such, it will contribute to Centrica’s long-term earnings.”

“The energy crisis that started in 2021 has resulted in many small suppliers going bankrupt, and Centrica had to take on a chunk of these new customers, which has significantly improved its competitive landscape,” Fulop writes. “The increase in the margin allowed by Ofgem (the U.K. Office of Gas and Electricity Markets) from 1.9% to 2.4% is a turning point.” And today, flush with cash, “Centrica could continue to increase shareholder returns with more share buybacks,” he says. In August, Morningstar analysts raised their value estimate for Centrica to GBX 180 from GBX 140.

Among European companies, Fulop highlights also Endesa ELE, an integrated utility operating in power production, distribution, and supply in the Iberian Peninsula. “Its nuclear plants account for 40% of its total electricity output, and most of them will close only in the 2030s.” Morningstar analysts think Endesa is currently undervalued: “The production mix is competitive, and accelerated renewables investments planned by the group should improve profitability by reducing the short position. Between 2023 and 2027, we project the EBITDA to grow by 4.8% annually on average,” affirms Fulop.

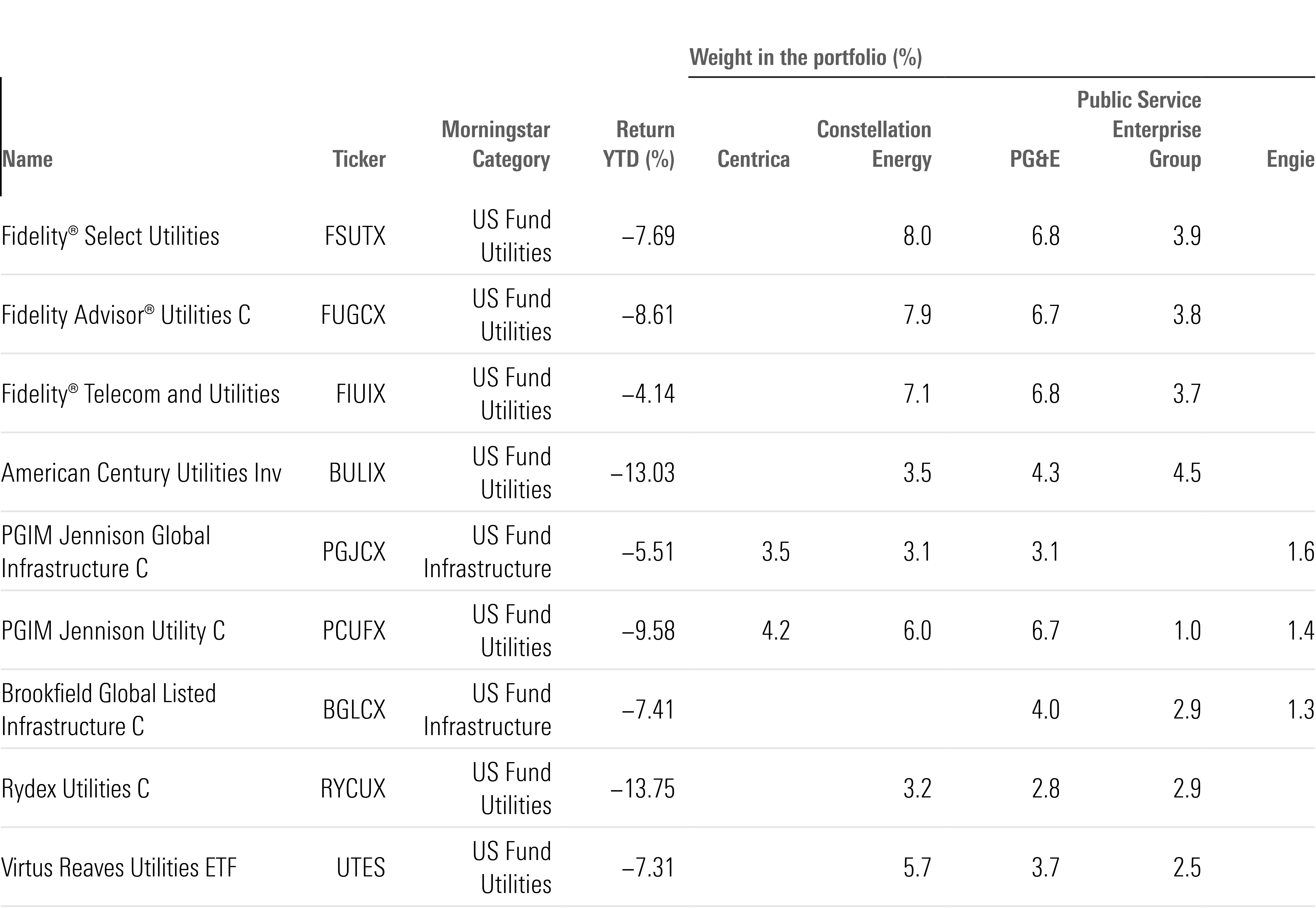

Below are the mutual funds most exposed to these securities among those distributed in the United States.

Some Nuclear-Related Funds

Nevertheless, Fulop says, the “nuclear renaissance will not be a dominant theme for European utilities, because, except for EDF, none of them plan to build a new nuclear reactor within the next decade, and investments will be limited to the extension of the useful life of existing reactors.” Therefore, “other parts of the value chain could be more exposed: uranium miners, nuclear reactor manufacturers, nuclear fuel cycle companies, and nuclear engineering and construction companies.”

The Great Beneficiary: Uranium

Uranium is a chemical element used as fuel in nuclear power plants. Because of its toxicity, it has never enjoyed a great reputation with the public, but it is obviously a commodity directly linked to the development of nuclear energy. Kazakhstan is the world’s largest producer of uranium, accounting for more than 40% of the global production. Following Kazakhstan are Australia, Namibia, and Canada, at 13%, 11%, and 8%, respectively.

The uranium market was disrupted by the outbreak of war in Ukraine. Kyiv depended heavily on Russian uranium. Following the invasion, Ukraine, where there are 15 reactors, rushed to sign a 12-year supply agreement with Canada. Meanwhile, operators in Finland and Eastern Europe were hit the hardest, as they owned Russian-made reactors—which only Russian companies knew how to supply. It took a year to find an American competitor capable of packing the uranium rods into the hexagonal blocks required by these plants.

The uranium market has surged 49% from Dec. 31 to Nov. 1. This is mainly because 10 years of a bear market in uranium led to a lack of investment in new mining and a reduction in inventories.

According to a recent forecast by the World Nuclear Association, demand for uranium in nuclear reactors is expected to climb by 28% by 2030 and to nearly double by 2040 as governments ramp up nuclear power capacity to meet zero-carbon targets. Nuclear capacity is expected to rise by 14% by 2030 and surge by 76% to 686 gigawatts of electricity by 2040, the report said. Capacity will grow through not only new reactors, the bulk of which are planned in China and India, but also by extending the operating lifetimes of existing plants.

At the same time, as happened before with other metals, the launch of new investment vehicles on physical uranium—such as ETCs or physical unit trusts—over the last 18 months gave a further boost to overall demand. All this may create interesting investment opportunities.

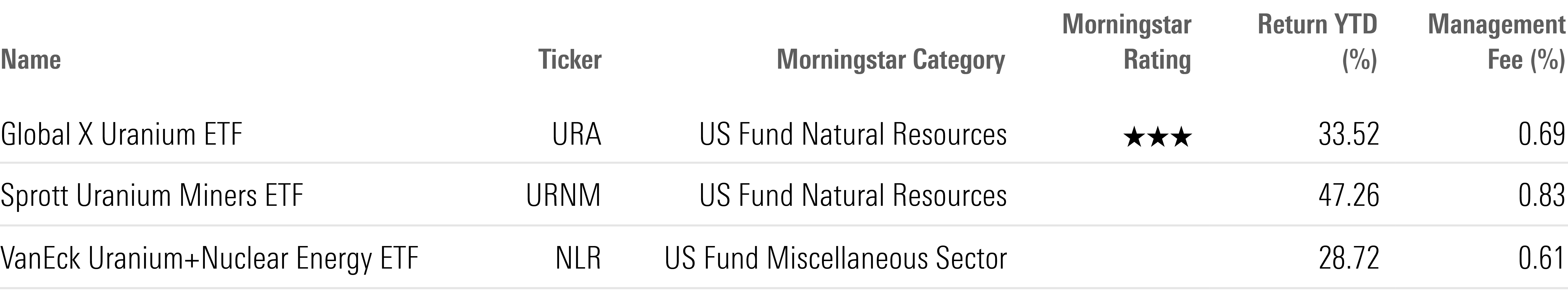

There are three exchange-traded funds that are directly exposed to the value of uranium and uranium miners and available to investors in the U.S.

Some Nuclear-Related ETFs

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)