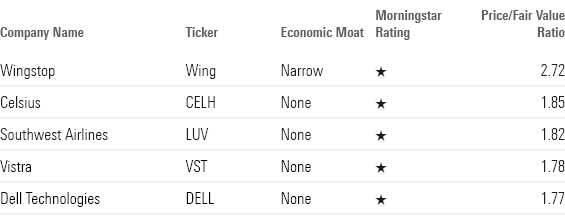

The Top 5 Overvalued Stocks

Wingstop and Southwest Airlines are among the most expensive stocks under Morningstar’s U.S. coverage.

The overall US stock market is considered fairly valued, but some names are trading at particularly extreme valuations. To find the stocks that Morningstar analysts think investors should most avoid or sell, we screened the companies under our US coverage for the ones whose prices are furthest above their fair value estimates.

The five stocks trading at the most expensive valuations are:

Where Are Stocks Overvalued?

Out of the 704 US stocks covered by Morningstar analysts, 244 (34.6%) are undervalued, based on their Morningstar Ratings. Meanwhile, 165 (23.4%) are considered overvalued. Morningstar Ratings take into consideration the fair value estimates our analysts set for each stock.

Valuations for US Stock Market

The technology and industrial sectors have the most overvalued names, with the recent artificial intelligence gold rush fueling big rallies.

That contrasts with the consumer cyclical sector, which makes up a considerable portion of 5-star undervalued stocks.

Morningstar Rated US Stocks by Sector

Most Overvalued Stocks

Topping the valuation charts is fast food chain Wingstop, which is trading at a price/fair value ratio of 2.72. Behind it is energy drink producer Celsius, which has a P/FV ratio of 1.85.

Top 5 Most Overvalued Stocks

Here’s more detail on what Morningstar’s equity analysts have to say about these expensive stocks.

Wingstop

- Fair Value Estimate: $139.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

- Forward Dividend Yield: 0.28%

“Wingstop posted great fourth-quarter earnings, with $127 million in sales and $0.64 in diluted earnings per share beating our $118 million and $0.57 estimates, respectively. Its franchisees enjoyed striking 21% domestic comparable store sales growth despite traffic declines across the industry and limited price increases, while unit growth accelerated to 13% during the fourth quarter as the firm added a record 255 net units in 2024. Importantly, the chicken restaurant chain goes from momentum to momentum, with 2024 guidance implying another year of high-teens systemwide sales expansion.

“The risk, as we see it, ties to what we view as impractical market expectations for a firm that boasts the best economic model in our US restaurant coverage. To this effect, despite Wingstop’s quarterly earnings topping respective FactSet consensus expectations for sales and EPS by 6% and 12%, shares fell 3%-4% on the earnings release. Wingstop’s growth prospects are electric, its sub-two-year payback periods drive a durable development narrative, and the expansion of its digital business and delivery partnerships offer a viable roadmap to average unit volumes of $2.0 million to $2.5 million at high-20s restaurant margins. Nevertheless, its menu is less habitual than most quick-service competitors and it plays in a niche category that has yet to fully prove its international or even domestic portability, with more than half its domestic stores sitting in just three states. We’d love to own the chain at the right price. For now, we encourage investors to remain firmly on the sidelines.”

Read more of Sean Dunlop’s analyst notes here.

Celsius Holdings

- Fair Value Estimate: $133.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

- Forward Dividend Yield: 0%

“Celsius has amassed impressive volume share gains in the North American functional and reduced sugar energy drink category in recent years and is poised to surpass over $1 billion in sales in 2023 from just $75 million in 2019. Propelling the momentum, we surmise Celsius’ better-for-you product portfolio and active-lifestyle branding strategically cater to consumers’ penchant for healthier alternatives, while a 2022 distribution agreement with PepsiCo PEP has bolstered its channel reach and ability to secure shelf space. That said, we remain skeptical that Celsius benefits from any durable competitive advantage based on brand intangibles or cost advantages, given intense competition from resource-rich incumbents with strong brands, such as Monster and Red Bull, and smaller entrants’ propensity to deliver innovation.

“As Celsius is still prudently prioritizing the North American market, larger international expansion plans (beyond Nordic countries and China) are slated for deployment after 2024, which should eventually include markets such as Western Europe and Australia. Although we see this avenue as a logical blueprint for growth, navigating differing local taste preferences and bolstering visibility will require greater investment, potentially limiting returns.”

Read more of Dan Su’s analyst notes here.

Southwest Airlines

- Fair Value Estimate: $19.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

- Forward Dividend Yield: 2.08%

“While we are retaining our fair value estimate of $19 per share, our forecast includes thin margins and is predicated on market share gains from a distressed low-cost competitor. In the no-moat airline’s final 2023 income statement, every line item of cost came in at least $50 million-$100 million higher than we expected, with salaries topping the list at $300 million more than our forecast. Granted, the airline clocked approximately $200 million more revenue in 2023 than we expected, but the result was an operating margin of 1%, down from 4.27% in 2022.

“Management’s 2024 expectations don’t solve the riddle: with capacity expected to rise 6% and structural unit costs (excluding fuel and other unusual or volatile items) also set to rise 6%, the implication is that costs will rise approximately 12%. We don’t believe Southwest’s 2024 revenue will rise anywhere near 12%. Southwest’s cost growth is quite consistent with what we have seen across the industry in the last two years, as a raft of labor and maintenance contracts have been renegotiated. In this post-pandemic timeframe, luckily for airlines, passengers have been willing to pay up for travel they had missed or canceled during quarantine—Southwest’s passenger revenue per available seat mile topped $0.17 in 2022 and 2023, fully $0.02 over the 2015-19 average. We do not believe this phenomenon will persist, as travelers’ frothy appetites should eventually normalize, even as airlines continue to add capacity to their more expensive networks.”

Read more of Nicolas Owens’ analyst notes here.

Vistra

- Fair Value Estimate: $26.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

- Forward Dividend Yield: 1.85%

“The cold weather nationwide should lead to higher sales volumes and margins at Vistra’s generation and retail businesses. Although we expect a positive impact, we aren’t making any immediate adjustments to our full-year financial forecasts only three weeks into the year and with the critical summer months ahead. Vistra should benefit the most in Texas, where it has the most customers and 18 gigawatts of generation. It should also benefit from unusually cold weather in the Midwest and Northeast with its $5.7 billion Energy Harbor acquisition.

“However, the surge in new solar and battery storage development during the last year limited the grid constraints and peak market prices Texas experienced during Winter Storm Uri in 2021 and Elliott in 2022. New battery storage projects added 1,200 MW of peak supply, the equivalent of a large nuclear plant, according to Ercot. This new development will continue to limit margin upside for Vistra’s legacy generation fleet.

“Our 2024 EBITDA estimate remains within management’s $3.7 billion-$4.1 billion guidance range, excluding Energy Harbor. We expect management to continue repurchasing about $1 billion of stock annually. However, the buybacks are unlikely to create incremental value with the stock trading at a large premium to our fair value estimate.”

Read more of Travis Miller’s analyst notes here.

Dell Technologies

- Fair Value Estimate: $46.00

- Morningstar Rating: 1 star

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

- Forward Dividend Yield: 1.82%

“Dell holds top market shares across its businesses, but these are predominantly commoditized, cyclical, and price-competitive markets that in our view don’t endow a leader like Dell with an economic moat. We forecast the firm to see no more than modest top-line growth into the medium and long terms, and we see little opportunity for material and durable margin expansion. Dell’s strong suit is its robust free cash flow generation, both in absolute terms and as a share of its net income. We are pleased with the company’s newfound focus on shareholder returns as a prioritized use of this heady cash flow.

“We expect Dell to focus on free cash flow generation, debt repayments, and shareholder returns over the medium term. Keeping its investment-grade debt rating will be a top priority, and management will be keen to maintain its dividend and send extra cash toward repurchases. Dell may pursue small, adjacent acquisitions, but we are most focused on its ability to modestly grow its core businesses and maintain a steady margin profile.”

Read more of Willliam Kerwin’s analyst notes here.

Top 5 Overvalued Stocks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)