5 Top-Performing Tech Stock ETFs

Listings from iShares and VanEck top the list of the best-performing ETFs in this category.

Exchange-traded funds for technology stocks have been on a tear in recent months, fueled by the boom in artificial intelligence. Among the biggest beneficiaries of this trend are companies dealing in semiconductors—most notably Nvidia NVDA, whose stock has more than tripled in the past year. Within the US Technology Index, semiconductor stocks have done best over the past few years. As a result, strategies with heavy weightings in chip stocks dominate the ranks of the best performers in this category. Additionally, four of the five names that made it through our screen for the best ETFs are offered by iShares.

- VanEck Semiconductor ETF SMH

- iShares Expanded Tech Sector ETF IGM

- iShares US Technology ETF IYW

- iShares US Tech Independence Fcs ETF IETC

- iShares Semiconductor ETF SOXX

Tech Stock ETF Performance

Tech stock funds outperformed the US market by 7.4 percentage points over the last year and by 1 point over the past five years. Over the past three years, however, the Morningstar US Market Index outperformed the category by 8.8 percentage points, due to a tech slump in 2022 that came from high interest and inflation rates.

Tech Stock Funds vs. the US Stock Market

Screening for the Top-Performing Tech Stock ETFs

To find the best tech stock ETFs, we looked for the ones with the top returns over multiple periods. We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over one-, three-, and five-year periods. This list was then filtered for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze. Any funds with asset bases under $100 million and minimal or no Morningstar analyst input on their Medalist Ratings were excluded.

From this screen, we’ve highlighted the five tech ETFs that have performed best over the past year.

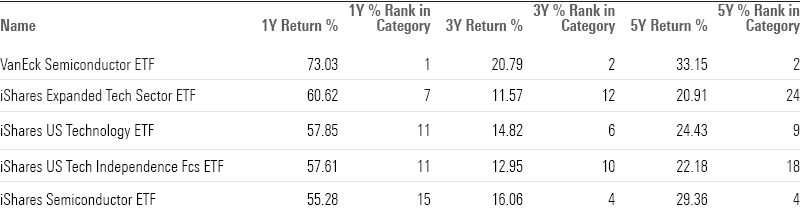

Top-Performing Tech Stock ETFs

VanEck Semiconductor ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Over a 10-year period, this share class outpaced the category’s average return by 11.2 percentage points annualized. It was also ahead of the US Technology Index by 5.2 percentage points over the same period. Although the overall rating does not hinge on one-year performance figures, it is notable that this share class returned 73.2%, an impressive 31.2-percentage-point lead over its average peer, placing it within the top 10% of its category. The investment seeks to replicate as closely as possible, before fees and expenses, and the price and yield performance of the MVIS US Listed Semiconductor 25 Index.”

—Morningstar Manager Research

iShares Expanded Tech Sector ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This fund has provided superior returns compared with peers, but poor returns compared with the category benchmark. This share class outpaced its average peer by 4.4 percentage points annualized over a 10-year period. However, it was not able to clear the hurdle of outperforming the US Technology Index, trailing it by an annualized 1.6 percentage points over the same period. The investment seeks to track the investment results of an index composed of North American equities in the technology sector and select North American equities from communication services and consumer discretionary sectors.”

—Morningstar Manager Research

iShares US Technology ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“It has provided better returns compared with peers, but similar returns compared with the category benchmark. Over a 10-year period, this share class outperformed the category’s average return by 5.9 percentage points annualized. And its return mirrored the performance of the US Technology Index over the same period. Although the overall rating does not hinge on one-year performance figures, it is notable that this share class returned 65.5%, an impressive 23.5-percentage-point lead over its average peer, placing it within the top 10% of its category. The investment seeks to track the investment results of the Russell 1000 Technology RIC 22.5/45 Capped Index. The underlying index measures the performance of the technology sector of the US equity market as defined by FTSE Russell.”

—Morningstar Manager Research

iShares US Tech Independence Fcs ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Narrowing in on the past three years, this fund trailed the US Technology Index by an annualized 3.1 percentage points but outperformed its average peer by 10.5 percentage points. More importantly, looking across a longer horizon, the strategy fell behind the index. On a five-year basis, it underperformed the index by an annualized 3.1 percentage points. The investment seeks to provide access to US companies with technology exposure, as classified using a proprietary system.”

—Morningstar Manager Research

iShares Semiconductor ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“This share class outpaced its average peer by 10.8 percentage points annualized over a 10-year period. It also beat the Morningstar US Technology Index by an annualized 4.7 percentage points over the same period. Although the overall rating does not hinge on one-year performance figures, it is notable that this share class returned 66.9%, an impressive 24.9-percentage-point lead over its average peer, placing it in the top 10% of its category. The investment seeks to track the investment results of the NYSE Semiconductor Index, composed of US equities in the semiconductor sector. The fund may invest up to 20% of its assets in certain futures, options and swap contracts, and cash and cash equivalents.”

—Morningstar Manager Research

Long-Term Returns of Top-Performing Tech Stock Funds

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)