4 Top Stock Picks In Media and Entertainment

Amid headwinds for streaming companies, Disney and Roblox are looking attractive.

After a mixed year for streaming media stocks in 2023, the market remains highly pessimistic about the transition from traditional television to streaming. However, attractive valuations on several key media stocks present opportunities for long-term investors.

Michael Hodel, director of media and telecom equity research for Morningstar, says consistent increases in customer count, along with new strategies to blur the lines between cable TV and online libraries, bring hope for investors among select stocks. He cites four top media stocks from among Morningstar’s coverage:

Entertainment Stock Performance

Still, Hodel says that investors need to be aware of the challenges facing the industry: “While several media stocks trade at wide discounts to our fair value estimates, the road ahead remains treacherous for many of these firms as they attempt to curb streaming losses.”

Recent reductions in content spending by streaming giants like Netflix NFLX and Disney’s Disney+ have increased their cash flows, but the pressure to fill the gap left by viewers’ transition from traditional TV to streaming platforms remains a headwind. In 2024, they might find the right balance between consumer price and usage, as recent increases in subscription prices have helped media companies’ cash flows, at the risk of pushing away customers.

“The key is to see how streaming service trade within media companies, how the customer bases respond to higher prices. Prices to better reflect the amount of content,” Hodel says. “Elasticity of demand is of vital importance: What does that do to customer growth overall, especially in the early part of the year?”

Morningstar Global Entertainment Index

“We’re hopeful that the industry is starting to work collectively to improve the attractiveness of traditional television offerings, but no firm completely controls its destiny in this regard,” Hodel says. “As a result, we prefer firms with diversified revenue streams that are trading at a significant discount to our valuation, such as Disney.”

He also points to mergers and acquisitions as a potential spark for some media stocks, with recent headlines discussing Warner Bros. WBD and Paramount PARA joining forces.

“Most people assume M&A activity is likely to ramp up in 2024 as smaller players attempt to keep pace with Netflix and Disney, so this development is worth watching closely,” Hodel explains.

Media Stock Valuations

Many media stocks were trading in significantly undervalued territory for much of 2023. A 30% rally in Netflix during the fourth quarter and a rebound for Disney have lifted the group’s valuations on an overall basis. However, Hodel says the group remains generally cheap.

Market-Cap-Weighted Price/Fair Value Estimate Index by Subsector

“An investor buying a basket of our entertainment or video game coverage in proportion to each firm’s market cap would hold a portfolio trading about 6% below what we believe it’s worth,” Morningstar analysts say.

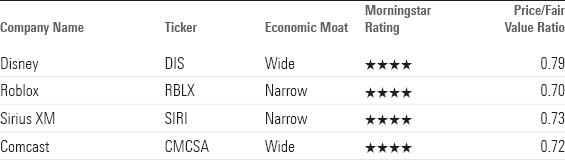

4 Top Entertainment Stock Pics

The Walt Disney Company

- Fair Value Estimate: $115.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

- Forward Dividend Yield: 0.33%

“We recently lowered our fair value estimate for Disney after taking a fresh look at the company and its efforts to navigate the transition to streaming services from the traditional linear television model. However, we still believe the firm’s deep content library and strong studios give it the resources to be successful over the long term.

“We expect Disney to remain aggressive with its streaming ambitions, but that it will also look to shore up its legacy television business as well. This effort will likely blur the lines between these business models, as Disney+ and Hulu will likely be included in the packages offered by traditional distributors like Comcast and Charter. We don’t believe the television business overall will return to the level of profitability it enjoyed before the streaming wars, but we expect margin improvement relative to the past couple of years as Disney prices its streaming services more appropriately and reins in content spending. Fiscal fourth-quarter results showed nice progress on this front.

“We also expect fans will continue to flock to the company’s parks and resorts, providing revenue while helping to build and reinforce major content franchises.”

Read more of Matthew Dolgin’s outlook for Disney here.

Roblox

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very high

“Among video game companies, we still like Roblox. We believe the firm remains well-positioned to capitalize on recent investments to improve reach among older gamers, add new features, increase capacity, and bolster security.

“Roblox is a unique video game firm that operates an online platform that lets users create, develop, and monetize games for other players. The firm continues to grow its global player base at an impressive clip, including in the United States, its most mature and lucrative market. Average bookings per account have been flat as the mix of players shifts to less-affluent markets, but trends within regions have been favorable. Europe posted 37% bookings growth year over year during the third quarter, with a 12% bump in bookings per account. Even with that growth, Europe trails the U.S. and Canada by a wide margin in terms of monetization—about $8 of quarterly bookings per active user versus $33. With more active users in Europe than in the U.S. and Canada and relatively high incomes, this gap should continue to close as the European user base matures.

“Roblox is also making good progress on profitability after a period of heavy investment. Management expects lower capital spending in 2024-25 versus 2023, which is poised to be lower than in 2022, which should allow free cash flow to expand from here. With the shares trading at a significant discount to our fair value estimate, we believe investors can gain exposure to the firm’s unique model with a large margin of safety, but we expect the stock to remain highly volatile. "

Find more of Michael Hodel’s note here.

Sirius XM Holdings

- Fair Value Estimate: $7.50

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

- Dividend Yield: 1.82%

“Sirius XM Holdings consists of two businesses: SiriusXM and Pandora. SiriusXM transmits music, talk shows, sports, and news via its satellite radio network, primarily to consumers who pay a subscription fee, often tied to a vehicle as the firm’s radios come preinstalled on a wide range of cars and trucks in the U.S. Most of the stations on the SiriusXM network are proprietary, differentiating the service from streaming music and terrestrial radio.

“Most new cars with SiriusXM radios come with a trial period between three and 12 months. The conversion to self-pay after the trial is 37%, which represents the majority of new paid subscriptions. These customers have a monthly churn of 1.5%, implying a customer life of around five years. SiriusXM does share some of the revenue from self-pay customers with the automakers in the form of loyalty programs. Over the next five years, we expect that the satellite service will continue to expand, albeit slowly, by converting enough car owners to self-pay to offset churn losses, as well as by discounting the prices of subscriptions to retain customers.”

Read more of Ali Mogharabi’s note on SiriusXM here.

Comcast

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

- Dividend Yield: 2.68%

Comcast’s core cable business enjoys significant competitive advantages but has seen growth slow as fixed-wireless offerings have provided a viable option for a subset of customers. NBCUniversal isn’t as well-positioned, but it holds unique assets, including core content franchises and theme parks. We don’t love the firm’s strategy for Peacock, but we expect NBCU’s assets will play a significant role in the media landscape of the future. Overall, we expect Comcast will deliver only modest growth but with strong cash flow for the foreseeable future.

Comcast’s cable business has steadily gained broadband market share over its primary competitors, phone companies like AT&T T and Verizon VZ, as high-quality internet access has become a staple utility. We estimate that the firm has increased broadband market share in the areas it serves to about 65% from 50% a decade prior, meaning Comcast’s customer base in the typical market area is twice the size of its rivals. That gap is far larger in areas where the phone companies haven’t invested in recent years. With a network that can be upgraded at a modest incremental cost, we expect Comcast will remain the dominant broadband provider in many parts of the country and compete well in areas where phone companies are building fiber. We also expect capacity limitations will ultimately constrain the number of broadband customers wireless carriers can serve. The high margins on internet access should offset the decline in the traditional television business, where margins have plunged in recent years.

Read more of Michael Hodel’s take on Comcast here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G63LAO4AMRG3RG44ARMH6RM6FE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KFWIBRDMEZEAXJKNN2NO5JCV2Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)