4 Undervalued Utilities Stocks With Strong Dividends

Even with higher interest rates, these top picks hold potential for both income and growth.

Utility stocks have been the worst-performing sector in 2023. But there’s a silver lining for investors looking to put money to work in these dividend-paying companies: Many are in undervalued territory, according to Morningstar analysts.

Not only that, but the sector is also offering attractive income potential. The median dividend yield of 3.7% is the highest it’s been since 2013, and in line with the 20-year average.

With these stocks on balance trading 3% below their Morningstar fair value estimates, “Overall, we think higher yields and undervalued growth make this a good time to buy utilities,” says Morningstar utilities and energy sector strategist Travis Miller.

Of the 39 utilities stocks covered by Morningstar analysts, 18 are undervalued, with two in 5-star territory and 16 rated 4 stars. Only five are considered overvalued. “That’s more 4-star utilities than we’ve typically had over the last decade plus,” Miller says.

Price/Fair Value for US Utilities

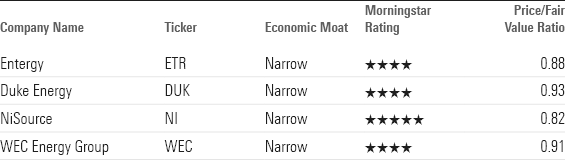

Morningstar analysts highlight four top utilities stock picks that offer attractive dividend yields and growth potential:

While a 3.7% dividend yield may not seem compelling to some, given that U.S. Treasury bonds are offering yields above 4%, Miller and Morningstar utilities sector strategist Andrew Bischof offer one consideration: “Although interest rates have climbed, utilities have a key advantage over fixed income: growth. We forecast that during the next two years, more U.S. utilities will raise their dividends than at any time in at least the last 30 years.”

The sector’s profile for growth and attractive dividends stems from taking advantage of renewable energy, rising electricity demand, and the newly Biden-funded hydrogen hubs.

Most utilities have performed poorly in 2023. Under pressure in large part from concerns about rising rates, the Morningstar US Utilities Index is down 5.4% so far this year. The index managed to yield 17.28% in 2021 but was cut down to just 1.65% in 2022.

Morningstar US Utilities Index

However, utilities stocks have seen a relief rally in recent days, as the Federal Reserve has signaled that it is done raising rates and that its next move will be rate cuts in 2024. The Utilities Index is up 9.1% over the past month, while the overall market has risen 8.2%.

Utility Stock Dividend Outlook

Miller and Bischof outline three key takeaways for investors on the outlook for utilities dividends:

- Median annual dividend is projected to grow 6% in 2024-27—a reversal of slowing growth since 2008.

- During 2024 and 2025, for the first time in at least 30 years, nearly all the 35 largest North American utilities are forecast to raise their dividends in consecutive years.

- The 35 largest North American utilities are set to invest nearly $700 billion in clean energy, safety, and reliability over the next five years, driving earnings and dividend growth.

The average utilities stock goes for 7% below its fair value estimate on a median basis, according to Morningstar analysts.

Utility Stock Performance

Renewable Energy a Key Driver for Utilities Stocks

Clean energy is a critical catalyst for growth and investment for utilities. It’s forecast to grow by 25% by 2023, with solar energy paving the way due to improving economics, favorable tax policies, and greater system efficiencies.

“Clean energy continues to increase as a share of total U.S. generation. In the second quarter of 2023, clean energy was up 8% from the second quarter of 2022. Utility-scale wind and solar accounted for 15% of total generation in 2022,” according to Morningstar analysts.

Growth in clean energy is being further fueled by the continued approval of applications for new renewable energy projects, driving growth predictions beyond just 2023.

Meanwhile the Biden administration announced $7 billion in funding for the United States’ first clean hydrogen hubs, set at seven locations around the country.

Some utilities are already direct partners of these hubs—AES, for example, which was awarded up to $2.4 billion for two green hydrogen projects. Utilities that are geographically close to these hubs may benefit from increased demand. Additionally, electricity demand is seen rising from a 2020 low, but there’s a hurdle: rising temperatures.

“Utilities have been able to offset the weather headwinds so far this year, but a warm fourth quarter could force management teams to once again turn to mitigation plans to achieve full-year results,” Miller and Bischof write.

Morningstar analysts have predicted 1.4% average annual electricity demand growth through 2030, but above-average temperatures are set to continue, according to the National Oceanic and Atmospheric Administration.

Higher Rates a Headwind for Utilities

One obstacle is higher interest rates, which raise the cost of capital for utilities. These companies generally can’t pass on higher costs to consumers without approval from state regulators.

“Higher interest rates have not persuaded regulators to raise customer rates, creating a headwind for utilities in 2024,” Miller and Bischof write. Still, “we think most utilities are well-positioned to grow earnings during the next three-five years.”

In addition, higher interest rates on safe government bonds create competition for investors looking for income. For the first time since 2018, interest rates are higher than utilities’ dividend yields.

“Interest rates have topped utilities’ yields throughout 2023—the longest stretch since before the 2008-09 global financial crisis,” Miller and Bischof note. “Utilities’ dividend yield premium averaged 150 basis points between 2010-22 and peaked at 280 basis points in September 2020. That spread is now closer to the average throughout the 1990s and early 2000s. Our valuations suggest most utilities’ dividend yields will plateau near 4% in the long run if interest rates stay near 5%.”

But one positive on the economic front has been easing inflation pressures. Despite the rise in interest, regulators are not raising customer rates, creating a chance for the average earning growth to drop by 1%, according to Morningstar analysts.

“Electricity and natural gas (piped) cost inflation continued to decline in the past quarter. Electricity price inflation is now below average and is no longer among the largest contributors to overall inflation among all major categories in the Bureau of Labor Statistics’ U.S. Consumer Price Index September inflation report,” they write.

“Customers continue to see relief from falling natural gas prices. Delivered natural gas prices are down nearly 20% during the trailing 12 months in September, helping moderate customer bills. The delivered gas price was one of the largest contributors to the decline in inflation in addition to gasoline and fuel oil,” Miller and Bischof explain.

Top Utilities Stocks Picks

Undervalued Utilities Stocks with High Dividends

Entergy

- Fair Value Estimate: $120.00

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

- Dividend Yield: 4.6%

“Entergy offers one of the most attractive combinations of yield, growth, and value in the utilities sector, with a 4.4% dividend yield and our 7% annual earnings growth outlook. Entergy’s price/earnings ratio of 15 times is a 15% discount to the sector average. Above-average electricity demand growth, clean energy investments, and reliability/resiliency network investments are core growth drivers.

“Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect Entergy’s valuation discount to disappear as the market becomes comfortable with its decade-long transition away from commodity-sensitive businesses.”

Read more of Travis Miller’s analyst notes here.

Duke Energy

- Fair Value Estimate: $105.00

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

- Dividend Yield: 4.5%

“After divesting its renewable energy business, Duke has a clear pathway to achieving management’s 5%-7% annual earnings growth target. The firm’s $65 billion capital investment plan for 2023-27 is focused on clean energy and infrastructure upgrades to reduce carbon emissions.

“New legislation in North Carolina supports the clean energy transition. Florida offers opportunities for solar growth. Duke’s 4.3% yield is among the highest in the sector, but dividend growth will lag earnings growth until the company’s payout ratio comes down.”

Read more of Andrew Bischof’s analyst notes here.

NiSource

- Fair Value Estimate: $33.00

- Morningstar Rating: 5 Stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

- Dividend Yield: 3.8%

“Even though NiSource trades at a similar valuation as its peers, we think it has a superior runway of growth and deserves to trade at a premium. NiSource’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of faster growth than the U.S. utilities sector average.

“We expect NiSource to invest $15 billion over the next five years, and as much as $30 billion during the next 10 years, leading to 7% earnings growth and similar dividend growth. Its electric utility plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. Its six gas utilities have ample near-term investment and regulatory support in regions that are unlikely to abandon gas.”

Read more of Travis Miller’s analyst notes here.

WEC Energy Group

- Fair Value Estimate: $96.00

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

- Dividend Yield: 3.8%

“WEC Energy combines best-in-class management and above-average growth opportunities supported by constructive regulation. The company increased and updated its capital plans, with plans to spend $23.4 billion, a $3.3 billion increase from its prior program.

“WEC will increase investments in renewable generation, natural gas generation, and transmission due to significant economic development in southeastern Wisconsin. This supports our 7.0% growth estimate, at the high end of management’s 6.5%-7.0% guidance range.”

Read more of Andrew Bischof’s analyst notes here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)