Why Preferred Stock Funds Are Looking Attractive for Income Investors

Dividend stocks pay more than the yields on bonds, but also come with risks.

For investors searching for higher yields and a long-term investment to ride out the latest up and down volatility of the stock market, preferred stocks are starting to look attractive.

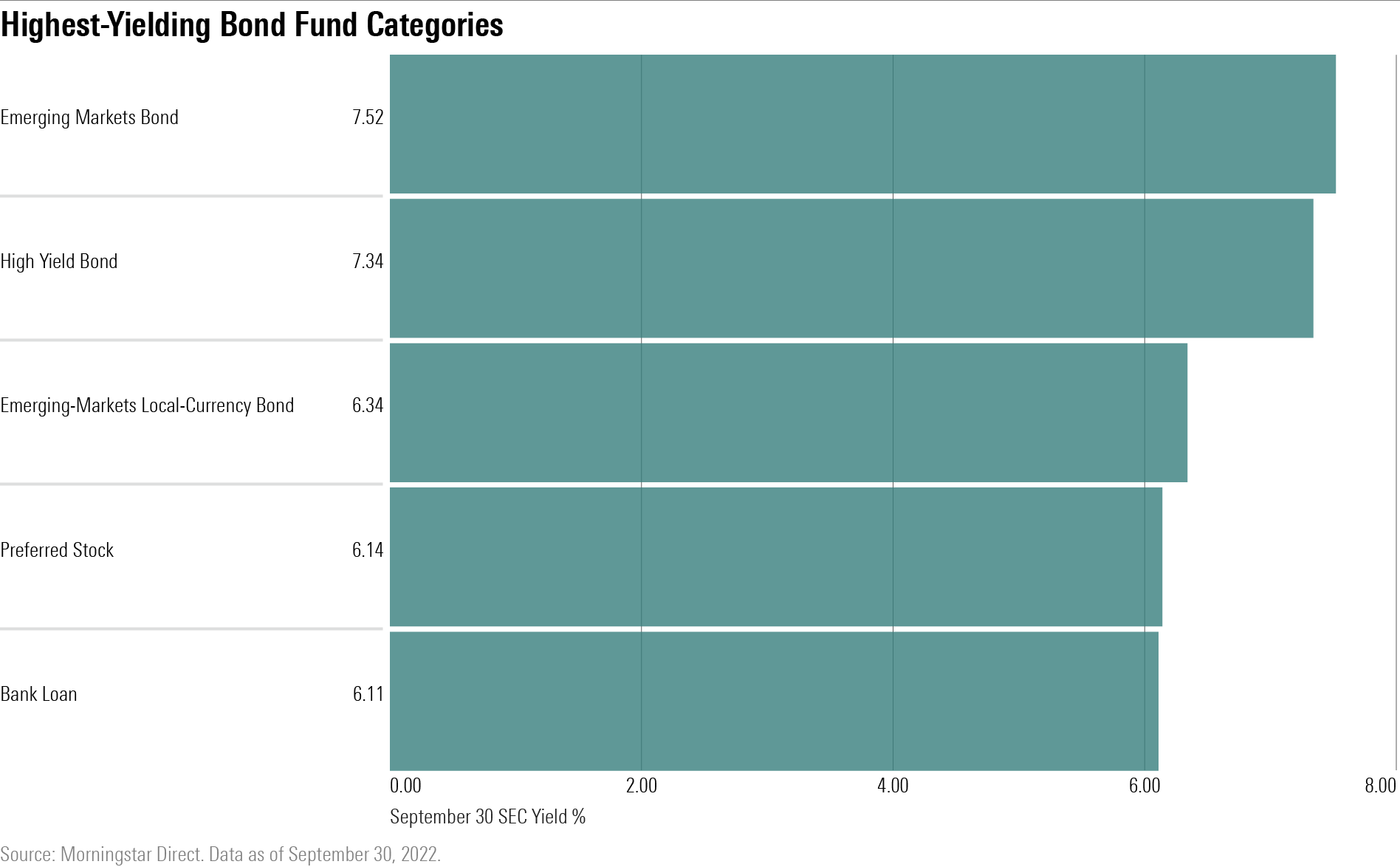

Preferred stocks are an often overlooked corner of the market. Straddling both the bond and stock markets, they currently offer a higher yield than most other bond-like investments and dividend-paying stocks. (While Morningstar’s category for funds that hold preferred securities is called “Preferred Stock,” the category falls under the umbrella of taxable bond funds.)

“For investors looking for higher yields, preferred stocks look attractive,” says Collin Martin, a director and fixed income strategist for Charles Schwab. “There are few investments with similar credit quality that can offer high yields.”

The average preferred stock fund boasts a 6.14% SEC yield—an estimate of a fund’s future 12-month yield—higher than the average intermediate-term bond’s yield at 3.59% as of Sept. 30. Meanwhile, the Morningstar Dividend Composite Index was yielding 3.2% at the end of last month.

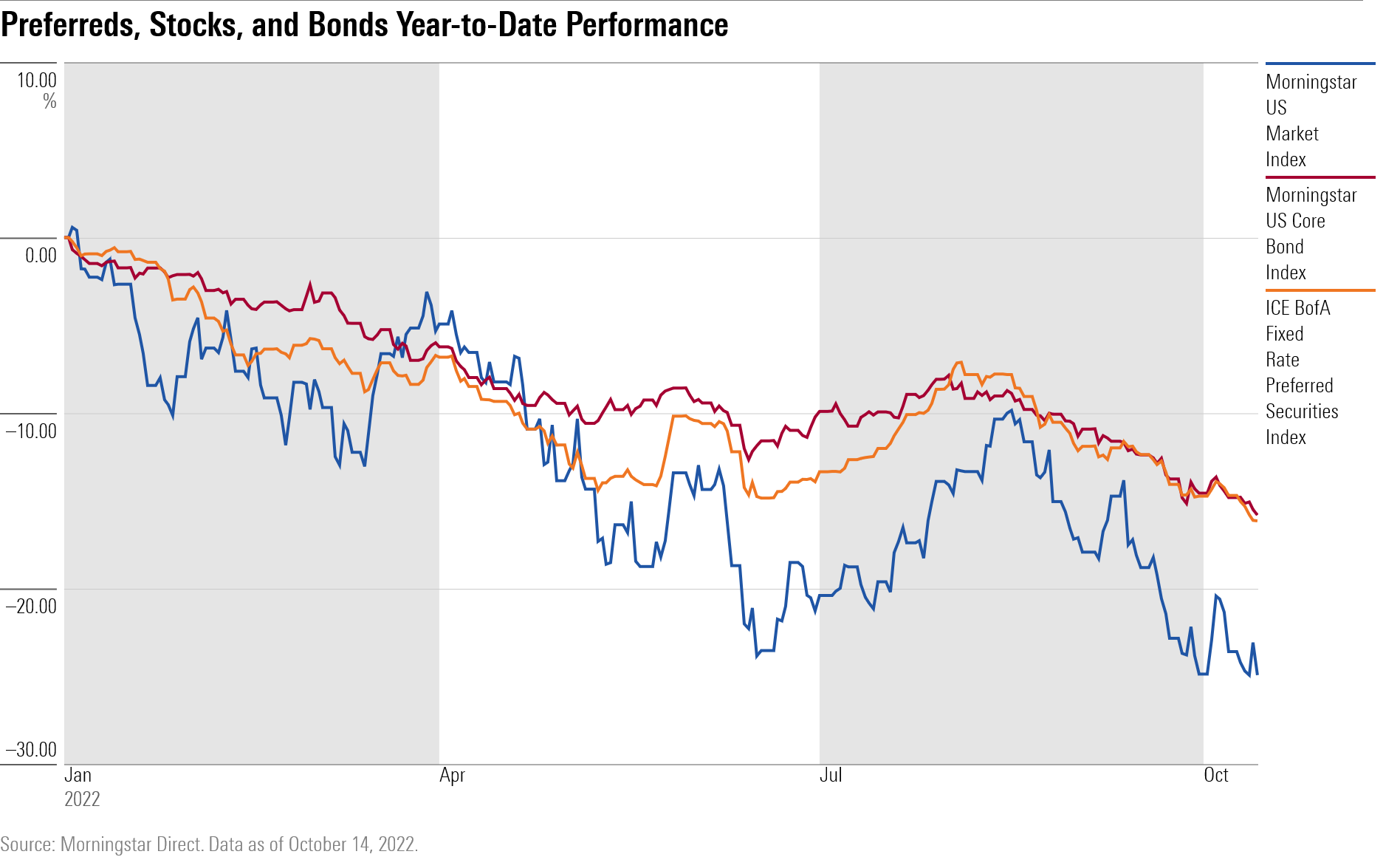

Not only do preferreds offer higher yields, they typically have a greater potential for price returns than bonds. This also means they’re also susceptible to bigger losses than many kinds of bonds and tend to have a close relationship to the performance of the stock market. However, this year, losses in the bond market have been so severe that preferreds and broad-bond indexes are neck and neck when it comes to negative returns.

The Bank of America Merrill Lynch Core Fixed Rate Preferred Securities Index, a widely-followed index of preferred securities performance, is down 16.15% this year through Oct. 14. That’s not far behind the drop of the Morningstar US Core Bond Index of 15.82%. The average preferred stock fund, meanwhile, has lost 14.64% this year.

However, preferreds are holding up better than traditional stocks, with the Morningstar US Market Index down 24.94%.

But with preferred stocks taking a hit this year, some argue that their recent price declines have also made them a buy.

“Prices have fallen a lot, and from a long-term standpoint, the entry-point is attractive,” Martin says.

What Are Preferred Stocks?

Preferred stocks pay holders a regular dividend, typically on a quarterly basis. The name refers to their place in the capital structure of companies where they outrank regular shares, also known as common stock. Morningstar’s John Rekenthaler noted in a column, “they’re neither preferred nor stocks.”

Depending on the structure of the securities, the dividend paid to investors can count as qualified dividend income, which is taxed at a lower rate than interest from bonds. That adds to the appeal for investors holding preferreds in taxable accounts.

The primary appeal of preferreds are their high yields, which often leads investors to compare them to traditional bond investments.

Concentration and Credit Risk

Higher yields are typically associated with higher risk, as is the case with high-yield and emerging market bonds, which have a higher chance of default. Morningstar’s Amy Arnott noted in her column “Why Preferred Stocks Don’t Make Good Bond Substitutes,” credit risk can be of concern for investors who own individual securities. In 2020, several preferred stock issuers deferred or cancelled dividend payments.

Though preferred stocks still carry risks, the companies that issue them are typically investment grade. Generally, they are high-quality financial companies, along with pipeline and utilities operators.

“Sixty percent of preferred stocks are issued by banks or insurance companies,” says Doug Baker, head of the preferred securities sector team at Nuveen and portfolio manager for the Nuveen Preferred Securities and Income Fund.

Since the 2008 financial crisis, banks have become more heavily regulated and are considered stronger financially than they once were. With the Federal Reserve raising interest rates, banks are able to increase their rates on loans while at the same time gathering deposits. All of this boosts their ability to make dividend payments on preferred stocks.

“The fundamental story is very strong,” says Baker. However, investors also should be mindful of their exposure to financial firms if they already own a large amount of financial stocks, he says.

Preferred Stocks Carry Interest Rate Risk

The typical preferred stock is issued for 30 years or longer, which makes them sensitive to changes in interest rates. To compensate for this risk, they carry high yields that can help buffer the negative impact of rising rates.

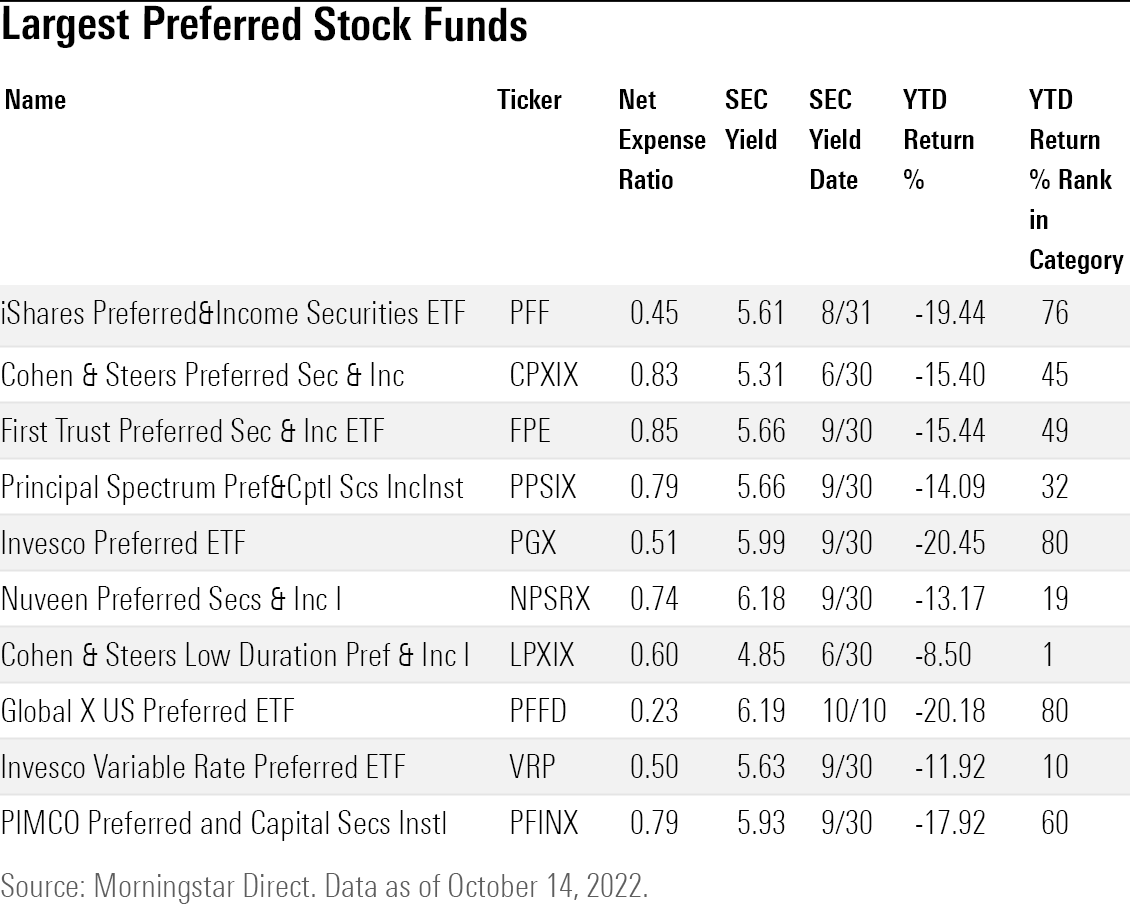

The impact rate hikes can have is evident when looking at the performance of the largest preferred stock funds this year. The Cohen and Steers Low Duration Preferred and Income Fund LPXIX is down only 8.50% through Oct. 14, topping the Cohen and Steers Preferred Securities and Income Fund CPXIX that is down nearly 15.4%.

Their unique equity and bond-like characteristics means preferred stocks are “less volatile than stocks but more volatile than senior bonds,” says Baker.

“You need to be able to ride out their ups and downs,” Schwab’s Martin says.

High Correlation to Stocks

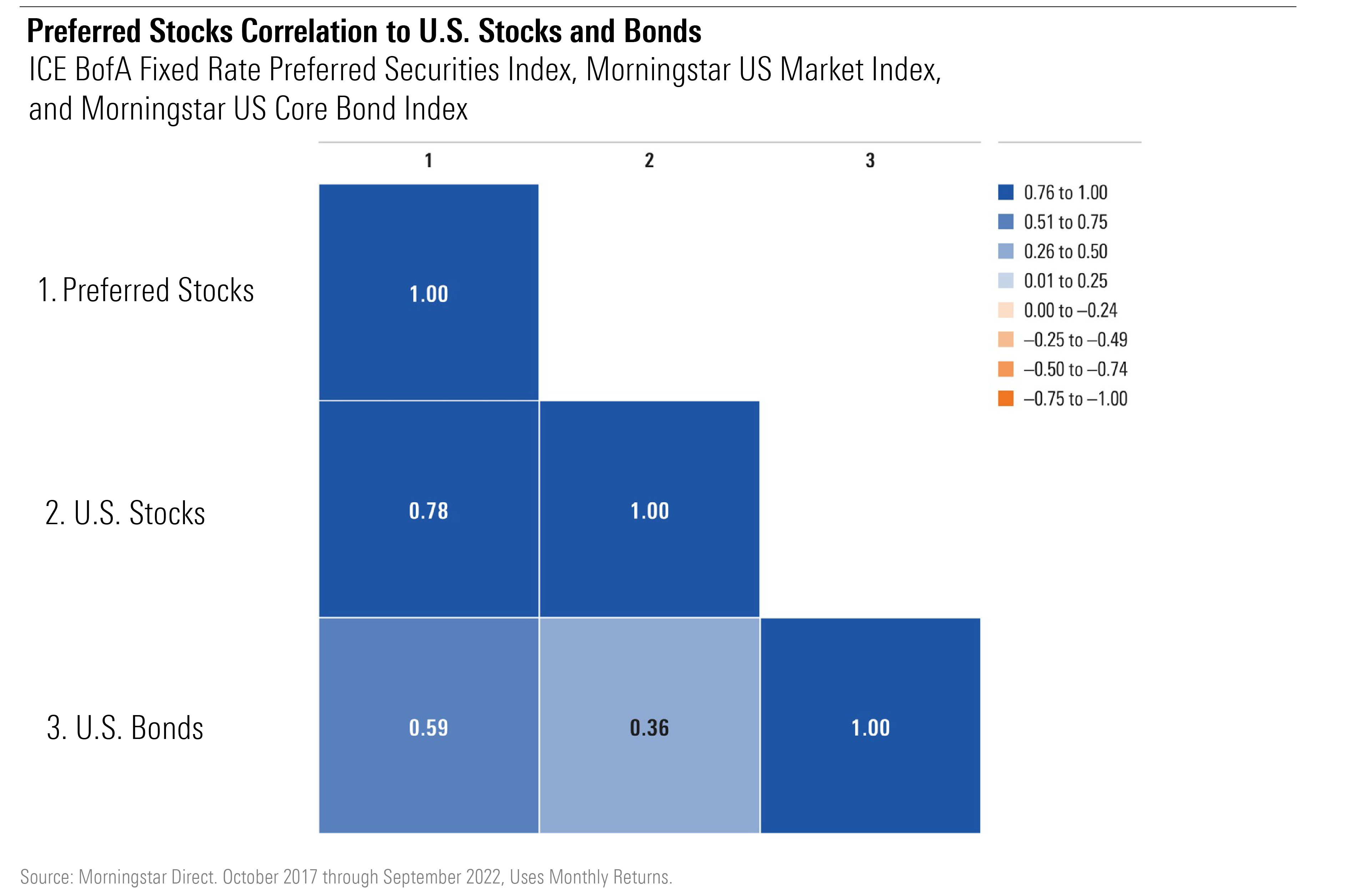

Though they carry similar characteristics, preferred stocks don’t have the same diversification benefits that bonds can add to a portfolio. Investors traditionally have thought of stocks and bonds as moving in opposite directions, and correlation measures the tendency of two different investments to move up or down at the same time. A correlation of 0 shows no relationship, while a correlation of 1 indicates two investments move together seamlessly.

Over the past five years, preferred stocks tracked the performance of the Morningstar US Market Index closer than the Morningstar US Core Bond Index. The Bank of America Merrill Lynch Core Fixed Rate Preferred Securities Index shows a 0.78 correlation to the Morningstar US Market Index, while only a 0.59 correlation with the Morningstar US Core Bond Index.

Morningstar’s Arnott argued that preferred stocks shouldn’t be considered an alternative to a bond fund, and instead seen as a higher-yielding alternative to stocks.

She says that ``like high-yield bonds, preferred stocks have a higher correlation with equity-market indexes than most areas of the bond market.”

Preferred Stock Can Be Called and Converted

Preferred stocks often have no maturity date but can be redeemed by the company that issues them after a certain point. Some preferred stocks can also be converted into common stock.

Issuers may also call the stock when they have to pay a dividend they consider to be too high, then reissue the securities at a lower cost.

“These unique features mean you can either get the best of both worlds or the worst of both worlds,” says Matt Freund, head of fixed income strategies and co-chief investment officer at Calamos Investments.

To Help Manage Risks, Turn to Preferred Stock Funds

For most investors, the way to navigate many of these risks is to diversify an investment in preferreds through a mutual fund. (Although there will still be sector concentration in financials and energy companies.)

Managers of actively run preferred funds tout their ability to assess credit and interest rate risks within their portfolios.

For investors wanting to gain exposure to preferred stocks at a low cost, there are passive options. The $13.9 billion iShares Preferred and Income Securities ETF PFF is the largest fund in the category and tracks an index “composed of U.S. dollar-denominated preferred and hybrid securities,” according to its prospectus. The fund is down 19.4% this year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)