Considering Bond Alternatives: Preferred Stocks and Utilities

Higher income and likely better returns, but with greater risk.

Readers' Choice Friday's column questioning whether high-quality bonds should still be used with equities to form balanced funds, given how far bond yields have fallen, sparked many responses. Among them were multiple recommendations for two investments that currently generate higher income than government bonds: 1) preferred stocks and 2) utilities stocks.

Today's article addresses that topic. I treat the two assets in one column because they are largely similar. Each are hybrid securities, offering higher income than conventional stocks while retaining equitylike characteristics. Preferred stocks accomplish that task by being, effectively, a flavor of junk bond, while utilities stocks do so by being full-blown equities, but issued from a sedate sector.)

(My favorite explanation of preferred stocks: “They are neither preferred nor stocks.” The securities are called “preferred” because they outrank common stocks when standing in the creditors’ line, but their claims nevertheless are subordinate to those of the company’s bonds. And while they technically are stocks, they have fixed par values and thus do not share in stock-market gains.)

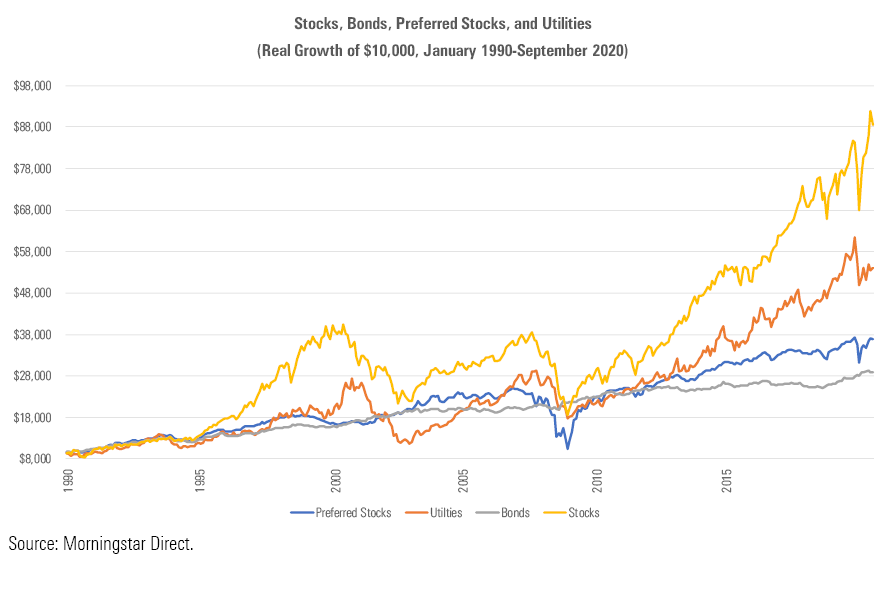

History's Verdict Let's see how these investments have performed. The chart below shows the real (that is, after inflation) performance of four assets: the overall stock market, as represented by the S&P 500; bonds, via the Bloomberg Barclays U.S. Aggregate Bond Index; preferred stocks, depicted by the track record of now-expired fund Vanguard Preferred Stock until 2001, arm-waving from 2001 through 2003, and the S&P Preferred Stock Index since 2003; and utilities stocks, through the aforementioned S&P Utilities Index. All returns conclude on Sept. 30, 2020.

(Just kidding about the arm-waving. For that two-year period from 2001 through 2003, I found a price-only return from another preferred-stock index provider, Winans, and converted those figures into total returns by adding estimated income. The result can't be off by more than a few basis points per month.)

The results were as expected. Stocks, the riskiest investment, topped the chart, followed by the two hybrid assets, with bonds, the safest choice, landing at the bottom. Recognizing that stocks suffered two severe downturns during that three-decade stretch, each hybrid asset endured one, and bonds none, requires no correlation statistics. The information is right there in the picture.

Also obvious from the graph is that when utilities crashed, from 2001 to 2002 (for various reasons, including Enron's implosion), preferred stocks held strong. Conversely, when preferred stocks collapsed, during the 2008 global financial crisis--an unsurprising outcome given that banks are by far the largest issuers of preferred stocks--utilities performed relatively well. This behavior suggests that preferred stocks and utilities be held together. They have offered broadly similar yields and total returns while responding differently to market upheavals. Benefit from diversification by owning both, rather than possessing each asset separately.

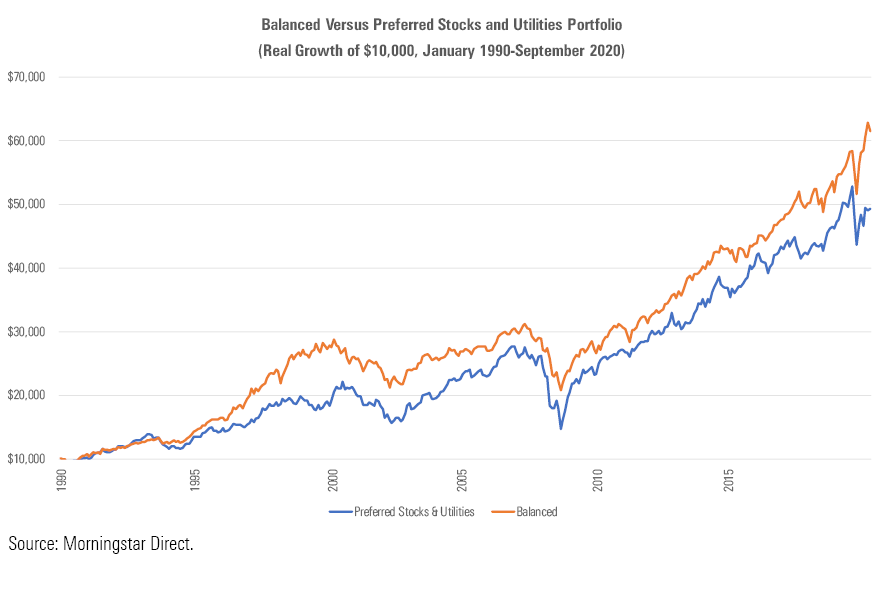

The 50/50 Solution One possibility of using preferred stocks and utilities is to skip the standard approach of building a balanced fund by holding risky stocks along with safer bonds, thereby crafting a portfolio of relative extremes that lands in the middle. Instead, occupy the middle directly, by placing half the portfolio into preferred stocks and the other half into utilities stocks. Admittedly, few investors would employ such a tactic, because those asset classes are small and thus the approach seems extreme. But I think the exercise is instructive.

Below are the totals for the 50% preferred stock/50% utilities portfolio, compared against a traditional balanced fund that consists of 60% invested in the S&P 500 and 40% in the Aggregate Index.

The 50/50 portfolio performed well, but it couldn’t keep pace with the mainstream balanced fund. Then again, that balanced fund represents the best of all possible worlds, as it consists only of large-company U.S. stocks, which comfortably beat both their smaller-company and international rivals during the study’s time span. In practice, the balanced portfolio’s 6.1% annualized return (remember, real terms, so that number is better than it looks) would have pretty much matched the 50/50 portfolio’s annual gain of 5.3%.

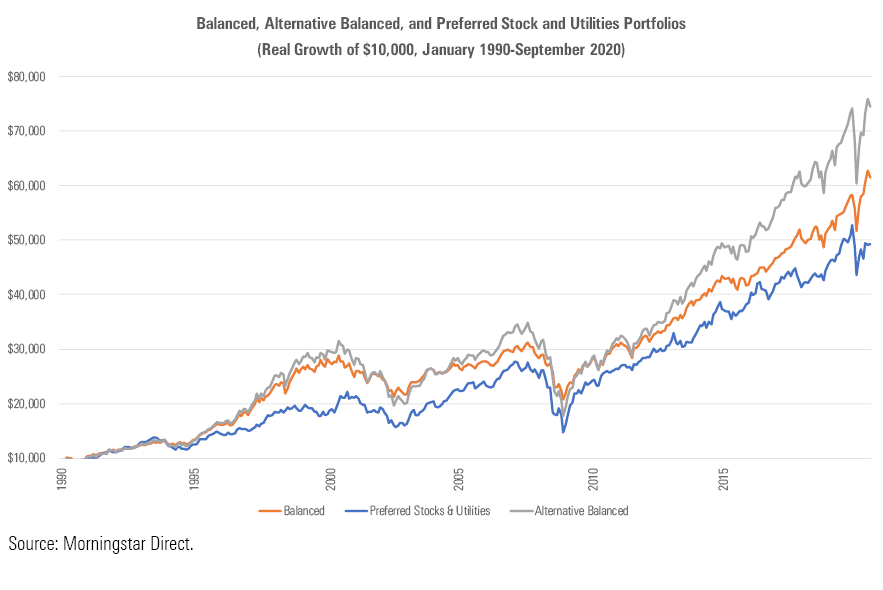

The Alternative Balanced Fund Another idea is to use preferred stocks and utilities to create an alternative version of a balanced fund. Instead of pairing conventional stocks with bonds, use a blend of preferred stocks and utilities stocks. Doing so will decrease portfolio diversification, because unlike bonds those hybrid investments are correlated with equities, but perhaps their extra returns will offset their additional risks.

Which leads to the final chart. It repeats the previous graph by showing the balanced and 50/50 portfolios, then adds a third option: an “alternative balanced” fund that consists of 60% equities, 20% preferred stocks, and 20% utilities stocks. (Ideally, the 60% stake in equities wouldn’t contain any utilities, but I did not make that adjustment for this exercise. No big deal, as utilities only account for 3% of the S&P 500.)

This result, as well, is about as one should have expected. The alternative balanced portfolio turned a higher profit than did the standard rendition, but along the way it was, shall we say, less balanced. It sold off more heavily during the 2000-02 stock-market decline, then during 2008, and then once again this March. Indeed, it’s questionable whether such a fund should even be regarded as “balanced.” Best to think of it as a higher-income version of an equity fund.

With utilities stocks paying roughly 3.5% and preferred stocks somewhat north of that, this hypothetical alternative balanced fund would yield 2.5%, before expenses. (The 60% stake in equities would receive a 1% payout, as the S&P 500 now yields 1.7%, while the remaining 40% in the hybrid investments would generate about 1.5% in income. In contrast, because bond yields have plummeted, an index balanced fund now distributes about 1.5%.)

Wrapping Up Sadly, there's no cost-free way to achieve the full benefits of investment-grade bonds. Save for cash, competing investments do not offer the same combination of high stability and protection against stock-market downturns. Switching from bonds to preferred stocks and utilities will immediately increase portfolio yield, and will likely make for higher long-term returns, but with the drawback of raising portfolio volatility. This lunch doesn't come for free.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)