Markets Brief: Why October CPI Report Forecasts Have Fed Policy Hanging in the Balance

Software stocks slump as investors wrestle with Fed outlook.

With the latest jobs report showing the economy continues to cruise along, upcoming inflation reports are now all the more important for the Federal Reserve’s next moves on interest rates.

That starts with Thursday’s October Consumer Price Index report.

“The Fed very much wants to slow down the pace of interest rate hikes, and I think they would like to at the December meeting,” says Tom Porcelli, chief U.S. economist at RBC Capital Markets. “But if inflation comes in higher than expected, they can’t do that.”

CPI Report Forecasts

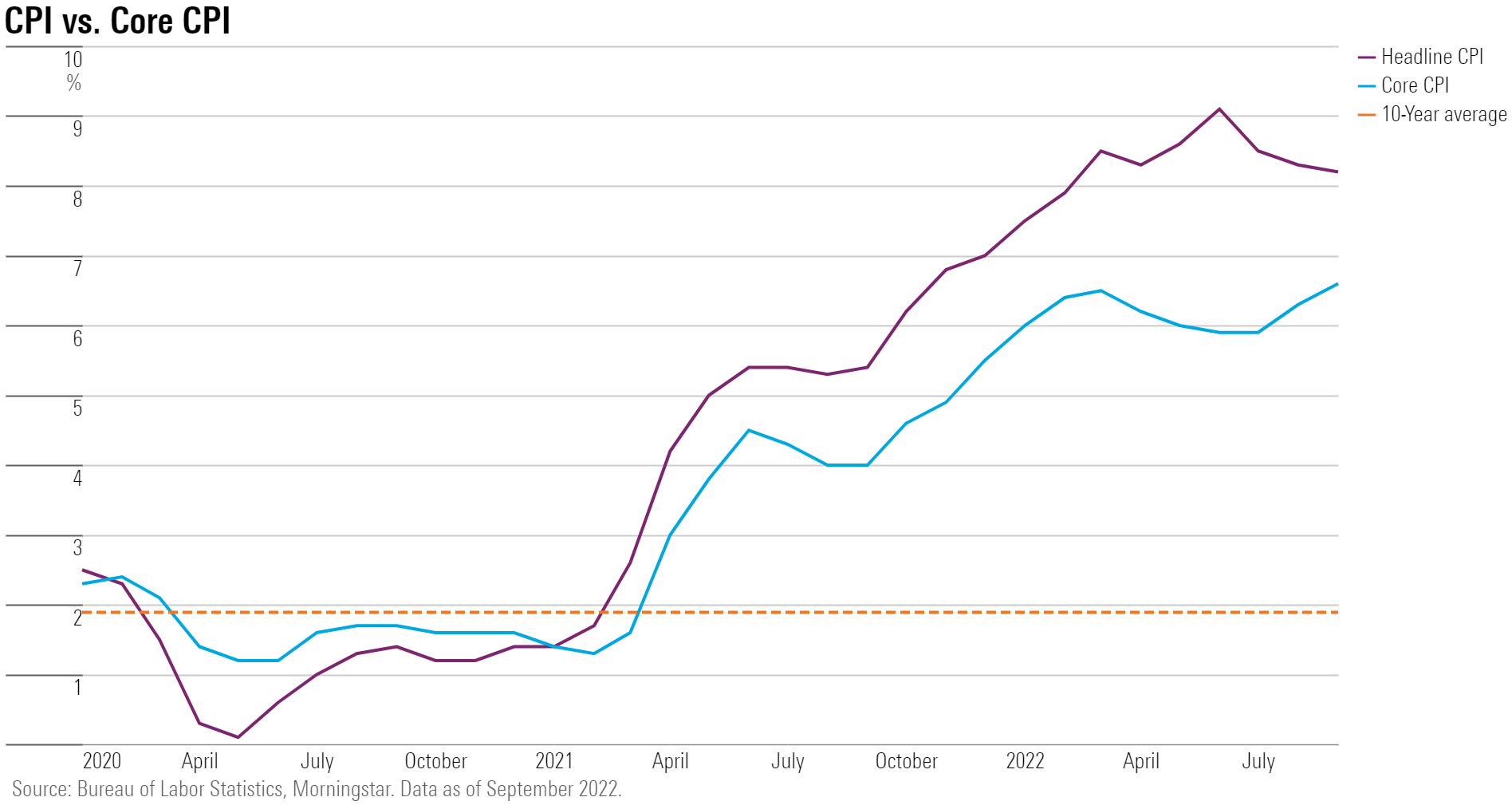

With their October CPI forecasts, economists are once again expecting inflation to come in at extremely high levels on a historical basis.

The consensus CPI report forecast calls for inflation rising 0.6% for October, according to FactSet. The so-called core rate of inflation—which excludes volatile food and energy prices—is expected to rise 0.5%. That would follow a 0.4% overall CPI reading in September and a 0.6% rise in core CPI.

On an annualized basis, the consensus CPI forecast is for an 8.0% year-over-year increase, and for core inflation to rise at a 6.5% rate. That would represent only a modest set of improvements from the September report, where the annual inflation rate was 8.2% overall and 6.6% for core.

Porcelli says that if the CPI data comes in higher than forecast, another aggressive 0.75-percentage-point rise in the federal-funds rate will be back on the table for December’s Fed meeting. The markets’ expectations are split between a 0.50-percentage-point and 0.75-percentage-point rate hike in December, according to the CME FedWatch Tool.

At the same time, even if the October CPI reading is lower than expected, more evidence of cooling prices from future reports will still be needed before the Fed can start slowing down the pace of interest-rate hikes. “The Fed is looking for signs of normalization,” says Stephen Juneau, economist at Bank of America Merrill Lynch.

Bank of America Merrill Lynch forecasts a slower-than-consensus increase in the headline CPI of 0.5% for October from the month before and expects core inflation to moderate to a 0.4% increase.

Here’s what to look at within the report that could set the direction for the Fed:

Core Price Trends

- Core services prices: Juneau says investors should keep an eye on two key categories with the CPI report: Core goods and core services price increases. Shelter prices have already started to moderate “pretty aggressively,” he says. But for other services prices, he says, “the Fed is worried about wage growth.” If low unemployment continues, rising wages will filter through to higher services costs, he says.

- Core goods prices: Goods prices have already started the process of slowing down, says RBC’s Porcelli. “And it’s core goods that will put downward pressuring on inflation over the coming year,” he says. Porcelli says that meaningful declines will take several months.

Headline Components

- Food prices: The CPI category known as “food at home” should show price increases are slowing, and “it’s incredibly encouraging,” Porcelli says. Bank of America Merrill Lynch’s Juneau adds that dining out prices haven’t slowed yet, as they are more affected by rising wages.

- Energy prices: After some good news in recent months on the energy front, October may bring some unwelcome readings. Crude oil and gasoline prices were both up from their September lows, according to Porcelli. But when it comes to the impact on Fed policy, energy prices are outside the Fed’s control, as Fed Chair Powell has noted.

Other Factors Beyond the Fed’s Control

- Motor vehicle maintenance, repair, and insurance: These areas make up very small weightings in the CPI, but, “they’re doing a lot of damage from the inflation perspective,” Porcelli says. On a month-over-month basis, each has risen about 1.4% on average over the past few months for “staggering increases.”

Porcelli says that the increases stem from the surge in used car sales, as used cars come with higher maintenance costs. “These prices could be stubbornly elevated for the time being. There’s nothing that the Fed can do about this area.”

Events scheduled for the coming week include:

- Monday: Lyft (LYFT) reports earnings.

- Tuesday: Walt Disney (DIS) reports earnings.

- Wednesday: Occidental Petroleum (OXY), and Roblox (RBLX) report earnings.

- Thursday: Consumer Price Index report for October to be released. NIO (NIO) reports earnings.

For the trading week ended Nov. 4:

- The Morningstar US Market Index fell 3.33%.

- The best-performing sectors were energy, which rose 2.56%, and basic materials, which rose 1.05%.

- The worst-performing sectors was communication services, which fell 7.22%, and technology, down 6.92%.

- Yields on the U.S. 10-year Treasury rose to 4.16% from 4.02%.

- West Texas Intermediate crude oil prices rose 5.36% to $92.61 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 355, or 42%, were up, and 488, or 58%, declined.

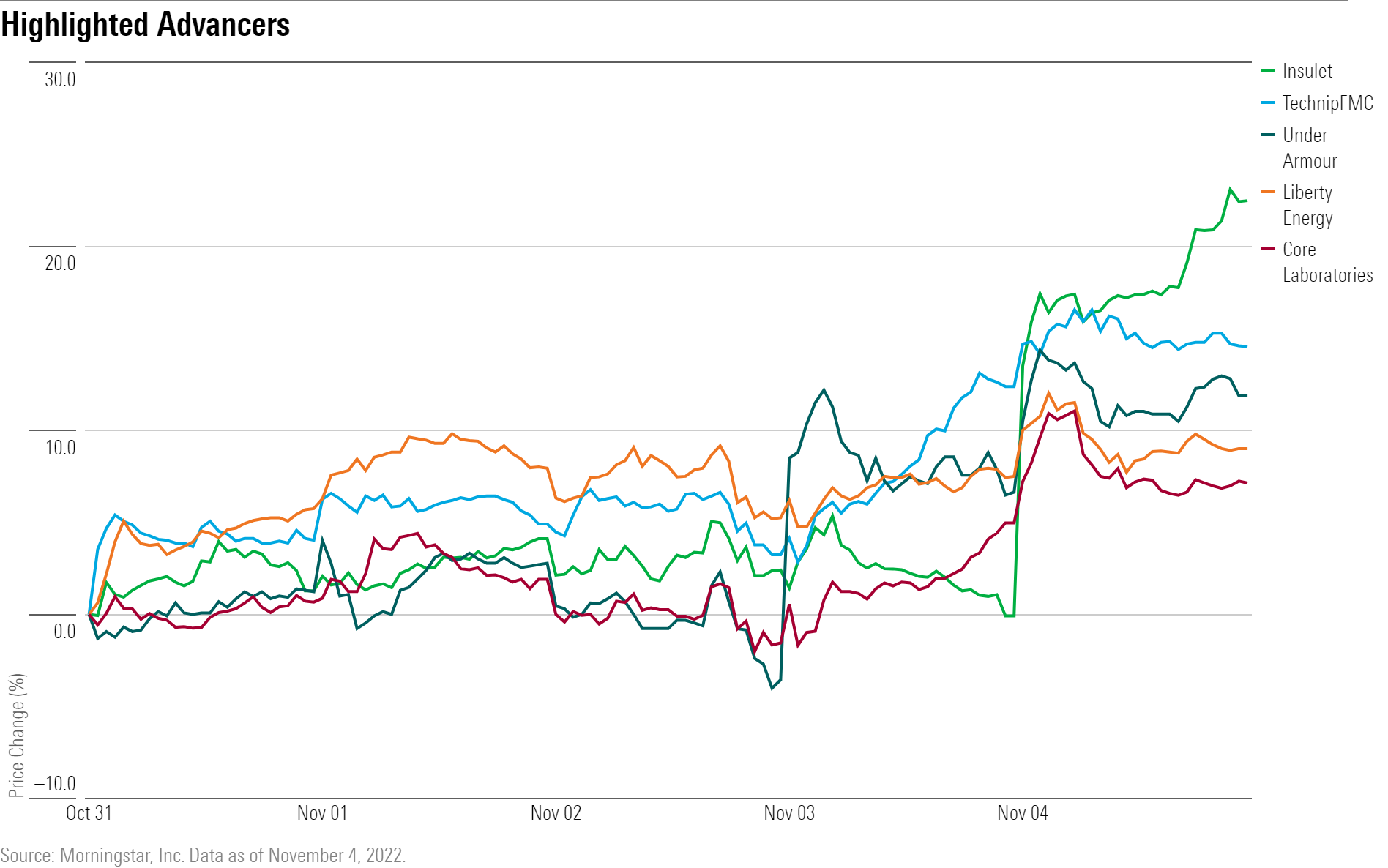

What Stocks Are Up?

Better-than-expected fiscal second-quarter earnings from Under Armour (UA) led to its stock rallying. The company’s earnings per share of $0.20 were ahead of consensus estimates of $0.16, according to FactSet. Revenue also came in slightly higher at $1.57 billion versus expectations of $1.55 billion.

However, the firm still lowered its outlook for the second half of its fiscal year. “The revision was minor and less than feared,” says Morningstar equity analyst David Swartz, which led to the market’s upbeat reaction toward the news.

Shares of insulin pump manufacturer Insulet (PODD) surged after the company reported third-quarter results that Morningstar’s Debbie S. Wang, a senior equity analyst, described as “stellar.” While the company reported a loss per share of $0.08 versus a market consensus of a profit per share of $0.15, sales came in much higher than expected. Third-quarter revenue was $341 million, beating expectations of $312 million.

However, “the star of the show was Omnipod 5, which drove U.S. pump revenue up 42% year over year,” says Wang. The device recently gained European regulatory clearance and is on track to be commercialized in the second half of 2023. “All this adds up to an acceleration in growth over the next two years,” Wang says. She raised her fair value estimate for Insulet stock to $216 from $190 following the results.

Energy stocks surged on increases in oil and gas prices. TechnipFMC (FTI), Liberty Energy (LBRT), and Core Laboratories (CLB) were among the top performers in the sector.

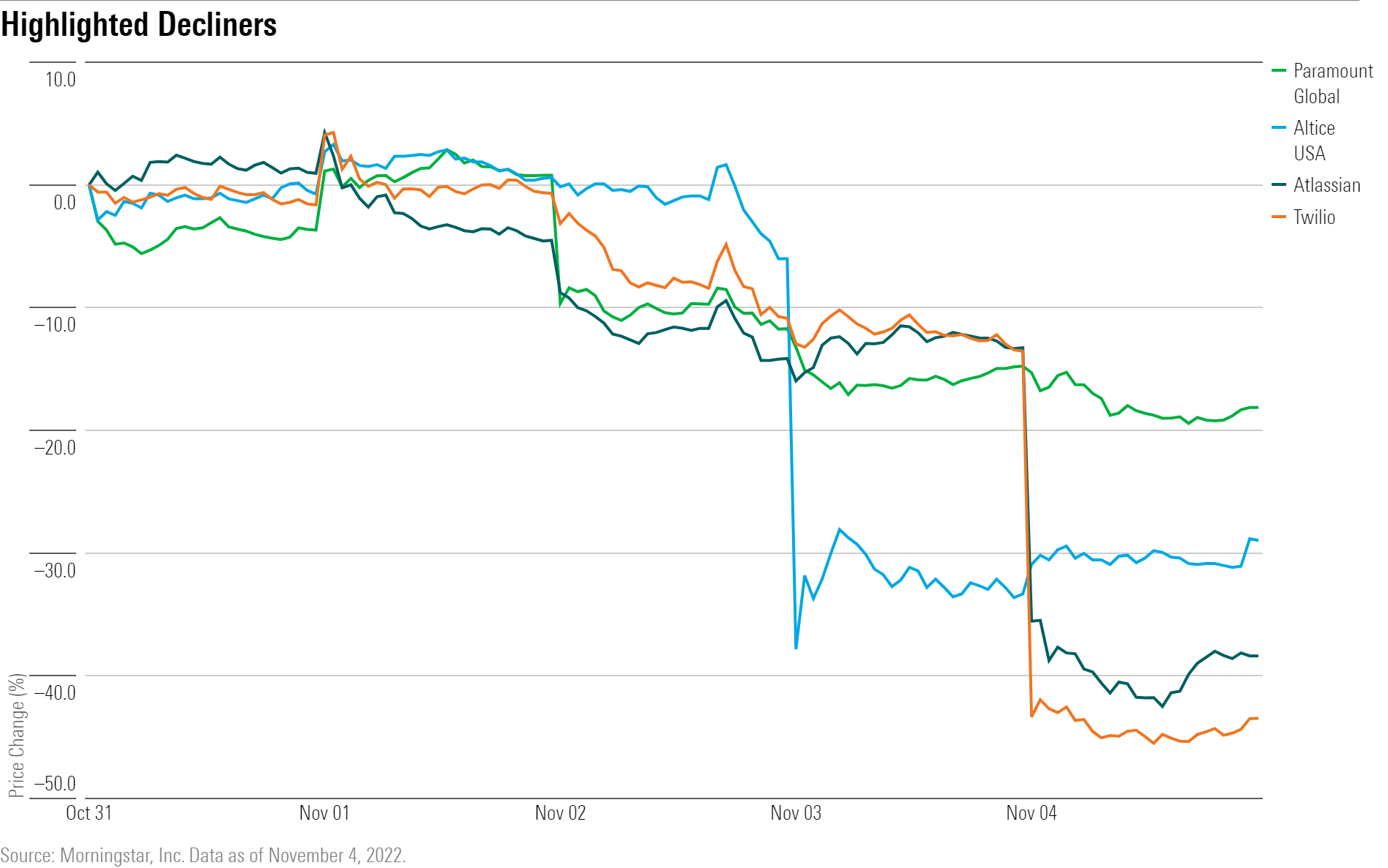

What Stocks Are Down?

A wave of disappointing third-quarter earnings from technology and communication services companies, and an even more hawkish Fed, led to massive declines for the two sectors.

Software provider Atlassian’s (TEAM) shares plunged after fiscal 2023 first-quarter earnings missed their mark. The company’s EPS of $0.36 missed the consensus estimate of $0.40, according to FactSet. But more disappointingly, the firm announced a softer revenue guidance range of $835 million to $855 million for its fiscal second quarter in 2023, whereas analyst consensus was $879.3 million prior to the results.

Twilio (TWLO) stock also slid on lower guidance numbers, as the communications software developer revealed it expected fourth-quarter revenue to be $995 million-$1.005 billion, considerably lower than a mean forecast of about $1.07 billion, according to FactSet.

Shares of Altice USA (ATUS) fell after their EPS results of $0.19 missed expectations of $0.35, and the company reported customer losses and weaker margins, according to Michael Hodel, director of equity research, media and telecom, at Morningstar. Paramount Global (PARA) stock also tumbled during the week.

Editors note: This article has been updated to reflect the consensus CPI forecast from FactSet as of Nov. 8.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)