5 Undervalued Stocks That Raised Their Dividends

Citigroup, Wells Fargo, and PNC are among the stocks with higher dividend payouts on our list.

Dividend stocks may be facing increased competition from higher bond yields, but potential income plus growth retains its appeal.

For investors eyeing dividend stocks, there are different approaches to consider. They can look for stocks that offer the highest yield, those with a history of stable dividend payouts and strong finances, or companies that are raising dividends.

For this article, we screened for stocks that have increased their quarterly dividends, which can be a sign of a company’s confidence in its future finances. We combined this screen with one for stocks that are trading below their Morningstar fair value estimates, meaning they have attractive prices for long-term investors. These stocks offer investors the potential for both increased dividend yields and growing investment values.

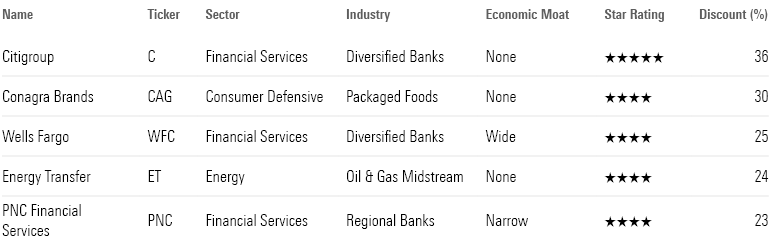

The Five Most Undervalued Stocks With Dividend Increases

How We Screened for Stocks With Increased Dividends

We started with the U.S.-based companies covered by Morningstar analysts that pay a quarterly dividend. We then tracked changes between any dividends paid during the second quarter of 2023 and the most recent dividends as of Aug 1.

We filtered for companies that saw a dividend increase of 5% or more to capture the most substantial changes. Stocks with dividend yields under 2% were excluded from the group. We then selected companies considered undervalued by Morningstar analysts—those rated 4 or 5 stars.

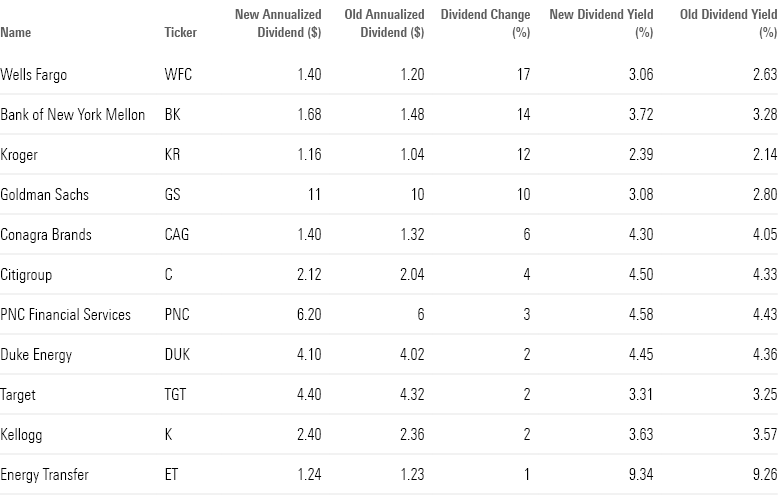

Only 11 companies made the cut. We’re highlighting the five with the largest discounts. A table with all 11 and the details of their dividend changes is at the bottom of this article.

Undervalued Dividend Stocks

Citigroup

- Annualized Dividend per Share: $2.12

- Dividend Yield: 4.50%

- Discount to Fair Value Estimate: 36%

In the second quarter, Citigroup’s earnings were largely consistent with Morningstar strategist Eric Compton’s expectations. He estimated earnings per share of $1.34—a penny more than what the banking group reported. The firm did not change its $78 billion-$79 billion full-year outlook for revenue, within which net interest income outperformed, while markets, investment banking, and wealth revenue remain under pressure.

Citigroup’s management raised the firm’s NII outlook by $1 billion, which implies weaker fee performance for the year. “While we acknowledge some of the cyclical headwinds at play for fees, we view them as more core to the overall business plan, so on net, we view the stability in revenue slightly negatively,” Compton says.

Conagra Brands

- Annualized Dividend per Share: $1.40

- Dividend Yield: 4.30%

- Discount to Fair Value Estimate: 30%

Conagra finished its May-ended fiscal year with strong results that were in line with or surpassed the expectations of Erin Lash, director of consumer equity sector research at Morningstar. Revenue was close to her $3 billion estimate, while the reported earnings per share of $0.62 beat her $0.55 forecast. But she says the firm’s fiscal 2024 outlook is bland, with 1% sales growth and $2.70-$2.75 in earnings per share, amid softer demand expectations.

“Shares still appear attractive, trading 30% below our valuation,” Lash says. “We remain optimistic about Conagra’s long-term margin improvement prospects, with our forecast calling for 18% adjusted operating margins long-term (from 14.6% in fiscal 2023), supported by a normalized cost environment and ongoing supply chain initiatives.”

Wells Fargo

- Annualized Dividend per Share: $1.40

- Dividend Yield: 3.06%

- Discount to Fair Value Estimate: 25%

Wells Fargo’s second-quarter results were ahead of both consensus and Eric Compton’s expectations. He highlights the financial services company’s increased expense outlook of $51 billion—up by $1.2 billion—due to higher severance charges and lower-than-expected attrition. He also points out the firm’s increased full-year NII expectations, up to 14% from 10% previously.

“The bank is still on track with our deposit balance and pricing forecasts—a positive in the current environment—and we see much of the outperformance being driven by better-than-we-anticipated repricing on the asset side,” Compton says. “The deposit base is still down only 3% halfway through the year, and management commented that it’s seeing a slowdown in the shift of deposits into higher-yielding alternatives.”

Additionally, he says he likes the firm’s “outsize ability to keep repurchasing shares, as the bank bought up another roughly 2.6% of outstanding shares in the quarter.”

Energy Transfer

- Annualized Dividend per Share: $1.24

- Dividend Yield: 9.34%

- Discount to Fair Value Estimate: 24%

“In the past decade, Energy Transfer has built itself into one of the largest midstream energy companies, with an enviable network of natural gas infrastructure, primarily in Texas and the U.S. midcontinent region. Energy Transfer has both contributed to and benefited from the U.S. shale oil and gas boom,” Morningstar sector strategist Stephen Ellis writes.

Although Energy Transfer has made a name for itself, the firm “has become a financial, regulatory, and political liability as sentiment turns against the energy industry,” says Ellis. The controversy over the Dakota Access Pipeline showcased how such challenges can threaten Energy Transfer’s projects. Meanwhile, the company’s Lake Charles liquid natural gas project is also “somewhat stalled,” Ellis says.

“The Department of Energy denied Energy Transfer’s request for a deadline extension for the completion of the facility (currently set for December 2028) in April and again at a rehearing in June. As a result, Energy Transfer intends to file a new export authorization for the project in August. This likely will mean further substantial delays until a final investment decision, as the project would essentially go to the back of the line for permit approval behind multiple U.S. LNG projects that have already applied,” Ellis says.

PNC Financial Services

- Annualized Dividend per Share: $6.20

- Dividend Yield: 4.58%

- Discount to Fair Value Estimate: 23%

The first of the regional banks to release second-quarter earnings, PNC reported weaker results than larger banks, lowering its full-year NII outlook due to rising funding costs and slower loan growth. But Eric Compton says the reported earnings per share of $3.36 largely fell in line with both his expectation of $3.31 and the FactSet consensus of $3.29. The firm’s NII and revenues are still set to grow this year, while the bank can still produce a mid-teens-percentage return on tangible equities.

Compton highlights that the change in the NII outlook was smaller than what he saw in the first quarter. At that time the midpoint of guidance fell by 500 basis points, versus 150 basis points in the second quarter.

“While we’re not completely done with the current rate cycle, we are seeing a deceleration in surprises as we approach some sort of equilibrium,” he writes. “Overall, deposit costs roughly tracked our updated expectations, as did deposit balance declines and the shift into interest-bearing balances.”

Cheap Stocks With Dividend Increases

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_7b0d5ad1cbc64c2db440c298c6bcccd7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)