9 Top-Performing Mid-Cap Growth Stock Funds

Funds from Baron, Baird, and Virtus lead the pack.

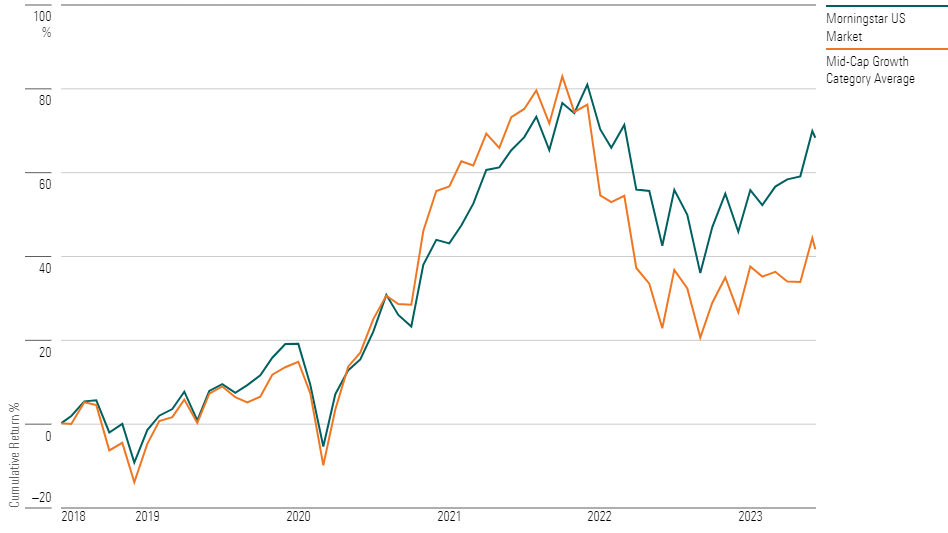

While mid-cap growth funds have lagged funds that focus on large-company stocks, the top performers have put up returns well ahead of the broader market.

As with other growth stock categories, investors in mid-cap growth funds have enjoyed a bounce in 2023. So far this year, the average mid-cap growth fund is up 13.2% while the Morningstar US Market Index gained 16.4%.

Mid-cap growth funds have seen wavering performance compared with the overall market in recent years. During the 13-month period starting from the last quarter of 2020 until the category’s peak in October 2021, these funds outperformed the overall market on average.

In 2022, the category lost 28.2% while the stock market lost 19.4%. The gains posted in 2023 so far have evened out the gains for the 12-month trailing period, as the category has gained 13.8% compared with the 17.5% gain of the overall stock market.

Mid-Cap Growth Funds vs. the U.S. Stock Market

What are the Top Mid-Cap Growth Funds?

Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Some mid-cap growth portfolios invest in stocks of all sizes, leading to a mid-cap profile, but others focus exclusively on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, which means those stocks can often command relatively high valuations. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

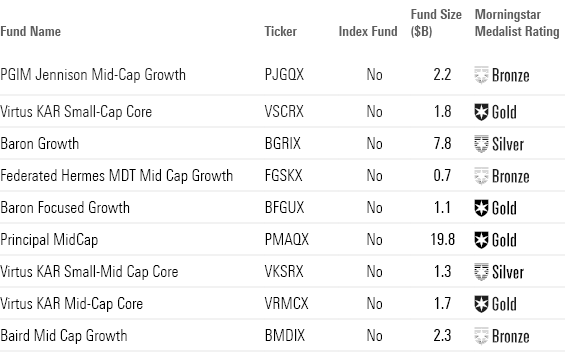

9 Top-Performing Mid-Cap Growth Funds

To screen for the best-performing funds in this Morningstar Category, we looked for those that have posted top returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the nine funds with the best year-to-date performance. This group only consists of active funds; no passively managed funds made the cut.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders. A table with the funds’ returns can be found at the bottom of this article.

Top-Performing Mid-Cap Growth Funds

PGIM Jennison Mid-Cap Growth

- Ticker: PJGQX

- Morningstar Medalist Rating: 4 stars

- Morningstar Rating: Bronze

“Following 2020′s first-quarter selloff, the strategy’s 131.4% cumulative return between March 23, 2020, and Feb. 15, 2021, was 16.2 percentage points more than the index. Then when the index fell 27.3% from its November 2021 peak to its March 2022 trough, the strategy held up better than both the index and its peers. Over Ben Bryan’s brief stint as manager, the strategy captured 103% of the benchmark’s returns in up markets but 96% of its returns in down markets.

“The team’s focus on fundamentally sound companies helped the strategy fare a bit better than most during 2022′s downturn. While brutal, the strategy’s 23.8% loss for the year still beat the index and 74% of its peers. Stock-picking within industrials and information technology was the primary positive driver over the period.”

—David Carey, associate analyst

Virtus KAR Small-Cap Core

- Ticker: VSCRX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

“The fund calls itself a small-cap strategy, and its managers generally buy small-cap companies. However, they like to stick with them if they’re doing well. Those companies’ stocks sometimes rise into mid-cap territory as a result.

“The team applies a patient process focusing on high-quality companies. Rather than look for stocks with the highest growth prospects, the team targets companies with reliable revenues, high profit margins, and low financial risks with promising upside potential. They then construct a concentrated portfolio of roughly 30 top ideas and rarely trade them. The managers have few constraints when building the portfolio, aside from a 10% maximum position size. While this concentration creates some single-stock risk, the portfolio has generally held up well when markets have turned south.

“Since the managers’ joint tenure began, the strategy has posted exceptional results. From March 2009 through August 2022, the I shares’ 18.0% annualized return easily outpaced its best-fit benchmark, the Russell 2500 Index, by more than 3 percentage points.

“The strategy’s risk-adjusted returns are even more impressive, as the defensive nature of its process tends to result in less volatility (as measured by standard deviation).”

—Anthony Thorn, analyst, and Tony Thomas, associate director

Federated Hermes MDT Mid Cap Growth

- Ticker: FGSKX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Bronze

“Over a 10-year period, this share class outperformed the category’s average return by 4.0 percentage points annualized. And it also exceeded the return of the category benchmark, the Russell Midcap Growth Index, by an annualized 86 basis points over the same period.

“Over time, this strategy has consistently held more undervalued companies compared with peers in its category. It’s also continually had more high-yield exposure than the category average during recent years, holding more stocks with high dividend or buyback yields. High-yield stocks tend to be associated with more mature, profitable businesses that can grow as well as provide a stream of income. However, such stocks could suffer if setbacks force them to cut their dividends. The strategy had less exposure to high-volatility stocks compared with its category. These low-risk stocks are typically at their best when markets are not. Low volatility exposure contributes to limited loss on the downside at the cost of a lag in bull markets.”

—Morningstar Manager Research

Baird Mid Cap Growth

- Ticker: BMDIX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Bronze

“Since manager Chuck Severson’s start in 2000, the institutional shares’ 8.3% annualized gain through April 2023 beat the Russell Midcap Growth Index’s 7.4% and the typical category peer’s 5.8%. The fund has been less volatile than the index, resulting in its superior Sortino ratio (a measure of risk-adjusted results) during that stretch.

“The fund got much of its edge from faring well in volatile markets, like the plunge in the first quarter of 2020 that was driven by the COVID-19 pandemic. It has delivered in most market corrections, like the financial crisis, 2011′s third quarter, 2012′s second quarter, and late 2018′s drawback. In the 2022′s market pullback, the strategy did slightly lag the index, in large part due to its energy underweight and picks within healthcare and industrials. As growth rebounded in 2023′s first quarter, the strategy recovered, outperforming the index and landing in the top decile of the category.”

—Stephen Welch, senior analyst

Baron Growth

- Ticker: BGRIX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“Lead manager Ron Baron still has his fingerprints all over this fund, but it’s been shaped by others too. Early in his career, Baron’s preference for defensible revenue led him to embrace companies with physical assets whose presence would be difficult to match. Many of his longtime favorites still play a large role in the portfolio after holding periods of 10 or even 20 years.

“The fund evolved over time, thanks to others at the firm such as co-manager Neal Rosenberg, and it came to embrace the durable attributes and scalable growth of financial data companies such as top holding MSCI MSCI, or software firms operating in niches such as Guidewire Software GWRE and Ansys ANSS. Such adaptations have boosted performance and helped this established fund keep up with the times.

“Consistent with Baron’s long-term approach to investing, turnover typically falls below 20% here, but in recent years it’s fallen into the single digits. Baron and Rosenberg have elected to hang onto some of their longest-held and highest-conviction stocks instead of moving more meaningfully into faster-growing areas of tech and healthcare that are more popular with competing funds.”

—Adam Sabban, senior analyst

Virtus KAR Small-Mid Cap Core

- Ticker: VKSRX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

“For the past three-year period, it beat the Russell Midcap Growth Index by an annualized 1.8 percentage points and outperformed the category average by 2.0 points. More importantly, across a longer horizon, the strategy outpaced the index. On a five-year basis, it outperformed the index by an annualized 2.0 percentage points.

“The portfolio is overweight in industrials and technology relative to the category average by 19.4 and 4.8 percentage points, respectively. The sectors with low exposure compared to category peers are healthcare and consumer cyclical, underweighting the average by 7.7 and 6.0 percentage points of assets, respectively. This portfolio turns over its holdings less quickly than peers, potentially leading to lower costs for investors and eliminating drag on performance.”

—Morningstar Manager Research

Baron Focused Growth

- Ticker: BFGUX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

“Over the past three-year period, it beat the Russell Midcap Growth Index by 20.4 percentage points and outperformed its average peer by 20.7 percentage points. More importantly, over a longer time frame, the strategy came out ahead; on a five-year basis, it led the index by an annualized 13.9 percentage points.

“The strategy’s portfolio shows it has maintained an overweight in volatility exposure and liquidity exposure compared with category peers. High volatility exposure is attributed to companies with a higher standard deviation of returns.

“Given the high trading volume of holdings, this strategy has been exposed to liquid assets during these years. This gives the managers more flexibility to sell without adversely affecting prices during bear markets. Compared with category peers, the strategy also had more exposure to the liquidity factor in the most recent month.”

—Morningstar Manager Research

Principal MidCap

- Ticker: PMAQX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“From the institutional share class’ March 2001 inception through October 2022, the mutual fund’s 10.6% annualized gain easily beat the Russell Midcap Growth Index’s 8.0% as well as 98% of its mid-growth category peers. (The retail separate account, Principal SMA MidCap Equity, posted similar results.) Two performance traits helped produce those stellar results. First, the fund’s returns ranked among the category’s least volatile (as measured by standard deviation). Second, the fund tended to fare better in selloffs, losing only 77% as much as the index in down months during that period.

“As many growth stocks retraced their steps in 2022, lead manager Bill Nolin’s atypical approach—which often shies away from popular growth sectors such as tech and healthcare in favor of financials and consumer cyclicals—proved beneficial. Three longtime holdings—O’Reilly Automotive ORLY (first bought in 2005), Arch Capital ACGL (2011), and Progressive PGR (2009)—posted healthy gains in an otherwise-tough market.”

—Tony Thomas, associate director

Virtus KAR Mid-Cap Core

- Ticker: VRMCX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

“Narrowing in on the past three-year period, it beat the Russell Midcap Growth Index by an annualized 4.0 percentage points and outperformed the category average by 4.3 percentage points. Across a longer horizon, the strategy surpassed the index; on a five-year basis, it outperformed the index by an annualized 1.3 percentage points.

“The share class had a higher Sharpe ratio (a measure of risk-adjusted return) than the index over the trailing five-year period. This strategy also delivered a smooth ride for investors, with a relatively low standard deviation of 18.9%, compared with the benchmark’s 22.0%.

“The portfolio is overweight in industrials by 28.0 percentage points compared with the category average, while its consumer defensive allocation is similar to the average. The sectors with low exposure compared to category peers are consumer cyclical and technology, which are underweight to the average by 7.4 and 6.9 percentage points, respectively.”

—Anthony Thorn, analyst

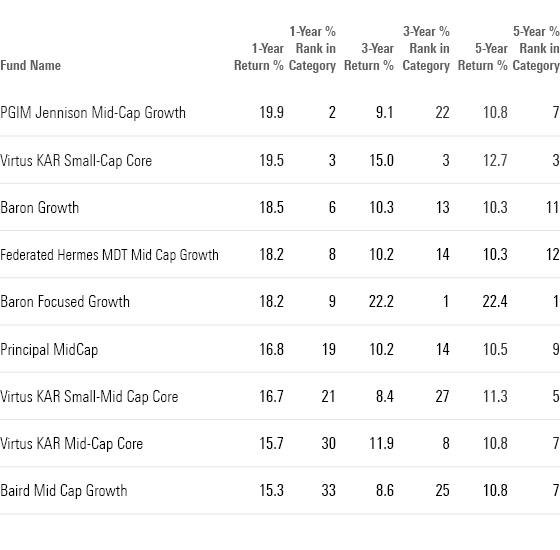

Long-Term Returns of Top-Performing Mid-Cap Growth Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)