6 Top-Performing Core Bond Funds

Vanguard, Fidelity, and Guggenheim are among the best-performing funds.

It continues to be a rocky road for bond fund investors.

Core bond funds—important holdings for many investors—carved out gains earlier this year after a rough 2022. But as bond yields have risen in the past two months, most of those gains have been erased.

However, the top funds in this category are still in positive territory for the year. Offerings from Fidelity, Vanguard, and Guggenheim are among the best performers. Historically, the funds that have done well tend to have portfolios with more high-quality corporate debt and less sensitivity to rising interest rates.

Core bond funds have on average returned 0.04% so far in 2023, compared with a 0.08% gain for the bond market as measured by the Morningstar Core Bond Index.

That follows 2022′s 13.35% loss on the average fund in the intermediate-term core bond Morningstar Category and a 12.99% drop in the core bond index, as the market contended with the highest inflation rate in four decades and aggressive interest-rate increases by the Federal Reserve.

With this year’s flat performance, the average core bond fund has lost 13.63% over the last three years, and the core bond index is down 13.84% over the last three years.

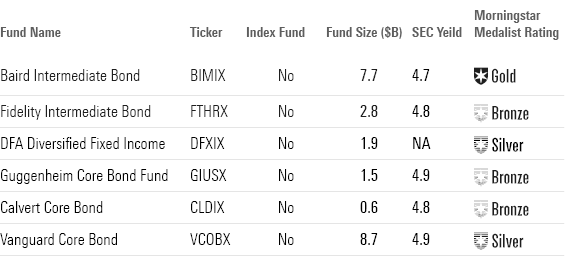

Intermediate Core Bond Funds vs the US Core Bond Index

What Are Core Bond Funds?

Core bond funds are essential building blocks in most diversified portfolios. The intermediate-term core bond category consists primarily of high-quality investment-grade U.S. bonds. Core bond funds typically hold roughly 40% of their portfolios in U.S. Treasuries, about 25% in mortgage-backed securities from government agencies, and the remaining 25% in investment-grade corporate bonds.

6 Top-Performing Core Bond Funds

To screen for the best-performing intermediate core bond funds, we looked for those that gained solid returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with analyst-driven Morningstar Medalist Ratings of Gold, Silver, or Bronze on those lowest-cost share classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the six funds with the best year-to-date performance. The group only includes actively managed funds.

Top-Performing Core Bond Funds

Baird Intermediate Bond

- Ticker: BIMIX

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“Compared with other funds in its category, this fund has historically hewed closely to its peers’ credit and interest-rate sensitivity. Relative to the category average, the managers have been substantially overweight in corporate debt. Additionally, there’s been an underallocation from AA-rated bonds. And finally, the fund leans meaningfully away from debt with 10- to 15-year maturities. The fund is managed against the Bloomberg Intermediate Government/Credit Index, which has a shorter duration than most core bond funds.

“Over the past five years, the class shares have returned an average of 1.3% per year, putting it in the 4th percentile of the category. For the last three years, the fund has returned an average of -2.7% a year, putting it in the 5th percentile. And for the past 12 months, the fund lands in the 5th percentile with a 1.5% gain.”

—Morningstar Manager Research

Fidelity Intermediate Bond

- Ticker: FTHRX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“This strategy isn’t made from the standard intermediate-term bond fund mold. It typically maintains a shorter-than-average duration, as its managers aim to keep interest-rate sensitivity close to the Bloomberg Intermediate Government/Credit Index, which constitutes securities with maturities of up to 10 years.

“This muted interest rate risk profile contributed to the strategy’s top-decile performance during the dramatic interest rate hike in 2022. Its 8.7% loss was less severe than the median 13.3% drop among peers. Similar outperformance was observed in past interest rate sell-offs of 2016, 2018, and 2021. Benefitting from 2022′s solid performance, over Rob Galusza’s tenure from July 2009 through July 2023, the strategy’s 2.9% annualized return outpaced the Bloomberg U.S. Aggregate Index category benchmark by 39 basis points and beat more than half of its category peers.”

—Saraja Samant, analyst

DFA Diversified Fixed Income

- Ticker: DFXIX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Narrowing in on the past three-year period, it beat the category index, the Bloomberg Barclays US Aggregate Bond Index, by an annualized 2.2 percentage points, and outperformed its average peer by 2.1 percentage points. And more importantly, when extended to a longer time frame, the strategy outpaced the index. On a five-year basis, it outperformed the index by an annualized 52 basis points. Its impressive one-year 1.9% loss gives it a 1.5-percentage-point lead over its average peer, placing it within the top 10% of its category.

“This strategy’s 12-month yield is 2.4%, lower than its average peers’ 3.0%. A lower yield tends to indicate lower credit risk. The portfolio holds assets with a higher average surveyed credit quality of AAA, compared with the category average of A, and it holds no non-investment-grade assets, despite the average peers’ 2%. Strategies with less credit risk may help provide a reliable ballast during periods of market stress.”

—Morningstar Manager Research

Guggenheim Core Bond Fund Institutional

- Ticker: GIUSX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“The good news for investors is that the strategy has historically enjoyed peer-beating long-term returns and modest volatility. Neither cutting risk in 2018 and 2019, nor its 2022 weakness, badly tarnished that record. Reducing risk in recent years made the strategy one of the best performers during the pandemic selloff in early 2020, and pivoting to add risk back quickly after markets plummeted helped produce top-decile returns in 2020 and relative success in 2021. As such, its trailing returns of three years or longer (including its gains since CIO Anne Walsh joined the fund in late 2012) still hovered near the top of the category through February 2023.

“During the 2020 selloff, the team dumped most of its short-term holdings and government debt and backed loaded up on beaten-down corporate credit. By the end of the year, nearly 40% of its assets consisted of investment-grade corporate exposure, with another 11% in below-investment-grade fare.

“The team has since balanced out the portfolio, shifting some assets back into a mix of CLOs, asset-backed securities, residential-mortgage-backed securities, and commercial MBS. Those sectors totaled 45% at the end of 2022, still well below their peak in early 2017, with a higher-quality profile. At the same time, investment-grade bonds accounted for 30% of the portfolio.”

—Eric Jacobson, director

Calvert Core Bond

- Ticker: CLDIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“Over the past five years, these shares have returned an average of 3.6% per year, putting the fund in the 1st percentile of its category. For the last three years, the fund has returned an average of -4.0% a year, leading it to the 17th percentile. And for the past 12 months, the fund lands in the 31st percentile with a -0.1% return.”

—Morningstar data, company website

Vanguard Core Bond

- Ticker: VCBOX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This share class led its average peer by an annualized excess return of 47 basis points over a seven-year period. It was also ahead of the Bloomberg Barclays US Aggregate Bond Index by 43 basis points over the same period.

“Over the past five years, the fund has returned an average of 1% per year, putting it in the 11th percentile of the category. For the last three years, the fund has returned an average of -4.5% a year, landing it in the 29th percentile. And for the past 12 months, the fund lands in the 32nd percentile with a -0.1% return.”

—Morningstar Manager Research

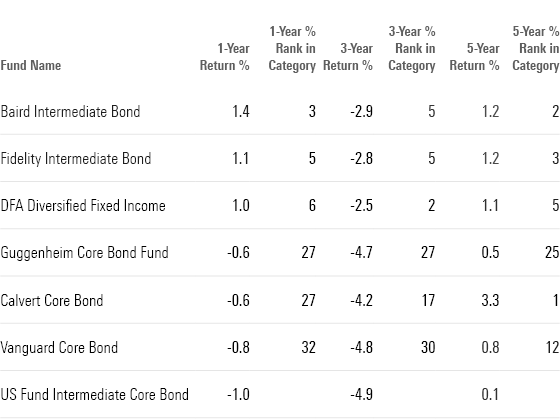

Long-Term Returns of Top-Performing Core Bond Funds

3 Great Bond ETFs

Correction: This article has been updated to correct the return on core bond funds in 2023.

Correction: An earlier version of this article incorrectly identified the three-year returns on the core bond fund category and the Morningstar US Core Bond index as annualized.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)