3 Top-Performing Short-Term Bond Funds

Short-term bond funds from Pimco, PGIM, and FPA have delivered for investors during a time of rising interest rates.

Investors in short-term bond funds have had a decent 2023 thanks to their lower level of sensitivity to rising interest rates.

So far this year, the average short-term bond fund has gained 2.5% compared with the 0.4% gain of the overall bond market as measured by the Morningstar US Core Bond Index.

Within the Morningstar Category, short-term bond funds with the least interest-rate sensitivity and managers that most effectively allocate risk have finished at the top, according to Morningstar’s data and analysts. Among top-performing short-term bonds over the last one-, three-, and five-year time frames are offerings from Pimco, PGIM, and FPA Funds.

For fixed-income investors, short-term bond funds have been a haven as the Federal Reserve raised interest rates to combat inflation. In 2022, the overall bond market as measured by the Morningstar Core Bond Index lost 13.0% but short-term bond funds lost 5.2% on average. A rebound in the broader market has helped even out performance for the 12-month trailing period ending Sept. 5, as during this period short-term bond funds on average gained 1.8% and the Core Bond Index lost 2.0%.

But now, with yields having risen significantly, short-term bonds are looking particularly attractive, even if it turns out the Fed isn’t completely done raising interest rates.

Short-Term Bond Funds vs the U.S. Core Bond Market

What Are Short-Term Bonds?

Short-term bond funds invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations—a measure of interest-rate sensitivity—of 1.0 to 3.5 years. These portfolios are attractive to conservative investors because they are less sensitive to interest rates than portfolios with longer durations.

3 Top-Performing Short-Term Bond Funds

To screen for the best-performing short-term bond funds in this category, we looked for the strategies that have posted top returns across multiple time periods.

We first screened for the short-term bond funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. Then we filtered the list for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Morningstar Medalist Ratings.

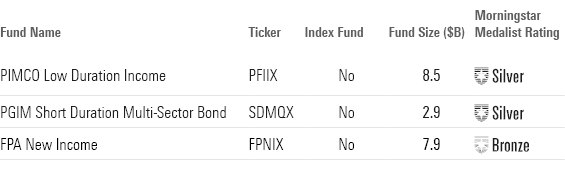

From this screen, we’ve highlighted three short-term bond funds with the best year-to-date performance. This group consists only of active funds. No index funds made the cut.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes that are not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

Top-Performing Short-Term Bond Funds

Pimco Low Duration Income Fund

- Ticker: PFIIX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“This share class outpaced its average peer by 1.8 percentage points annualized over a 10-year period. And it also exceeded the return of the category benchmark, the Bloomberg Barclays U.S. Aggregate Government/ Credit 1-3 Year Index, by an annualized 2.2 percentage points over the same period. Although the overall rating does not hinge on one-year performance, its impressive 4.6% return is worth mentioning, a 3.6-percentage-point lead over its average peer, placing it within the top 10% of its category.”

“CIO Dan Ivascyn and CEO Manny Roman represent that next generation and have built on the organizational strengths they inherited. An experienced and critical-thinking investor, Ivascyn has sought to curate an elite staff and capable investment culture since he assumed his current role in 2014 and since Roman joined him in 2016. They have significantly grown the firm’s pool of investment professionals and supported them by spending massively on technology and technologists to spur persistent outperformance while keeping risk in check. There may be a few others in Pimco’s league, but very few.”

—Eric Jacobson, Director

PGIM Short Duration Multi-Sector Bond Fund

- Ticker: SDMQX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Over the past five years, the PGIM Short Duration Multi-Sector Bond shares have returned an average of 1.9% per year, leading it in the 15th percentile of the category. For the last three years, the fund has returned an average of 0.1% a year, leading the fund to the 25th percentile among all short-term bond funds. And for the past 12 months, the fund lands in the 8th percentile with a 3.4% gain.”

“The managers have been paring back risk as they point to market participants mispricing the chance of recession. Treasuries and agency securities accounted for 15% of assets as of September 2022, which is up from just over 10% at the end of 2021. Concurrently, high-yield corporates fell to roughly 11% of assets from over 14%.”

“Similarly, the managers have steadily reduced the portfolio’s emerging-markets exposure in recent years, citing a combination of rising interest rates, slowing growth, and elevated geopolitical tension headwinds. This allotment represented just shy of 5% of assets as of September 2022, roughly one third as large as three years earlier.”

—R.J. D’Ancona, Senior Analyst

FPA New Income Fund

- Ticker: FPNIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“Its main appeal is its volatility-adjusted track record. The strategy has been a strong competitor, without having taken on the risks courted by many rivals. It has historically been among the fund universe’s least volatile, which has helped it earn Sharpe ratios that typically clock in higher than all but a few bond funds in Morningstar’s U.S. database over most trailing periods.”

“This strategy can take on more esoteric exposures, but it has managed these risks well. The portfolio almost always features an eclectic mix of deals that may look cheap because they’re too small for the needs of a larger manager or that may look risky but have underlying safeguards or carry specific collateral features making them safer and more predictable than they appear.”

“Over the past five years, the FPA New Income shares have returned an average of 1.6% per year, leading it in the 30th percentile of the category. For the last three years, the fund has returned an average of 0.5% per year, leading the fund to the 15th percentile among all short-term bond funds. And for the past 12 months, the fund lands in the 22nd percentile with a 2.7% gain.”

—Eric Jacobson, Director

Long-Term Returns of Top-Performing Short-Term Bond Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)