5 Top-Performing Technology ETFs

Offerings from iShares and Invesco lead the pack.

It continues to be a resounding year for investors in exchange-traded funds that focus on technology stocks. On average, as of Sept. 12, 2023, such ETFs have gained 27.3%, while the overall stock market as measured by the Morningstar US Market index rose 17.3%.

The top performers in this category include funds focused on semiconductor stocks, which have lately been powered by the boom in artificial intelligence technologies. iShares, VanEck, and Invesco have emerged as the top names over the last one-, three-, and five-year time frames.

Investors in technology ETFs have enjoyed new momentum in 2023 after suffering an average loss of 38.5% in 2022, compared with the 19.4% loss of the overall stock market that year. The gains posted in 2023 have evened out their performance for the 12-month trailing period ending Sept. 12. During this period, technology ETFs have returned 10.8%, while the overall market gained 9.7%.

Technology Funds vs. the U.S. Stock Market

What Are Technology ETFs?

Technology portfolios buy high-tech businesses, either inside or outside the United States. Most concentrate on stocks in companies dealing with computers, semiconductors, software, networking, and the internet. A few also buy stocks in medical devices and biotechnology, and some concentrate on a single industry.

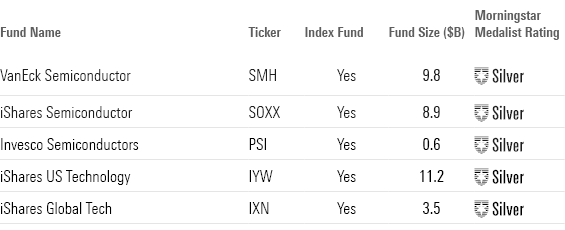

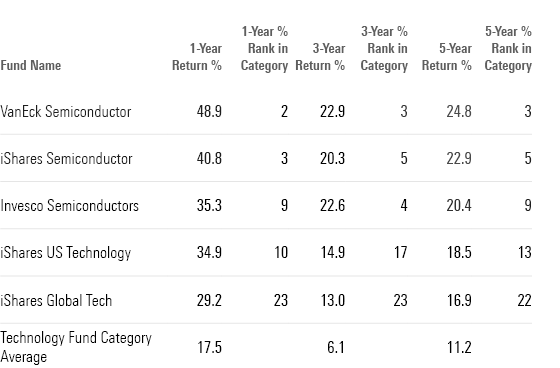

5 Top-Performing Tech Stock Funds

To screen for the best-performing ETFs in this Morningstar Category, we looked for the strategies that have posted the top returns across multiple time periods.

We first screened for the ETFs that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. Then we filtered the list for ETFs with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets and those with no Morningstar analyst input on their Medalist Ratings.

From this screen, we’ve highlighted the five ETFs with the best year-to-date performance. This group consists only of index funds, which mirror a target index’s portfolio.

Top-Performing Technology Funds

VanEck Semiconductor

- Ticker: SMH

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Over a 10-year period, this share class outperformed the category’s average return by 10.3 percentage points annualized. It also outperformed the category index, the Morningstar US Technology Index, by an annualized 4.6 percentage points over the same period. It is notable that this share class returned 36.9%, an impressive 19.4-percentage-point lead over its average peer, placing it in the top 10% of its category.

“The ETF tracks the MVIS US Listed Semiconductor 25 Index, which is intended to follow the overall performance of companies involved in semiconductor production and equipment. The top three holdings are Nvidia NVDA, Taiwan Semiconductor Manufacturing TSM, and Broadcom AVGO.”

—Morningstar Manager Research

iShares Semiconductor

- Ticker: SOXX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“This share class led its average peer by an annualized excess return of 10 percentage points over a 10-year period. It also outperformed the category index by an annualized 4.4 percentage points over the same period. It is notable that this share class returned 32.9%, an impressive 15.4-percentage-point lead over its average peer, placing it in the top 10% of its category.

“The investment seeks to track the investment results of the ICE Semiconductor Index, which is composed of U.S. equities in the semiconductor sector. The fund generally will invest at least 80% of its assets in the component securities of its index, and in investments that have economic characteristics that are substantially identical to the component securities of its index.”

—Morningstar Manager Research

Invesco Semiconductors

- Ticker: PSI

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Over the past five years, shares have returned an average of 20.4% per year, putting it in the 9th percentile of the category. For the last three years, the fund has returned an average of 22.6% a year, landing it in the 4th percentile. And for the past 12 months, the fund has been in the 9th percentile with a 35.5% gain.

“The fund is based on the Dynamic Semiconductor Intellidex Index, which is composed of common stocks of 30 U.S. semiconductor companies. These are companies that are principally engaged in the manufacture of semiconductors. The top three holdings of this fund are Intel INTC, Micron Technology MU, and Analog Devices ADI.”

—Morningstar data, company website

iShares US Technology

- Ticker: IYW

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“It has provided better returns compared with peers, but subpar returns compared with the category benchmark. Over a 10-year period, this share class outperformed the category’s average return by 5.5 percentage points annualized. However, it was more difficult to outpace the Morningstar US Technology Index, where it trailed by an annualized 14 basis points over the same period.

“This investment tracks the Russell 1000 Technology RIC 22.5/45 Capped Index. The underlying index measures the performance of the technology sector of the U.S. equity market as defined by FTSE Russell.”

—Morningstar Manager Research

iShares Global Tech

- Ticker: IXN

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This share class led its average peer by an annualized excess return of 4.2 percentage points over a 10-year period. But despite the above-average returns, it trailed the Morningstar US Technology Index by an annualized 1.4 percentage points over the same period.

“The investment seeks to track the investment results of the S&P Global 1200 Information Technology 4.5/22.5/45 Capped Index, which is composed of global equities in the technology sector.”

—Morningstar Manager Research

Long-Term Returns of Top-Performing Technology ETFs

3 Solid ETFs That Favor Tech Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)