Growth-Stock Funds Fly High but Fall Short in 2023′s First Half

Most stock-pickers missed the market’s best-performing sectors and stocks.

This article is part of Morningstar’s Q2 market review and outlook.

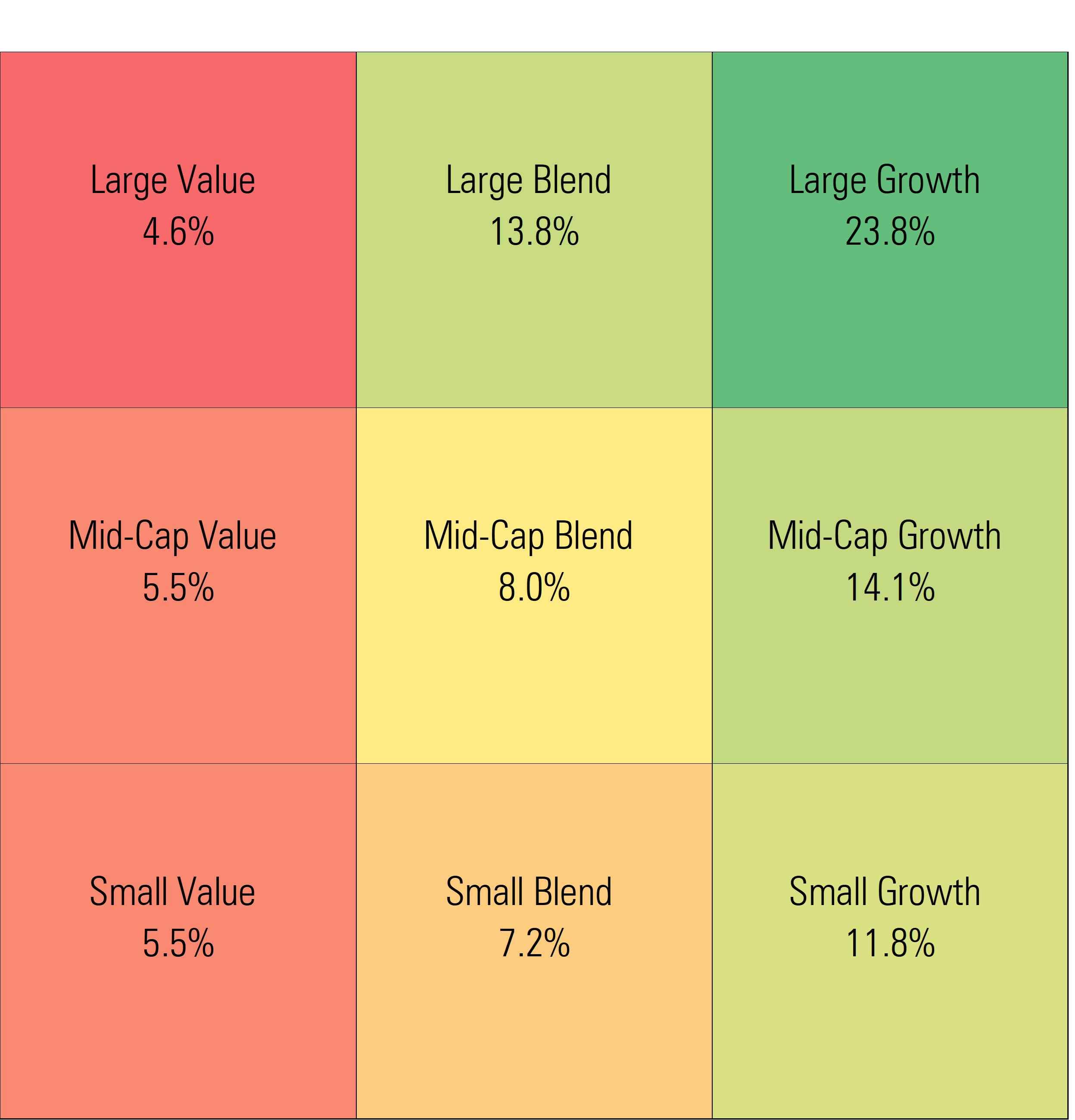

It seems reports of the demise of equity funds were greatly exaggerated. After the average actively managed funds in the large-, mid-, and small-growth Morningstar Categories plunged 28%-30% in 2022, they staged a remarkable ascent in 2023′s first half. Small-growth funds gained nearly 12%, while large-growth funds doubled that figure.

Q2 Morningstar U.S. Stock Fund Category Returns

Although many of these gains were well above historical averages for a six-month period, they also disappointed in an important way: Two-thirds of U.S.-centric active managers fell short of stylistically relevant indexes and passively managed rivals.

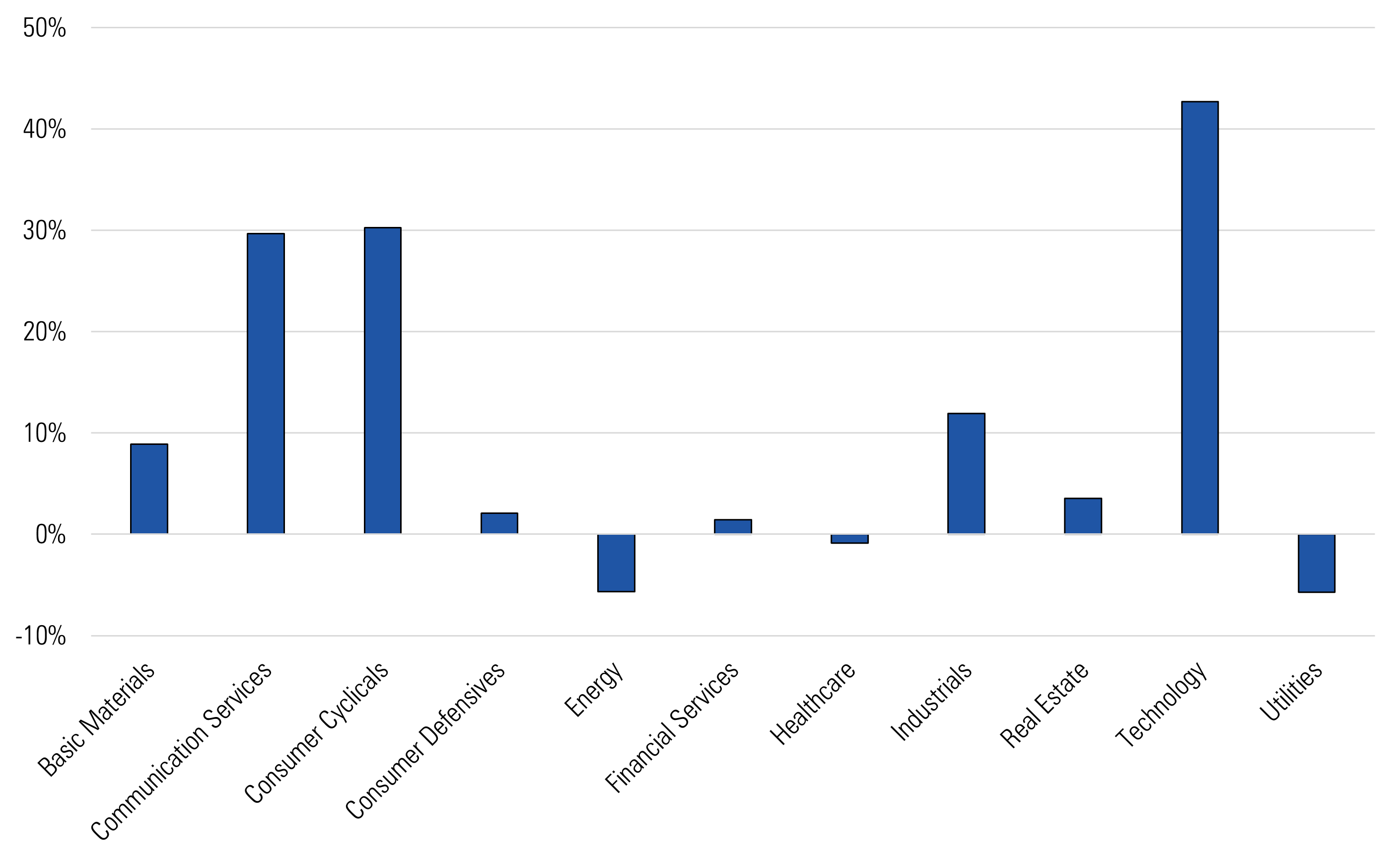

It seems part of their struggle was their untimely sector allocations in a year that so far has been an oligopoly for success. While five or six sectors beat the index in a typical year, sector leadership has been narrow in 2023, with only three besting the broad market: communication services, consumer cyclicals, and technology.

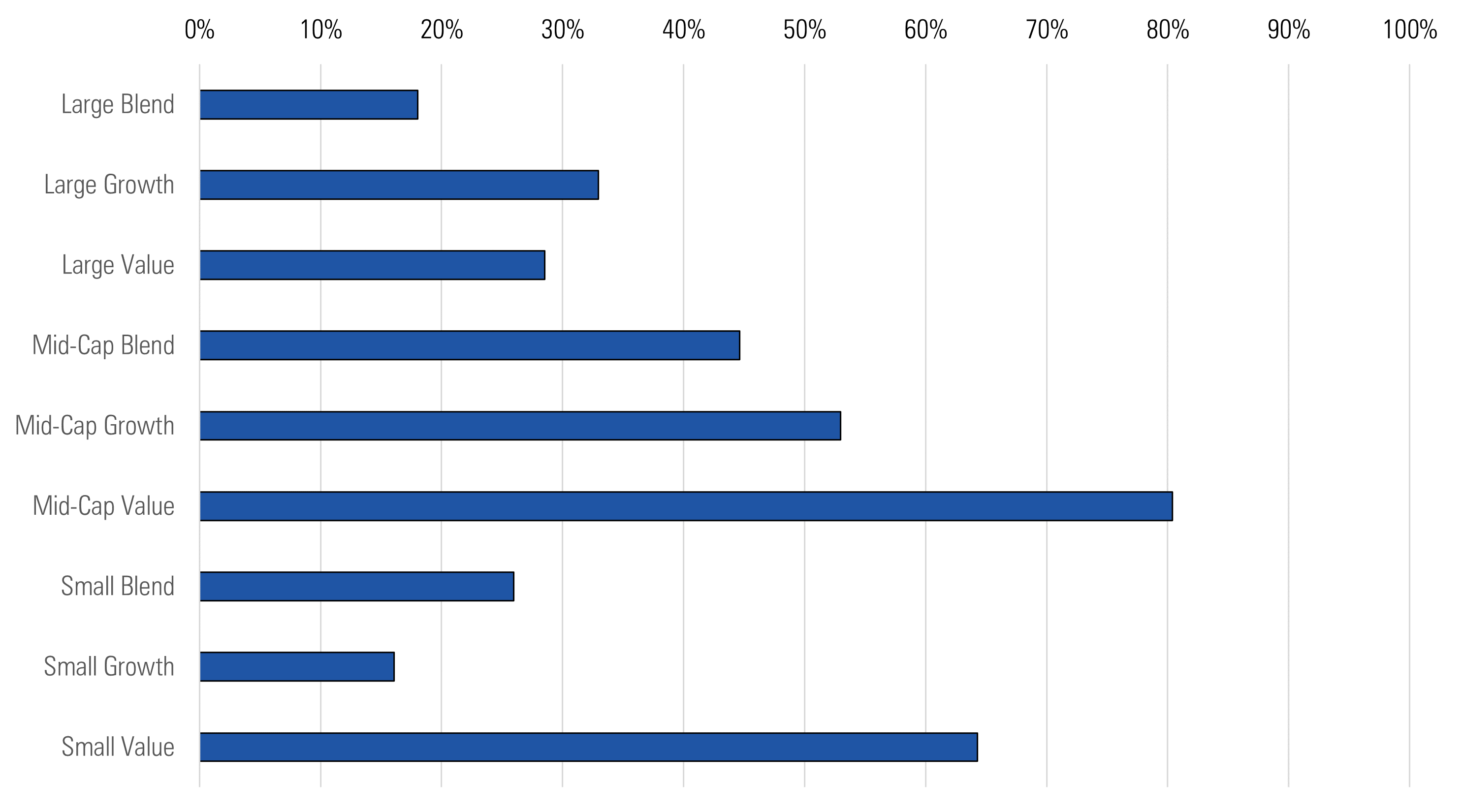

Silicon Rally

Portfolios that avoided these sectors often languished. Half of large-growth funds held a below-index stake in consumer cyclical, and more than two-thirds were underweight in technology. Most instead favored healthcare—among 2023′s worst-performing sectors thus far. On the other hand, nearly two-thirds of mid-value funds held an above-index stake in consumer cyclicals, and a few skirted technology. It’s fitting, then, that four-fifths of funds in that category outmaneuvered their Morningstar indexes.

Percentage of Actively Managed Funds That Beat Their Stylistically Similar Morningstar Indexes In H1 2023

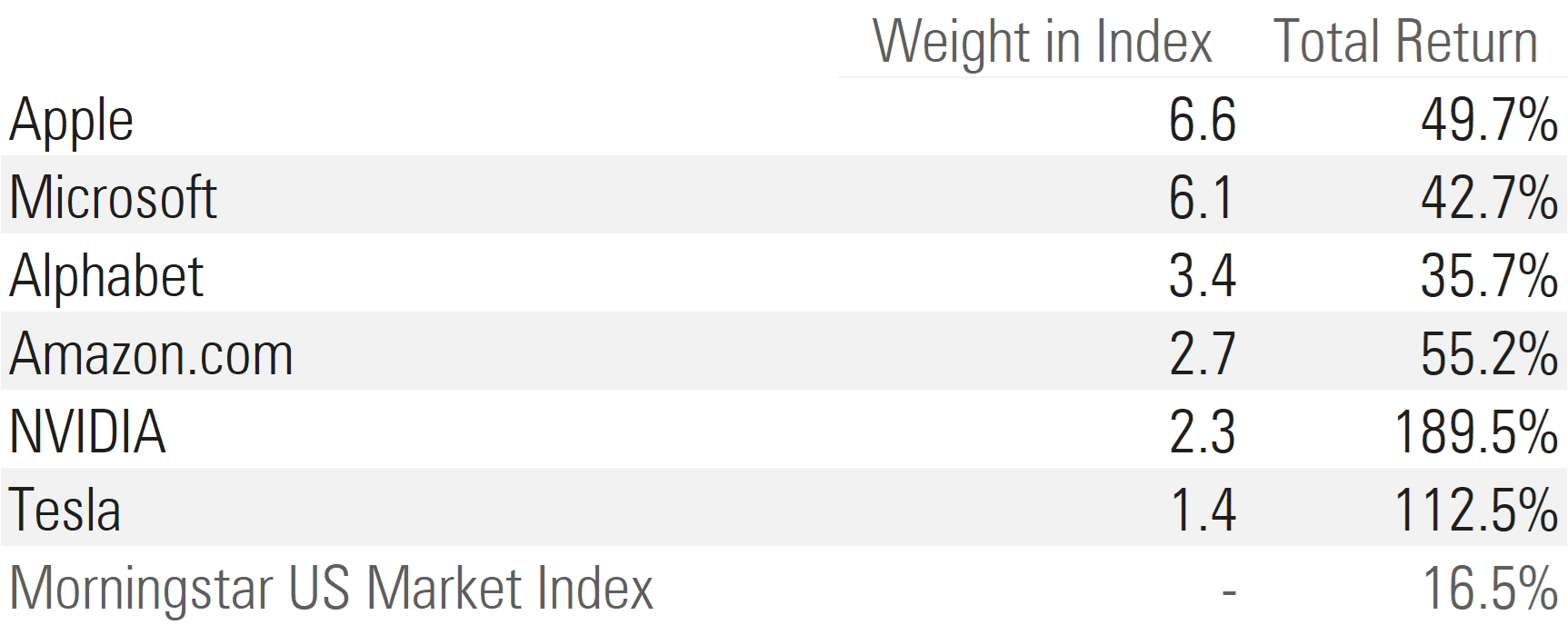

Another headwind to large-blend and large-growth funds has been the big returns to a handful of mega-cap stocks. Real enthusiasm for artificial intelligence propelled Nvidia NVDA to a stunning gain of over 170%. Alphabet GOOGL and Microsoft MSFT, whose artificial-intelligence-powered chatbots arguably kicked off the fervor, also posted impressive total returns. Tesla TSLA doubled. Apple AAPL and Amazon.com AMZN have pulled off memorable performances this year as well. Without these six stocks, the Morningstar US Large-Mid Cap Broad Growth Index’s return would have been half what it is. Many actively managed funds held relatively light stakes in them.

The Major Six Stocks of the Morningstar US Market Index

But funds with big helpings tended to notch top-decile returns. For example, ARK Innovation ARKK and Baron Partners BPTRX each climbed over 40% thanks largely to their big bets on Tesla. (The stock made up about 10% of ARK’s assets and 40% of Baron Partners’ assets as of recent filings.) Other funds reaped Nvidia’s rewards, including PGIM Jennison Growth PJFAX and sibling Harbor Capital Appreciation HACAX (they held around 7% in the stock), as well as Fidelity Blue Chip Growth FBGRX (8%). PGIM Jennison Focused Growth SPFAX and Fidelity Growth Company FDGRX each were among the heaviest Nvidia stakes, at 9%-10% of assets. Oakmark Select OAKLX did well with its 10% position in Alphabet.

Value indexes suffered from greater exposure to this year’s poorest-performing sectors. Energy stocks sank with oil prices, and rising interest rates choked utilities stocks. Within healthcare, managed-care stocks went to ground as demand for healthcare services surged and regulatory clouds darkened the horizon. The fates of regional banks were even gloomier, as they plunged nearly 30% on average amid the banking crises triggered by the implosions of SVB Financial, First Republic Bank, and Signature Bank.

Hotchkis & Wiley Mid-Cap Value’s HWMIX hefty 20% stake in energy mostly explains its bottom-third showing for 2023′s first half. Mairs & Power Small Cap MSCFX and T. Rowe Price Small-Cap Value PRSVX similarly lagged their categories, owing to their big allocations to regional banks.

International Stocks

The non-U.S. stock market was more modest. The Morningstar Developed Markets ex-US Index posted a smaller yet commendable 10% gain, which was above average for a six-month period.

Yet the international stocks lacked the extremes of U.S. stocks; returns were spread out in a more egalitarian manner. As measured by the Morningstar Developed Markets ex-North America Growth Target Market Exposure Index, international growth stocks rose by 13% while its value-focused relative logged a 9% uptick.

Like in the United States, international tech and consumer cyclical stocks ascended more than 20%, and semiconductors, auto-related, and travel and leisure stocks performed well. Non-U.S. industrials also gained 15% or more, beating their U.S. counterparts, thanks to the sterling performances of Japanese and French firms.

With around half their assets in tech stocks, Invesco Global Opportunities OPGIX, Baron Global Advantage BGAFX, and Guinness Atkinson Global Innovators IWIRX performed well. FMI International’s FMIJX above-average industrials stake helped it notch an exceptional result within its category.

Eurozone and Japanese stocks, which collectively represent nearly half of the non-U.S. developed market, outperformed the Morningstar Developed Markets ex-US Index. Meanwhile, Canada, Sweden, and the United Kingdom recorded only modest gains.

Emerging-market stocks were more subdued. The Morningstar Emerging Markets Index climbed a moderate 5.2%, buoyed by the Taiwanese and Korean tech sectors. However, the Chinese market slumped as the country’s consumer and healthcare stocks succumbed to double-digit percentage losses. Holding one-third or more of assets in Chinese stocks, T. Rowe Price Emerging Markets Stock PRMSX, Fidelity Advisor Focused Emerging Markets FAMKX, and American Century Emerging Markets AEMMX struggled within the diversified emerging-market category.

In a nutshell, the first half of 2023 was a mixed bag for international and emerging-market stocks.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)