4 Top-Performing Large-Blend ETFs

S&P 500 ETFs are among the group’s best performers.

Large-blend stock funds are among the most important building blocks for a diversified portfolio. Investors have increasingly turned to passively managed S&P 500 Index funds when putting money to work in large-blend investments, and the shift has paid off.

S&P 500 exchange-traded funds, or ETFs, rank among the best performers in the Large Blend Morningstar Category over the last five years. In 2023, large-blend ETFs had collectively gained 15.1% as of Aug. 30, 2023, while the US stock market, as measured by the Morningstar US Market Index, rose 18.0%.

Among the top-performing large-blend ETFs are offering from iShares and Vanguard. The especially low fees associated with these funds have helped them stand out.

The historical returns of ETFs are a testament to their ability to provide better market coverage. In 2022, the category lost only 17% compared to the 19.4% lost by the overall market. The gains of 2023 have helped even out returns for the trailing 12-month period ending Aug. 30, 2023. During this period, large-blend funds gained 11.7%, closely following the 12.7% gain of the overall stock market.

Large Blend Funds vs the U.S. Stock Market

What Are Large-Blend Funds?

Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large-cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate. Large-blend portfolios are fairly representative of the overall U.S. stock market in terms of size, growth rates, and price. These portfolios tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, their returns are often similar to those of the S&P 500 Index.

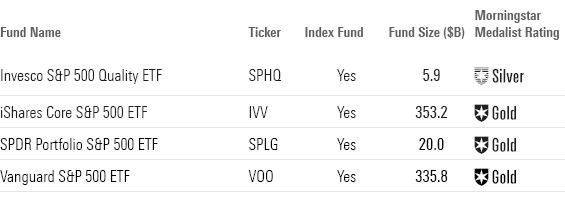

4 Top-Performing Large-Blend ETFs

To screen for the best-performing ETFs in this category, we looked for the strategies that have posted top returns across multiple time periods.

We first screened for the ETFs that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. Then we filtered the list for ETFs with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

From this screen, we’ve highlighted the four ETFs with the best year-to-date performance. This group consists only of index funds, which closely track the S&P 500—with the exception of the Invesco S&P 500 Quality ETF SPHQ, which screens for quality.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes that are not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

Top-Performing Large-Blend ETFs

Invesco S&P 500 Quality ETF

- Ticker: SPHQ

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

“Over the past five years, Invesco S&P 500 Quality ETF shares have returned an average of 11.7% per year, landing it in the 6th percentile of the category. For the last three years, the fund has returned an average of 11% a year, putting it in the 18th percentile. And for the past 12 months, the fund has landed in the 3rd percentile with a 12.4% gain.

“The fund tracks the S&P 500 Quality Index. S&P’s quality score favors more profitable companies while trying to steer clear of those that rely on debt financing or have been aggressively growing their assets. The index ranks all S&P 500 constituents by their quality score and picks the highest-ranking 100. It weights selected holdings by the product of their market cap and their quality score.”

—Bryan Armour, director

iShares Core S&P 500 ETF

- Ticker: IVV

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

“The fund’s portfolio closely resembles that of its average category peer in both style and sector allocations. Capturing the same opportunity set as its active peers emphasizes the effect of the fund’s low fee, giving it a durable advantage over the long run.

“The strategy replicates the flagship S&P 500. Rather than index rules dictating construction, an index committee has discretion over selecting stocks that meet certain liquidity and profitability standards. The index then weights the chosen constituents by their market cap.

“U.S. large-cap stocks attract liquidity and widespread attention, such that new information is quickly reflected in prices. Market-cap weighting is a sensible approach here. It harnesses the market’s collective wisdom of the relative value of each holding, with the added benefit of low turnover and associated trading costs.”

—Mo’ath Almahasneh, associate analyst

SPDR Portfolio S&P 500 ETF

- Ticker: SPLG

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“Over a 10-year period, this share class outpaced the category’s average return by 2.1 percentage points annualized. And it also outperformed the category index, the Russell 1000 Index, by an annualized 15 basis points over the same period.

“The risk-adjusted performance only continues to make a case for this fund. The share class outstripped the index with a higher Sharpe ratio (a measure of risk-adjusted return) over the trailing 10-year period. Often, higher returns are associated with more risk. However, this strategy hewed close to the benchmark’s standard deviation.

“The fund’s portfolio closely resembles its average category peer in both style and sector allocations. Capturing the same opportunity set as its active peers emphasizes the effect of the fund’s low fee, giving it a durable advantage over the long run.”

—Mo’ath Almahasneh

Vanguard S&P 500 ETF

- Ticker: VOO

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

“Vanguard S&P 500 ETF offers a broadly diversified, low-turnover portfolio of U.S. large-cap stocks at a minuscule price, giving it a durable edge over its category peers.

“Over the past five years, the fund’s shares have returned an average of 10.8% per year, putting it in the 19th percentile of its category. For the last three years, the fund has returned an average of 10.2% a year, landing it in the 31st percentile. And for the past 12 months, the fund has landed in the 31st percentile with a 6.7% gain.

“The fund’s performance fluctuates with the market, as it is always invested. Low cash drag helps during market rallies but can hurt during downturns. This fund outperformed its average peer by 4.04 percentage points during the market rally from March 24, 2020, through Dec. 31, 2021. By contrast, the fund lagged its average peer by 1.23 percentage points when markets soured in 2022.”

—Mo’ath Almahasneh

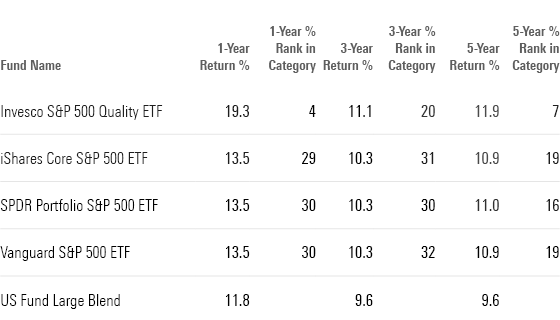

Long-Term Returns of Top-Performing Large-Blend Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)