5 Top-Performing Small-Growth ETFs

ETFs from Vanguard, State Street Global Advisors, and iShares lead the pack.

Even as the overall stock market has moved higher, it’s been a tough year for investors in small-growth stock funds.

So far in 2023, the Morningstar U.S. Market Index has gained 11.0%, while the average small-growth fund has only gained 1.5%.

Among the exchange-traded funds that focus on small-growth stocks, the ones that have posted top returns in recent years include offerings from Vanguard, State Street Global Advisors, and iShares.

Small-company stocks have been lagging the overall market for the better part of the last three years. This year, small-growth stocks have struggled, first in response to concerns about a recession and more recently thanks to the impact of rising interest rates.

For the three-year annualized return period ending Oct. 3, 2023, small-growth funds gained just 0.67% per year while the overall market gained 8.78%. Similarly, during a five-year period ending the same day, small-growth funds gained just 2.76% per year while the overall market gained 8.89% per year.

What Are Small-Growth Funds?

Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small-cap. Small-growth portfolios focus on faster-growing companies. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Small-growth portfolios tend to favor companies in up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing, their stocks tend to be volatile.

Small-Cap Growth Fund vs. the U.S. Stock Market

5 Top-Performing Small-Growth ETFs

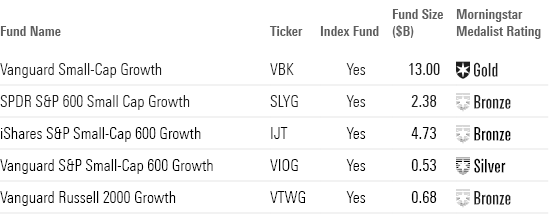

To screen for the best-performing funds in this Morningstar Category, we looked for those that have posted top returns across multiple time periods.

We first screened for funds that ranked highest in the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the five funds with the best year-to-date performance. This group only consists of index-tracking funds.

Top-Performing Small-Growth ETFs

Vanguard Small-Cap Growth

- Ticker: VBK

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 3 stars

“The fund tracks the CRSP US Small Cap Growth Index, which captures the faster-growing side of the small-cap market. Growth stocks tend to have high valuations because of investor sentiment around their superior growth prospects. These valuations represent the market’s consensus opinion, but they may not always be justified, making this a relatively volatile segment. While small-cap stocks constitute most of the fund, larger mid-cap stocks are also present, which should tamp down some volatility.

“The fund has lagged the category average by 22 basis points annually since it started tracking its current index in April 2013. Market cap weighting pushes the portfolio up the ladder slightly, resulting in less volatility than what the typical peer sees. While risk-adjusted returns still fell short, a low expense ratio and superior diversification together position the fund to carve out a solid advantage going forward.”

—Zachary Evens, associate analyst

SPDR S&P 600 Small Cap Growth

- Ticker: SLYG

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“This fund’s average market cap was just $2.4 billion as of Feb. 28, 2023, about half that of its typical peer. Average constituent size is smaller because this index is filled only after its larger siblings, the S&P MidCap 400 Index and S&P 500, claim the 900 largest profitable companies in the United States. As of February 2023, only stocks with market caps between $750 million and $4.6 billion are eligible for inclusion in the S&P SmallCap 600 Index.

“The fund’s broad reach minimizes stock-specific risk. The portfolio usually holds around 350 stocks, and only 10% of assets were concentrated in the fund’s top 10 holdings as of Feb. 31, 2023. No one position claimed more than 2% of the portfolio.

“The portfolio’s sector composition looks a little different than that of its average peer because of its smaller size and the blend stocks it holds. For example, its financial services allocation was almost 8 percentage points heavier than the category average as of January 2023. A 13% stake in healthcare stocks—9 percentage points less than the typical peer’s—makes up for much of this difference.”

—Zachary Evens

iShares S&P Small-Cap 600 Growth

- Ticker: IJT

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 3 stars

“It outpaced its typical peer by 2.96 percentage points annually for the period, with lower volatility. The fund captured 98% of the category average’s upside and only 86% of its downside over that time. Smaller stocks tend to be more volatile than larger ones, but including only profitable companies keeps risk in check in what can be a risky market segment.

“Overall, the portfolio remains a good representation of the small-growth category. Most key growth metrics are closely tied to the category average.”

—Zachary Evens

Vanguard S&P Small-Cap 600 Growth

- Ticker: VIOG

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 3 stars

“Over a 10-year period, this share class outpaced the category’s average return by 1.1 percentage points annualized. And it also beat the category index, the Russell 2000 Growth Index, by an annualized 1.5 percentage points over the same period.

“Overall, the portfolio remains a good representation of the small-growth category. Most key growth metrics are closely tied to the category average. Long-term earnings growth has moved in lockstep with the category average over the last 10 years. Approximating the category average should help this fund turn its low fee into a distinct performance advantage.”

—Zachary Evens

Vanguard Russell 2000 Growth ETF

- Ticker: VTWG

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 2 stars

“Sector composition usually mimics the average peer, and valuations tend to follow. Approximating the category average means the fund’s low fee should aid its category-relative performance.

“The fund’s average market cap is about half that of the category average. Smaller stocks tend to be more volatile than their larger peers, but they may have more room to run. The micro-cap stocks that constitute a considerable chunk of the portfolio also tend to be of lower quality than their slightly larger counterparts. The Russell 2000 Index does not incorporate any screens to limit low-quality names. Common quality metrics, like return on assets and return on invested capital, usually fall short of the average peer. This represents an extra risk that may not be rewarded in an already volatile market segment.

This fund tilts toward historically growth-friendly sectors relative to the broad market. It leans heavily into healthcare and technology stocks at the expense of communication services and financial companies. These sector biases are a source of active risk that the market may not reward over the long term.”

—Zachary Evens

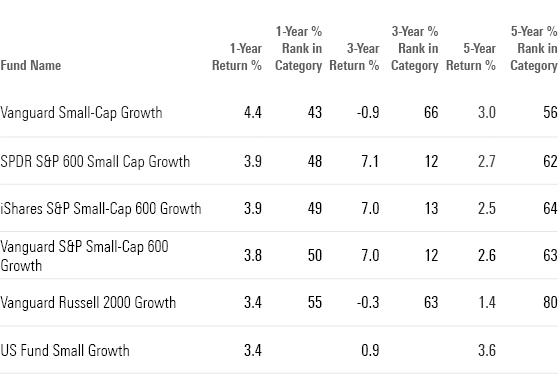

Long-Term Returns of Top-Performing Small-Growth Funds

3 High Quality Stock ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)