Which Funds Had Big Swings in 10-Year Performance Rankings?

There have been quite a few flip-flops in this turbulent year.

It was a turbulent year across financial markets, and a handful of mutual funds were taken for a ride in 2020 when it came to their performance rankings.

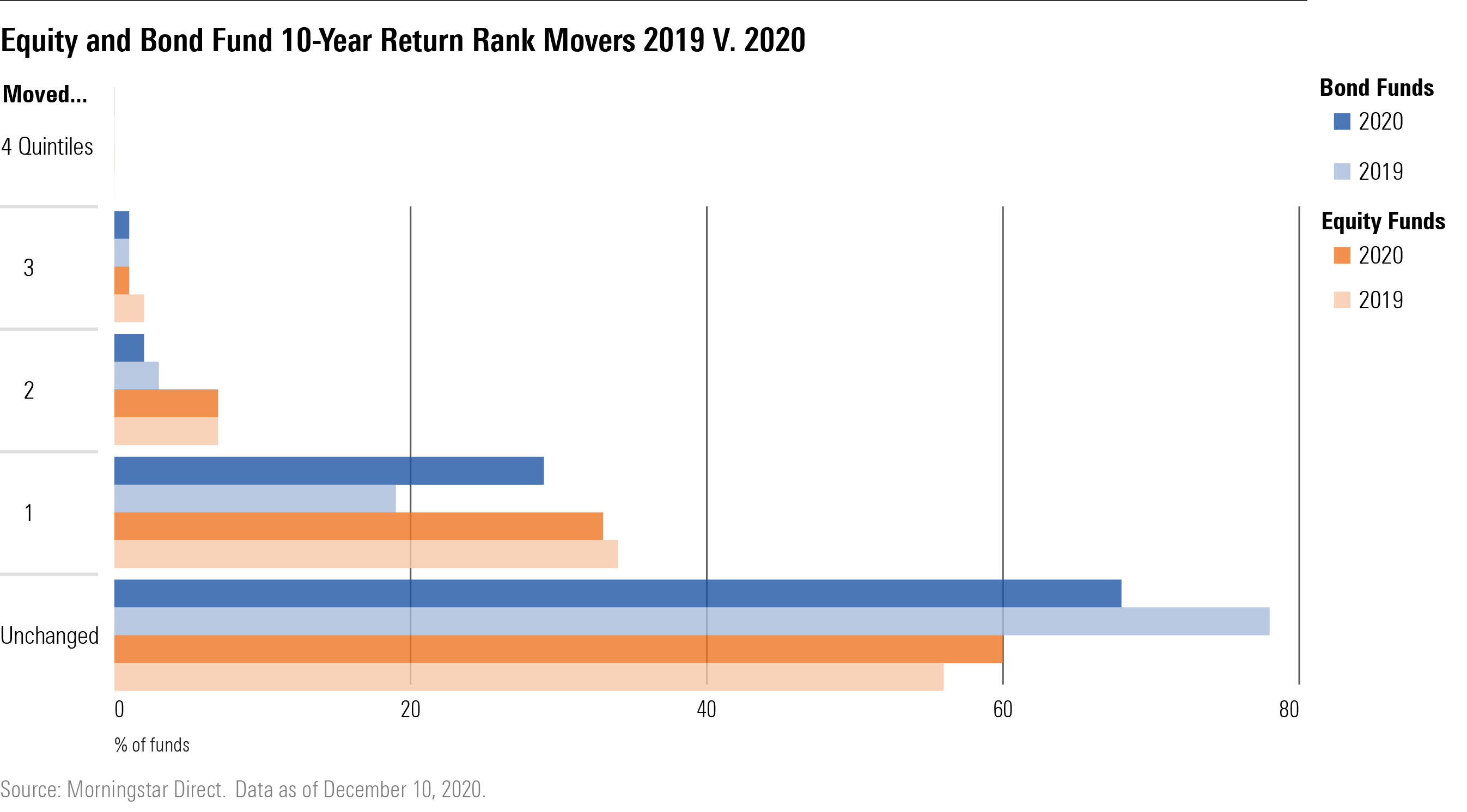

In general, fund rankings--which show a fund's performance compared with other funds in their Morningstar Categories--tend to not move much over the course of a year, especially for longer-term track records. However, dramatic reversals in markets, such as what investors experienced in 2020, can lead some funds with heavy portfolio tilts to see a sudden shift higher or lower.

We're reprising a screen that we put to work during the height of the coronavirus-related market turmoil. Our starting universe was all equity and taxable-bond funds with 10-year track records. Using performance for the funds' oldest share classes, we compared a fund's 10-year return rank in its category for two time periods, the 10-year period as of Dec. 31, 2019, and the 10-year period as of Dec. 11, 2020, and looked for funds that saw a significant change in fortune.

Out of 2,394 equity funds, 8% moved two return quintiles or more, and out of 1,253 bond funds, 3% saw the same dramatic swing.

From there we narrowed our screen to funds covered by Morningstar, including Morningstar Medalists, which are funds that have Morningstar Analyst Ratings of Gold, Silver, or Bronze. That left us with 732 stock funds and 342 bond funds.

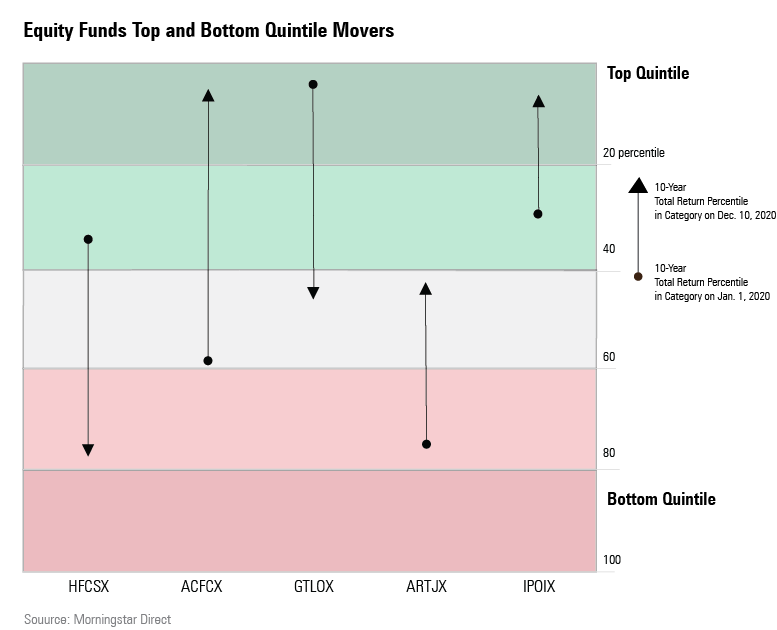

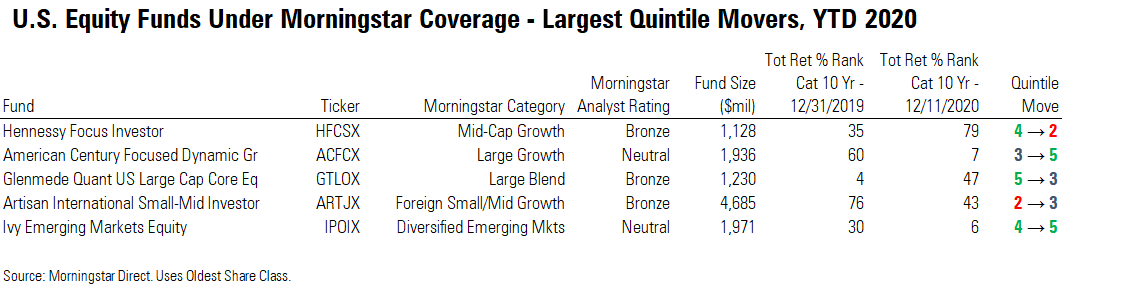

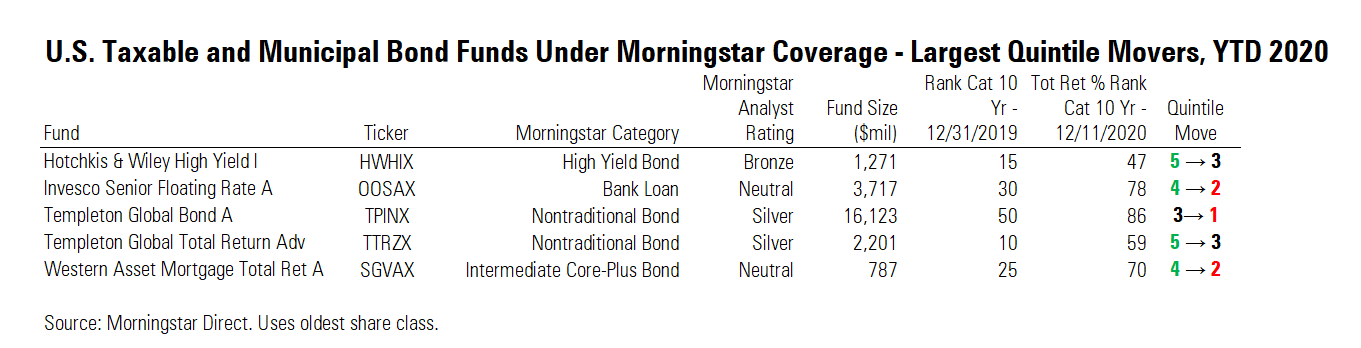

First, here's a look at the funds that moved the most. Morningstar Category performance quintiles rank the top 20% as quintile 5 and the bottom 20% as quintile 1.

Analyst-Rated U.S. Equity Funds Among equity funds covered by Morningstar analysts, three saw substantial moves. Hennessy Focus HFCSX fell two quintiles from the start of the year. Morningstar senior analyst Kevin McDevitt points to the fact that 84% of the fund's September holdings were in cyclical stocks hurt by the COVID-19 recession and "while the fund had historically outperformed during down markets, it badly lagged during 2020's first-quarter bear market."

American Century Focused Dynamic Growth ACFCX trended in the opposite direction. While once a middle-of-the-pack fund, it shot to the top by the end of 2020. Morningstar analyst Stephen Welch writes in a recent report that "the fund's most-volatile holdings have delivered its biggest gains." In 2020, the fund has outperformed the benchmark by 25 percentage points, and it has captured 97% of the index's losses while gaining 118% of the upside.

In the large-blend category, Bronze-rated Glenmede Quantitative U.S. Large Cap Core Equity GTLOX moved from the top quintile to the third. Welch says in his most recent analyst report that the fund was "weighed down by its valuation tilt and underexposure to mega-caps like Microsoft MSFT." It gained only 5.4% in 2020, 12 points less than the large-blend benchmark's gain of 17.3%.

Analyst-Rated International-Equity Funds Among foreign-equity funds on Morningstar's coverage list, a few funds made big moves. Artisan International Small-Mid ARTJX moved from the 76th to the 43rd percentile. In his recent report, analyst Jack Shannon writes that the Bronze-rated fund's 16.8% annualized return from October 2018 through August 2020 "meaningfully exceeded the 4.7% and 11.7% of the index and average peer, respectively, and the portfolio's overweightings in healthcare and technology drive a lot of this strategy's historic outperformance."

In the diversified emerging-markets category, Neutral-rated Ivy Emerging Markets Equity IPOIX gained 29.4% during the year, besting the category benchmark by 15.6 percentage points. Director of equity strategies Dan Culloton warns that performance has been solid but choppy: "The strategy topped over three fourths of its peers in 2019, while its heavy stakes in U.S.-China trade-war-impacted stocks like Geely Automobile Holdings and Brilliance China Automotive caused it to land in the category's bottom quintile in 2018."

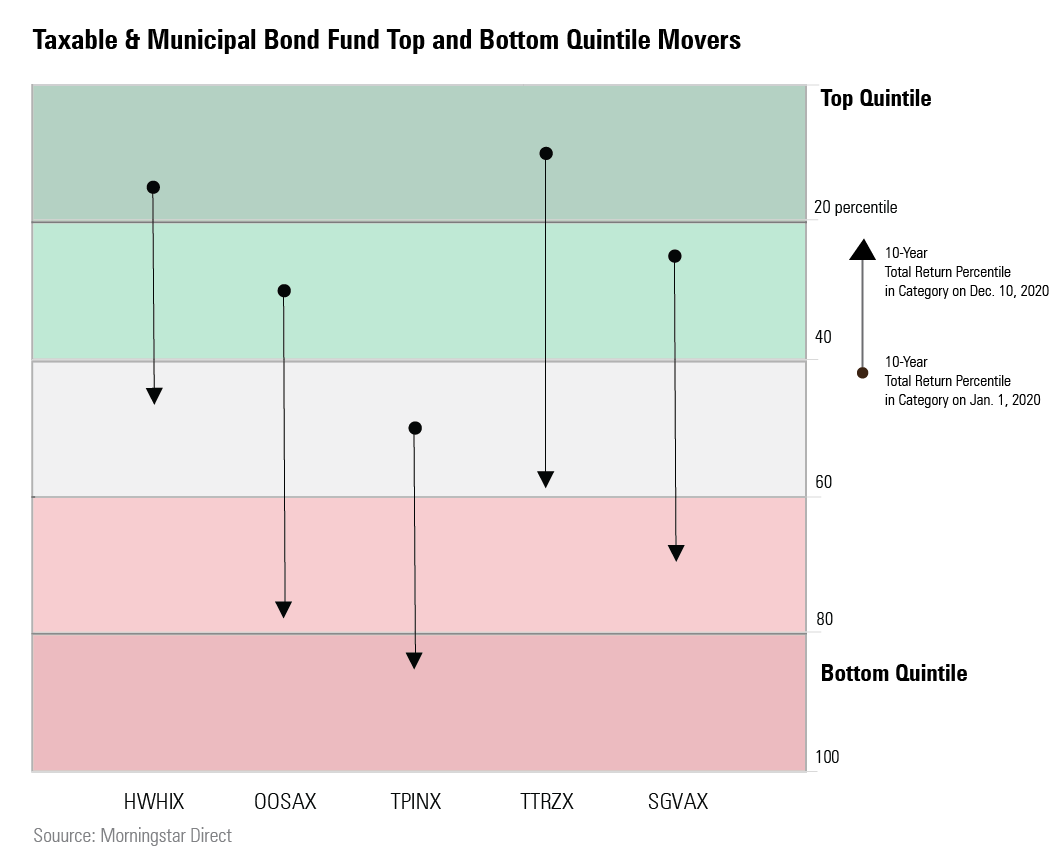

Bond Funds Among the taxable- and municipal-bond fund categories, the five funds below moved two or three quintiles in their 10-year category rank for total return between the beginning of the year and Dec. 11, 2020.

All five of the funds finished two quintiles lower than where they started at the beginning of 2020. Among the five are two Neutral-rated funds, one Bronze-rated fund, and two Silver-rated funds.

Templeton Global Bond TPINX made the list, dropping to the lowest-return quintile from the third quintile since the beginning of the year. The Silver-rated fund has lost 4.89% going into the end of 2020, ranking in the bottom quintile for the nontraditional bond category. That in turn has hurt its long-term ranks. Director of fixed-income strategies Karin Anderson says in her latest analyst report that "given the team's contrarian style and concentrated portfolio, relative performance can shift dramatically over shorter periods."

The other Franklin fund that fell in 2020 was Templeton Global Total Return TTRZX, from the top quintile to the third. The fund's high-conviction approach amplifies its risk/reward profile in the short run, says Anderson in her report. She goes on to say that the fund increased its concentration among its emerging-markets bond positions in Mexico, Brazil, and Indonesia, which hurt returns.

Hotchkis & Wiley High Yield HWHIX descended two quintiles from the top quintile at the beginning of the year. The fund lagged so far in 2020, sitting in the bottom return quintile in the high-yield bond category through Dec. 14. Senior analyst Eric Jacobson says that the fund focuses on midsize and smaller issuers, which can make it more susceptible to economic pain. Jacobson also notes that the fund has a higher tilt toward smaller issues, which are less liquid. "The fund's small-cap focus and a handful of individual credit problems put the fund behind its peers in both 2018 and 2019," he writes.

The lone bank-loan fund, Invesco Senior Floating Rate OOSAX, has also dropped two return quintiles since the beginning of the year. The Neutral-rated fund has had its fair share of struggles of late. Associate director of fixed-income strategies Brian Moriarty says in his latest analyst report that despite a new lead manager, the fund has struggled since a decline in credit markets in late 2018: "The portfolio still reflects the poor decisions that led to its current performance slide."

Some of those poor decisions, he says, include two of its largest positions: Arch Coal ARCH and Murray Energy. This pair of holdings began to fall sharply in value starting in May 2019 and continued to decline through May 2020. The fund lost 13% during that period.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)