How the Largest US Stock Funds Did Last Quarter

During Q1 2024, Fidelity Contrafund led on performance while the QQQ lagged.

For the largest US stock funds, the first quarter of 2024 picked up where 2023 left off, with the funds sporting heavier tilts toward technology and growth stocks posting stronger performances. That was especially the case for funds with big stakes in Nvidia NVDA and most of the other so-called “Magnificent Seven stocks,” including Microsoft MSFT, Amazon.com AMZN, Alphabet GOOG/GOOGL, and Meta Platforms META. (Apple AAPL struggled and Tesla TSLA dived.)

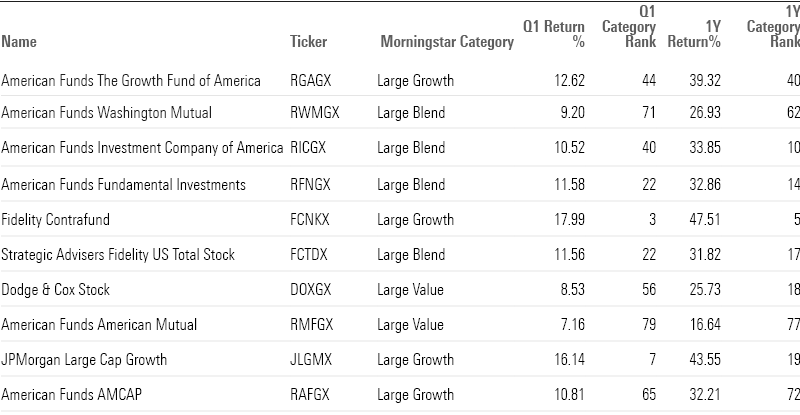

A case in point was the $132 billion Fidelity Contrafund FCNKX, which posted the strongest returns among the 10 largest actively managed US stock funds, gaining 17.99% in the quarter. Contrafund investors benefited from the fund’s big weighting in Meta, which rallied 37.33%.

A notable exception was the $258 billion Invesco QQQ Trust QQQ, which despite its 50% weighting in technology stocks saw its first-quarter returns lag well behind the average large growth fund.

For this article, performance data is based on the lowest-cost share class for each fund. Some funds may be listed with share classes not accessible to individual investors outside retirement plans. The individual investor versions of those funds may carry higher fees, reducing returns.

Largest Actively Managed US Stock Funds Q1 Performance

Largest Active Stock Funds Q1 Performance

A heavy tech stock tilt benefitted the $88 billion JPMorgan Large Cap Growth JLGMX. The fund rode gains in Nvidia and Meta, along with a big weighting in Eli Lilly LLY, which rose 43.55% in the quarter. The JPMorgan fund ranked second among the largest actively managed stock funds, with a 16% return.

The returns for both Fidelity Contrafund and JPMorgan Large Cap Growth placed the strategies in the top 20% of their Morningstar Category.

Largest Passively Managed US Stock Funds Q1 Performance

Passively managed funds were also affected by the outperformance of growth and technology stocks. The $118 billion Vanguard Growth ETF VUG posted the best performance among the ten largest index-tracking funds, with a 10.91% return in the first quarter. That was followed by the 10.55% return on the $1.1 trillion Vanguard 500 Index Institutional Select VFFSX. However, that wasn’t enough for the fund to land in the top half of the large growth category.

Invesco QQQ fared even worse, landing in the bottom 20% of all large growth funds with an 8.66% first-quarter return. That marks a change in relative performance for the fund, which outperformed 96% of all large growth funds in 2023. Morningstar’s Daniel Sotiroff says the QQQ, which tracks the Nasdaq 100, fell victim to single-stock trends. He explains that Meta and Nvidia were strong in the quarter, and top-performing funds generally tilted toward those two stocks. The remaining Magnificent Seven stocks were more mixed, with Apple and Tesla losing ground, and Microsoft’s return was on par with the category average. Those mixed trends left QQQ at a disadvantage.

Largest Passive Stock Funds Q1 Performance

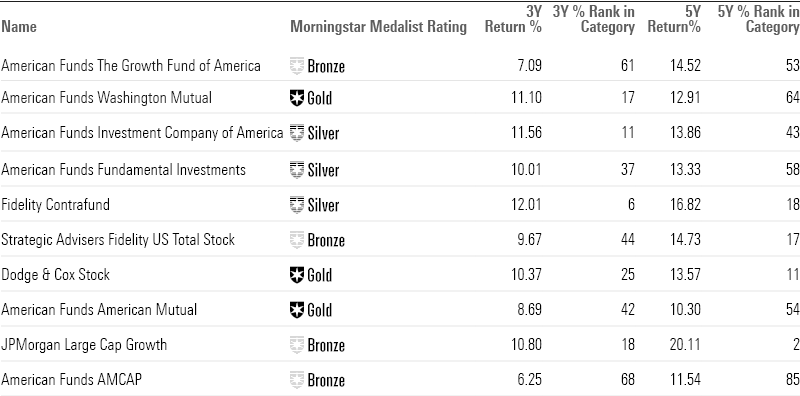

Long-Term Performance for the Largest Active Funds

Over the last three years, Fidelity Contrafund recorded the strongest highest returns among the largest active stock funds at 12.01% per year, followed by American Funds Investment Company of America RICGX with 11.56% and American Funds Washington Mutual RWMGX, up 11.10% per year.

Over the last five years, JPMorgan Large Cap Growth has provided investors with the best returns, gaining 20.11% per year, followed by Fidelity Contrafund’s 16.82% return and Strategic Advisers Fidelity US Total Stock’s FCTDX 14.73%. JPMorgan and Fidelity also rank in the top 25% of the large growth category over one-, three-, and five-year periods.

Largest Active Stock Funds Long-Term Performance

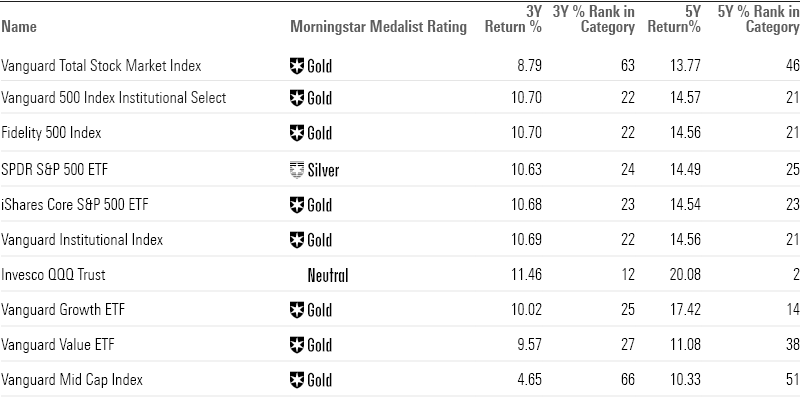

Long-Term Performance for the Largest Passive Funds

Among the 10 largest passively managed funds, eight are in the top third of their respective categories for the last three years and seven are in the top third for the past five years.

Despite its relatively poor first-quarter performance, over longer periods, Invesco QQQ holds onto its top rankings. It returned 11.46% per year over the last three years and 20.08% per year over the last five years. Vanguard Growth ETF follows close behind.

Largest Passive Stock Funds Long-Term Performance

The following are highlights from Morningstar analysts on the largest US stock funds.

Largest Active Stock Funds

American Funds Growth Fund of America

“American Funds Growth Fund of America’s experienced managers are more than capable, but its size limits their impact. It remains a decent option at the right price. The emphasis on large firms with broad market exposure has given it resilience in many down markets relative to the large-growth index. That includes 2020′s coronavirus-driven bear market. However, it lost more than both indexes in 2022. The strategy bounced back in 2023, outperforming the category and S&P 500, but lagged the growth index, as underweighting the giant-cap tech companies such as Nvidia hurt.”

—Stephen Welch, senior analyst

American Funds Washington Mutual

“This strategy is in the hands of experienced investors. Alan Berro, who heads the nine-manager team, started in the industry in the 1980s and has run money here since the late 1990s. The other eight managers each have more than 20 years of investment experience. Behind the management team sits a deep and talented analyst team, which consists of more than 100.”

—Stephen Welch

American Funds Investment Company of America

“While American Funds Investment Company of America has seen some recent changes, its experienced managers are capable leaders. After years of focusing too much on capital preservation, this strategy’s relatively new leaders are trying to steer it back to its core growth of capital and income mandate. The fund seeks a healthy mix of dividend-payers and growth names, but it has had trouble in recent years striking the right balance. To increase the managers’ flexibility, co-heads Marin Romo and Grant Cambridge decreased the strategy’s pre-yield target and expanded the team’s eligibility list of stocks.”

—Stephen Welch

American Funds Fundamental Investment

“American Funds Fundamental Investors experienced team and flexible growth-and-income approach make it a solid option for investors that understand what is under the hood. American Funds has three large-blend strategies, and this strategy’s flexible mandate has often made the most aggressive. The managers aren’t afraid to stand out from the S&P 500, and their ability to invest abroad is possibly its biggest differentiator. Indeed, its 17.9% allocation to non-US companies landed near the top of the large-blend Morningstar Category as of September 2023. The managers try to limit their non-US investments to companies that have no solid equivalent U.S. option.”

—Stephen Welch

Fidelity Contrafund

“The exceptional skill of Fidelity Contrafund’s portfolio manager outweighs the disadvantages of its massive asset base, and it has been helped recently by a sizable position in Meta Platforms. Will Danoff has successfully steered this diversified strategy through multiple market cycles, including recent ones. The fund’s roughly 13% annualized return over the past decade beat the S&P 500 (the fund’s broad-market prospectus benchmark) and ranked among the best-performing third of funds in either the large-blend or large-growth Morningstar Categories. It’s a particularly impressive feat given the strategy’s colossal asset base of more than $200 billion across all accounts, which has long limited its flexibility.

“During his [Danoff’s] tenure, the fund’s no-load share class gained 13.3% annualized through December 2023, beating the 10.7% gain of the S&P 500 (its broad-market prospectus benchmark) and the 11.1% gain of the Russell 1000 Growth Index (the large-growth category index). Its total return exceeded nearly all surviving large-cap funds.”

—Robby Greengold, strategist

Strategic Advisors Fidelity US Total Stock

“This strategy leans toward smaller, higher-growth companies compared with its average peer in the Large Blend Morningstar Category. Looking at additional factor exposure, this strategy has held more highly liquid stocks compared to Morningstar Category peers in the past few years.

“Over the past three-year period, it mirrored the benchmark Russell 1000 Index but outperformed the category average by 95 basis points. And more importantly, when looking across a longer horizon, the strategy outpaced the index. On a five-year basis, it outperformed the index by an annualized 29 basis points.”

—Morningstar Manager Research

Dodge & Cox Stock

“Dodge & Cox’s global industry analysts do thorough, bottom-up research. They look to go against the consensus view on businesses they believe have competitive advantages, good growth potential, and talented executives. Vetting ideas first in sector committees gives analysts expert, industry-relevant feedback; the portfolio managers further scrutinize analysts’ proposals with a keen eye toward portfolio construction. The managers insist on picking up cheap stocks, often taking advantage of bad news or a tough economic environment to build positions. They’ll follow fundamental research into whichever stocks or sectors look attractive.

“In addition to its thoroughness, the process is also contrarian, valuation-focused, and long-term oriented. To get its edge, Dodge & Cox’s analysts and managers want to buck the consensus view. They want stocks trading cheaply relative to their apparent competitive strength and growth prospects. They’re not afraid to look for bargains among companies facing what the team believes are temporary, surmountable challenges. They’re also willing to stick around until those companies’ fortunes improve.”

—Tony Thomas, associate director

American Funds American Mutual

“The managers use a conservative, time-tested approach. Like sibling American Funds Washington Mutual AWSHX, it focuses on dividend-paying industry leaders. This fund, though, has a higher income target, and its managers don’t need to stay fully invested.

“The fund’s eight managers and two analyst groups, who run their portfolios separately, invest primarily in competitively advantaged and attractively valued dividend-payers. (Only 5% of assets may be invested in non-dividend-payers.) When compelling equity opportunities are lacking, managers can hold cash or bonds in sizable amounts. Regardless of its cash-and-bond exposure, each portfolio must meet an above-market, pre-expense yield target to ensure the fund achieves its income goal. To keep managers from stretching for yield, however, that target is adjusted relative to the S&P 500.”

—Stephen Welch

JPMorgan Large Cap Growth

“JPMorgan Large Cap Growth’s team has handled a tricky momentum-centric approach well. The team operates a sound approach that is backed by strong fundamental research; however, an emphasis on price momentum introduces some uncertainty. The team searches for competitively positioned companies with long-term growth and margin expansion opportunities. But rather than sizing positions purely based on its fundamental conviction, the team often follows the market’s lead when it comes to building or trimming a position.

“Devulapally is not afraid to let his winners ride and often adds to positions once a stock begins to appreciate. Notably, during the 2023 surge in stock prices for companies such as Nvidia NVDA and Meta Platforms META, the team significantly increased its holdings in these companies. The portfolio’s allocation to Nvidia jumped to 5% of assets from 1%, while Meta’s allocation climbed to 5% from near zero. As of December, the strategy was slightly underweight in Nvidia and modestly overweight in Meta versus the Russell 1000 Growth Index.

“Its preference for momentum provided early tailwinds in 2024 as many stocks that ended 2023 strongly continued their rise. Its 4.3% return in January beat the 2.5% return of both the index and typical peer. Overweighting high-flying stocks like Eli Lilly LLY and underweighting struggling large caps like Tesla TSLA aided the results.”

—Andrew Redden, analyst

American Funds AMCAP

“The team focuses on reasonably priced growth stocks that it intends to hold for the long haul. It targets companies with profit potential, proven management, and businesses whose competitive advantages can sustain above-average growth. They typically steer clear of speculative fare, commodity-oriented businesses borrowing to fund growth, and turnaround plays. Company-level research combined with the managers’ distinct styles lead to a diverse portfolio of 200-220 stocks. Its sector weightings stand out from the Russell 3000 Growth Index. Since late 2017, the fund has had mid- to high-single-digit overweightings in healthcare stocks such as Abbott Laboratories ABT, which the managers initially got at a discount by buying a firm Abbott subsequently acquired.

—Stephen Welch

Analyst Insights: Largest Passive Stock Funds

S&P 500 Funds

Vanguard 500 Index Institutional Select

“The bedrock of this strategy is market-cap weighting, which harnesses the market’s collective wisdom of the relative value of each holding with the added benefit of low turnover and associated trading costs. It’s a sensible approach because the market tends to do a good job pricing large-cap stocks. The companies in this portfolio attract liquidity and widespread investor attention, such that prices reflect new information quickly.”

—Mo’ath Almahasneh, associate analyst

SPDR S&P 500 ETF Trust

“After declining 18% in 2022 owing to high inflation and increased economic uncertainty, the S&P 500 staged a comeback in 2023. It returned 26% as a few names and sectors powered gains. Technology, communication services, and consumer cyclical stocks outperformed the market by a large margin, which this strategy captured through its broad reach and market-cap weighting.”

—Mo’ath Almahesneh

Fidelity 500 Index

“Over a 10-year period, this share class outperformed the category’s average return by 2.2 percentage points annualized. And it also exceeded the return of the category benchmark, the Russell 1000 Index, by an annualized 28 basis points over the same period.”

—Morningstar Manager Research

iShares Core S&P 500 ETF

“Because of the strategy’s bias toward the largest and the most established companies, it misses out when small-cap stocks outperform large-cap stocks, as in the fourth quarter of 2020. The S&P 500 lagged the Morningstar US Market Index—which includes large-, mid-, and small-cap stocks—by 2 percentage points over the fourth quarter of 2020. Likewise, the strategy can become top-heavy during periods of consolidation among top U.S. companies. This exposes the funds to U.S. market risks should another dot-com-type bubble burst, during which the S&P 500 fell over 40% back in the early 2000s.”

—Mo’ath Almahasneh

Vanguard Institutional Index Instl Pl

“Because of the strategy’s bias toward the largest and the most established companies, it misses out when small-cap stocks outperform large-cap stocks as they did in the fourth quarter of 2020. The S&P 500 lagged the Morningstar US Market Index (which includes large-, mid-, and small-cap stocks) by 2 percentage points over the fourth quarter of 2020. Likewise, the strategy can become top-heavy during periods of consolidation among top U.S. companies. This exposes the funds to U.S. market risks should another dot-com-type bubble burst, during which the S&P 500 fell over 40% in the early 2000s.”

—Mo’ath Almahasneh

Tracking Other Indexes

Vanguard Total Stock Market Index Institutional Select

“Vanguard Total Stock Market funds offer highly efficient, well-diversified, and accurate exposure to the entire U.S. stock market while charging rock-bottom fees—a recipe for success over the long run. This portfolio tends to diversify away from stock-specific risk. As of December 2023, its top 10 holdings represented 26% of the portfolio, generally much lower than peers. However, the share of assets in the largest holdings steadily climbed in 2023, reflecting the market’s narrow rally. The recent outperformance of the Magnificent Seven ballooned the top 10 holdings to 27% of assets at the end of November 2023, the highest percentage since the benchmark’s inception.”

—Mo’ath Almahasneh

Invesco QQQ Trust

“Invesco QQQ Trust QQQ admits only stocks that trade on the Nasdaq exchange, which arbitrarily restricts its opportunity set, breeds concentration, and casts doubt on the durability of its tremendous returns. The rules underpinning the construction of the Nasdaq-100 Index, which this fund tracks, are borne out of Nasdaq’s desire to promote its exchange—not investment rationale. The benchmark plucks the 100 largest nonfinancial firms listed on the Nasdaq and weights them by market capitalization. It automatically excludes stocks listed elsewhere, which shrinks the fund’s opportunity set for no economic reason. Some of the large-cap market’s best recent performers, like Eli Lilly and Merck, are precluded from the portfolio because of their New York Stock Exchange listing. And should one of the fund’s marquee holdings move from the Nasdaq, the fund would have to sell it.”

—Ryan Jackson, analyst

Vanguard Growth ETF

“The fund tracks the CRSP U.S. Large Cap Growth Index, which captures the growth-oriented side of the large-cap market. Growth stocks tend to have high valuations because of positive investor sentiment around their superior growth prospects. While growth stocks constitute most of the fund, value, and blend stocks are also present, which should steady the fund when its growth holdings can’t meet their lofty expectations.”

—Zachary Evens, analyst

Vanguard Value ETF

“The fund replicates the CRSP US Large Cap Value Index, which selects cheaper large-cap stocks and weights them by their market cap. These companies have modest valuations that reflect their dimmer outlooks. However, performance relative to expectations is what counts, and these firms’ meager valuations are a lower hurdle to deliver solid returns.”

—Mo’ath Almahasneh

Vanguard Mid Cap Index InstitutionalPlus

“The fund diversifies risk effectively and tames concentration. Assets in the top 10 holdings constituted only 7% of the portfolio, 8.5 percentage points lower than the average mid-cap blend fund. In addition, its style and sector allocations accurately mimic its average peer in the mid-blend category. No sector deviated by more than 2 percentage points from the average peer. These qualities emphasize the fund’s cost advantage in driving category-relative performance.”

—Mo’ath Almahasneh

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)