6 Top-Performing Large-Value ETFs

Offerings from iShares, Vanguard, and SPDR top the list of the best funds in this category.

Exchange-traded funds focused on large-value stocks have had a tough run lately. However, as investors saw in 2022 when value strategies outperformed the overall market, these ETFs can still contribute to a diversified portfolio.

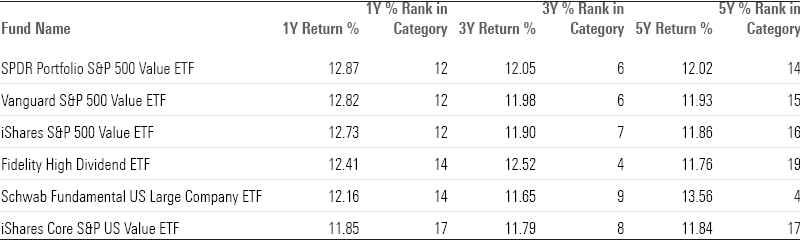

Looking at large-value ETFs, many of the ones with the best outcomes tracked value stocks in the S&P 500. In addition, all of the top six performers were index funds; no actively managed stock strategies made the cut. The best-performing funds over the past one-, three-, and five-year time frames include offerings from SPDR, Schwab, Vanguard, Fidelity, and iShares.

- iShares Core S&P US Value ETF IUSV

- Fidelity High Dividend ETF FDVV

- Schwab Fundamental US Large Company ETF FNDX

- iShares S&P 500 Value ETF IVE

- Vanguard S&P 500 Value ETF VOOV

- SPDR Portfolio S&P 500 Value ETF SPYV

Large-Value Stock ETF Performance

The past year has been underwhelming for investors in large-value ETFs. The average fund in this category is up 6.7% over the last 12 months, compared with the overall market’s gain of 19.3% as measured by the Morningstar US Market Index. Value stocks have been left in the dust as investors have favored high-growth companies, especially big technology stocks.

It’s not all bad news for value investors, however. Thanks to returns in 2022, over a three-year period, large-value funds outperformed the market by 0.6 percentage points per year. But value again lags on a five-year scale, with the US Market Index outperforming the large value stock fund category by 4.2 percentage points.

Large Value Funds vs. the U.S. Stock Market

What Are Large-Value Funds?

Large-cap stocks are those within the top 70% of the capitalization of the U.S. equity market. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow). Large-value funds invest in U.S. companies that are less expensive or growing slower compared to other large-cap stocks.

Screening for the Top-Performing Large-Value ETFs

To find the best ETFs in this category, we looked for those that have posted the top returns across multiple periods.

We first screened for the ETFs that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. Then we filtered for the funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

From this screen, we’ve highlighted the six ETFs with the best one-year performance.

Top-Performing Large-Value ETFs

Fidelity High Dividend ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Fidelity High Dividend ETF sidesteps the common perils of investing in high-yield stocks, making it an attractive strategy that should deliver strong yield and stack up well against the Russell 1000 Value Index long-term. This index strategy takes a well-rounded approach to stock selection. Yield, measured relative to stocks’ sector peers, mainly drives the process. This can invite risk because the highest-yielding stocks are often some of the weakest. The fund combats that by incorporating payout ratio and dividend growth—signals of financial health—into stock selection.”

—Ryan Jackson, analyst

iShares Core S&P US Value ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“The fund samples the S&P 900 Value Index, which pulls in the cheaper half of U.S. large- and mid-cap stocks, then weights them by market cap. These stocks attract widespread investor attention and tend to be priced more accurately than small-cap companies. This makes market cap weighting a sensible approach. It allows constituent weights to fluctuate with their prices, bypassing the need to rebalance stock positions outside of companies added or removed from the index. This, along with index buffers, helps reduce turnover and the associated trading costs.”

—Mo’ath Almahasneh, associate analyst

Schwab Fundamental US Large Company ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Schwab Fundamental US Large Company takes a contrarian approach, fundamentally weighting its portfolio holdings and following a strict rebalancing schedule. Its broad reach, low turnover, and demonstrated ability to excel when valuations mean-revert make it an attractive option.

“The investment seeks to track as closely as possible, before fees and expenses, the total return of the Russell RAFI US Large Company Index. The fund normally will invest at least 90% of its net assets (including any borrowings for investment purposes) in stocks in the index.

“This fund makes its bacon with abrupt periods of outperformance. It’s constructed to benefit from distinct periods of mean-reversion, such as the aftermath of the early 2020 pandemic-fueled drawdown. The fund can look lethargic at times, but its breakout periods should compensate for its quieter stretches.”

S&P Value Tracking Funds

iShares S&P 500 Value ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

SPDR Portfolio S&P 500 Value ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

Vanguard S&P 500 Value ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

Top-Performing Large-Value ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)