11 Top-Performing Large-Value Funds

Dodge & Cox, Oakmark, and Vanguard are among the 11 funds we found with the best returns.

The last few years have brought many ups and downs for investors in large-value stock funds, but a handful of these funds have consistently provided category-beating returns.

The best-performing large-value funds over the last one-, three-, and five-year periods have tended to overweight technology and consumer cyclical stocks while underweighting the healthcare and energy sectors. The top performers include Oakmark OANMX, Oakmark Select OANLX, and Artisan Value APHLX. Fidelity Investments, Vanguard, and Dodge & Cox also have funds among the top ranks.

Large-Value Stock Fund Performance

For most of the last five years, large-value funds have posted weaker returns than large-blend and large-growth funds. The exception came during the 2022 bear market, when these funds posted smaller losses than growth funds. But in 2023, as growth stocks powered ahead thanks to technology companies, value once again lagged.

In 2023, the category underperformed the overall stock market as measured by the Morningstar US Market Index by 15 percentage points. However, thanks to relatively better performance in 2022, the average returns for large-value funds look better over a three-year period, during which they outperformed the market by 0.84 percentage points per year. But a mixed picture comes through again when looking at five-year returns. Over this time, large value underperformed the market by 3.81 percentage points per year.

Large Value Fund Category Performance

What Are Large-Value Funds?

These funds invest in the stocks of big U.S. companies that are less expensive or are growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large-cap. Value is defined based on low valuations, such as low price ratios and high dividend yields, as well as slow growth, which can mean low growth rates for earnings, sales, book value, and cash flow.

Screening Large-Value Funds

To find the top-performing large-value funds, we looked at returns data from the past three years. We screened for the open-ended funds and exchange-traded funds that ranked in the top 25% of the category using their lowest-cost share classes over the past one-, three-, and five-year periods. We also filtered for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze, and excluded funds with asset bases under $100 million and analyst coverage thresholds under 80%. This left us with 11 funds. Six are index funds, and the remaining five are actively managed.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes that are not accessible to individual investors outside of retirement plans, or they may be aimed at institutional investors and require very large minimum investments. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders. In addition, Medalist Ratings may differ among share classes of a fund.

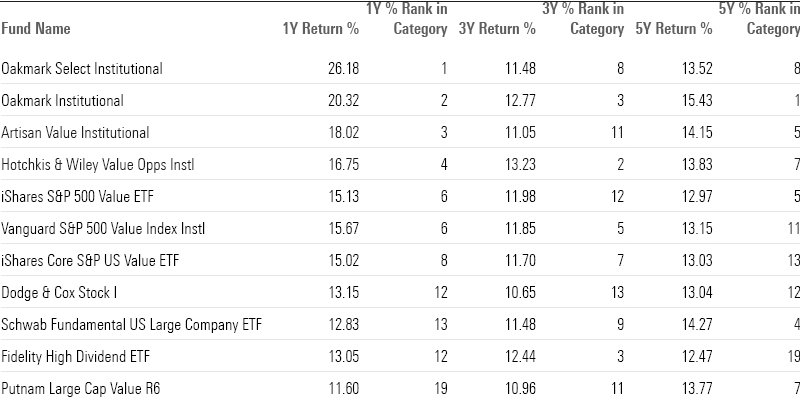

Top Performing Large Value Funds

The Top-Performing Large Value Funds

Here’s a closer look at the best-performing large-value stock funds, along with commentary from Morningstar analysts.

Oakmark

- Medalist Rating: Gold

“Manager Bill Nygren and his team ascribe to three key tenets. They target cheap large-cap stocks—more explicitly, those trading at least 30% below the team’s estimate of their intrinsic value. They want companies that can grow their per-share value at least as fast as the S&P 500. And they believe that the management teams best suited to deliver such results are those that think and act like owners.

“The team’s analysts then adroitly follow these principles in their research. They pore over public documents, conduct numerous site visits and meetings with management, and tailor their valuation models to the unique features of a business or its industry. Among many tools, they’ll use sum-of-the-parts analyses, comparisons with private-market deals, and merger-and-acquisition activity to assess a company’s worth.”

Oakmark Select

- Medalist Rating: Silver

“The strategy adopts many key features from Oakmark, but it’s not simply a ‘best of’ collection. The two offerings share core principles. They seek stocks trading at least 30% below an estimate of a company’s true worth. To close that gap, such companies should have effective management teams and a clear path to increasing per-share value. Analysts at Harris Associates, which advises both strategies, have liberal views of valuation and use (among other tools) sum-of-the-parts analyses, relevant merger-and-acquisition activity, or comparisons based on key fundamental data (such as sales or subscriber growth) to develop their estimates. But here, the end portfolio is relatively small: only 20-25 holdings versus Oakmark’s 40-60. Individual holdings can be quite large—up to 10% of assets each—and a few more mid- and small-cap companies are likely to find a place here rather than at Oakmark.”

—Tony Thomas, associate director

Artisan Value

- Medalist Rating: Bronze

“The team looks for large- and mid-cap firms that trade cheaply relative to the strength of their business models and balance sheets. The managers typically favor higher-quality fare compared with the Russell 1000 Value Index, although its high-conviction approach can look out of step with the market at times. The portfolio typically holds 30-40 names. The managers have found valuations for stable fare to be lofty and have favored cyclical sectors for most of the fund’s history. That hasn’t always paid off, but they have shown patience. They also invest up to about 20% of assets in high-quality growth names.”

—Drew Carter, analyst

Hotchkis & Wiley Value Opps Instl

- HWAIX

- Medalist Rating: Bronze

“Hotchkis & Wiley uses the same contrarian value philosophy across its equity strategies, but this one has the most leeway. It invests across the market-cap spectrum, though small- and mid-cap stocks must clear higher hurdles than large caps. It also invests across the capital structure, buying high-yield and convertible bonds when prices are attractive. It may invest in special situations, such as risk arbitrage, and may buy stakes in private firms. It often has sizable non-U.S. equity positions, and it hedges currency exposure opportunistically.”

—Paul Olmsted, senior analyst

iShares S&P 500 Value ETF

- IVE

- Medalist Rating: Silver

“A sound investment process and strong management team underpin our Medalist Rating of Silver. The fund accurately captures the opportunity set available to its category peers.”

—Mo’ath Almahasneh, associate analyst

Vanguard S&P 500 Value Index Instl

- VSPVX

- Medalist Rating: Silver

“The fund’s sector allocations did not deviate from the category average by more than 7% as of March 2023. However, this changed toward the end of 2022. Compared with its average peer, the fund now overweights technology and consumer cyclical stocks by 6 and 3 percentage points, respectively, while underweighting healthcare and energy. When calculating stocks’ growth scores, the index considers their momentum over the trailing 12 months. Cheaper companies can meet the momentum criteria during value rallies, as happened in 2022 when value stocks were among the bear market’s most resilient. The S&P index rebalanced in December 2022, and the fund increased its exposure to newly undervalued sectors. However, such changes should wash out as valuations mean-revert over the long run.”

iShares Core S&P US Value ETF

- IUSV

- Medalist Rating: Silver

“The fund samples the S&P 900 Value Index, which pulls in the cheaper half of U.S. large- and mid-cap stocks and then weights them by market cap. These stocks attract widespread investor attention and tend to be priced more accurately than small-cap companies. This makes market-cap-weighting a sensible approach.”

Dodge & Cox Stock I

- DODGX

- Medalist Rating: Gold

“Dodge & Cox’s global industry analysts do thorough bottom-up research. They look to go against the consensus view on businesses they believe have competitive advantages, good growth potential, and talented executives. Vetting ideas first in sector committees gives analysts expert, industry-relevant feedback; the portfolio managers further scrutinize analysts’ proposals with a keen eye toward portfolio construction. The managers insist on picking up cheap stocks, often taking advantage of bad news or a tough economic environment to build positions. They’ll follow fundamental research into whichever stocks or sectors look attractive.”

Schwab Fundamental US Large Company ETF

- FNDX

- Medalist Rating: Silver

“The Russell RAFI US Large Company Index, which underpins this fund, selects stocks representing the largest 87.5% of the Russell 3000 Index as measured by their fundamental size. The index uses five-year averages for each of these metrics to limit turnover and reduce the impact of one-year fluctuations. Russell combines these three measures into one composite value to determine stocks’ fundamental size—its weight in the index.”

—Ryan Jackson, analyst

Fidelity High Dividend ETF

- FDVV

- Medalist Rating: Silver

“Fidelity High Dividend ETF sidesteps the common perils of investing in high-yield stocks, making it an attractive strategy that should deliver strong yield and stack up well against the Russell 1000 Value Index long-term.

“This index strategy takes a well-rounded approach to stock selection. Yield, measured relative to stocks’ sector peers, mainly drives the process. This can invite risk because the highest-yielding stocks are often some of the weakest. The fund combats that by incorporating payout ratio and dividend growth—signals of financial health—into stock selection. It also screens out firms with the worst payout ratios, as their dividends can belie their shaky outlooks. Some sinking stocks will slip through the cracks, but these measures reject many of the market’s riskiest firms and breed a high-quality portfolio.”

—Ryan Jackson, analyst

Putnam Large Cap Value R6

- PEQSX

- Medalist Rating: Silver

“Managers Darren Jaroch and Lauren DeMore effectively combine quantitative screening and fundamental analysis to support this relative-value strategy. The screens generate most ideas, and once Jaroch and DeMore agree that a stock is promising, analysts perform more due diligence to gain comfort with the management team and the durability of earnings growth.

“The team wants stock-picking, rather than sector bets or factor tilts, to drive performance. As a result, the managers keep sector and stock weightings within 5 percentage points of the Russell 1000 Value Index and closely monitor the portfolio’s factor exposures. At the industry level, the portfolio has been heavier on software companies largely owing to its 3.1% allocation to out-of-benchmark holding Microsoft MSFT as of March 2023.”

—David Carey, analyst

Long-term Returns for Top-Performing Large Value Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)