How the Largest Stock Funds Performed In 2023

Invesco QQQ leads the pack with its big tech exposure.

In 2023, the performances of the most widely held U.S. stock funds came down to one key factor: exposure to growth stocks.

The last quarter of the year brought a market surge for traditional funds and exchange-traded funds with large holdings in growth stocks and technology, especially those that held percentages of the Magnificent Seven: Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL/GOOG.

The Invesco QQQ Trust QQQ had a banner year, posting a 40.1% gain. The ETF is nearly 50% tech stocks, with another 15% in communications services, and it outperformed 96% of all other large-growth funds.

In contrast, American Funds AMCAP RGAGX, which holds 24% in tech and roughly 8% in communications services, gained 24% in 2023. That was behind the overall 26.4% rally in the Morningstar US Market Index, leaving the fund in the bottom half of the large growth category.

Overall, the market’s trends were favorable to the largest U.S. stock funds, each of which are index funds tracking the S&P 500. All four finished 2023 ahead of at least 70% of other large-blend funds.

| Name | Ticker | 2023 Category Rank |

|---|---|---|

| SPDR S&P 500 ETF | SPY | 30 |

| Fidelity 500 Index | FXAIX | 26 |

| iShares Core S&P 500 ETF | IVV | 26 |

| Vanguard 500 Index | VFFSX | 26 |

Over a three-year period, the higher returns belonged to the largest actively managed funds. Dodge & Cox Stock DOXGX finished 2023 with an average annual return of 13.1%, and American Funds Washington Mutual Funds RWMGX has returned 11.5% per year for the last three years.

Over a five-year period, passive funds are on top, with a 21.9% average annual return for Invesco QQQ and 18.7% per year for Vanguard Growth ETF VUG.

For this article, performance data is based on the lowest-cost share class for each fund. Some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

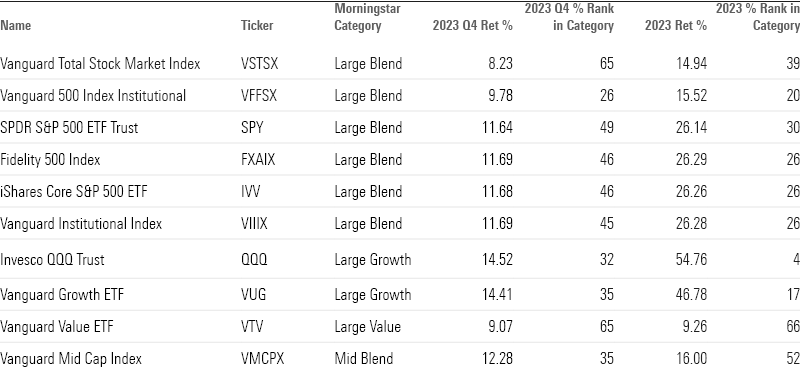

2023 Performance for the Largest Index Funds

Out of the 10 largest U.S. stock index funds, seven ranked in the top third of their category. The exceptions include Vanguard Value ETF VTV, which holds just a combined 14% of its portfolio in tech and communications services. This is similar to the Vanguard Mid Cap Index, which has roughly 23% in the two sectors.

Index Fund Performance

2023 Performance Largest Active U.S. Stock Funds

Among actively managed U.S. stock funds, the best performer was Fidelity Contrafund FCNKX. With a nearly 12% stake in Meta (up 194% in 2023), the large-growth strategy gained nearly 40% in 2023.

But from a category-beating perspective, American Funds Investment Company of America RICGX posted the best performance.

Active Fund Performance

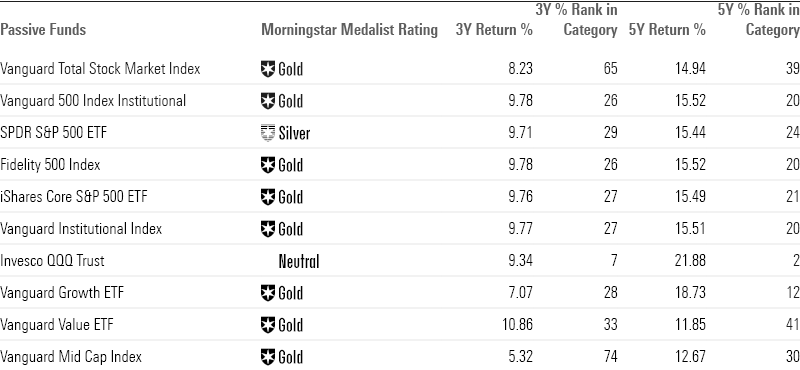

Largest Passive U.S. Stock Funds Longer-Term Performance

Even though the Vanguard Mid Cap Index holds a heavier weighting in tech stocks than its average peer, the fund posted the lowest three-year returns among the largest funds, at 5.32% per year.

At the other end of the spectrum is Vanguard Value, which is up 10.9% per year over the last three years, reflecting the outperformance of value stocks during that period, which includes the brutal bear market for growth stocks in 2022.

Long-term Performance of Index Funds

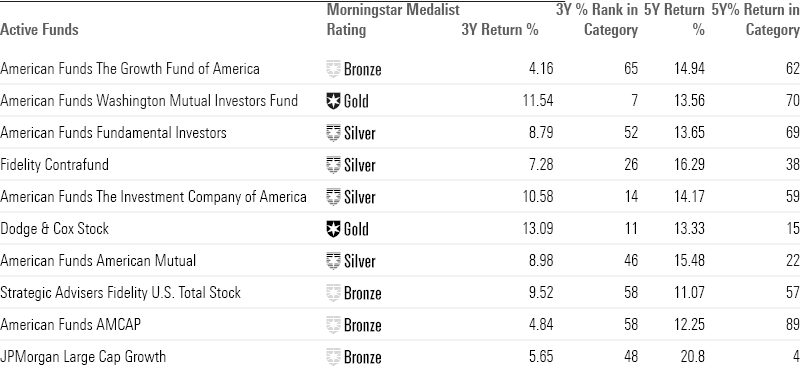

Largest Active U.S. Stock Funds Longer-Term Performance

American Funds Washington Mutual posted the largest gains over the last three years among active funds, at 11.5%. For passive funds, Vanguard Value ETF led the pack, with an average annual return of 10.9% over that time frame.

Over the past five years, growth funds have held the edge over blended and value funds. Among passive funds, Invesco QQQ Trust gained 21.9% per year for the last five years. Among active funds, JPMorgan Large Cap Growth JLGMX is the best performer, with an annualized return of 20.8%.

Long-term Performance of Active Funds

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)