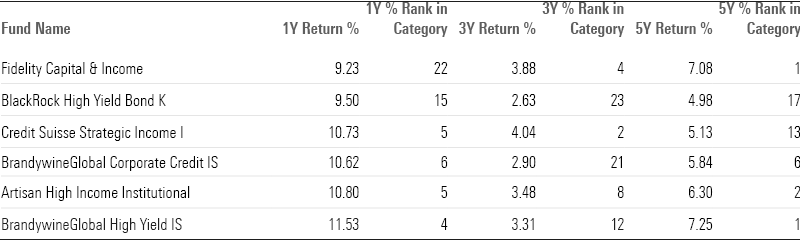

6 Top-Performing High-Yield Bond Funds

Offerings from Fidelity, BlackRock, and BrandywineGlobal top the list.

With investors optimistic about the economy avoiding recession and the Federal Reserve cutting interest rates, high-yield bond funds have continued an impressive run. Over the past year, the best-performing of these funds have posted returns approaching (or topping) double-digit percentages.

While index-tracking funds dominate many categories, actively managed strategies have done best among high-yield bond funds. The names with the best performance over the last one-, three-, and five-year time frames include offerings from Fidelity Investments, BlackRock, and BrandywineGlobal.

- Fidelity Capital & Income FAGIX

- BlackRock High Yield Bond BRHYX

- Credit Suisse Strategic Income CSOIX

- BrandywineGlobal Corporate Credit BGISX

- Artisan High Income APHFX

- BrandywineGlobal High Yield BGHSX

High-Yield Bond Fund Performance

The last few years have seen high-yield bond funds outperform the overall bond market. In 2022, when the broad taxable bond market lost 13% as measured by the Morningstar US Core Bond Index, the average high-yield bond fund lost 10%. Then in 2023, high-yield bond funds on average gained 12.1%, while the Core Bond Index rose 5.3%.

Over the last 12 months, funds invested in these lower-quality bonds have returned 8.8% on average, while the bond market has returned 1.1%. Over the last three years, the category has outperformed the Core Bond Index by 1.9 percentage points per year. Over the last five years, these funds have outperformed the index by 3.8 percentage points per year.

High-Yield Bond Funds vs. the Core Bond Market Index

What Are High-Yield Bond Funds?

Portfolios made of high-yield bond funds (also called junk bonds) focus on debt securities with at least 65% of bond assets that are rated BB or lower. Because of those lower-quality bonds, these portfolios carry higher risk than other types, but they also offer higher yields.

Screening for the Top-Performing High-Yield Bond Funds

To find the best-performing funds in this category, we looked for those that have posted the top returns across multiple periods.

We first screened for the funds that ranked in the top 25% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. We then filtered for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

From this screen, we’ve highlighted the six funds with the best one-year performance. This group was created with the lowest-cost share class for each fund, so some may be listed with share classes that are not accessible to individual investors outside of retirement plans. The individual investor versions of these funds may carry higher fees, which reduces returns to shareholders.

Top-Performing High-Yield Bond Funds

Fidelity Capital & Income

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

- SEC Yield: 6.29%

“This strategy is among the high-yield category’s most aggressive. At times, manager Mark Notkin has had significant allocations in bonds and loans rated CCC and below, exposing it to greater default risk than many peers. Those who have stuck with this strategy have been well-rewarded. Its 7.9% annualized return over Notkin’s tenure from August 2003 through July 2023 bested that of all peers.”

—Sam Kulahan, senior analyst

BlackRock High Yield Bond

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 4 stars

- SEC Yield: 7.35%

“The managers follow a flexible approach, emphasizing higher-quality bonds when riskier debt offers paltry compensation and leaning into lower-quality market segments when they think risk-taking pays off. This flexible approach has resulted in an impressive long-term track record. Over Mitchell Garfin and David Delbos’s tenure from March 2015 through July 2023, both the U.S.- and Luxembourg-domiciled funds landed in the top quartiles of their peer groups.

“The investment seeks to maximize total return, consistent with income generation and prudent investment management. The fund invests primarily in non-investment-grade bonds with maturities of ten years or less. It normally invests at least 80% of its assets in high-yield bonds.”

—Jeana Marie Doubell, analyst

Credit Suisse Strategic Income

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

- SEC Yield: 8.14%

“A seasoned group of managers supported by a deep team of credit analysts manage this fund, which adopts a distinctive approach of investing heavily in bank loans along with high-yield credit. Unlike most peers, at any given time, approximately 35%-60% of the portfolio is allocated to bank loans, followed by 25%-50% in high-yield bonds, and then a high-single-digit stake in collateralized loan obligations.”

—Saraja Samant, analyst

BrandywineGlobal Corporate Credit

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

- SEC Yield: 7.05%

“Co-managers Bill Zox and John McClain execute with discipline. They buy issues when their market prices are lower than the team’s estimate of intrinsic business value and sell them when their initial thesis has played out or when there are better opportunities in the market. The investment seeks high current income consistent with the preservation of capital over a five-year time horizon. The fund normally invests at least 80% of its net assets in a diversified portfolio of corporate debt securities including those rated investment grade or below investment grade, or which are unrated.”

—R.J. D’Ancona, senior analyst

Artisan High Income Institutional

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

- SEC Yield: 8.06%

“Manager Bryan Krug’s approach is concentrated and idiosyncratic, balancing potentially elevated risk against impressive bond-picking and thoughtful portfolio construction. Krug and his team take an intrepid approach to high-yield-bond investing. This includes a preference for asset-light companies that carry lower credit ratings (unfairly, Krug would argue) but generate substantial cash flow and require less capital reinvestment.”

—Brian Moriarty, associate director

BrandywineGlobal High Yield

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

- SEC Yield: 7.23%

“Co-managers Bill Zox and John McClain execute a disciplined value approach. They buy issues when their market prices are lower than the team’s estimate of intrinsic business value and sell them when their initial thesis has played out or when there are better opportunities in the market.

“The strategy’s distinct approach gives the managers the freedom to take advantage of market inefficiencies. To this end, the managers tend to hold concentrated positions (issuers often account for 3%-5% of assets) in their best ideas, which are often sourced from areas where larger rivals can’t operate as meaningfully. The bulk of the portfolio’s holdings aren’t found in the top 100 issuers of the ICE BofA U.S. High Yield Index benchmark.”

Top-Performing High-Yield Bond Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)