6 min read

How Wealth Managers Can Redefine the Client Experience

Running an advisory business today requires more than investment knowledge.

Today’s investors expect a personalized client experience from their advisors. In a recent investor survey, 56% of respondents said personalized advice is their top reason for selecting an advisor. However, advisors report they can spend only about half their time on client-focused activities.

The rest is consumed by investment analysis, brand building, and efforts to grow their practice. Other demands on advisors’ time can limit growth and make it more challenging to provide the individualized advice that investors seek.

By improving efficiency behind the scenes, advisors can dedicate more energy to what matters most: building trust, deepening relationships, and guiding clients toward long-term success.

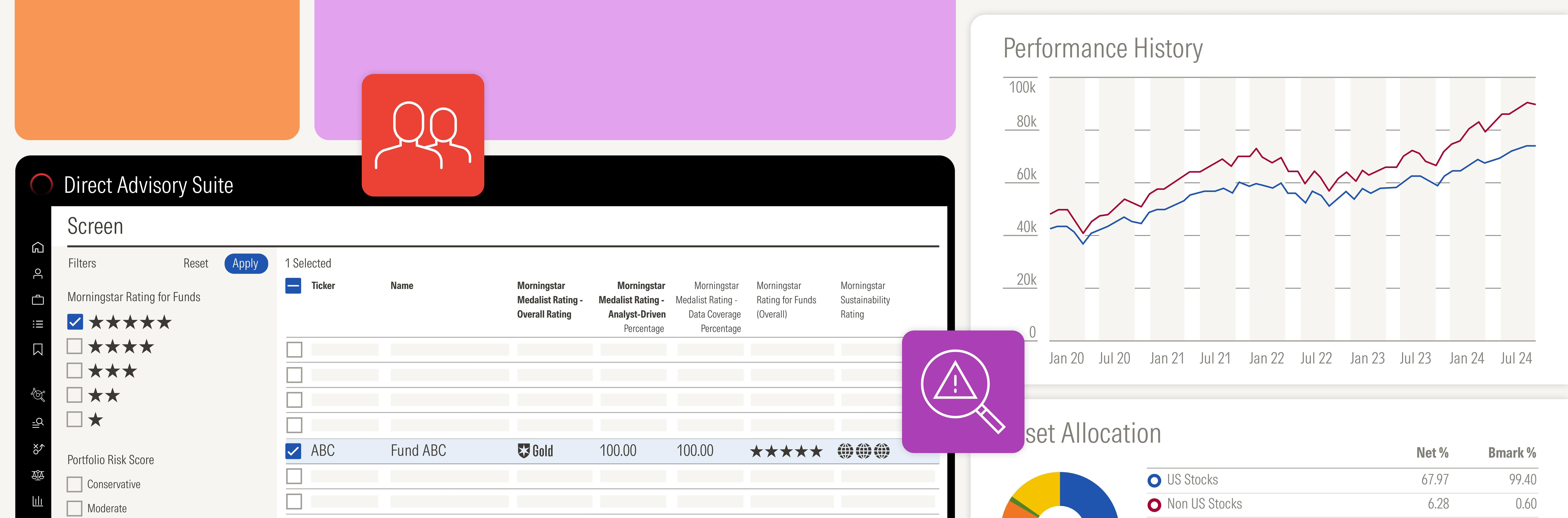

Here’s how tools like Morningstar's Direct Advisory Suite can power the workflows of modern advice.

What Goes Into Meaningful Client Conversations

Investment research and insights: Staying ahead with reliable investment research. Advisors can translate complex market data into simple, actionable insights, helping clients feel informed and confident in their decisions.

Digestible portfolio analytics: Advanced, interactive charting can help evaluate investment allocations and construct unique portfolios.

Accurate client profiling: Give clients peace of mind by aligning portfolios to their risk preferences.

Efficient portfolio management: Real-time portfolio updates, AI-powered imports, and customizable comparisons reduce time spent on manual tasks.

Behavioral coaching: Guided talking points enable advisors to address decision-making, helping clients stay disciplined during market volatility and focused on long-term goals.

Interactive reporting: Help clients see what you see. Dynamic reports with firm branding, secure delivery, and archival options elevate professionalism and accessibility.

Workflow efficiencies: Scalable processes, connected technologies, and automated data capture free up advisor time, allowing them to focus on more strategic tasks.

Compliance confidence: In a Morningstar survey, 42% of firms list compliance as one of the top challenges they face today. FINRA-reviewed components and built-in disclosure tools ensure client interactions remain compliant with wealth management standards.

Take Client Engagement From Static to Stunning With Direct Advisory Suite

Technology should enhance, not replace, the human element of advice.

Direct Advisory Suite is the next evolution of Advisor Workstation. Our set of connected capabilities helps advisors confidently deliver personalized advice and drive investor success.

Update Client and Portfolio Data Instantly With AI-Powered Features

With the help of AI, advisors can upload client statements as images or PDFs. Our AI assistant extracts holdings and market data, creating complete, accurate portfolios in as few as 30 seconds. This reduces manual effort and increases accuracy, allowing advisors to shift their focus to higher-value client needs.

Our AI-powered tools can also help you surface the most relevant investment research for your questions. Generate client-ready talking points, daily watchlist summaries, and coaching prompts that help guide conversations and provide better investment insights.

Personalize Plans With Risk Profiling and Alignment

Morningstar’s Portfolio Risk Score, based on underlying holdings, helps advisors translate complex portfolio data into meaningful insights for clients.

With Direct Advisory Suite, advisors can easily determine each client’s Risk Comfort Range. This personalized measure aligns their risk tolerance and time horizon with a portfolio designed to meet their investment goals. Powered by real-time, market-leading risk tolerance questionnaires and an interactive risk score toggle, advisors can fine-tune portfolios with a single click to better reflect exposure to liquidity and volatility.

The Risk Comfort Range defines the level of portfolio risk that is appropriate for each client, based on their assessment and an assumed seven-year investment horizon. Once a client completes the questionnaire, advisors receive an actionable Risk Comfort Range that directly connects the client’s personal profile to a suitable, data-informed portfolio.

Impress Clients With New Levels of Engagement Through Interactive Reports

Advisors can replace lengthy PDF reports with interactive web reports. In Direct Advisory Suite, clients can toggle between views, explore live data, and focus on the information that matters most to them. This interactive approach makes investment concepts easier to understand and increases client confidence in the advisor’s guidance.

Shift from showing and telling to actively collaborating with clients. Interactive reports bring clarity to investment discussions and help clients retain key insights. Advisors can highlight definitions in real time or streamline reports by removing unnecessary data, ensuring conversations stay focused and easy to understand.

Maintain Regulatory Confidence

FINRA-reviewed components and disclosure tools build compliance guardrails into the process. In Direct Advisory Suite, personal links with built-in security and expiration ensure that client information is still confidential and protected, maintaining regulatory confidence.

How This Tool Will Strengthen Advisor-Client Relationships

A tailored client experience is the cornerstone of trust in the advisor-client relationship. Direct Advisory Suite simplifies this process by turning data into collaborative discussions. And deeper trust can lead to higher retention and long-lasting relationships.

Spend less time on administrative tasks and more time guiding clients.