This Year’s Top-Performing Growth Funds Can’t Erase Longer-Term Losses

Some of this year’s top performers have the worst trailing returns.

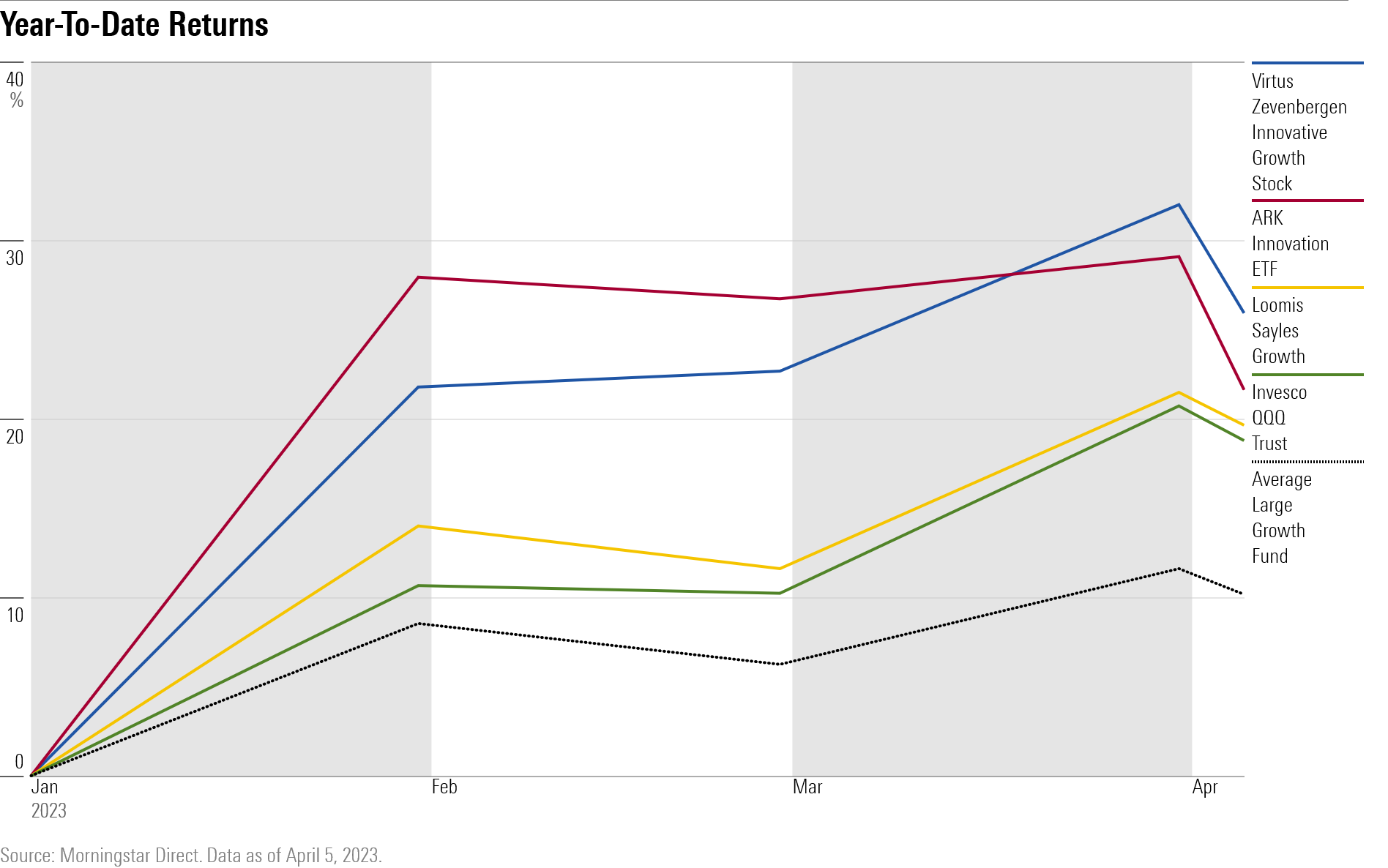

For investors in funds focused on high-growth stocks, it’s been a great start to the year thanks to a big rally in technology names and growth stocks in general. But for many of those funds, it’s still not enough to make up for last year’s terrible performance.

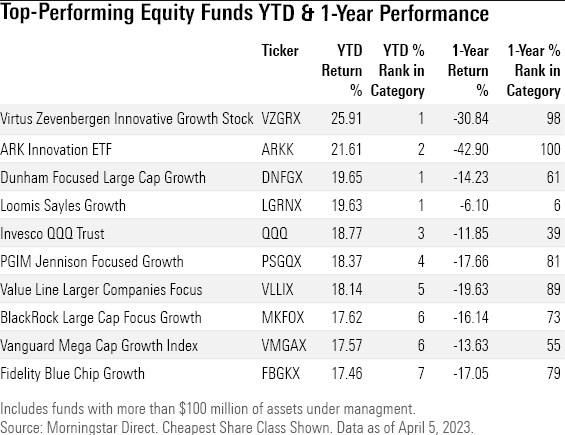

Many of these high-growth focused stock funds are posting year-to-date gains well into the double digits and far outstripping their peers. That follows a 2022 where the average large-growth fund lost 30% of its value.

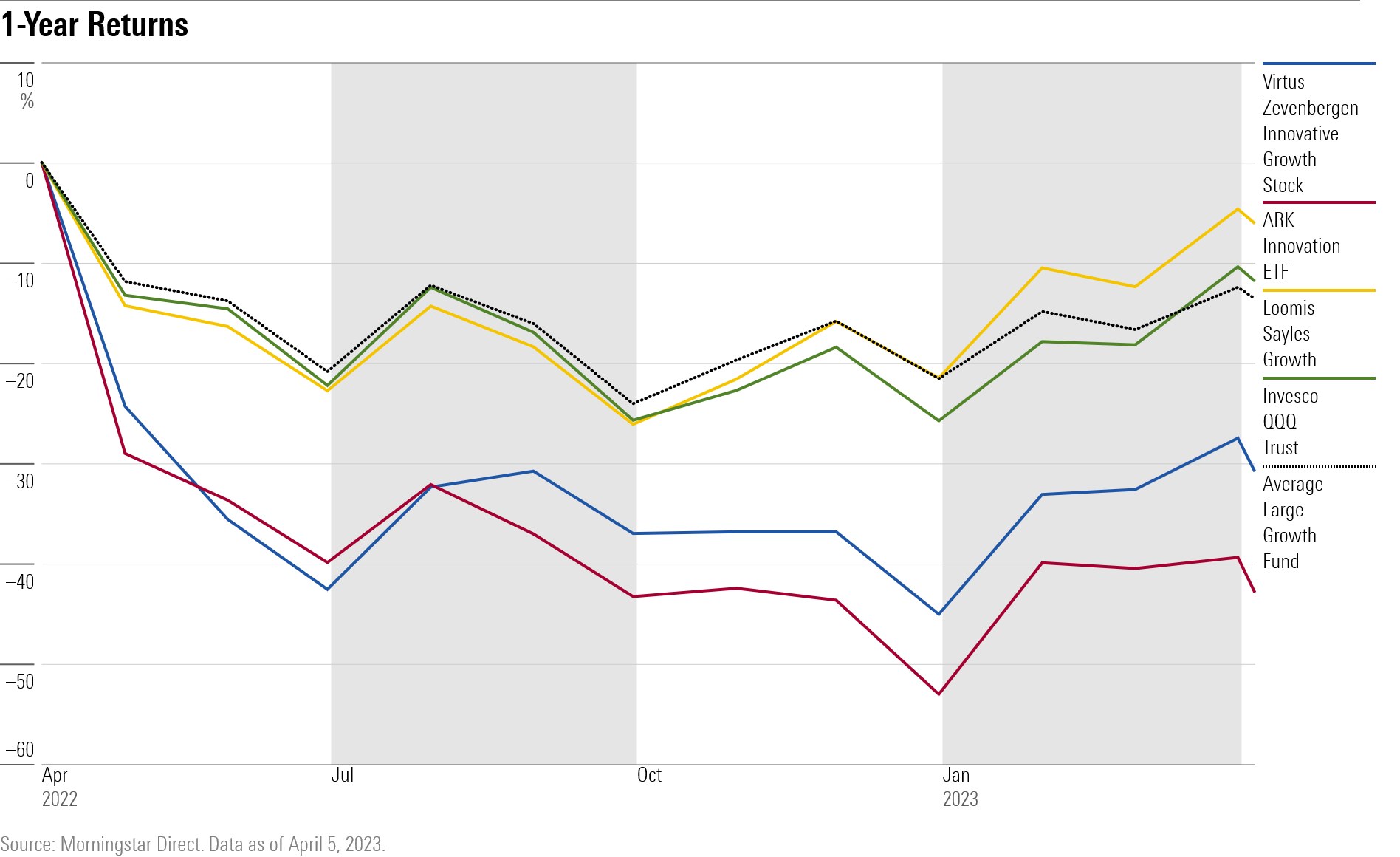

However, most of 2023′s top stocks funds are still ranking near the bottom of their categories in terms of one-year returns, and their investors are still sitting on big losses from the bear market.

To dig into this trend, we looked at the performance of all diversified U.S. stocks funds with more than $100 million in assets.

The $422.7 million Virtus Zevenbergen Innovative Growth Stock VZGRX was up 25.9% through April 5, the most of any diversified U.S. stock fund.

However, the fund lost 55.3% in 2022, and over the one-year period ended April 5, it is still down 30.8%, ranking in the 98th percentile of large-growth funds.

Big Tech Bets for Top-Performing Funds

Still, there’s no denying that it’s been a welcome reprieve for funds with the heaviest weightings in technology and other growth stocks.

Many of these funds hold larger stakes in technology stocks, which led the market higher to start this year, including semiconductor companies Nvidia NVDA and Advanced Micro Devices AMD and also including Tesla TSLA and Meta META. All four stocks gained more than 50%, making them some of the best performing stocks in 2023.

That was the case for the Virtus fund, which held 6.7% of its portfolio in Tesla and another 4.8% in Nvidia as of Dec. 31. By contrast, Tesla was 2.2% of the Morningstar US Large Growth Index at the end of 2022, and Nvidia was 2.5%. Tesla is up 70.3% this year, and Nvidia is up 88.2%.

ARK Innovation’s Big Swings

It’s a similar story for the $7.4 billion ARK Innovation ETF ARKK, which has historically tied its fortune to large stakes in high-growth, speculative companies. The fund is up 21.6% in 2023, but investors are still down around 42.9% if they’ve held the fund for a year.

For ARK Innovation, Tesla was a 6.6% weight and Roku ROKU a 5.8% weight as of Dec. 31. Roku lands in the Morningstar US Mid Growth Index, where it carried a 0.2% weight at the end of last year.

Of course, ARK is particularly known for its swings in performance.

“The strategy’s booms and busts have culminated in middling total returns and extreme volatility since its 2014 inception,” writes strategist Robby Greengold.

Recently, ARK Innovation’s portfolio has become more concentrated, which can heighten a fund’s volatility. “As of March 2023, ARK was exposed to acute stock-specific risks with a compact portfolio of just 27 stocks—an all-time low for the strategy and among the lowest of any U.S.-sold equity fund,” Greengold writes.

A Long- and Short-Term Growth Stock Winner

Not all of 2023′s top-performing funds have struggled over the past year. Some still hold larger stakes in high-growth companies, but more-disciplined approaches have benefited investors.

Loomis Sayles Growth LGRNX is up 19.6% this year, making it one of the best-performing funds in 2023. At the same time, it’s down only 6.1% over the past year, while the average large-growth fund is down 13.6%.

Stakes in Nvidia, Meta, and Tesla have lifted the $9.9 billion fund this year. However, taking a more restrained approach has helped the fund. “Unlike many growth managers, manager Aziz Hamzaogullari stayed away from Tesla until early 2022,″ says associate director of equity strategies Tony Thomas. “Even then, he only nudged in, so he didn’t have as much at stake as that stock continued to sell off.”

“By being disciplined about prices, the manager avoided high-flying stocks when they sold off, and then he selectively added some stocks and captured some rebounds,” he says.

The managers applied the same discipline to Netflix NFLX, another holding that’s been both a source of joy and pain for stock fund managers. “He stayed out of Netflix for a decade until the stock’s sharp drop in late 2021 gave him an opportunity. Like Tesla, he built another decent position in Netflix in time to catch its rebound.”

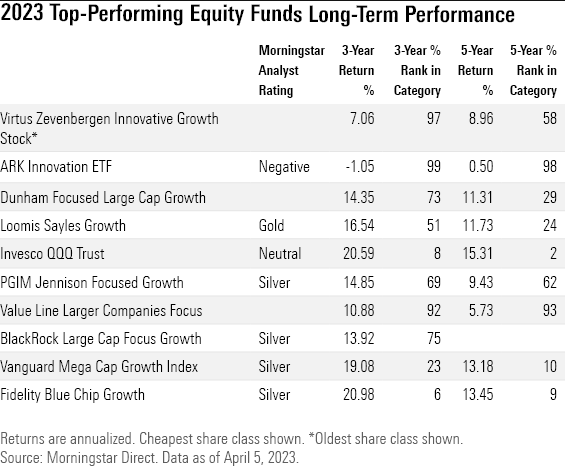

The fund’s approach has worked for investors over longer periods. Over the past five years, Loomis Sayles Growth is up 11.7%, putting it in the 24th percentile of large-growth funds.

While tech stocks are notoriously volatile, one of the best-known tech-heavy funds has charted a less extreme path over the past year.

The index-tracking $173.1 billion Invesco QQQ QQQ is up 18.8% in 2023, fueled by a large stake in semiconductor companies, and unlike other technology-heavy peers, it’s outperformed over the past 12 months. The fund is down 11.9% over the past year, while the average large-growth fund lost 13.6%.

“The technology slump last year hurt QQQ but didn’t kill it,” says analyst Ryan Jackson, “while this year’s market has perfectly played into some of the unusual rules that drive its construction.”

“Last year, the fund’s mega-cap tilt and reasonable growth orientation may help it handle difficult markets better than the smaller-minded, faster-growing strategies that have led the way so far in 2023,” he says.

Vanguard Mega Cap Stays Buoyant

The buoyancy of mega-cap stocks also helped $11.9 billion Vanguard Mega Cap Growth Index VMGAX. The fund is up 17.6% in 2023 and down 13.6% over the past year, in line with the average large-growth fund.

“The Vanguard strategy’s bias toward high-quality stocks should help buoy long-term performance as these types of stocks have historically weathered market storms better than mid-caps or those with poor fundamentals,” writes associate analyst Zachary Evens.

Growth-Stock Funds’ Long-Term Performance Trends

Pulling back the lens and looking at fund returns over medium- and longer-term time frames provides additional information for investors.

The $40.5 billion Fidelity Blue Chip Growth’s FBGKX decline of 17.1% over the past year is worse than the average large-growth fund. That’s despite a top-decile 2023 performance where the fund is up 17.5%.

“The strategy was unlikely to do well in 2022 as global inflation and interest rates soared and aggressive-growth stocks suffered the market’s steepest drops,” writes Greengold.

But in addition to Fidelity Blue Chip’s solid start for 2023, it has the best three-year record among 2023′s top funds and ranks in the ninth percentile of large-growth funds over the past five years.

“[Sonu] Kalra has demonstrated the long-term merit of the strategy. Its success on his watch owes mostly to his knack for spotting high-potential up-and-comers, such as Tesla and Nvidia, which the mutual fund has ridden over the past decade to spectacular gains,” Greengold writes.

Loomis Sayles Growth also has a strong track record over the past five years. It is up 11.7% during that time frame, outpacing the average large-growth fund’s return of 9.7%, which lands it in the top quarter of all growth stock funds.

Invesco QQQ also maintains one of the medium-term best records. Its 15% annualized five-year return means it’s outperformed 98% of large-growth funds.

At the other end of the spectrum, ARK Innovation ETF and Virtus Zevenbergen Innovative Growth Stock both rank in the bottom half of their categories for the past three-year and five-year time frames.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)