Which Funds Are Taking the Biggest Hit on Silicon Valley Bank and Other Bank Stocks?

Regional-bank ETFs post large declines, and even some diversified funds suffer from financials exposure.

As the ripples from SVB Financials’ SIVB collapse quickly spread across the financials sector, some funds are booking significant losses.

Investors in the regional-bank stock exchange-traded funds have suffered the biggest declines. However, some broader financials funds, along with a few diversified stock funds, also are recording large losses after the collapse of Silicon Valley Bank. They include Diamond Hill Mid Cap DHPYX and Franklin Mutual Beacon BEGRX.

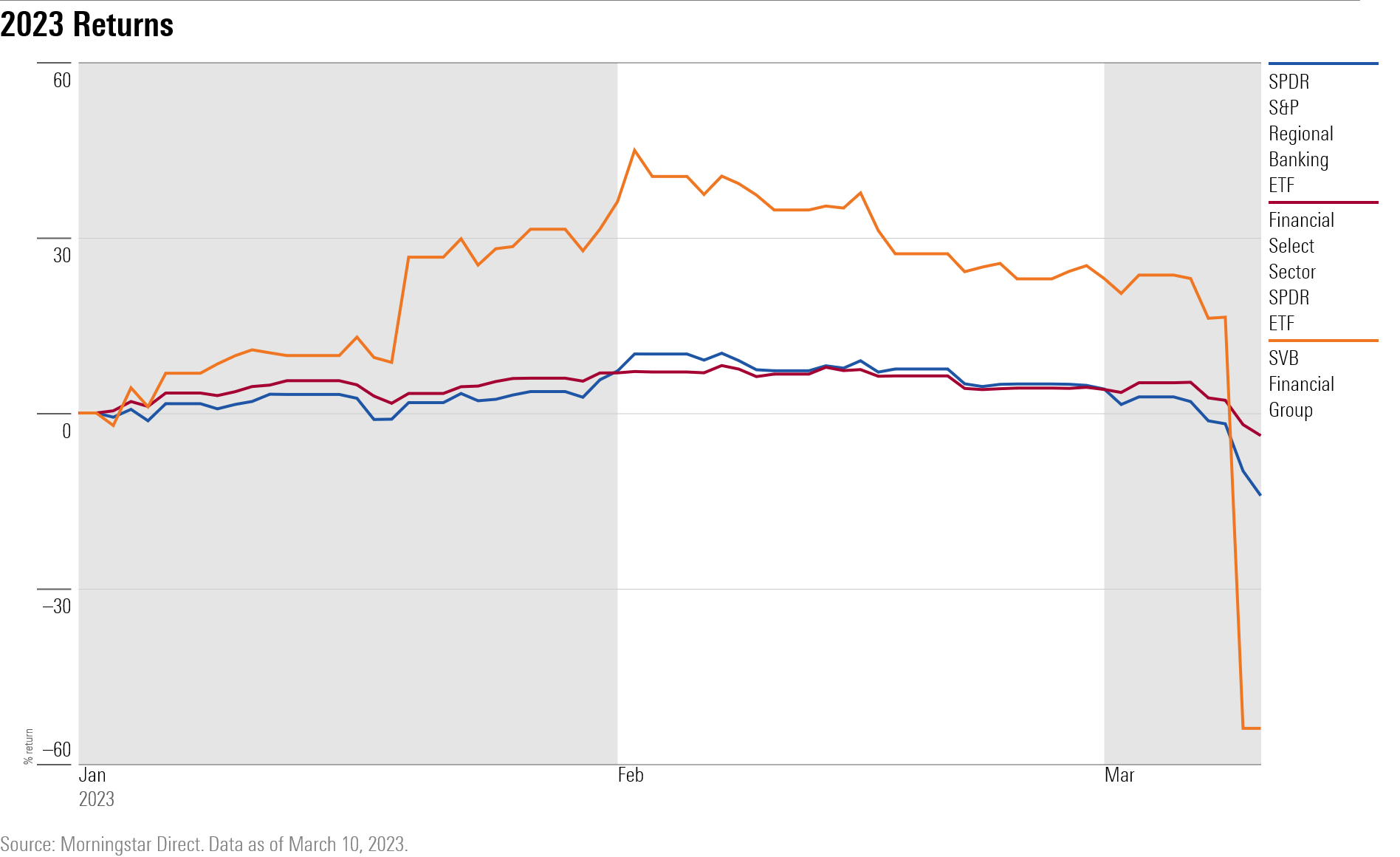

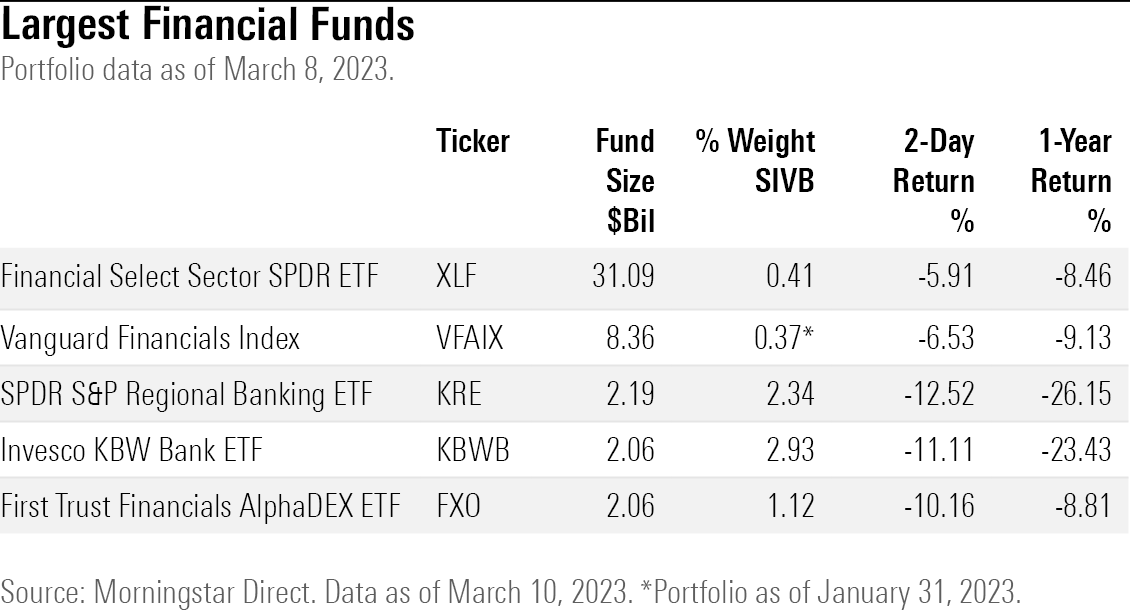

The Financial Select Sector SPDR ETF XLF fell 5.9% over the two-day period from Thursday to Friday, while the SPDR S&P Regional Banking ETF KRE lost more than double that with a 12.5% plunge.

Investors in broad market index funds such as SPDR S&P 500 ETF SPY or Vanguard Total Stock Market ETF VTI carry minimal exposure to SVB but still experienced losses as most financials shares sunk on Thursday and Friday. The declines in bank stocks continued during Monday’s session following the collapses of both SVB and Signature Bank SBNY.

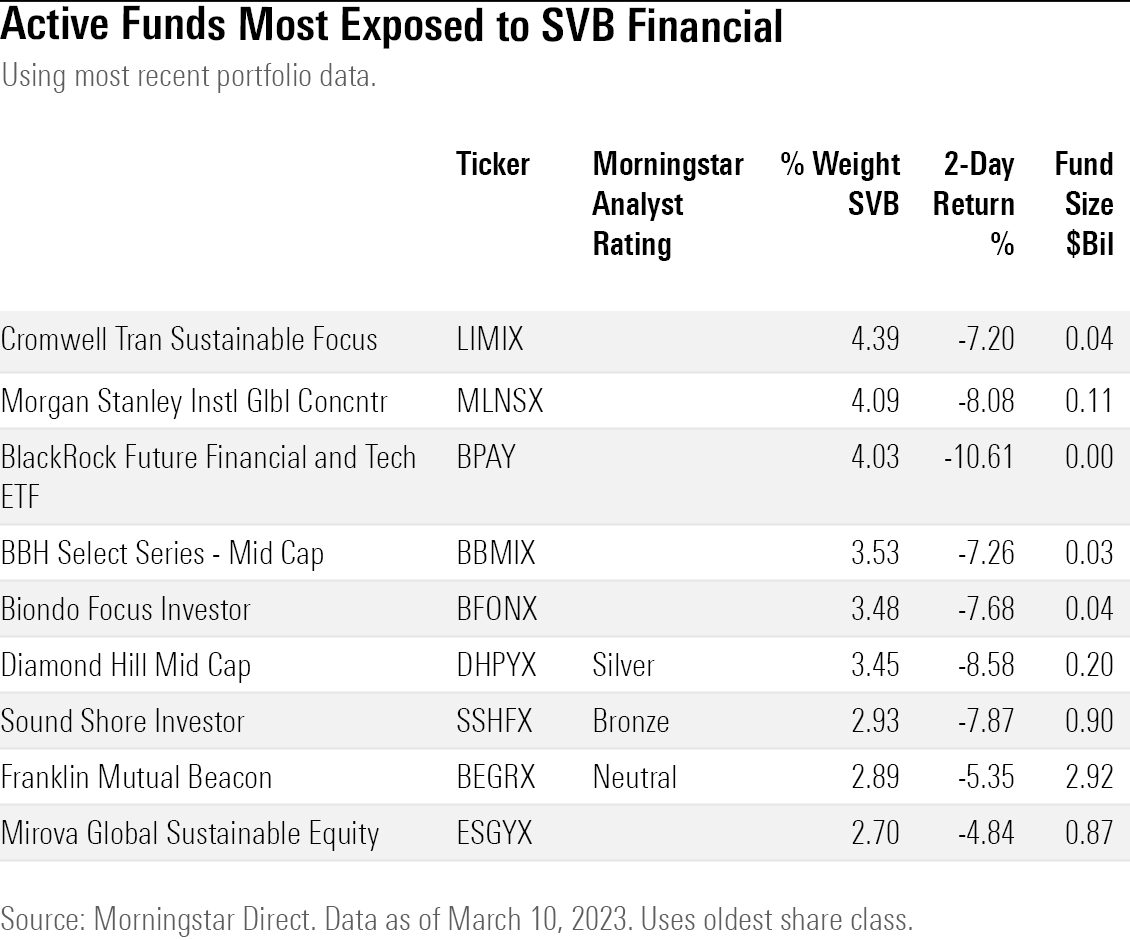

Some actively managed funds held larger positions in SVB, and as a result have experienced outsize losses. However, no funds had more than 5% in the bank’s stock, according to Morningstar Direct. (In addition, because traditional, open-end mutual funds report their holdings with a lag, some funds that are shown as owning the stock could have sold before Thursday’s plunge.)

Still, some funds may have to book even bigger—if not total—losses on the tech-company focused bank after it was put under government control Friday and trading in its shares was halted.

ETFs With the Biggest Silicon Valley Bank Exposure

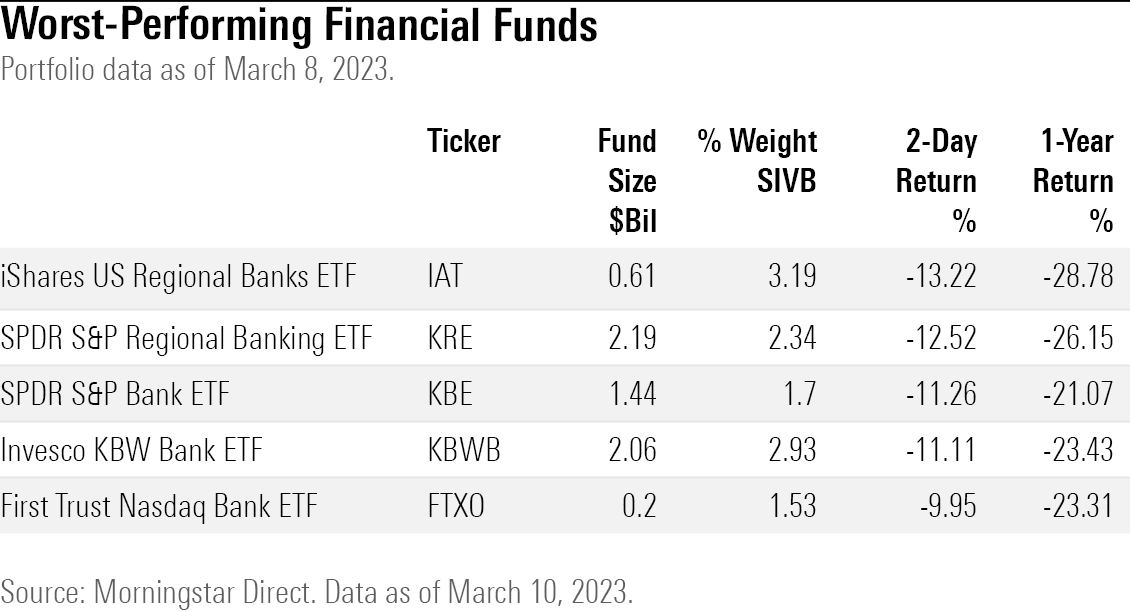

ETFs focused on regional banks were most exposed to SVB stock, and fell the hardest as a result.

Silicon Valley Bank was SPDR S&P Regional Banking ETF’s largest holding as of Wednesday when the $2.2 billion fund carried 2.3% of its portfolio in the company. The ETF declined 12.5% on Thursday and Friday and is down 26.2% over the past year.

Other top holdings of SPDR S&P Regional Banking ETF include Western Alliance Bancorp WAL, which fell 31.1%, and East West Bancorp EWBC, which declined 14.0% over the two-day period. The fund is the third-largest financials sector fund.

IShares U.S. Regional Banks ETF IAT has had similar exposure. More than 3% of the fund was invested in SVB as of Wednesday. The iShares ETF dropped 13.2%.

Investors in the more-diversified Financial Select Sector SPDR ETF were less affected by the bank’s collapse. Only 0.41% of the $13.1 billion portfolio was invested in Silicon Valley Bank stock as of Wednesday.

The largest ETFs were less-exposed to Signature Bank. Within SPDR S&P Regional Banking ETF, Signature Bank constituted only 1.67% of the fund as of March 8.

Active Funds With the Biggest Silicon Valley Bank Holdings

Some active managers took larger bets on the bank, but none carried more than 5% of their fund in the stock. Shares were held by both value- and tech-stock-centric managers.

Diamond Hill Mid Cap held 3.5% of its $200 million portfolio in SVB stock as of Feb. 28. The fund fell 8.6% over Thursday and Friday. “The fund has long had an affinity for financials,” says Morningstar director of equity strategies Dan Culloton. As of Feb. 28, 24% of the portfolio was invested in the sector, while the average mid-cap value fund invested only 18.6%.

Culloton points out that the fund had been purchasing the shares of Silicon Valley Bank since the latter part of 2021 and throughout much of 2022.

In shareholder commentary from the end of 2022, Diamond Hill manager Chris Welch acknowledged that SVB stock was facing difficulties. “Regional banks First Republic and SVB Financial were pressured amid a rising-rate environment, which is weighing on net interest margins.”

Welch singled out the unique position of Silicon Valley Bank. “SVB Financial faced additional headwinds given its exposure to the innovation economy, its primary area of focus—though we believe such an environment offers the company an opportunity to add tremendous value for its clients and cement its leadership position in a lucrative space,” he wrote.

Another value-focused fund, Franklin Mutual Beacon, held 2.9% of its $2.92 billion in Silicon Valley Bank as of Jan. 31. The managers first purchased the stock in October of last year, says Morningstar senior analyst Greg Carlson. “The team has a long history of investing in financials and has some highly experienced managers and analysts,” he says.

Other Franklin funds have stakes in the company, including Franklin Mutual Shares MUTHX, which held 1.9% as of Jan. 31, and Franklin Mutual Quest MQIFX, which carried a 0.9% position. All three funds ended near the bottom of their respective categories on Thursday, says Carlson.

It wasn’t just value managers that held shares of the bank. Morgan Stanley Institutional Global Concentrated MLNIX had just over 4% of the fund invested in the bank as of Dec. 31, 2022. The fund aims to “identify 15-20 global companies with attractive valuations, above-average appreciation potential, and competitive dividend yield” according to its prospectus. It fell 8.1% over Thursday and Friday.

BlackRock Future Financial and Technology ETF BPAY also held the stock. The ETF just launched in August 2022 and invests in “companies delivering innovative and emerging technologies used in the financial services industry.” Other holdings include Fiserv FISV and Global Payments GPN.

The bank was held by two sustainability-focused funds. Cromwell Tran Sustainable Focus LIMIX held 4.4% in the stock as of Dec. 31, and Mirova Global Sustainable Equity ESGMX held 2.70%.

Managers of Mirova Global Sustainable Equity added to their position in the bank in the fourth quarter. In the fund’s year-end 2022 commentary, its managers recognized the challenges facing SVB Financial, but stuck by the stock. “We believe that SVB’s synergistic banking franchise in the innovation tech and healthcare sectors has strengthened in this challenging environment, and that its competitive advantages including deep sector expertise, unique relationship networks, and experience managing through volatile tech cycles position it well for renewed growth,” they wrote.

However, actively managed funds with larger stakes in the company are still relatively small. Franklin Mutual Beacon is the biggest with just under $3 billion in assets. On an absolute basis, J.P. Morgan Large Cap Growth JLGMX owned the most shares outright of the company. The $42.6 billion fund held less than 1.0% of its portfolio in the bank as of Jan. 31, 2023. American Funds Smallcap World SMCWX also held a large number of shares but only 0.2% of the $62.9 billion fund was invested as of Dec. 31. Other J.P. Morgan and American Funds were invested but held less than 1% in the fund.

This article was updated to include the returns from March 10, 2023.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)