Bank Stock Selloff Triggered by SVB Financial Liquidity Crunch

Rising funding costs put pressure on banks’ net interest income.

Investors sold off bank stocks Thursday, spooked by fears of a possible industry liquidity crisis after SVB Financial SIVB said Wednesday that it sold most of its $21 billion securities portfolio in which it had unrealized losses.

The crisis prompted the U.S. government to take control of the bank on Friday.

SVB, a major lender to early-stage startup technology and healthcare companies, said it would record an aftertax loss of $1.8 billion in the first quarter of 2023 as a result.

Liquidity Crunch Leads to SVB Collapse

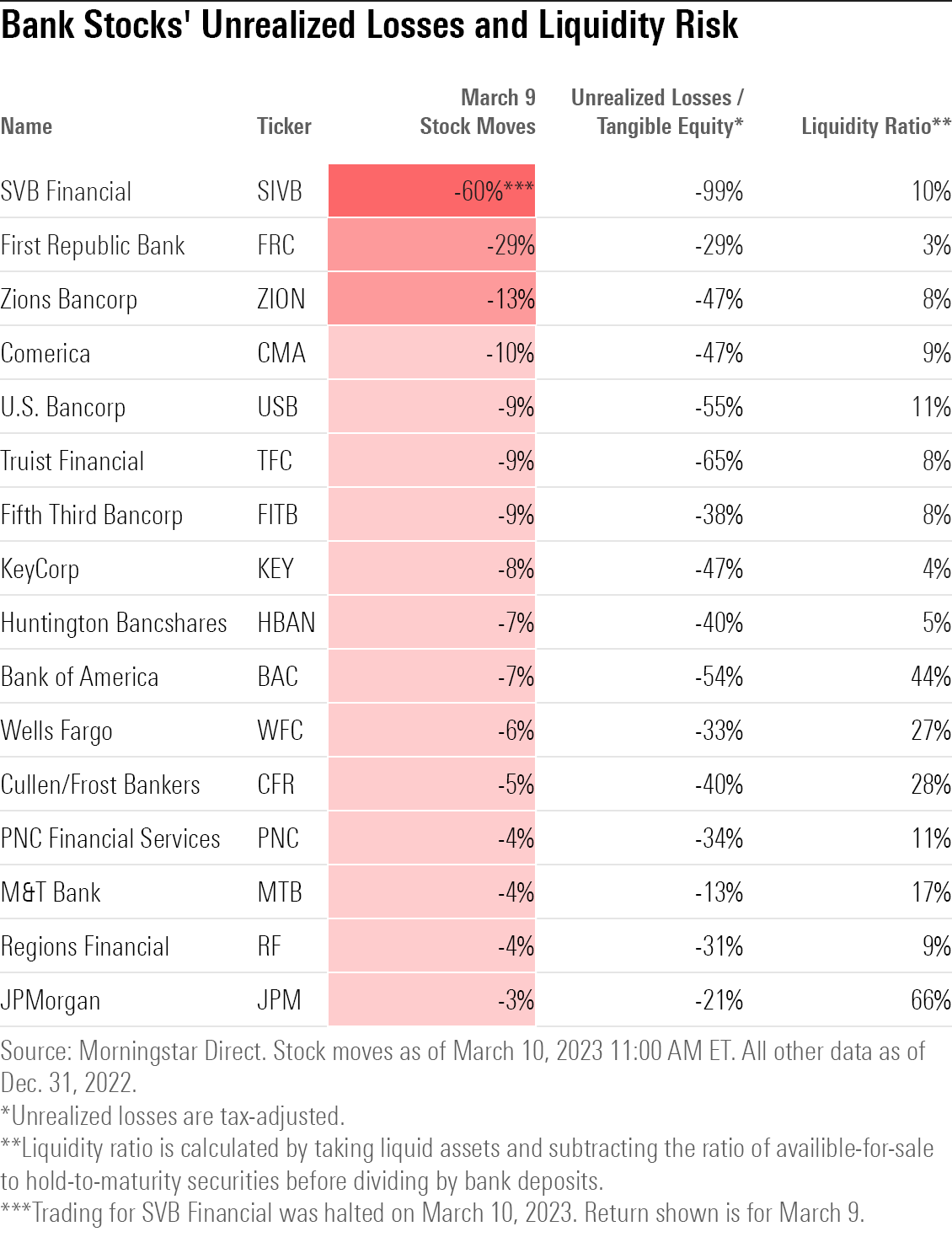

SVB’s stock plunged more than 60% to $106.04, a new 52-week low, on March 9, 2023. Trading in SVB stock was halted before the market opened on Friday, March 10 and the Federal Deposit Insurance Corporation took over the bank’s assets.

“Aside from crypto-related meltdowns, this is one of the first banks we’ve seen that has really suffered a liquidity crunch, which has forced it to restructure the balance sheet and realize losses on its securities portfolios,” said Eric Compton, equity strategist at Morningstar.

He added: “SVB scores materially worse than any bank we cover on liquidity and unrealized-loss metrics. This makes us think that SVB could be facing a unique liquidity crunch that does not have to feed through the entire system; however, it does highlight that these risks are now more elevated. It also highlights that it can be very difficult to predict how funding pressure can change in any given quarter and when these risks can materialize.”

Which Bank Stocks Were Hit the Hardest by SVB’s Plunge?

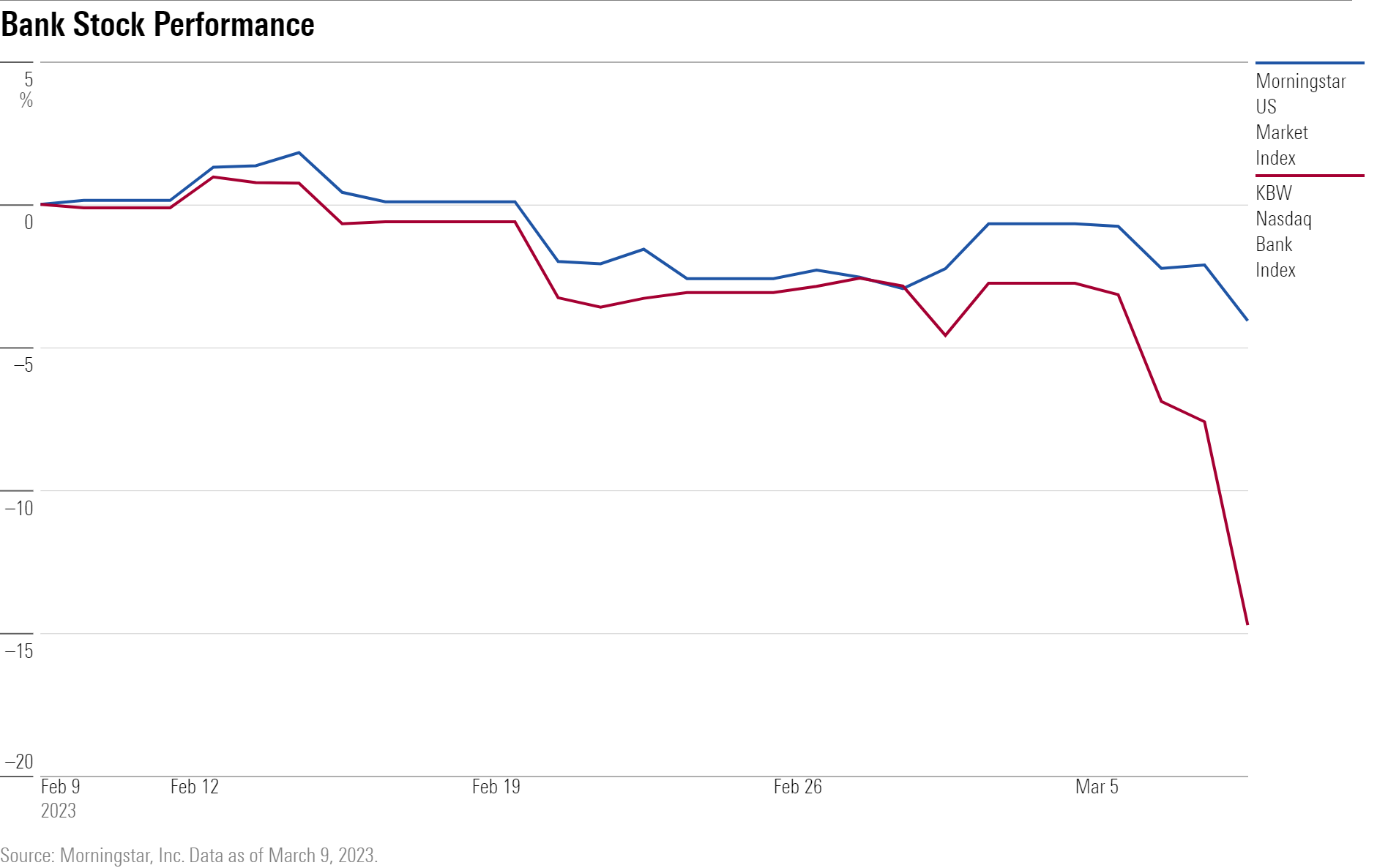

SVB’s collapse sent other bank stocks tumbling, with the KBW Nasdaq Bank Index losing 7.7% Thursday. The drop continued on Friday morning, with the index falling an additional 1.3% as of 11 a.m. Eastern time. The index is now down nearly 15.6% in the past month.

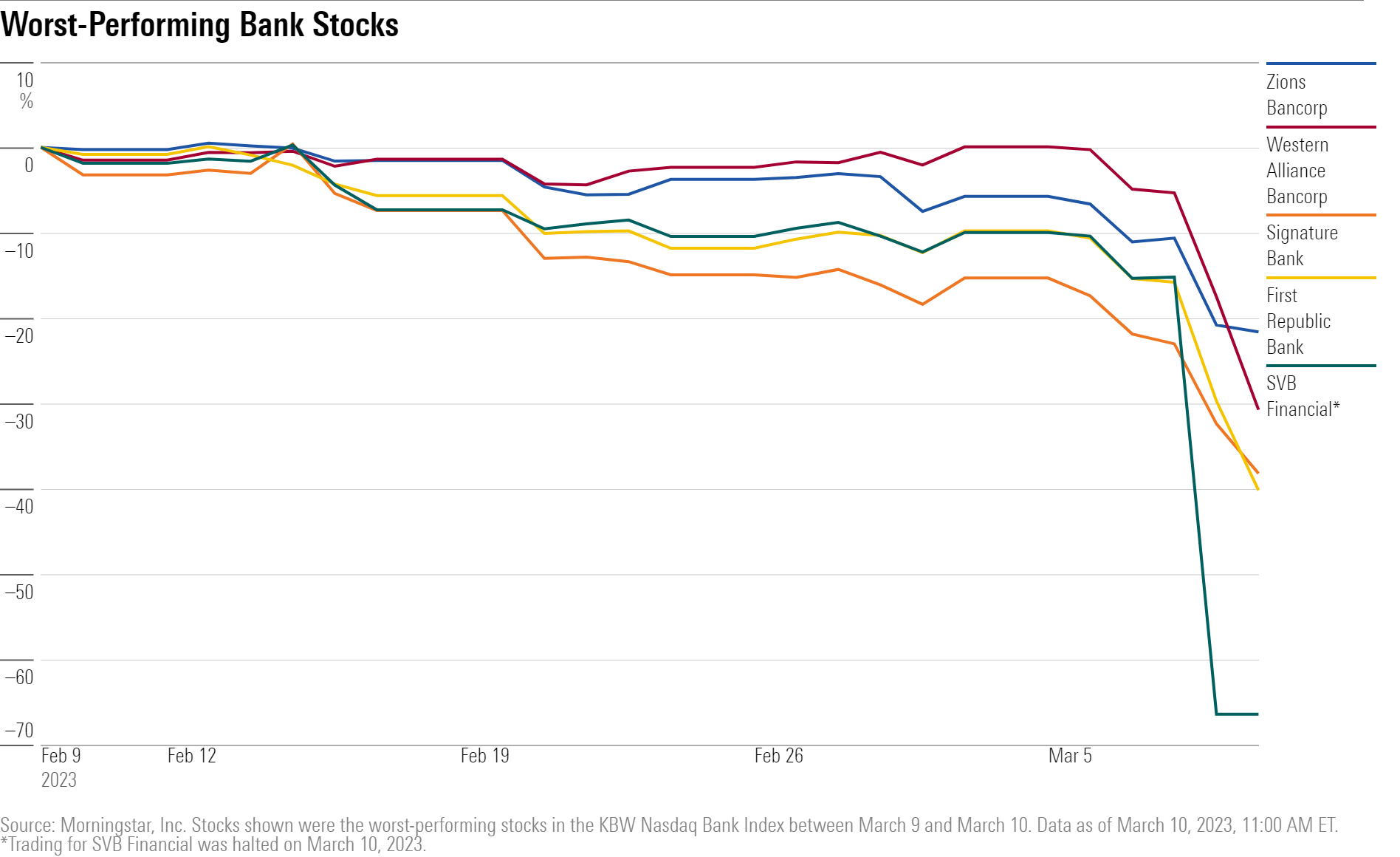

Among the worst performers:

- First Republic Bank FRC, based in San Francisco, saw its shares plummet 16.5% Thursday and an additional 15.2% Friday morning.

- Phoenix-based Western Alliance Bancorp WAL stock lost nearly 13.0% Thursday and an additional 17.1% on Friday morning.

- New York-based Signature Bank SBNY stock fell 12.2% Thursday and an additional 8.6% on Friday morning.

- Salt Lake City-based Zions Bancorp ZION stock fell 11.4% Thursday and an additional 1.9% on Friday morning.

- Dallas-based Comerica CMA dropped 8.0% Thursday and an additional 2.4% on Friday morning.

- Pasadena-based East West Bancorp EWCB shares were down more than 8.0% Thursday and an additional 3.7% on Friday morning.

- Minneapolis-based U.S. Bancorp USB stock lost 7.0% Thursday, and another 2.2% on Friday morning.

What Happened at SVB?

Compton explains: “Banks bought mortgage-backed securities and Treasuries before interest rates started to rise. As interest rates have risen, the prices of these securities went down. Banks are holding a number of securities which technically have losses on them but as yet are unrealized.

“The securities pose limited credit risk because Treasuries and government-backed MBS carry the explicit or implicit backing of the government. However, if a bank is forced to sell them at a loss, those losses will then flow through the balance sheet and start to erode equity. This presents a liquidity problem, especially if deposits start to leave the banks, which they are. Deposit outflows put more and more pressure on the banks to sell off existing assets. This risk has been lurking beneath the surface but just materialized in a big way for SVB. This is why bank stocks are selling off in response to this news.”

In November 2022, Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation, flagged mounting unrealized losses in bank securities portfolios as an “overhang” that could soon become “problematic.”

Still, Compton says he doesn’t expect other banks in his coverage area will need to take similar measures to SVB. He explains that while Truist Financial TFC, U.S. Bancorp, and Bank of America BAC have the largest unrealized losses as a percentage of tangible equity, “their liquidity profiles seem much less stressed than SVB.”

SVB’s actions highlight increasing funding pressures in the banking industry that will put pressure on net interest income, Compton says.

“Liquidity issues are an evolving risk worth watching,” he adds.

Correction (March 10, 2023): A previous version of the article showed incorrect data in the “Bank Stocks’ Unrealized Losses and Liquidity Risk” table for the Unrealized Losses/Tangible Equity and Liquidity Risk columns. This has been corrected.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)