U.S. Fund Flows: Investors Continued to Pull Back in October

Sentiment improved as equity markets rallied, but outflows persisted.

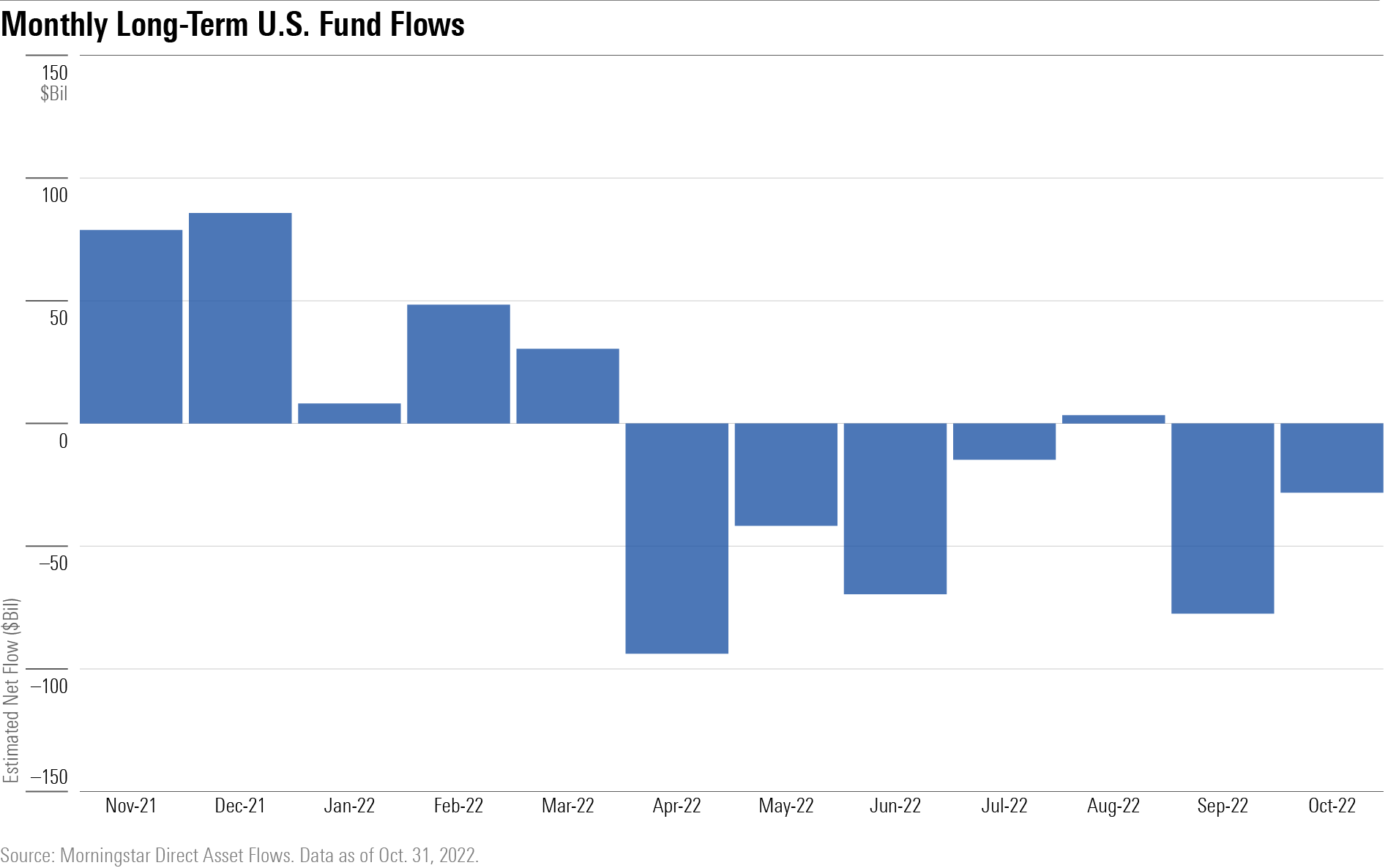

Long-term mutual funds and exchange-traded funds suffered outflows of about $28 billion in October 2022 despite improved investor sentiment toward risk assets, following $77 billion in outflows in September. Seven of the 10 U.S. category groups shed assets in October.

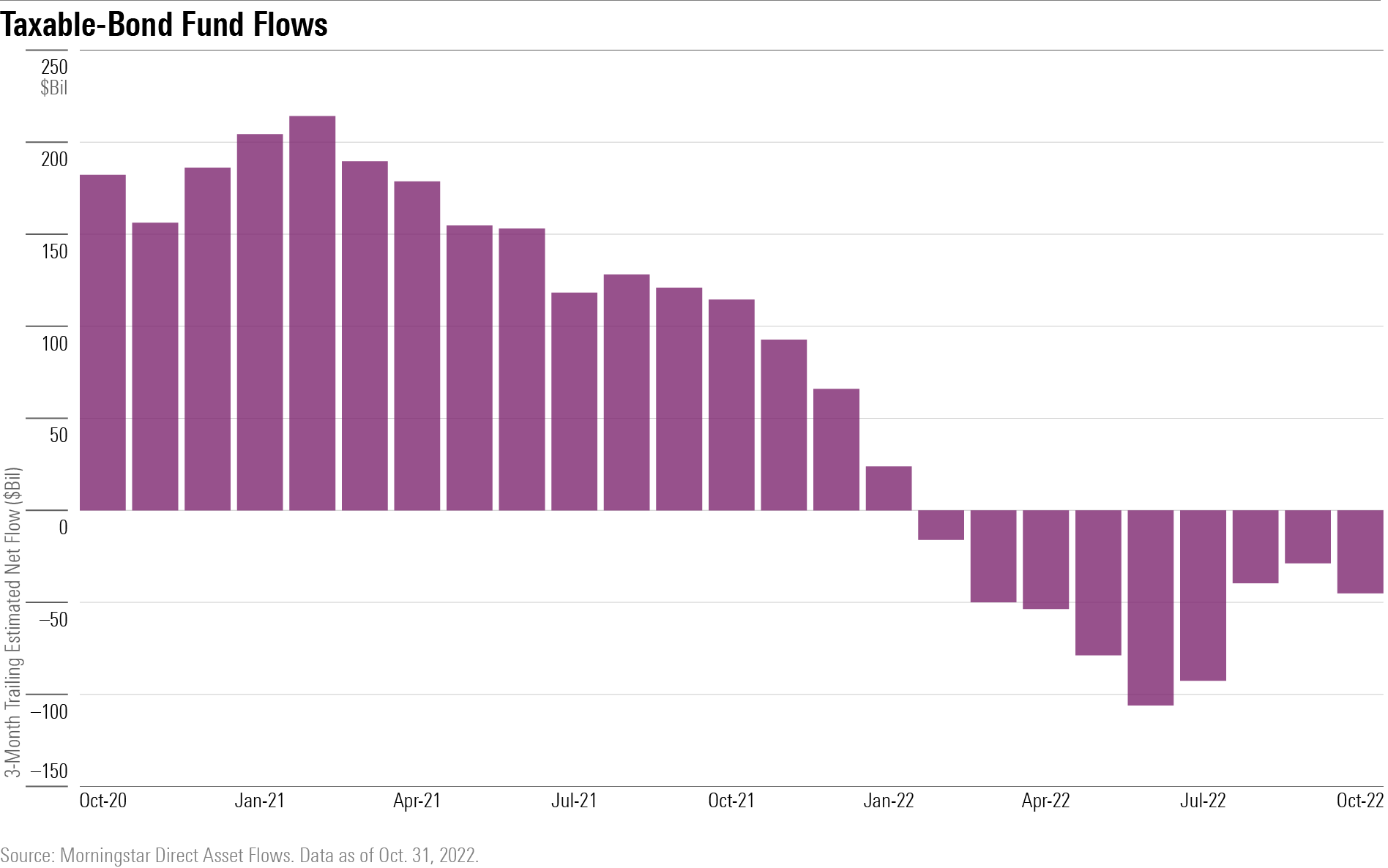

Trouble for Taxable-Bond Funds Continues

Investors pulled $21.9 billion from taxable-bond funds in October, most of all category groups. The tide looked to turn when they notched their only month of inflows in 2022 in August (though trailing three-month numbers were still negative). But two consecutive months in the red erased the momentum. The Morningstar US Core Bond Index retreated 1.29% in October as yields on Treasury bonds increased.

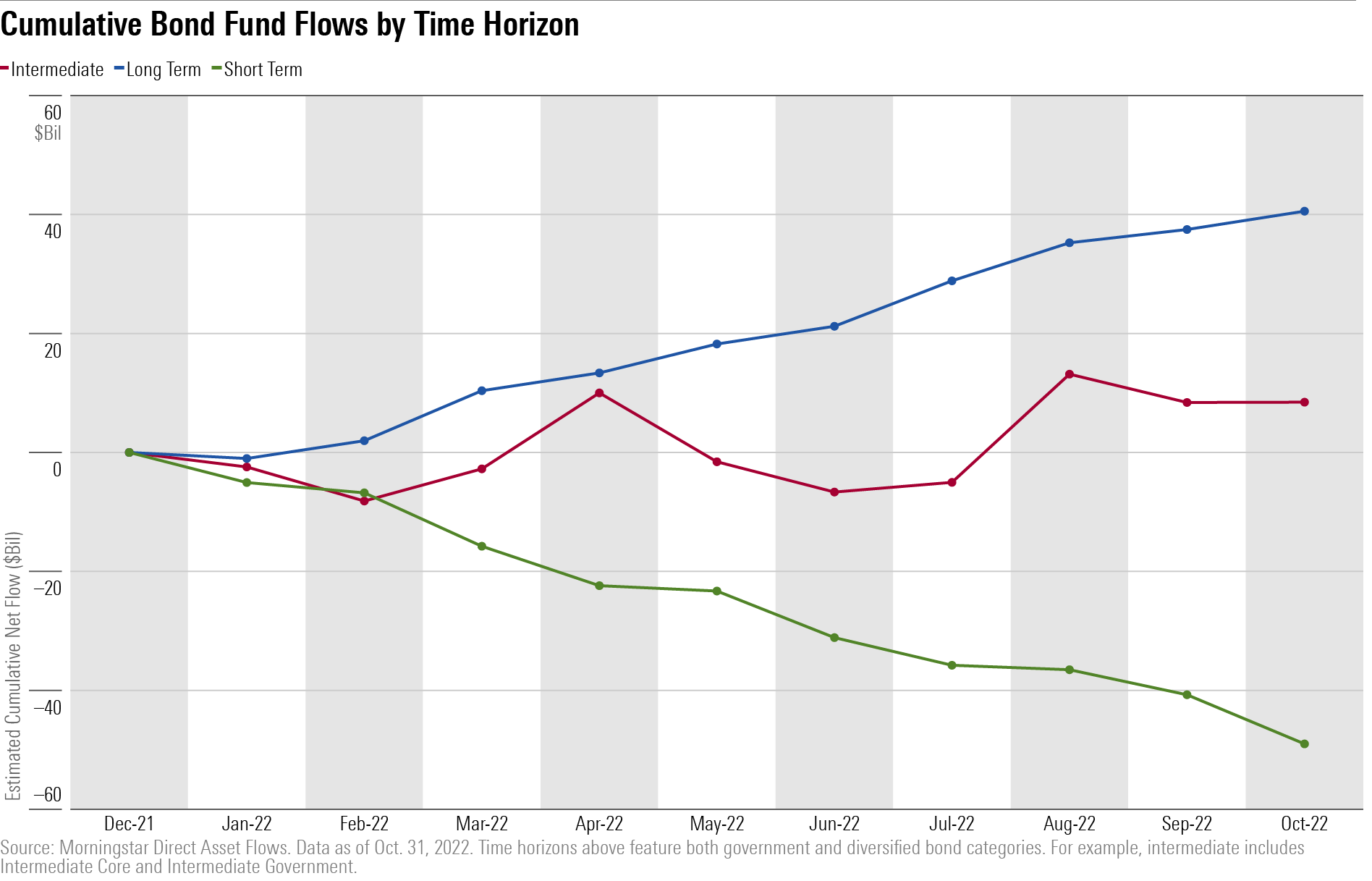

Bond Investors Go Long

The short-term bond category accounted for about half of taxable-bond outflows in October, shedding $10.7 billion. Their $60.6 billion year-to-date outflow now ranks last among all Morningstar Categories. Investors have embraced interest-rate risk and turned away from shorter-dated portfolios all year, in both government- and diversified bond categories.

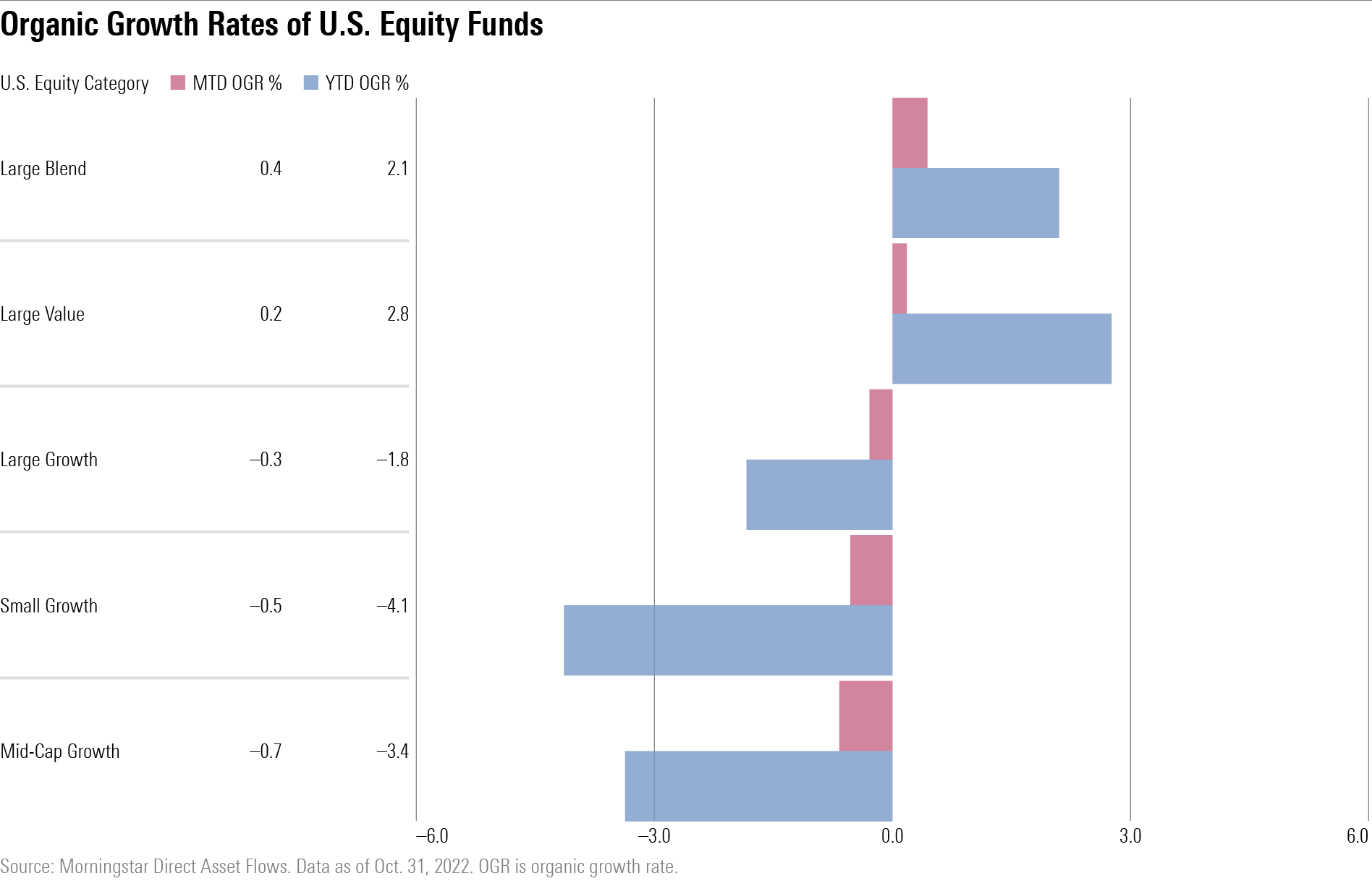

Investors Turn Away From Domestic Growth Funds, but Not Others

Investors have bailed on growth-oriented U.S. equity funds in 2022, and October was no exception. Small-, mid-, and large-growth funds all experienced outflows during the month. However, strong passive inflows boosted large-blend and large-value funds, which took in $21.5 billion and $2.6 billion, respectively.

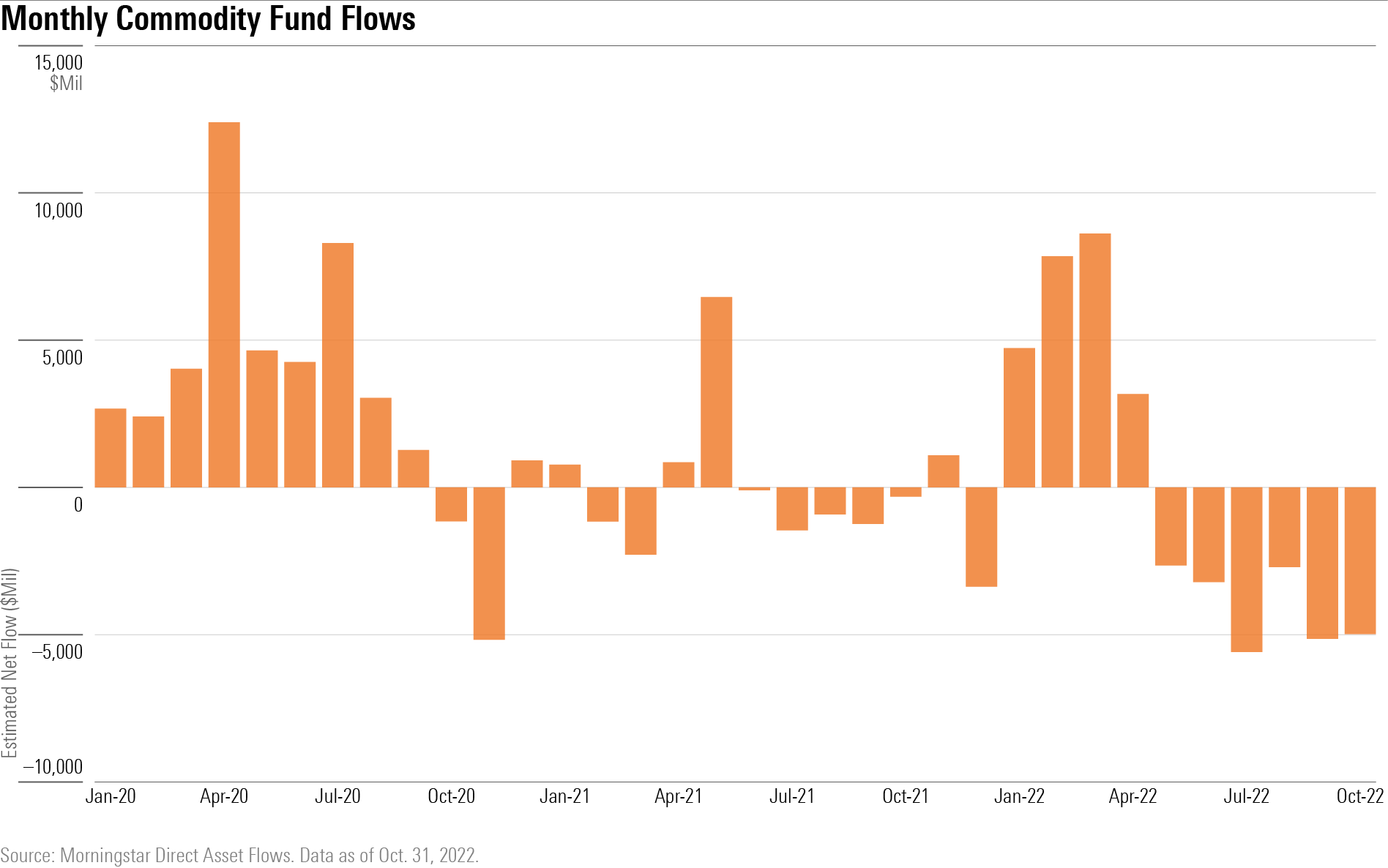

Commodities Funds Shed Assets Yet Again

Commodities funds have faced two headwinds during 2022′s first 10 months: declining precious-metals prices and a pivot away from investments that hedge against inflation. The combination has led to six consecutive months of outflows for the category group, the first such streak since 2013.

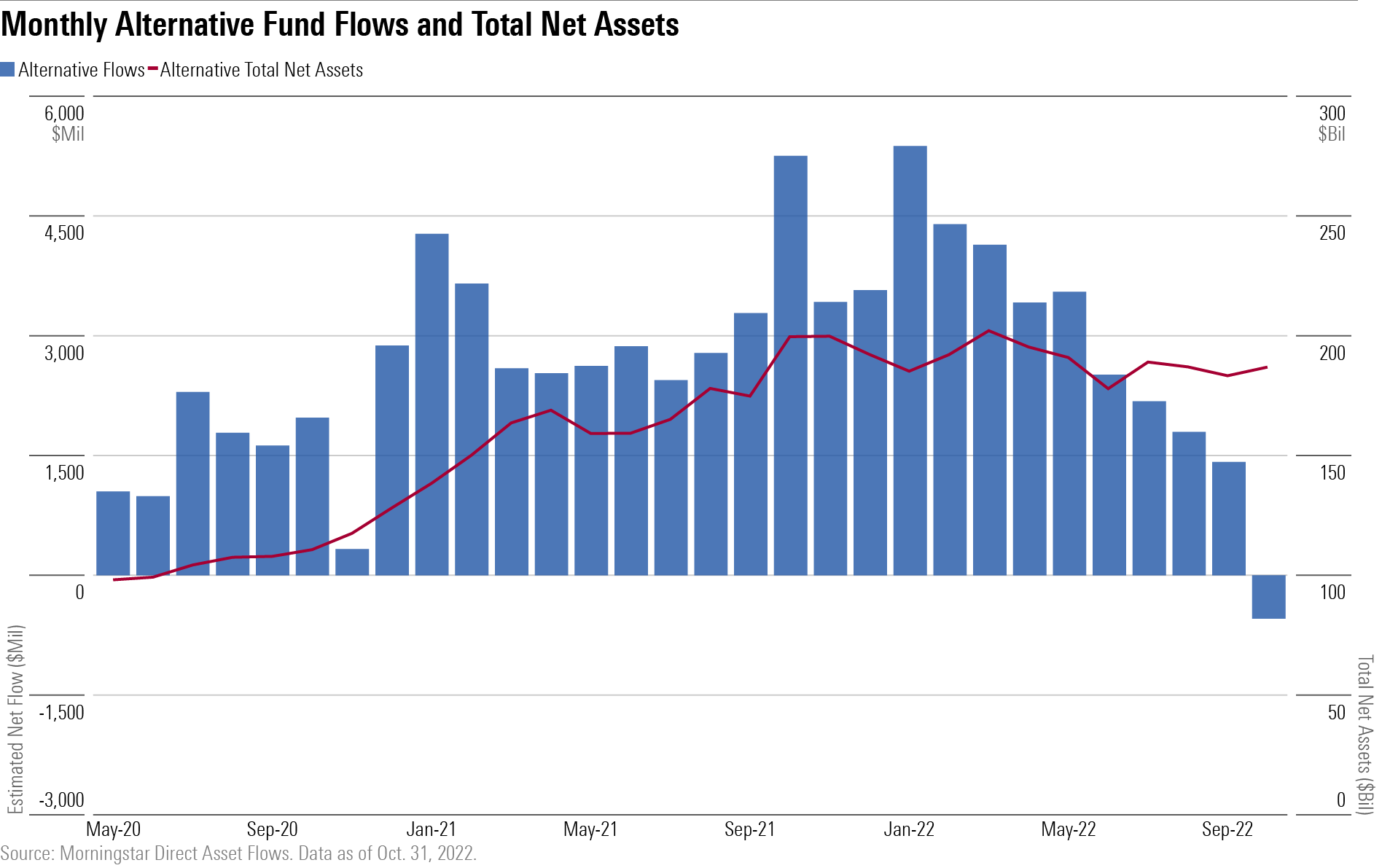

Alternative Funds Post Outflows for First Time in Over Two Years

Alternative funds, which invest in strategies such as relative value and macro trading, shed about $500 million in October, breaking their incredible 29-month streak of inflows, which saw their total assets grow to $187 billion from $96 billion. It’s unclear if October was a true inflection point, though the pace of inflows has steadily declined since January 2022.

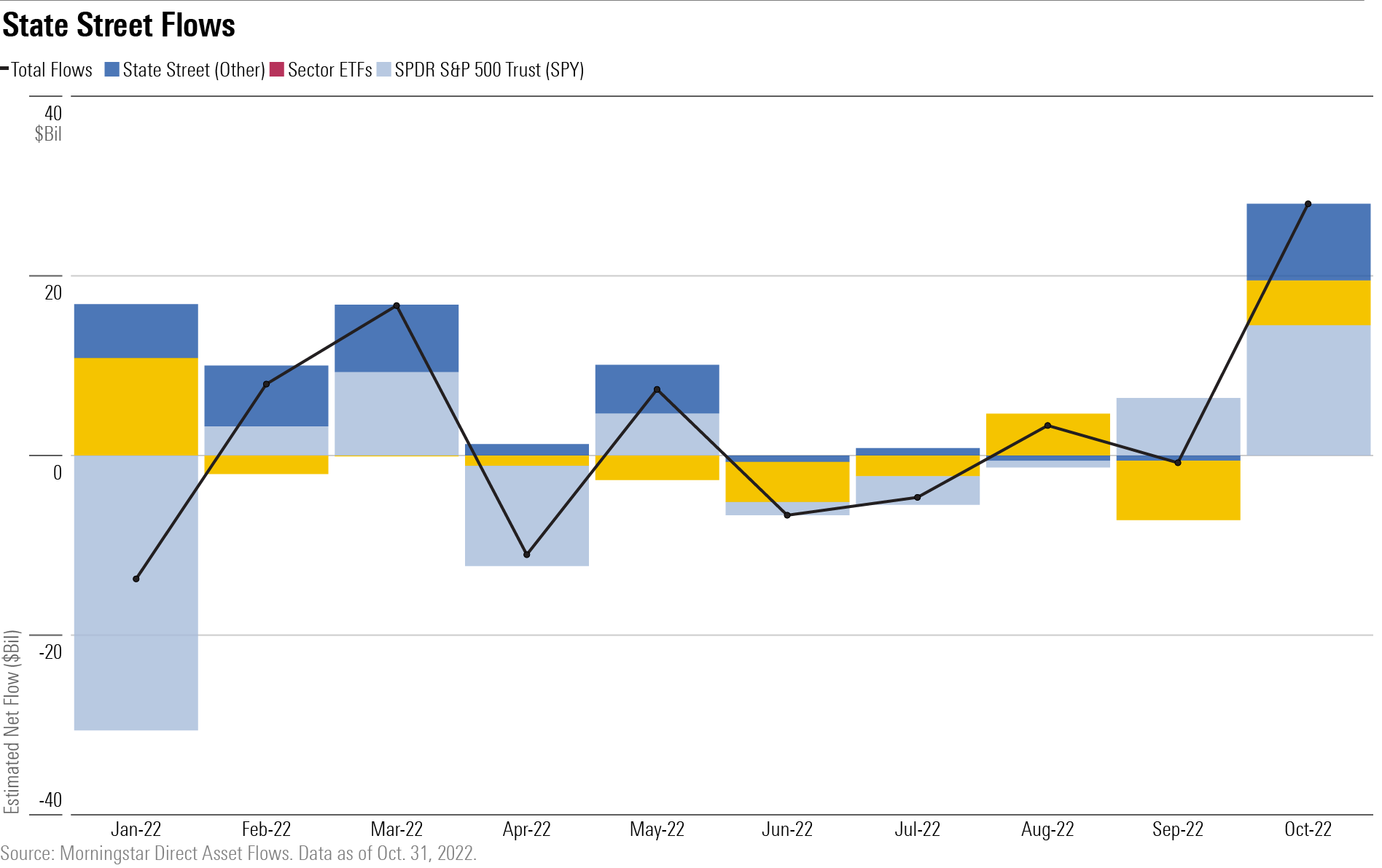

State Street: SPY and the Sectors

It’s been an up-and-down year for State Street, which has seen five months each of inflows and outflows after gathering $28 billion in October. Flows into SPDR S&P 500 Trust SPY and State Street’s lineup of sector ETFs dictate the fund family’s flows from one month to the next. Investors tend to use those ETFs tactically, which breeds volatility in monthly flows.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for October 2022. Download the full report here.

Clarification: This article was revised to make clear that though taxable-bond funds experienced inflows in August, flows were still negative on a trailing three-month basis.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)